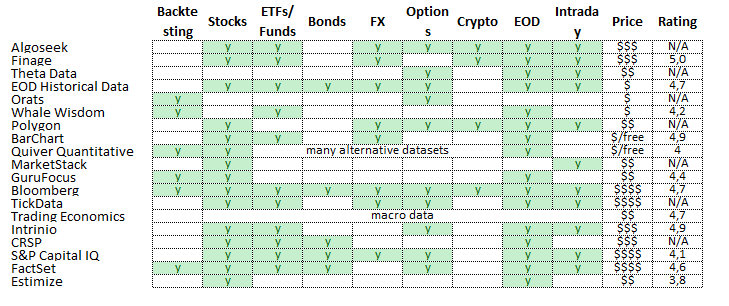

We had a chance to test almost every historical market data provider throughout our 15-year-long experience in quantitative investment strategies and trading. Thanks to that, we’ve now created a list of the best market data providers for each asset class.

We include financial data for various budget ranges, including many free historical market data options. For some providers, there are also public reviews available. In that case, we average all these reviews into one composite rating.

The data sources we cover are available as end-of-day data and intraday data, all the way up to a tick data granularity. All data frequencies are available for almost every asset class covered. High-frequency API integrations are often supported as well.

How to use our historical market data overview?

- Backtesting = indicates whether a data provider also offers a backtesting tool/platform (column 1)

- Assets = indicates which assets a data provider offers (columns 2-7)

- EOD/Intraday = indicates whether a data provider offers end of day data, or intraday trades/quotes (columns 8-9)

- Price = indicates a yearly price range for an average data product; this is a rough ballpark figure

- Rating = an average of all the public reviews we were able to find from trusted sources (e.g. TrustPilot, Google, Apple, Facebook, trading review websites, etc.)

Algoseek Data Products

Pros

Cons

PricePrice range: $$$ (5k-10k) For detailed pricing information, refer to https://www.algoseek.com/pricing.html#pricing Reviewsno publicly available Algoseek reviews, but we’ve seen positive comments on trading forums online Our ExperienceAlgoSeek is an excellent choice if you are looking for top-notch, error-free, institutional-quality intraday data and you are willing to pay for it. |

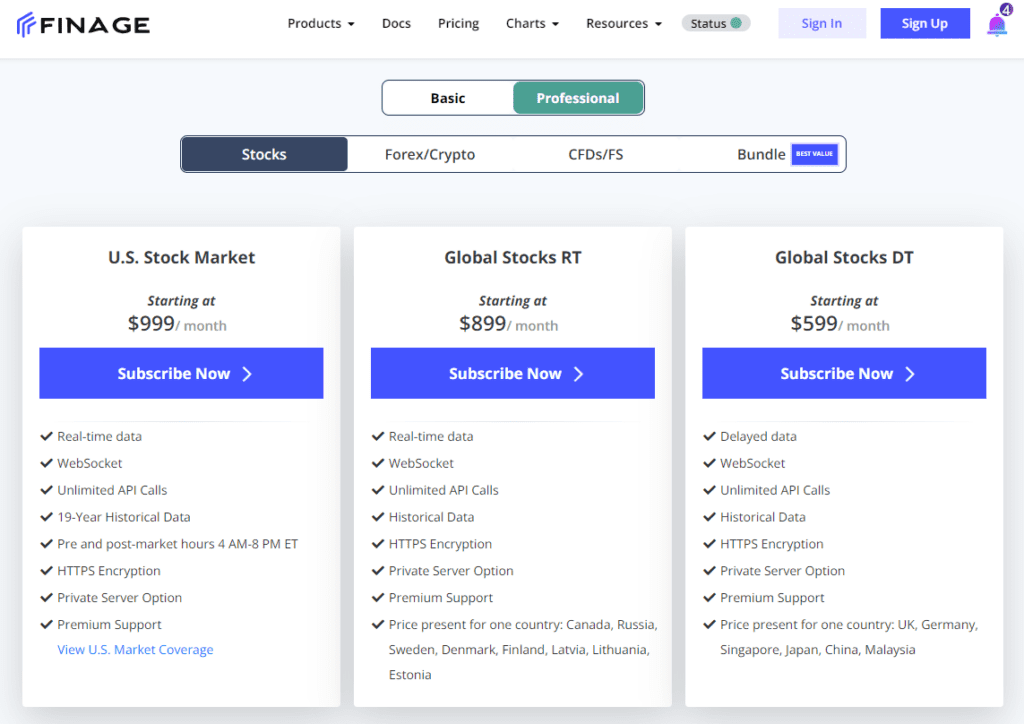

Finage Data Products

Pros

Cons

PricePrice range: $$$ (5k-10k) For detailed pricing information, refer to https://finage.co.uk/?mainCategory=1&category=1#pricing Reviews5.0 out of 5 (from 11 reviews) [+sem dat nejake hviezdicky alebo nejaku grafiku co to vyobrazi] Our ExperienceFinage offers reliable, high-quality institutional-level historical and real-time data. It’s a great choice for any professional trading setup, be it a hedge fund, family office, or a trader. It comes with a price tag, though. Finage Discount CodeYou can get a 10% discount on all Finage datasets as a Quantpedia reader by using the promo code: QUANTPEDIA |

