We’ve already analyzed tens of thousands of financial research papers and identified more than 700 attractive trading systems together with hundreds of related academic papers.

Browse Strategies- Unlocked Screener & 300+ Advanced Charts

- 700+ uncommon trading strategy ideas

- New strategies on a bi-weekly basis

- 2000+ links to academic research papers

- 500+ out-of-sample backtests

- Design multi-factor multi-asset portfolios

Upgrade subscription

The Book-to-Market effect is probably one of the oldest effects which have been investigated in financial markets. It compares the book value of the company to the price of the stock – an inverse of the P/B ratio. The bigger the book-to-market ratio is, the more fundamentally cheap is the investigated company. Book-to-Market wasn‘t even considered as a market anomaly at the beginning of the century when Ben Graham famously popularized its use. The ratio lost some of its popularity when the Efficient Market Theory and CAPM became the main Wall Street theories. Still, it gained back its position after several studies have shown the rationality of using it. This anomaly is well-described in the classical Fama and French research paper (1993).

Pure value effect portfolios are created as long stocks with the highest Book-to-Market ratio and short stocks with the lowest Book-to-Market ratio. However, this pure value effect has substantial drawdowns with more than 50% drawdown in the 1930s. The value factor is still a strong performance contributor in long-only portfolios (formed as long stocks with the highest Book-to-Market ratio without shorting stocks with low Book-to-Market ratios).

This strategy was initially based on the paper by Fama and French: The Cross-Section of Expected Stock Returns, but to stay up to date and to have data with longer history we drew from a newer paper by Asness, Frazzini, Israel and Moskowitz: Fact, Fiction, and Value Investing.

* For those interested in systematic quantitative value factor ETF implementation, here is a link to the Alpha Architect Quantitative Value ETF (strategy background), our partner. *

Fundamental reason

One explanation is that investors overreact to growth aspects for growth stocks, and value stocks are, therefore, undervalued.

According to some academics, the ratio of market value to book value itself is a risk measure. Therefore, the larger returns generated by low MV/BV stocks are simply compensation for risk. Low MV/BV stocks are often those in some financial distress.

- Unlocked Screener & 300+ Advanced Charts

- 700+ uncommon trading strategy ideas

- New strategies on a bi-weekly basis

- 2000+ links to academic research papers

- 500+ out-of-sample backtests

- Design multi-factor multi-asset portfolios

Backtest period from source paper

1926-2014

Confidence in anomaly's validity

Strong

Indicative Performance

3.6%

Notes to Confidence in Anomaly's Validity

Notes to Indicative Performance

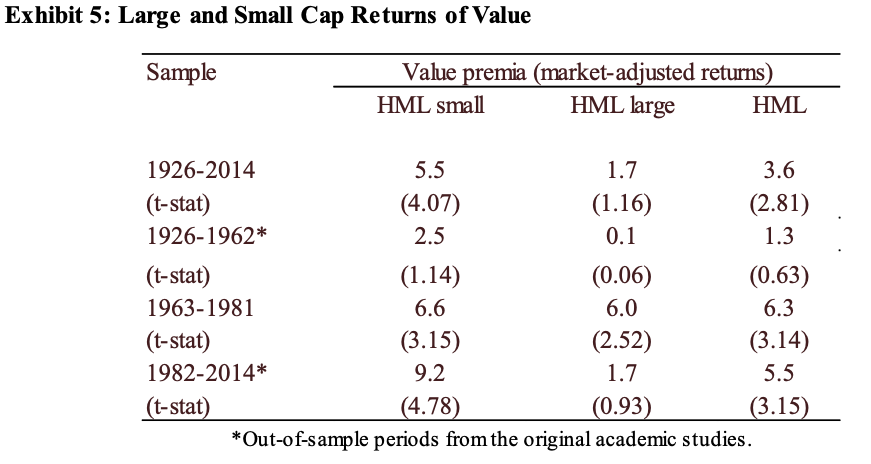

from data in exhibit 5 (HML column)

Period of Rebalancing

Monthly

Estimated Volatility

12.02%

Notes to Period of Rebalancing

Notes to Estimated Volatility

calculated from t-statistics of 2.81 from exhibit 5

Number of Traded Instruments

1000

Notes to Number of Traded Instruments

Notes to Maximum drawdown

Complexity Evaluation

Complex strategy

Notes to Complexity Evaluation

Financial instruments

stocks

Simple trading strategy

The investment universe contains all NYSE, AMEX, and NASDAQ stocks. To represent “value” investing, HML portfolio goes long high book-to-price stocks and short, low book-to-price stocks. In this strategy, we show the results for regular HML which is simply the average of the portfolio returns of HML small (which goes long cheap and short expensive only among small stocks) and HML large (which goes long cheap and short expensive only among large caps). The portfolio is equal-weighted and rebalanced monthly.

Hedge for stocks during bear markets

No - Long-only value stocks logically can’t be used as a hedge against market drops as a lot of strategy’s performance comes from equity market premium (as the investor holds equities, therefore, his correlation to a broad equity market is very very high). Now, evidence for using a long-short value factor portfolio as a hedge against the equity market is very mixed. Firstly, there are a lot of definitions of value factor (from simple standard P/B ratios to various more complex definitions), and the performance of different value factors differ in times of stress. Also, there are multiple research papers in a tone of work of Cakici and Tan : “Size, Value, and Momentum in Developed Country Equity Returns: Macroeconomic and Liquidity Exposures” that link value factor premium to liquidity and growth risk and show that the implication is that value returns can be low prior to periods of low global economic growth and bad liquidity.

Out-of-sample strategy's implementation/validation in QuantConnect's framework

(chart+statistics+code)