Don’t know exactly how to use our tools? Read our Quantpedia Answers series, which will give you a manual and responses to the most frequently asked questions through brief and clear instructions.

What strategies/assets are in competing funds?

It’s a typical question every trader, fund manager, or investment manager has and Quantpedia Pro offers answers:

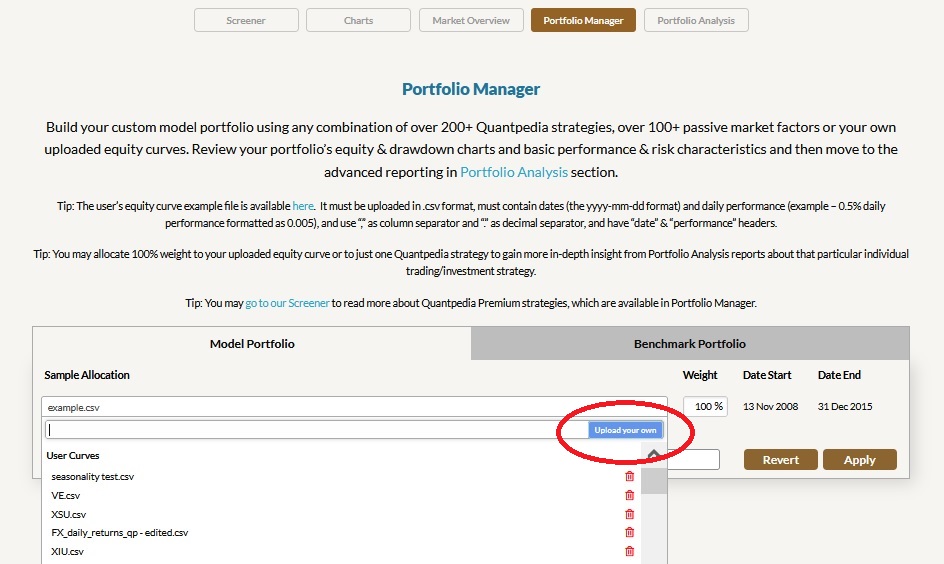

1. At first, we must upload the equity curve of the investigated fund and allocate 100% of the model portfolio to it. The user’s equity curve example file is available here. It must be uploaded in .csv format, must contain dates (the yyyy-mm-dd format) and daily performance (example – 0.5% daily performance formatted as 0.005), and use “,” as column separator and “.” as decimal separator, and have “date” & “performance” headers.

