Don’t know exactly how to use our tools? Read our Quantpedia Answers series, which will give you a manual and responses to the most frequently asked questions through brief and clear instructions.

How to protect my portfolio against bear market?

First option is to have a crystal ball and sell all the risky assets right before a bear market begins. Then there’s a second option, which Quantpedia prefers – invest in strategies that perform well in bear markets and/or in strategies that protect your portfolio well. What are these strategies? Let’s find out.

What Strategies perform well during Equity bear markets?

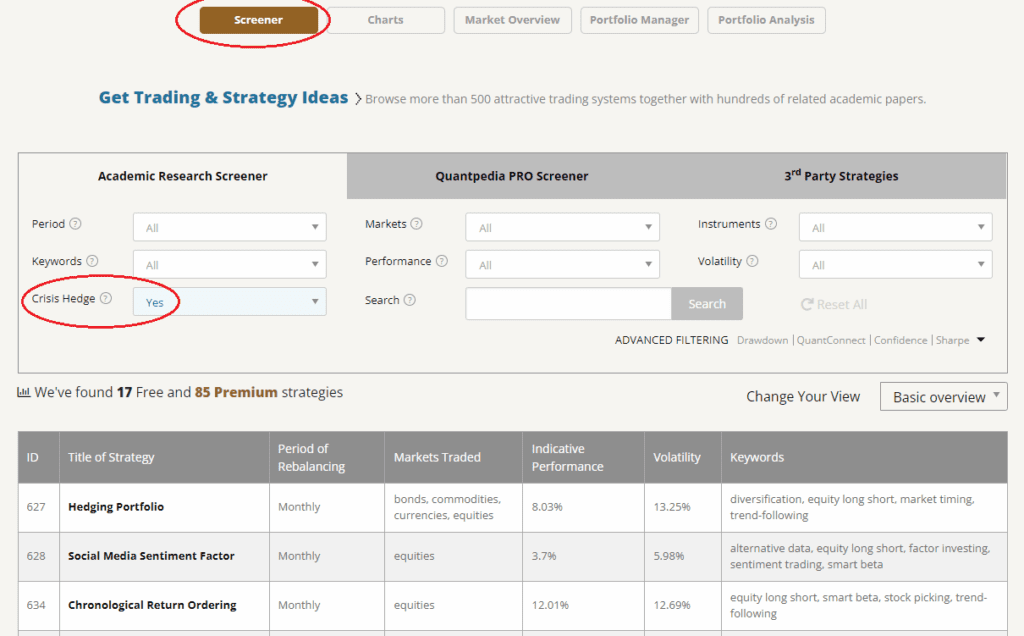

You can easily screen for equity Bear market Hedges in Quantpedia’s Premium Screener:

All the resulting strategies are tested by Quantpedia to have bear market hedging properties.

What Strategies perform well when your portfolio does NOT?

You can easily find out, thanks to Quantpedia Pro’s Crisis Hedge analysis, which strategies perform well when your portfolio performs poorly. Poor performance may be defined in various ways – we will firstly focus on negative months of your portfolio and secondly on negative trend of your portfolio.

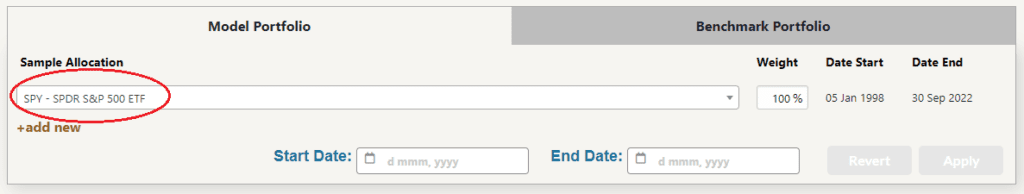

1. Upload/Choose your portfolio in Quantpedia Pro’s Portfolio Manager:

You can upload your own portfolio, pick any strategy from Quantpedia’s database or simply pick any ETF of your choice. We chose SPY US ETF in this example.