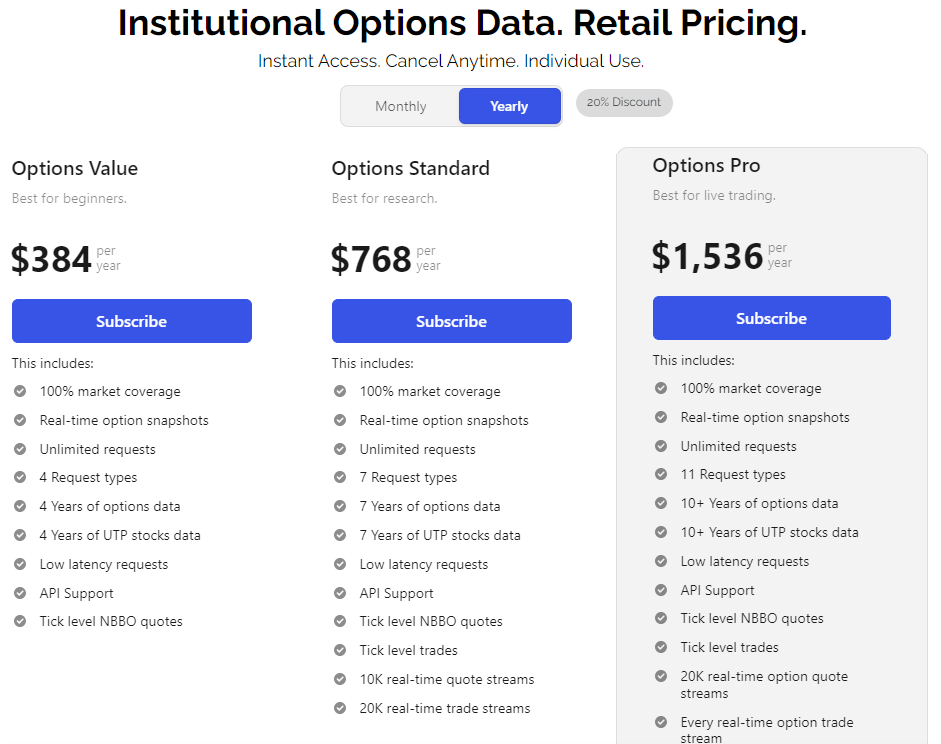

Theta Data Products

Pros

Cons

PricePrice range: $$ (1k-5k) For detailed pricing information, refer to https://www.thetadata.net/subscribe Reviewsno publicly available Theta Data reviews, however, we’ve seen a lot of positive comments on trading forums worldwide Our ExperienceTheta Data seems to be a fantastic choice for any Option trader. The price-to-value ratio looks incredible and is definitely worth trying. Maybe the only downside of Theta Options Data is that the company is not that old, and only time will show how it will handle potential setbacks or outages. |

EOD Historical Data Products

Pros

Cons

PricePrice range: $ (<1k) For detailed pricing information, refer to https://eodhistoricaldata.com/pricing-quantpedia/ Reviews4.7 out of 5 (from 43 reviews) [+sem dat nejake hviezdicky alebo nejaku grafiku co to vyobrazi] Our ExperienceEOD Historical Data is one of the most affordable historical and intraday market data providers. They offer a huge data variety, covering all main asset classes. EOD Historical Data is a one-stop shop for starting as well as advanced traders of main asset classes, not requiring a tick-level data depth. EOD Historical Data Discount CodeYou can get a 37% discount on all EOD Historical Data market data as a Quantpedia reader by using the following promo code link: https://eodhistoricaldata.com/pricing-quantpedia |

Orats Data Products

Pros

Cons

PricePrice range: $ (<1k) For detailed pricing information, refer to https://orats.com/quantpedia Reviewsno publicly available reviews for Orats market data Our ExperienceOrats is a wonderful one-stop shop for all starting as well as advanced options traders. There’s all you need for trading options professionally or just as a hobby. A huge plus is that you don’t need a huge budget to afford it. Orats Discount CodeYou can get a massive 33% to 66% discount on all main Orats data and Tools as a Quantpedia reader by using the following promo code link: https://orats.com/quantpedia |

