Financial markets are volatile, Bull markets don’t last forever, and sooner or later, Bear markets follow.

It’s easy to build a trading strategy that is successful in economic expansion. But these strategies for good times are sensitive to the recession when they can experience painful drawdowns.

Therefore, it’s a significant advantage if the investor’s portfolio contains systematic strategies which are good performers in the Bear market. It’s not easy to find these strategies, but we can help.

How?

To find strategies which can be utilized as a hedge or diversification to equity market factor during Bear markets according to their source academic papers, please use the Crisis Hedge filtering field in our Screener.

See an example in our video about trading strategies for Bear Markets:

Quantpedia Pro offers even more:

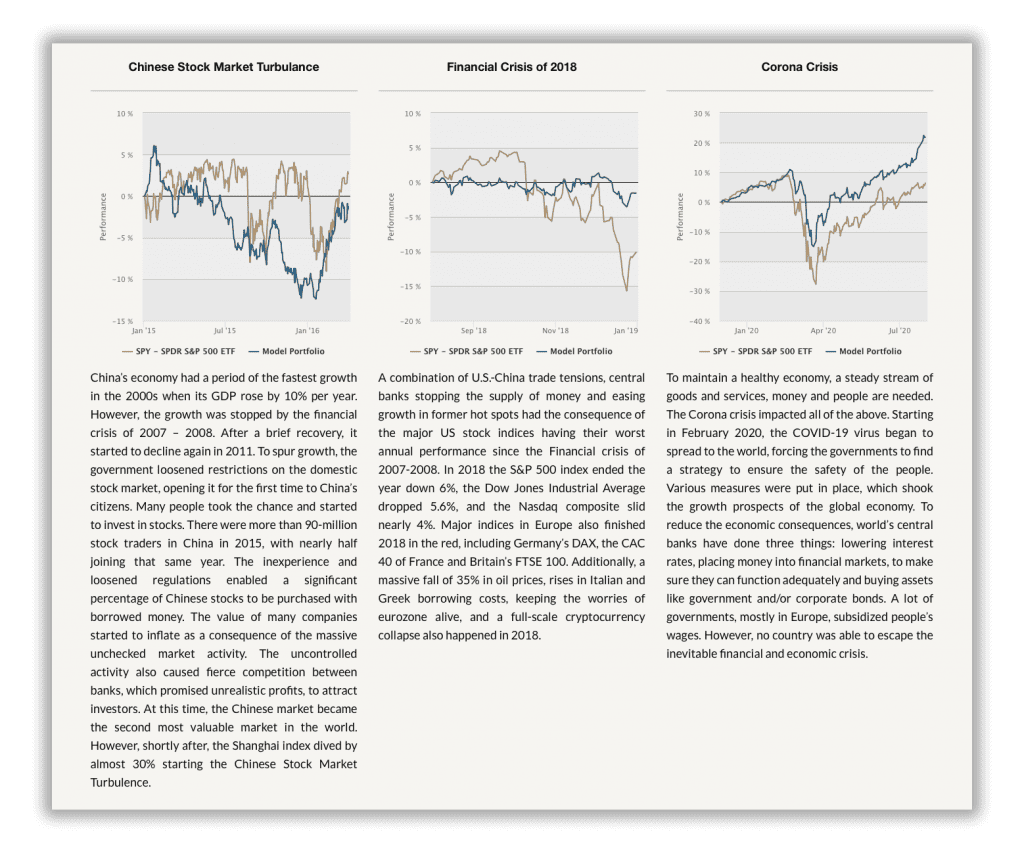

Crisis Analysis – is a risk-management report that allows you to review your portfolio’s performance during 15 significant crisis periods over the last 20+ years.