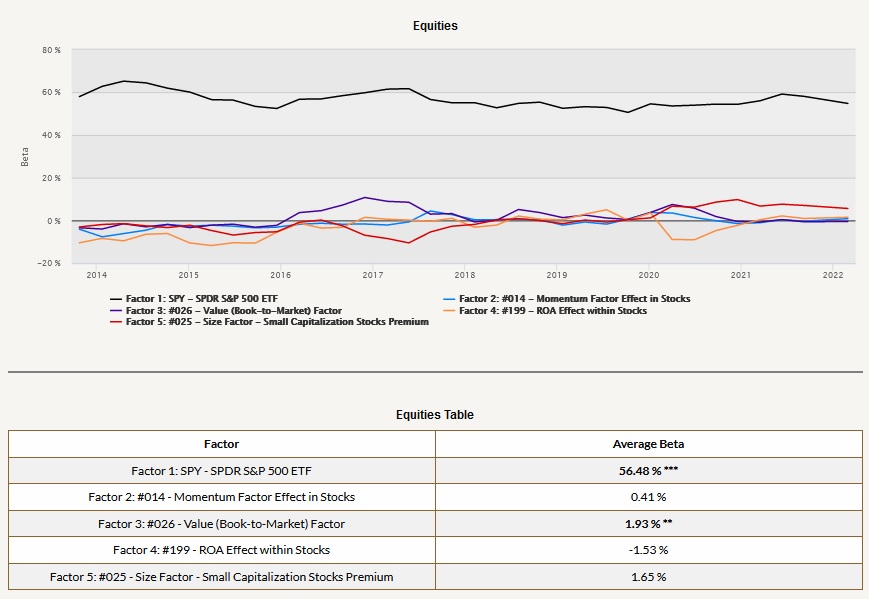

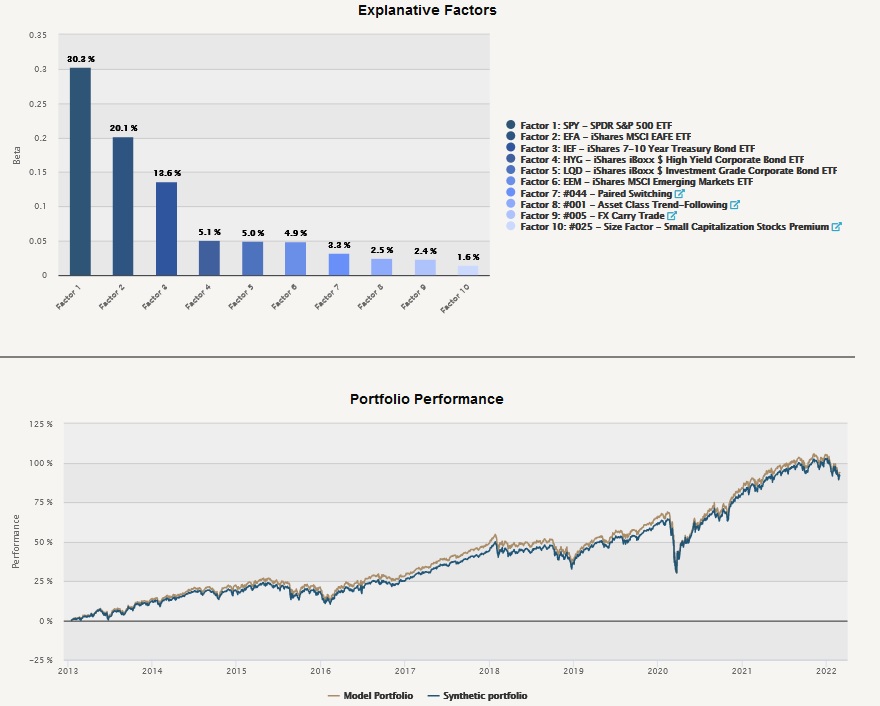

2. Then we have a few options on how to proceed. We can review the Multi-Factor Analysis report that decomposes uploaded equity curves into elementary investment factors using our state-of-the-art multi-factor regression analysis with over 80 underlying factors.

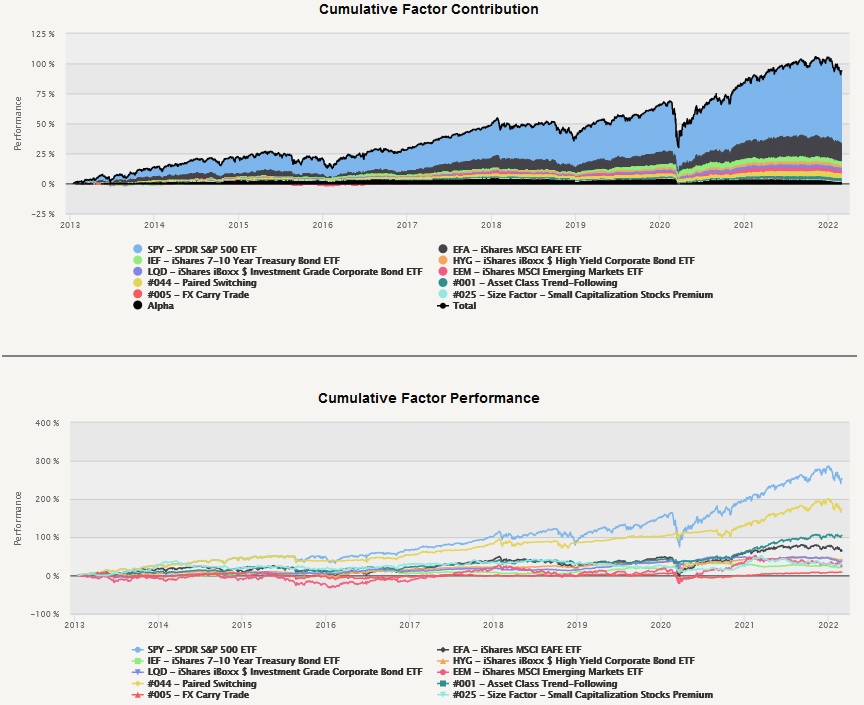

3. We can see which factors explain the performance mostly, plus we can also see how well the portfolio built from factors matches the original equity curve’s performance. Additionally, we can see how much individual factors contribute to the performance.

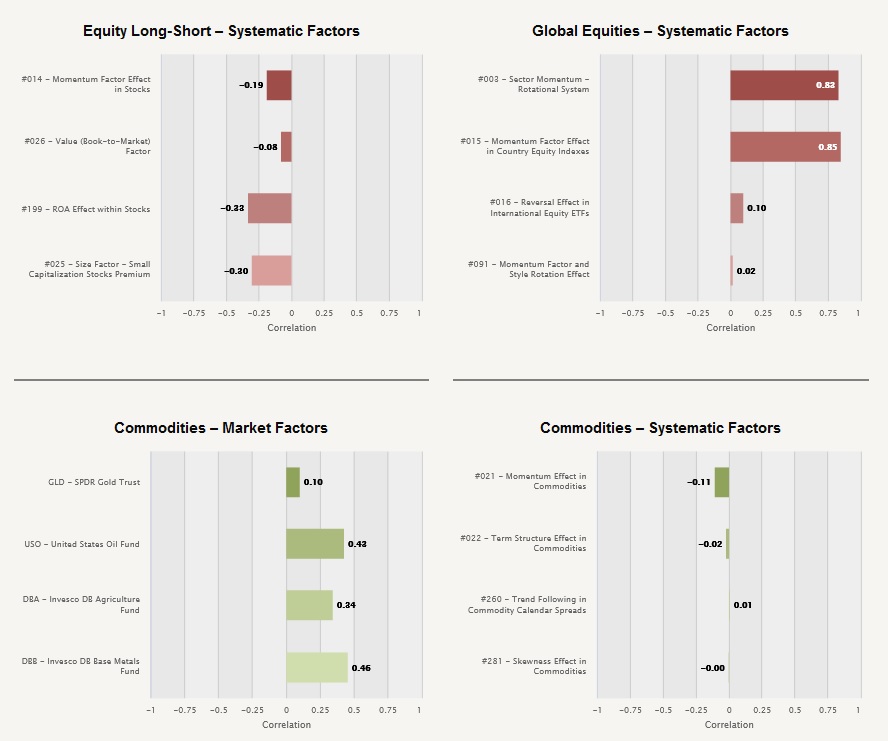

4. Is that all? Not even close. As a next step, we can use the Correlation analysis report and assess how the mysterious fund correlates to other global assets and systematic strategies. It can also give us a better understanding of how it is similar to other known factors.

5. Lastly, we can use the Factor Analysis Models report, which is similar to multi-factor analysis, but instead of our own set of factors, we can use traditional factor models (like Fama&French, etc.). It also helps to find out what are the mysterious fund’s main drivers of performance.