Don’t know exactly how to use our tools? Read our Quantpedia Answers series, which will give you a manual and responses to the most frequently asked questions through brief and clear instructions.

What ETFs should I add to my portfolio?

Looking for ETFs that would improve the risk-return of your portfolio the most? Well, then Quantpedia Pro‘s report called Complementary Strategies is an ideal solution for you.

How to find out which ETF’s would enhance your portfolio’s Sharpe ratio?

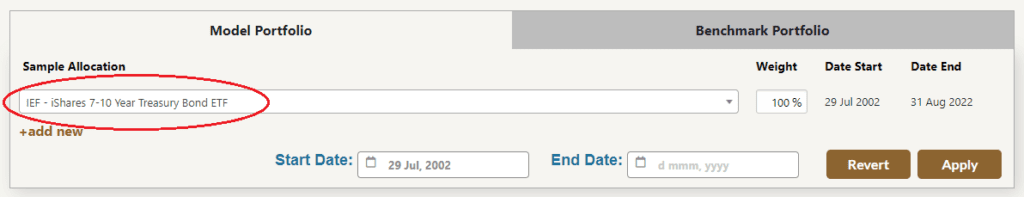

1. Choose your initial portfolio that is to be improved in Quantpedia Pro’s Portfolio Manager. Your portfolio can be anything – a fund, a strategy, an ETF or any mixture of these.

In our example we chose IEF US – ETF representing 7-10 year US Treasury Bonds.

2. Select Complementary Strategies analysis:

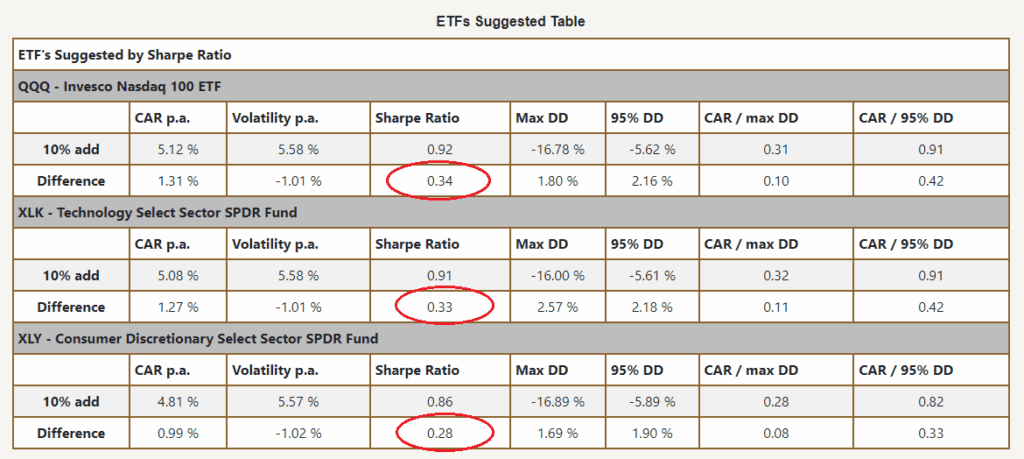

3. Analyze the results:

In case of a US Treasury bond ETF, we may observe that the best risk-return addon would unsurprisingly be composed of equities. More specifically, the three ETFs that would improve the Sharpe ratio of IEF US the most are 2 technology sector ETFs and one pro-cyclical Consumer Discretionary ETF. This is fully in line with the correlation of these pro-cyclical ETFs and an underlying anti-cyclical Bond ETF.