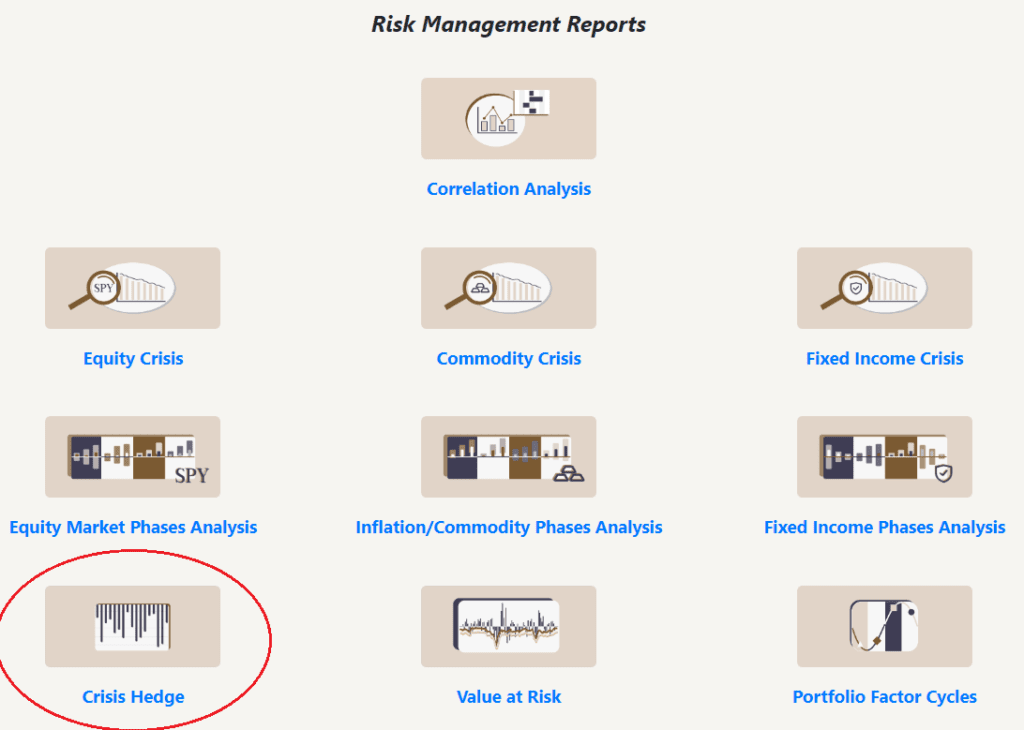

2. Select Crisis Hedge report:

3. Analyse results in a matter of seconds.

How does your portfolio behave in negative periods

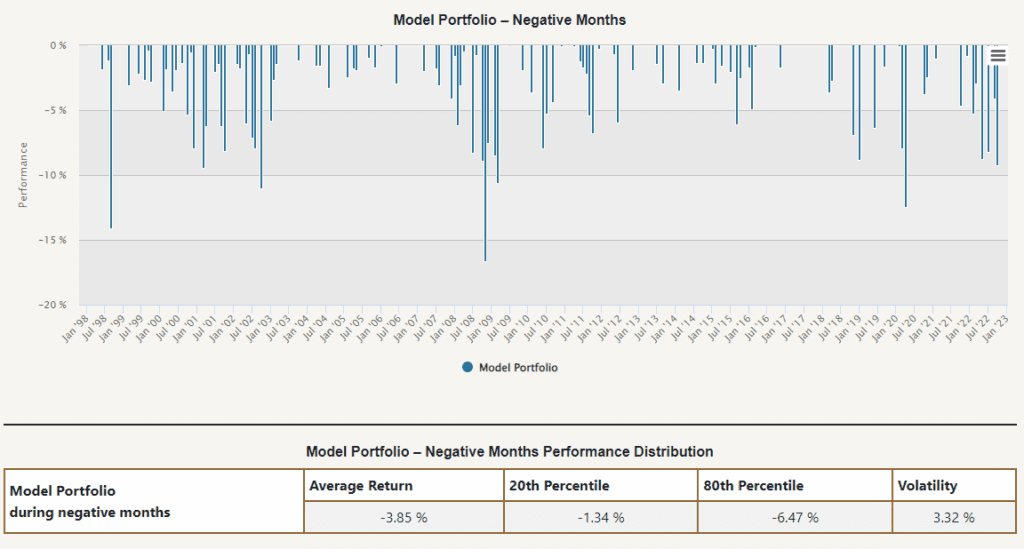

The first part of the Crisis Hedge report displays all the negative months of your portfolio and also return distribution during these months:

