A new financial research paper related to volatility selling strategies:

Authors: Sepp

Title: Gaining the Alpha Advantage in Volatility Trading

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3032098

Abstract:

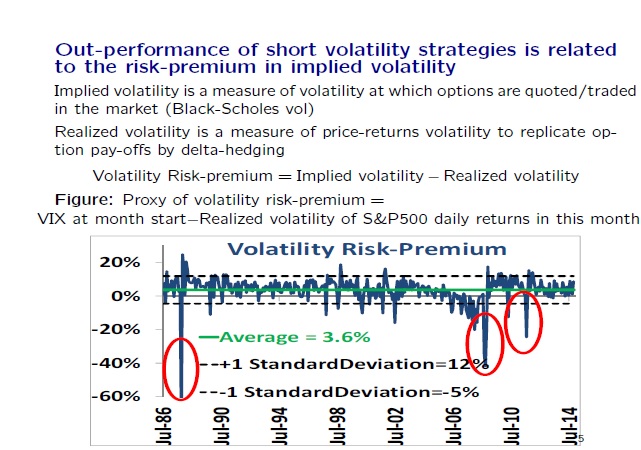

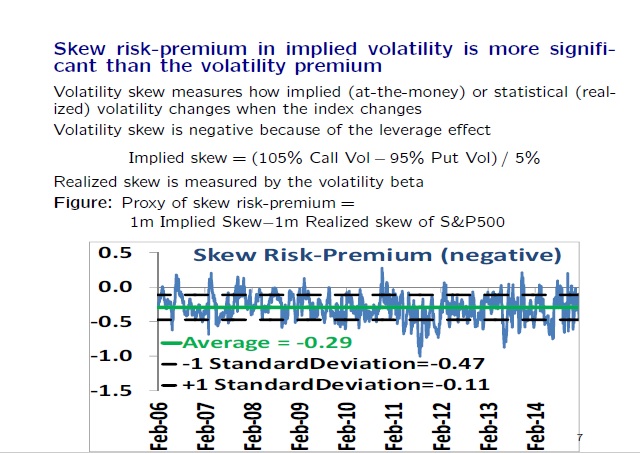

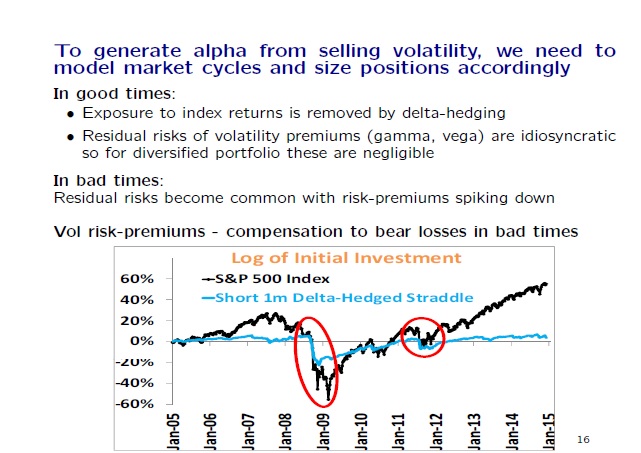

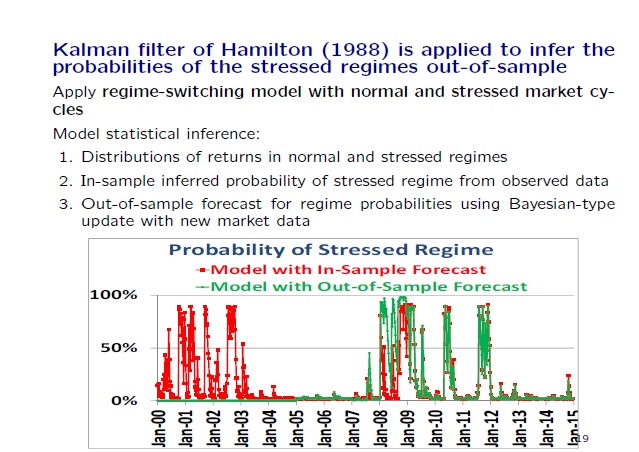

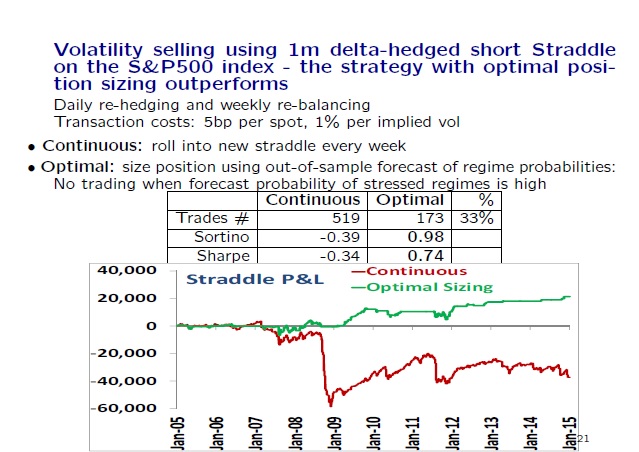

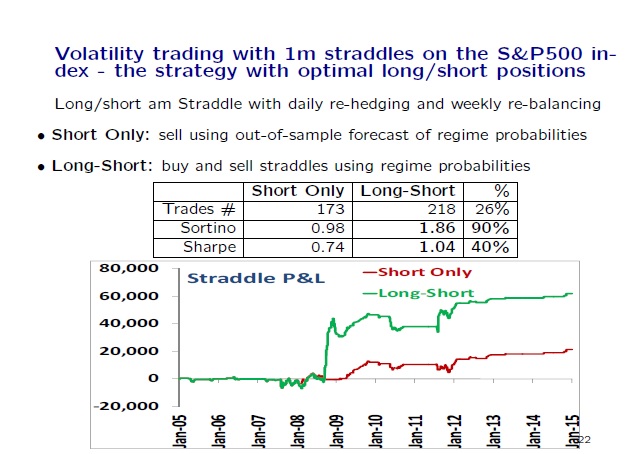

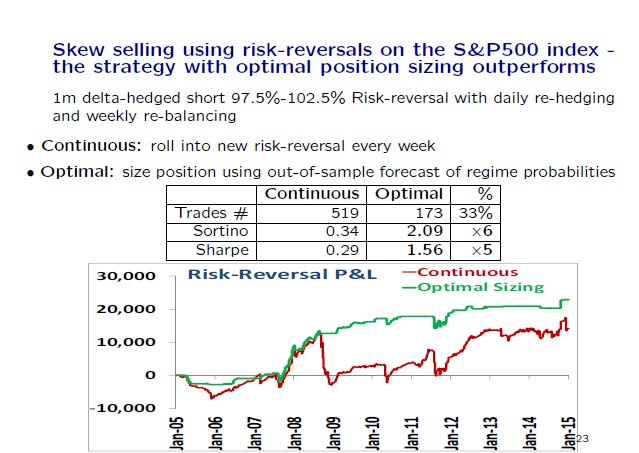

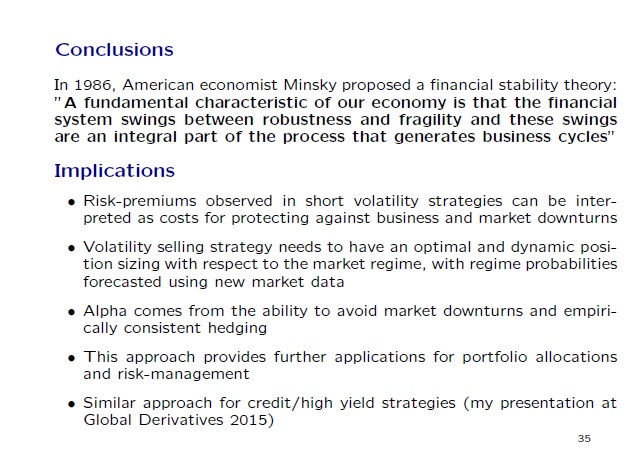

We present some empirical evidence for short volatility strategies and for the cyclical pattern of their P&L. The cyclical pattern of the short volatility strategies produces an alpha in good times but collapses to the beta in bad times. We introduce a factor model with risk-aversion to explain the risk-premium of short volatility strategies as a compensation to bear losses in bad market regimes. We then consider an econometric model for statistical inference of market regimes and for optimal position sizing. Finally, we illustrate model applications for generating alpha from volatility strategies.

Notable presentation slides from the academic research paper:

"

"

Are you looking for more strategies to read about? Check http://quantpedia.com/Screener

Do you want to see performance of trading systems we described? Check http://quantpedia.com/Chart/Performance

Do you want to know more about us? Check http://quantpedia.com/Home/About

Share onLinkedInTwitterFacebookRefer to a friend