We’ve already analyzed tens of thousands of financial research papers and identified more than 700 attractive trading systems together with hundreds of related academic papers.

Browse Strategies- Unlocked Screener & 300+ Advanced Charts

- 700+ uncommon trading strategy ideas

- New strategies on a bi-weekly basis

- 2000+ links to academic research papers

- 500+ out-of-sample backtests

- Design multi-factor multi-asset portfolios

Upgrade subscription

ESG score stands for the Environmental, Social and Governance scores. Numerous databases provide ESG data, and as a result, different datasets can lead to different outcomes. The environment score is a measure of environmental aspects such as emission reductions, low resource consumption and product innovations aiming at improving environmental protection. The social score measures customer and product responsibility and the aim for the “public welfare”, for example, cash donations, protection of public health, business ethics, respect to health or diversity of the workforce, etc. Lastly, the governance score is a measure of behaviour concerning the board of directors, shareholder rights and the integration of financial and non-financial goals of the company. ESG investing is becoming more and more popular, and as a result, there is an enlarging number of papers that examine this topic. While some papers examine the levels of ESG scores, there is a different branch of literature that examines the ESG momentum. The idea is simple; firms that have improved the ESG the most are expected to outperform. According to the paper, it is expected that the market could react to a change in rating in a relatively short period. However, the advantages of a better-rated ESG portfolio are expected to be apparent only in the long term, for example, because of increased cash flows, etc. Therefore, the strategy is to overweight, relative to the MSCI World Index, companies that increased their ESG ratings most during the recent past and underweight those with decreased ESG ratings. Where the increases and decreases are based on a 12-month ESG momentum. Last but not least, this paper from the MSCI uses the risk model GEM3S, but the idea is important, not the risk model.

Fundamental reason

Socially responsible investing is getting more and more popular among investors. The increased attention leads to an increasing worldwide amount of money invested by responsible investors either for profit or non-profit motives. The main idea of the paper is simple. The research hypothesizes that firms which have improved the ESG the most are expected to outperform other firms. One possibility is to look at the level of ESG scores. Still, the advantages of a better-rated ESG portfolio are expected to be apparent only in the long term, for example, because of increased cash flows.

On the other hand, the momentum compares the rise of the ESG scores. According to the paper, it is expected that the market could react to a change in rating in a relatively short time period. Therefore, the high ESG momentum stocks should be outperforming lower ESG stocks. Moreover, the lowest ESG stocks should underperform.

- Unlocked Screener & 300+ Advanced Charts

- 700+ uncommon trading strategy ideas

- New strategies on a bi-weekly basis

- 2000+ links to academic research papers

- 500+ out-of-sample backtests

- Design multi-factor multi-asset portfolios

Backtest period from source paper

2007-2015

Confidence in anomaly's validity

Moderately Strong

Indicative Performance

2.23%

Notes to Confidence in Anomaly's Validity

OOS back-test shows slightly negative performance. It looks, that strategy’s alpha is deteriorating in the out-of-sample period.

Academic research papers show usually mixed evidence of the statistical significance of ESG factor strategies…

Notes to Indicative Performance

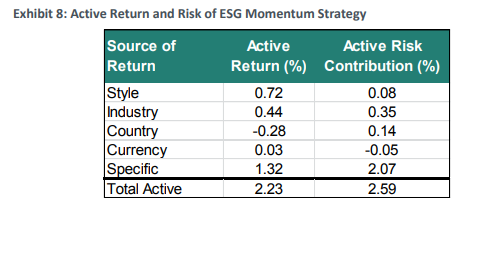

data from Exhibit 8, Total active

Period of Rebalancing

Monthly

Notes to Period of Rebalancing

Notes to Estimated Volatility

data from Exhibit 8, Total active

Number of Traded Instruments

1000

Notes to Number of Traded Instruments

More or less, it depends on investor’s need for diversification

Notes to Maximum drawdown

Complexity Evaluation

Very complex strategy

Notes to Complexity Evaluation

Financial instruments

stocks

Simple trading strategy

The investment universe consists of stocks in the MSCI World Index. Paper uses MSCI ESG Ratings as the ESG database. The ESG Momentum strategy is built by overweighting, relative to the MSCI World Index, companies that increased their ESG ratings most during the recent past and underweight those with decreased ESG ratings, where the increases and decreases are based on a 12-month ESG momentum. The paper uses the Barra Global Equity Model (GEM3) for portfolio construction with constraints that can be found in Appendix 2. Therefore, this strategy is very specific, but we aim to present the idea, not the portfolio construction. The strategy is rebalanced monthly.

Hedge for stocks during bear markets

Not known - Source and related research papers don’t offer insight into the correlation structure of the proposed trading strategy to equity market risk; therefore, we do not know if this strategy can be used as a hedge/diversification during the time of market crisis.

Out-of-sample strategy's implementation/validation in QuantConnect's framework

(chart+statistics+code)