Hedges for Negative Months of your portfolio

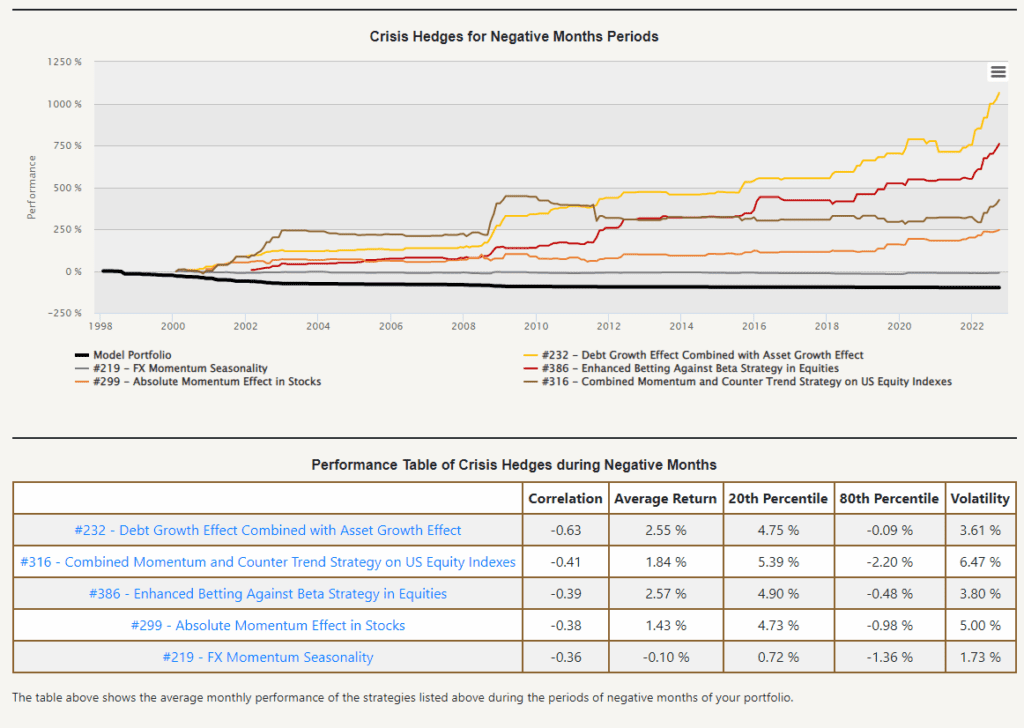

The second part of the Crisis Hedge report shows which trading strategies perform best, when your portfolio performs the worst:

Hedges for Negative Trend of your portfolio

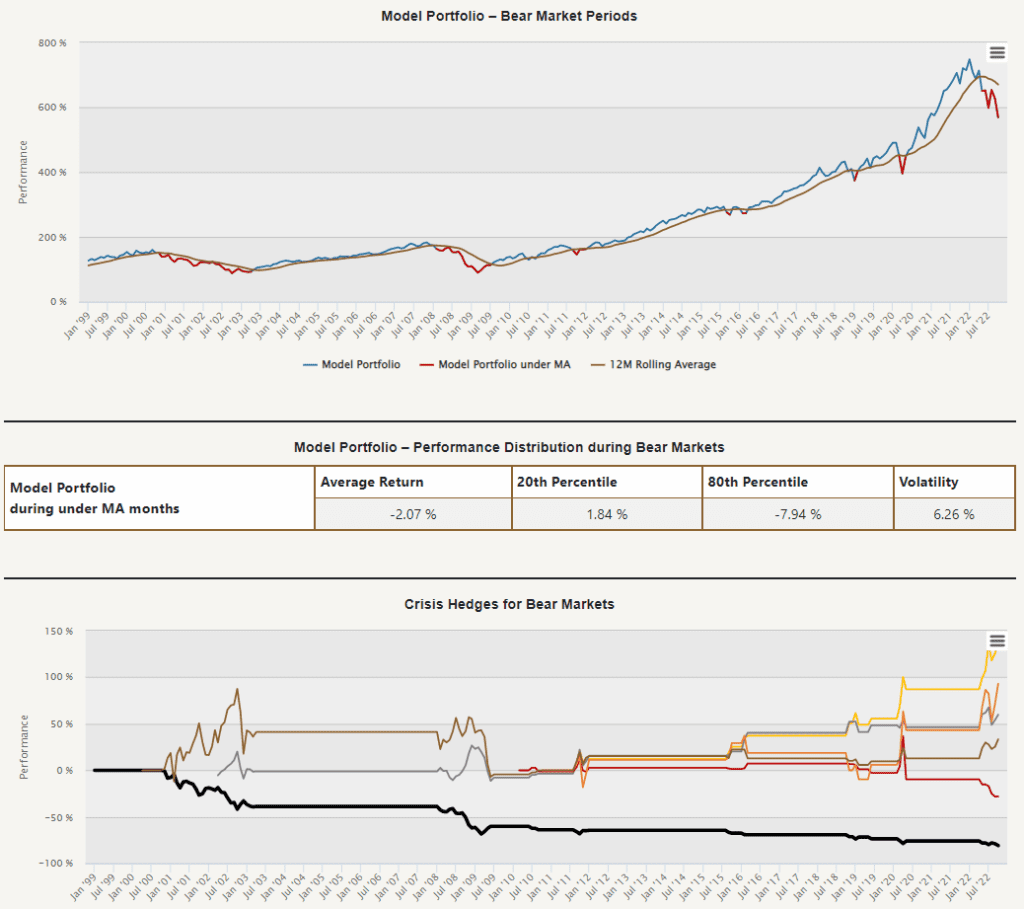

The third part of the Crisis Hedge report shows which trading strategies perform best, when your portfolio trends negatively: