A new research paper related to multiple currency strategies:

#5 – FX Carry Trade

#8 – Currency Momentum Factor

#9 – Currency Value Factor – PPP Strategy

Authors: Baku, Fortes, Herve, Lezmi, Malongo, Roncalli, Xu

Title: Factor Investing in Currency Markets: Does it Make Sense?

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3415700

Abstract:

The concept of factor investing emerged at the end of the 2000s and has completely changed the landscape of equity investing. Today, institutional investors structure their strategic asset allocation around five risk factors: size, value, low beta, momentum and quality. This approach has been extended to multi-asset portfolios and is known as the alternative risk premia model. This framework recognizes that the construction of diversified portfolios cannot only be reduced to the allocation policy between asset classes, such as stocks and bonds. Indeed, diversification is multifaceted and must also consider alternative risk factors. More recently, factor investing has gained popularity in the fixed income universe, even though the use of risk factors is an old topic for modeling the yield curve and pricing interest rate contingent claims. Factor investing is now implemented for managing portfolios of corporate bonds or emerging bonds.

In this paper, we focus on currency markets. The dynamics of foreign exchange rates are generally explained by several theoretical economic models that are commonly presented as competing approaches. In our opinion, they are more complementary and they can be the backbone of a Fama-French-Carhart risk factor model for currencies. In particular, we show that these risk factors

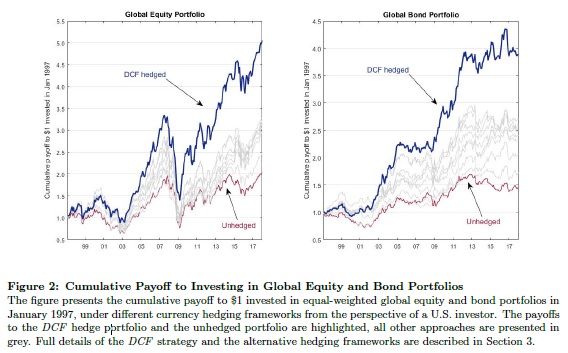

may explain a significant part of time-series and cross-section returns in foreign exchange markets. Therefore, this result helps us to better understand the management of forex portfolios. To illustrate this point, we provide some applications concerning basket hedging, overlay management and the construction of alpha strategies.

Notable quotations from the academic research paper:

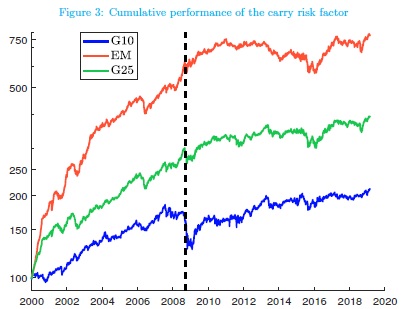

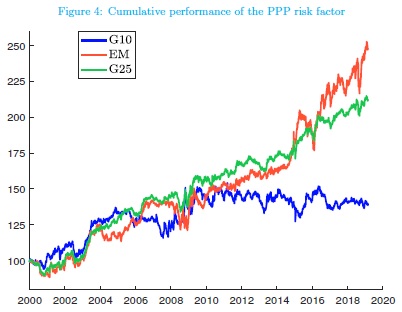

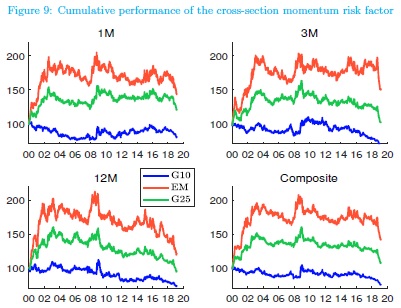

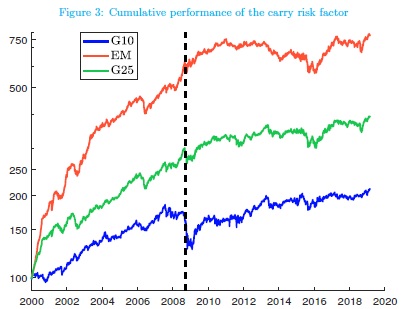

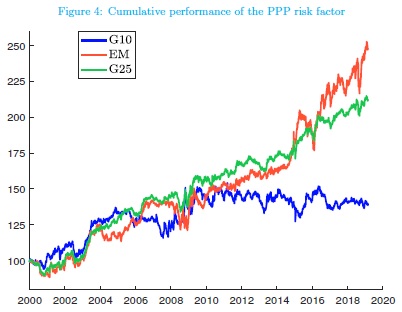

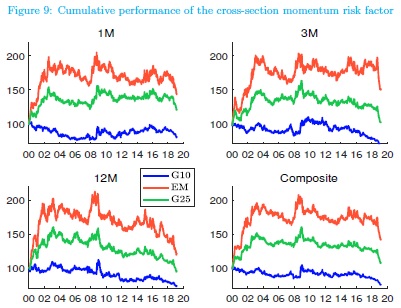

"In this paper, we propose analyzing foreign exchange rates using three main risk factors: carry, value and momentum. The choice of these market risk factors is driven by the economic models of foreign exchange rates. For instance, the carry risk factor is based on the uncovered interest rate parity, the value risk factor is derived from equilibrium models of the real exchange rate, and the momentum risk factor bene�fits from the importance of technical analysis, trading behavior and overreaction/underreaction patterns. Moreover, analyzing an asset using these three dimensions helps to better characterize the fi�nancial patterns that impact an asset: its income, its price and its trend dynamics. Indeed, carry is associated with the yield of the asset, value measures the fair price or the fundamental risk and momentum summarizes the recent price movements.

By using carry, value and momentum risk factors, we are equipped to study the cross-section and time-series of currency returns. In the case of stocks and bonds, academics present their results at the portfolio level because of the large universe of these asset classes. Since the number of currencies is limited, we can show the results at the security level.

For each currency, we can then estimate the sensitivity with respect to each risk factor, the importance of common risk factors, when speci�fic risk does matter, etc. We can also connect statistical �figures with monetary policies and regimes, illustrating the high interconnectedness of market risk factors and economic risk factors. The primary goal of building an APT model for currencies is to have a framework for analyzing and comparing the behavior of currency returns. This is the main objective of this paper, and a more appropriate title would have been "Factor Analysis of Currency Returns". By choosing the title "Factor Investing in Currency Markets", we emphasize that our risk factor framework can also help to manage currency portfolios as security analysis always comes before investment decisions.

This paper is organized as follows. Section Two is dedicated to the economics of foreign exchange rates. We fi�rst introduce the concept of real exchange rate, which is central for understanding the di�fferent theories of exchange rate determination. Then, we focus on interest rate and purchasing power parities. Studying monetary models and identifying the statistical properties of currency returns also helps to defi�ne the market risk factors, which are presented in Section Three. These risk factors are built using the same approach in terms of portfolio composition and rebalancing. Section Four presents the cross-section and time-series analysis of each currency. We can then estimate a time-varying APT-based model in order to understand the dynamics of currency markets. The results of this dynamic model can be used to manage a currency portfolio. This is why Section Five considers hedging and

overlay management."

Are you looking for more strategies to read about? Check http://quantpedia.com/Screener

Do you want to see performance of trading systems we described? Check http://quantpedia.com/Chart/Performance

Do you want to know more about us? Check http://quantpedia.com/Home/About

Follow us on:

Facebook: https://www.facebook.com/quantpedia/

Twitter: https://twitter.com/quantpedia

Youtube: https://www.youtube.com/channel/UC_YubnldxzNjLkIkEoL-FXg