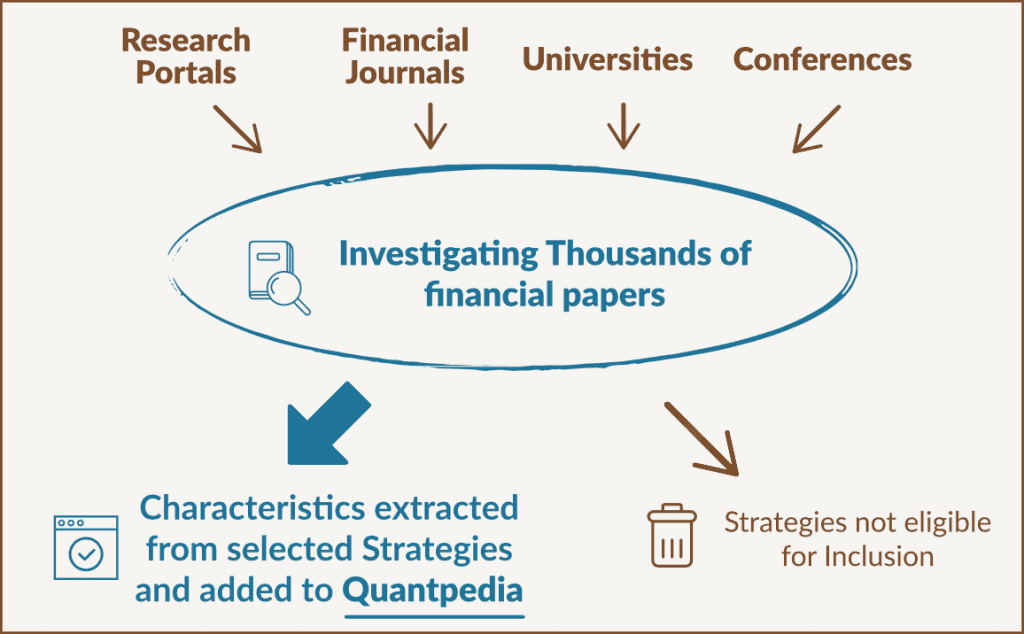

What’s our process? We use a great number of finance research resources all over the world, including research portals, financial journals, universities and conferences. We sift through these sources every day and search for new interesting articles and papers. By the end of each year, thousands of financial papers have been investigated in this way.

Quantpedia has strict selection rules

Each article is evaluated based on the strategy’s implementability, backtest length period and overall soundness. We check how well the strategy is explained (we automatically remove black-boxes) and if it has a clearly stated performance characteristic. We prefer research papers which also contain some type of risk characteristics (max. drawdown, volatility, etc.). Only a small percentage of strategies pass all of these selection criteria.

Each article is evaluated based on the strategy’s implementability, backtest length period and overall soundness. We check how well the strategy is explained (we automatically remove black-boxes) and if it has a clearly stated performance characteristic. We prefer research papers which also contain some type of risk characteristics (max. drawdown, volatility, etc.). Only a small percentage of strategies pass all of these selection criteria.

We extract trading rules in plain language

Selected strategies are then added into the existing Quantpedia’s structure. We extract trading rules in plain language, performance and risk characteristics and various descriptive characteristics (the instruments used for trading, markets traded, backtest period length, etc.). Each strategy is then categorized by several keywords, and database connections to similar strategies are created.

Selected strategies are then added into the existing Quantpedia’s structure. We extract trading rules in plain language, performance and risk characteristics and various descriptive characteristics (the instruments used for trading, markets traded, backtest period length, etc.). Each strategy is then categorized by several keywords, and database connections to similar strategies are created.

See out-of-sample implementation of selected strategies

The subset of Quantpedia’s strategies are implemented in QuantConnect’s framework and contains out-of-sample back-tests/replications together with equity curves, trading statistics and source code so that our users can continue in the exploration. Or they can just check if out-of-sample performance matches the in-sample info from source research papers. Check strategies with QuantConnect charts / codes / statistics →📈

The subset of Quantpedia’s strategies are implemented in QuantConnect’s framework and contains out-of-sample back-tests/replications together with equity curves, trading statistics and source code so that our users can continue in the exploration. Or they can just check if out-of-sample performance matches the in-sample info from source research papers. Check strategies with QuantConnect charts / codes / statistics →📈

Visit our Premium blog

A new blog post for our Premium users is created once a new strategy is added into Quantpedia. Members can see all of a strategy’s characteristics and use the Screener and visualization tools to compare it to other Quantpedia strategies. All new academic research papers related to already existing Quantpedia Premium strategies are also published on our blog, but those blog posts are visible only for Premium users. Occasionally, we find academic papers related to common quantitative trading strategies. Such papers are usually described on our free blog.

A new blog post for our Premium users is created once a new strategy is added into Quantpedia. Members can see all of a strategy’s characteristics and use the Screener and visualization tools to compare it to other Quantpedia strategies. All new academic research papers related to already existing Quantpedia Premium strategies are also published on our blog, but those blog posts are visible only for Premium users. Occasionally, we find academic papers related to common quantitative trading strategies. Such papers are usually described on our free blog.

Why would somebody publish working strategy?

If you are an academic, then it’s simple. A lot of the academics are curious, and they are doing research in the pursuit of knowledge. They want to show they have bright ideas and they want to let other people know about it. And it’s also a way to climb academic career ladder. And it’s a possibility to start a side business as a consultant for some hedge fund or start a fund on their own. Asset management companies publish working trading strategies because they want to raise more assets and gain the trust of pension and sovereign funds and family offices.

If you are an academic, then it’s simple. A lot of the academics are curious, and they are doing research in the pursuit of knowledge. They want to show they have bright ideas and they want to let other people know about it. And it’s also a way to climb academic career ladder. And it’s a possibility to start a side business as a consultant for some hedge fund or start a fund on their own. Asset management companies publish working trading strategies because they want to raise more assets and gain the trust of pension and sovereign funds and family offices.

Once published, will strategy stop working?

There are multiple research papers which answers this common question. No, strategy usually doesn’t vanish. It’s less profitable than in the past, and the return-to-risk ratio is usually lower. But the strategy can still easily be part of the diversified multi-strategy portfolio. It’s not easy to arbitrage market anomalies. Most of the anomalies have time-varying return so fair part of the return is preserved as arbitrage is not risk-free. Therefore there will never be enough capital to arbitrage all return away.

There are multiple research papers which answers this common question. No, strategy usually doesn’t vanish. It’s less profitable than in the past, and the return-to-risk ratio is usually lower. But the strategy can still easily be part of the diversified multi-strategy portfolio. It’s not easy to arbitrage market anomalies. Most of the anomalies have time-varying return so fair part of the return is preserved as arbitrage is not risk-free. Therefore there will never be enough capital to arbitrage all return away.

Use Quantpedia Pro to gain deeper insight

Quantpedia Pro is the analytical platform that will help you to explore Quantpedia Premium model strategies and do preliminary portfolio testing more efficiently. Utilize its extensive calculation and reporting capabilities – 200+ charts and tables, factor regression analysis, risk scenarios, seasonality analysis, tests of alternative weighting schemes, correlation analysis etc.

Quantpedia Pro is the analytical platform that will help you to explore Quantpedia Premium model strategies and do preliminary portfolio testing more efficiently. Utilize its extensive calculation and reporting capabilities – 200+ charts and tables, factor regression analysis, risk scenarios, seasonality analysis, tests of alternative weighting schemes, correlation analysis etc.