Whale Wisdom Data Products

Pros

Cons

PricePrice range: $ (<1k) For detailed pricing information, refer to https://whalewisdom.com/pricing Reviews4.2 out of 5 (from 1 review) [+sem dat nejake hviezdicky alebo nejaku grafiku co to vyobrazi] Our ExperienceWhale Wisdom is one of the best 13F filing providers on the market, with many simple and valuable tools and analytics for 13F filings, insider trading, and fund holdings. If you are in a quest for filings alpha, then Whale Wisdom is your must-have. Whale Wisdom Discount CodeYou can get a 5% discount on all Whale Wisdom subscriptions and Tools as a Quantpedia reader by using the following Whale Wisdom promo code: quant5 |

Polygon Data Products

Pros

Cons

PricePrice range: $$ (1k-5k) For detailed pricing information, refer to https://polygon.io/pricing Reviewsno publicly available Polygon reviews, but many positive online comments Our ExperiencePolygon is one of the leading equity, options, and forex data providers with long history. Trades data and quotes data of top-notch quality without any limits are some of the main perks of Polygon. Polygon Discount CodeYou can get a 5% discount on all Polygon market data as a Quantpedia reader by using the following Polygon promo code: QUANTPEDIA |

BarChart Data Products

Pros

Cons

PricePrice range: $ (<1k) For detailed pricing information, refer to https://www.barchart.com/get-barchart-premier Reviews4.9 out of 5 (from 108 reviews) [+sem dat nejake hviezdicky alebo nejaku grafiku co to vyobrazi] Our ExperienceBarChart is one of the best stock screeners out there for day traders and novice stock investors. It boasts many free features, one of the best charting interfaces, and a historical data feed. More seasoned trading professionals may, however, find it a tad basic. |

Quiver Quantitative Data Products

Pros

Cons

PricePrice range: $ (<1k) For detailed pricing information, refer to https://api.quiverquant.com/ Reviews4.0 out of 5 (from 1 review) [+sem dat nejake hviezdicky alebo nejaku grafiku co to vyobrazi] Our ExperienceQuiver Quantitative is a fresh, hot meat when it comes to affordable alternative datasets and strategies. We recommend giving Quiver Quant a look, as they have many free datasets, and even those that are paid are priced relatively cheaply. Quiver Quantitative Discount CodeYou can get a 5% discount on all Quiver Quantitative market data as a Quantpedia reader by using the following Quiver Quantitative promo code: QUANT5 |

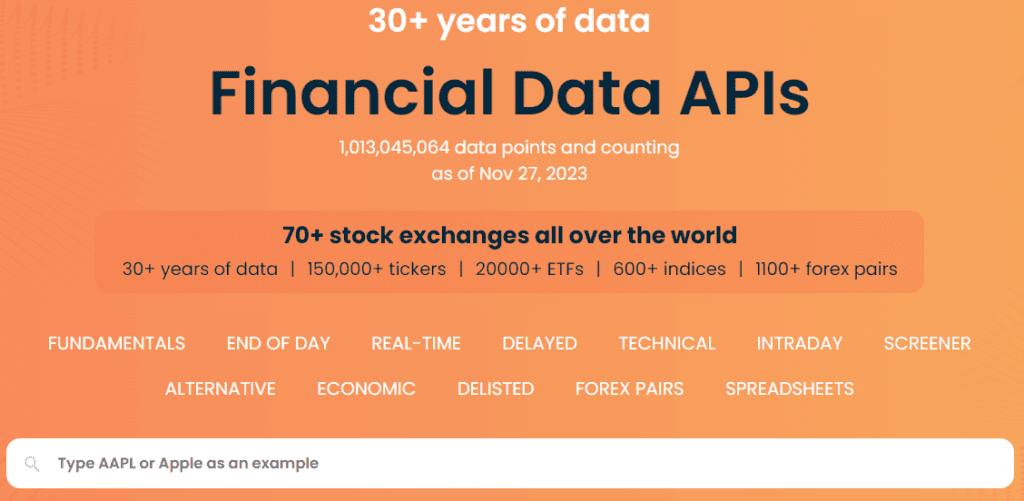

marketstack Data Products

Pros

Cons

PricePrice range: $$ (1k-5k) For detailed pricing information, refer to https://marketstack.com/product Reviewsno publicly available reviews Our ExperienceMarketstack provides an affordable and comprehensive stock data feed that goes back more than 30 years in history. It’s definitely worth taking a look at and at least comparing it with similar products. |

GuruFocus Data Products

Pros

Cons

PricePrice range: $$ (1k-5k) For detailed pricing information, refer to https://www.gurufocus.com/pricing/ Reviews4.4 out of 5 (from 98 reviews) [+sem dat nejake hviezdicky alebo nejaku grafiku co to vyobrazi] Our ExperienceGuruFocus is a good tool for stock pickers and day traders, especially for value investors. It offers countless useful value stock screeners and value investment ideas. It’s a user-friendly research tool for anyone deep-diving into stocks. |

Bloomberg Data Products

Pros

Cons

PricePrice range: $$$$ (>10k) For detailed pricing information, refer to https://www.bloomberg.com/professional/ Reviews4.7 out of 5 (from 459 reviews) [+sem dat nejake hviezdicky alebo nejaku grafiku co to vyobrazi] Our ExperienceBloomberg is most likely the most famous financial software that has ever been released. Thanks to this, it gained somewhat of a monopoly when it comes to trading and financial research. Bloomberg’s now an absolute necessity for every asset manager and larger-scale trader. On the other hand, an ordinary researcher will not be able to afford it. |

Tick Data Products

Pros

Cons

PricePrice range: $$$$ (>10k) For detailed pricing information, refer to https://www.tickdata.com/tickdatastore Reviewsno publicly available reviews, but this is a hugely renowned company, so no worries Our ExperienceTickData is something like Bloomberg, when it comes to high-quality intraday data. It’s one of the most renowned companies out there. You won’t make a mistake taking the quote and trade data from them. The only (and big) downside is the price tag. Definitely not something for a retail DIY trader. |

Trading Economics Data Products

Pros

Cons

PricePrice range: $$ (1k-5k) For detailed pricing information, refer to https://tradingeconomics.com/analytics/pricing Reviews4.7 out of 5 (from 1278 reviews) [+sem dat nejake hviezdicky alebo nejaku grafiku co to vyobrazi] Our ExperienceTrading Economics is one of the oldest macro data services out there. It’s also one of the most visited websites when searching for financial macro data. It also offers excellent unbiased news service and a handy mobile app. |

Intrinio Data Products

Pros

Cons

PricePrice range: $$$ (5k-10k) For detailed pricing information, refer to https://intrinio.com/ Reviews4.9 out of 5 (from 60 reviews) [+sem dat nejake hviezdicky alebo nejaku grafiku co to vyobrazi] Our ExperienceIntrinio is a young, energetic data provider with a drive to become the best. We can recommend Intrinio to any investment or trading professional and institutions, especially when it comes to their exceptional equity fundamental data. Intrinio has all it takes to support large teams of data experts. |

CRSP Data Products

Pros

Cons

PricePrice range: $$$ (5k-10k), but depends on a particular dataset For detailed pricing information, refer to https://www.crsp.org/research/ Reviewsno publicly available reviews, but CRSP is one of the most renowned US data vendors Our ExperienceCRSP stands for the Center for Research in Security Prices and it provides industry-standard stock data especially for research. You will find CRSP data being cited in most of the SSRN research papers performing equity research. You won’t make a mistake using CRSP data, the only question is, whether it fits into your budget. Academics should get a discounted tier, though. |

S&P Capital IQ Data Products

Pros

Cons

PricePrice range: $$$$ (>10k), but depends on a particular dataset For detailed pricing information, refer to https://www.spglobal.com/marketintelligence/en/ Reviews4.1 out of 5 (from 112 reviews) [+sem dat nejake hviezdicky alebo nejaku grafiku co to vyobrazi] Our ExperienceS&P Capital IQ can be thought of as a databank or data aggregator. S&P offers massive amounts of their own data, however also aggregates tons of data from external data providers. Hence, S&P Capital IQ aims to be a one-stop shop for any data you may possibly need. That’s cool! But also expect a corresponding price for a massive service like this (typically per dataset). |

FactSet Data Products

Pros

Cons

PricePrice range: $$$$ (>10k) For detailed pricing information, refer to http://www.factset.com/ Reviews4.6 out of 5 (from 239 reviews) [+sem dat nejake hviezdicky alebo nejaku grafiku co to vyobrazi] Our ExperienceFactSet has become globally famous for its phenomenal equity screening and fundamental equity analysis. Equities have remained FactSet’s strongest side, now with almost any equity research tool you can possibly imagine. In the meantime, FactSet has also expanded into other asset classes, offering competitive tools worth looking at. Especially, if you have access to institutional funding. |

Subscribe for Newsletter

Be first to know, when we publish new content