We’ve already analyzed tens of thousands of financial research papers and identified more than 700 attractive trading systems together with hundreds of related academic papers.

Browse Strategies- Unlocked Screener & 300+ Advanced Charts

- 700+ uncommon trading strategy ideas

- New strategies on a bi-weekly basis

- 2000+ links to academic research papers

- 500+ out-of-sample backtests

- Design multi-factor multi-asset portfolios

Upgrade subscription

Trend-following is one of the oldest trading techniques, and trend-following systems belong to the standard repertoire of investors and traders. Many times it has been successfully used in futures markets. But does it work on stocks?

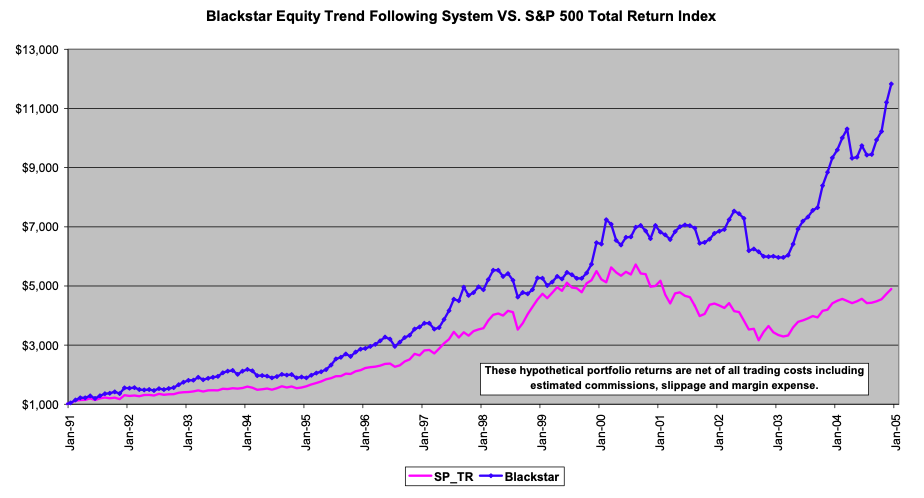

Research shows it does, and it performs well for such a simple strategy. There are many trend-following systems with different rules, but all systems have a common attribute. They try to buy growing assets, although “grow/trend” could be defined in many ways. We present a research paper documenting a simple trend-following system on stocks which uses a new all-time high as entry condition and ATR as a trailing stop.

* Are you interested in systematic quantitative factor ETFs? Here is a link to the Alpha Architect Value Momentum Trend ETF (strategy background), our partner, which combines international equities’ value, momentum, and trend factors. *

Fundamental reason

Behavioral biases (investors herding, under- and over-reaction, etc.) create a non-normal return distribution on financial markets. Trend-following systems cut the left tail of the long-tail distribution. This characteristic creates improved risk/return characteristics of trend-following systems when compared to a diversified buy&hold approach.

- Unlocked Screener & 300+ Advanced Charts

- 700+ uncommon trading strategy ideas

- New strategies on a bi-weekly basis

- 2000+ links to academic research papers

- 500+ out-of-sample backtests

- Design multi-factor multi-asset portfolios

Backtest period from source paper

1983-2004

Confidence in anomaly's validity

Strong

Indicative Performance

19.3%

Notes to Confidence in Anomaly's Validity

Notes to Indicative Performance

per annum, data from table on page 13

Period of Rebalancing

Daily

Estimated Volatility

15.6%

Notes to Period of Rebalancing

Notes to Estimated Volatility

data from table on page 12

Number of Traded Instruments

1000

Notes to Number of Traded Instruments

more or less, it depends on investor’s need for diversification and number of stocks which satisfy system’s entry conditions

Notes to Maximum drawdown

data from table on page 13

Complexity Evaluation

Complex strategy

Notes to Complexity Evaluation

Financial instruments

stocks

Simple trading strategy

The investment universe consists of US-listed companies. A minimum stock price filter is used to avoid penny stocks, and a minimum daily liquidity filter is used to avoid stocks that are not liquid enough. The entry signal occurs if today’s close is greater than or equal to the highest close during the stock’s entire history. A 10-period average true range trailing stop is used as an exit signal. The investor holds all stocks which satisfy the entry criterion and are not stopped out. The portfolio is equally weighted and rebalanced daily. Transaction costs of 0.5% round-turn are deducted from each trade to account for estimated commission and slippage.

Hedge for stocks during bear markets

No - The selected strategy is designed as a long-only; therefore, it can’t be used as a hedge against market drops as a lot of strategy’s performance comes from equity market premium (as the investor holds equities, therefore, his correlation to the broad equity market is very very high).

Related Dataset

Finage US & Global Stock Data all in one place – Stock data in real-time streaming and historical API, 18 years of historical stock data API for all stock exchanges with last price, OHLCV, aggregate, LV1 and LV2 market depth data + Financial Fundamentals data will empower your website with stock quote charts, stock news, market status, and company details via stock API.

Out-of-sample strategy's implementation/validation in QuantConnect's framework

(chart+statistics+code)