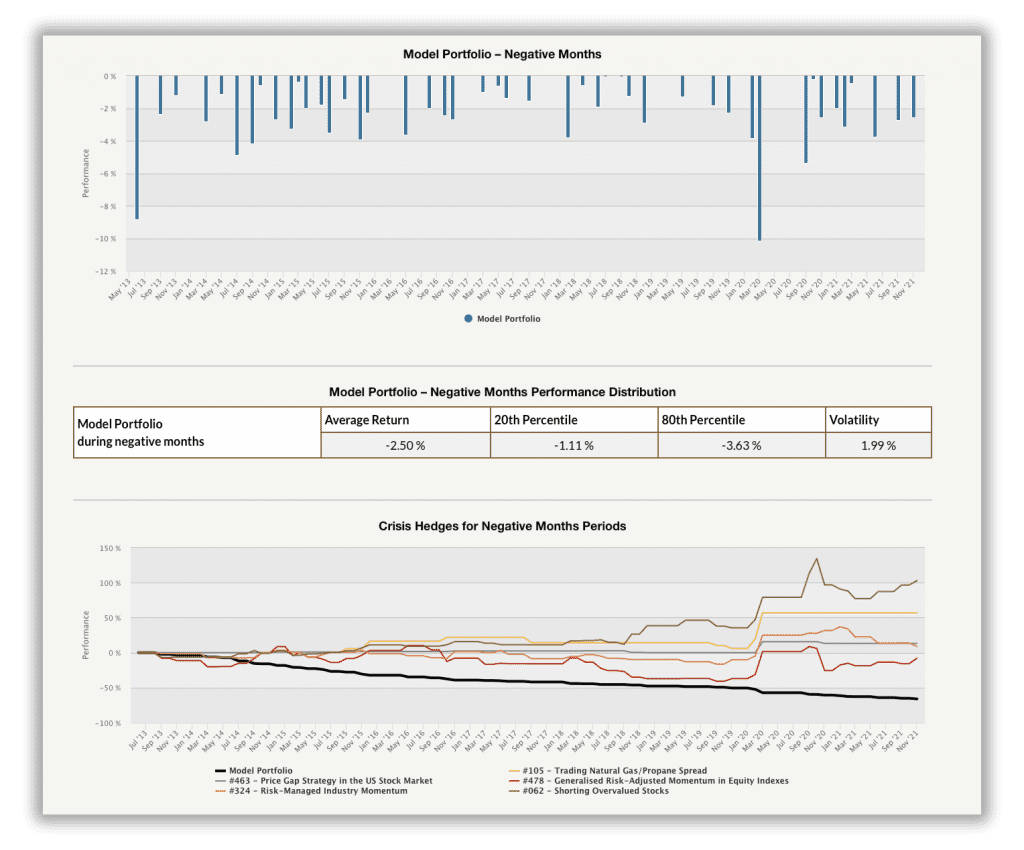

Crisis Hedge – runs an automatic search through our database and helps you to find a trading strategy that works as a hedge to your model portfolio during negative months or bear markets.

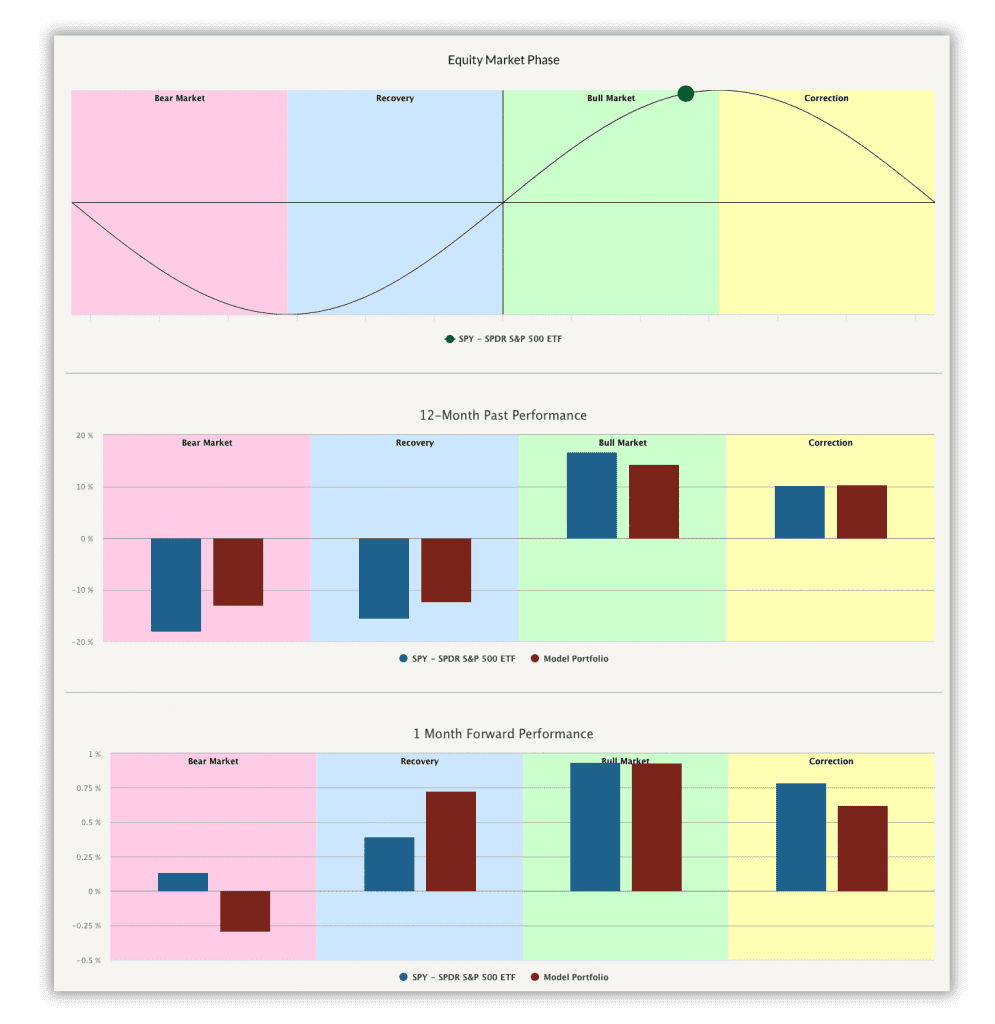

Market Phases Analysis – shows performance and correlations of your model portfolio during Bull markets, Bear markets, Corrections and Recoveries.

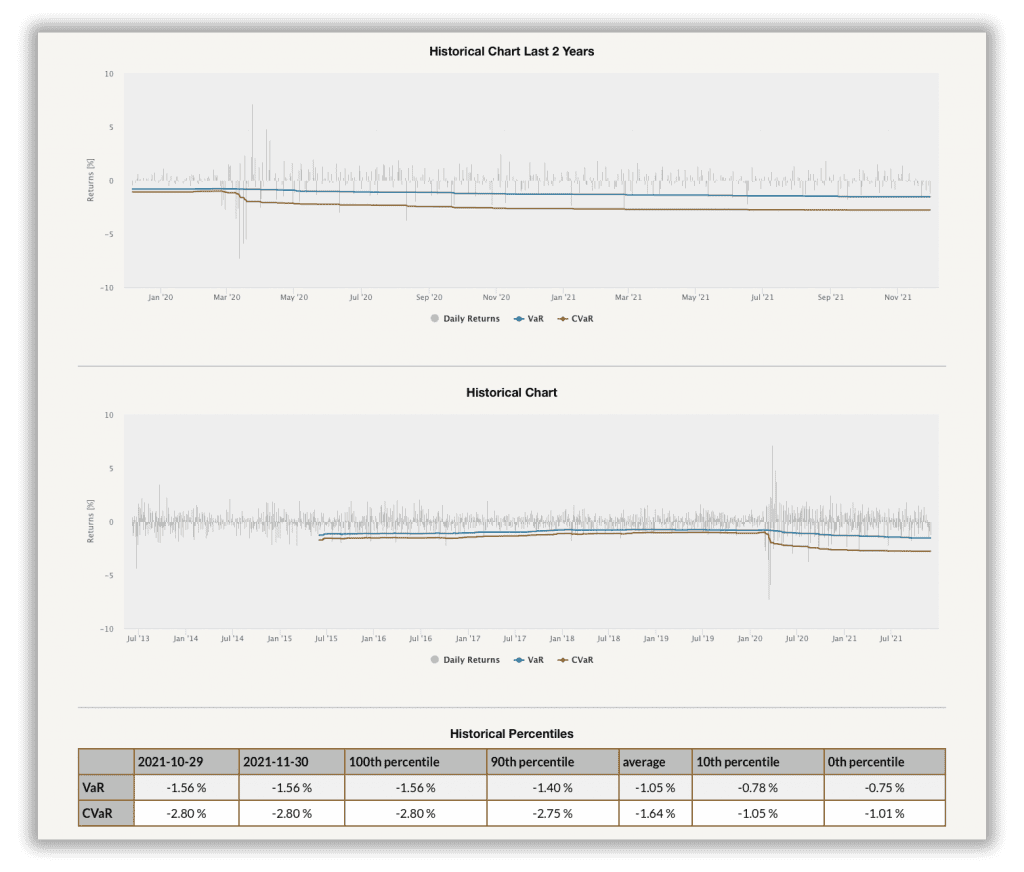

Value at Risk – helps our clients understand what level of risk they can expect during a crisis to better prepare for it.