Don’t know exactly how to use our tools? Read our Quantpedia Answers series, which will give you a manual and responses to the most frequently asked questions through brief and clear instructions.

How can I Smooth out the performance of my portfolio?

Smooth and stable performance is a very important attribute of a strategy. How to easily smooth out performance of an existing strategy?

1. Pick your desired portfolio, fund, or strategy you would like to smooth in Quantpedia’s Portfolio Manager, in our example we simply picked an S&P 500 ETF:

2. Open Quantpedia Pro‘s Volatility Targeting report:

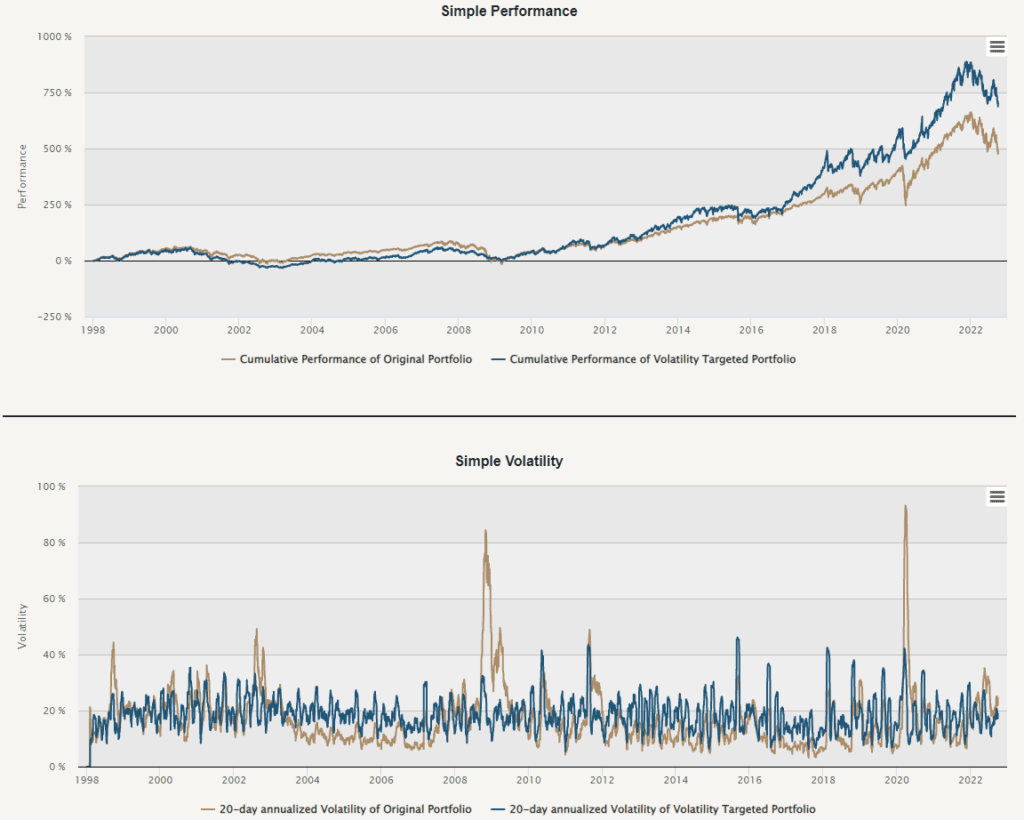

3. Analyze how different Volatility Targeting methods perform and how they are able to smooth out performance of your strategy:

- Historical Volatility Targeting

- Exponential Volatility Targeting

- Momentum based Volatility targeting

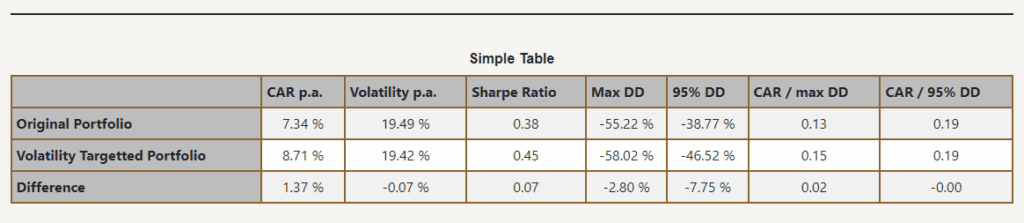

4. Analyze performance and volatility of your strategy/portfolio with and without Volatility Targeting:

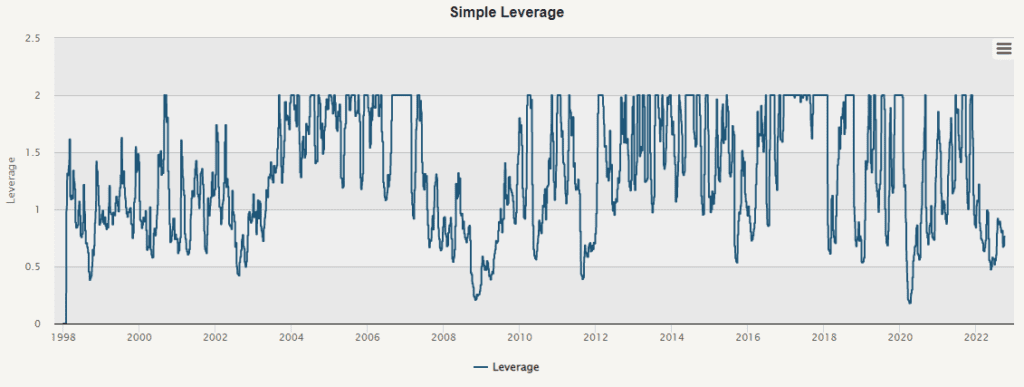

5. Analyze what amount of leverage needs to be used to achieve the desired volatility targeting effect:

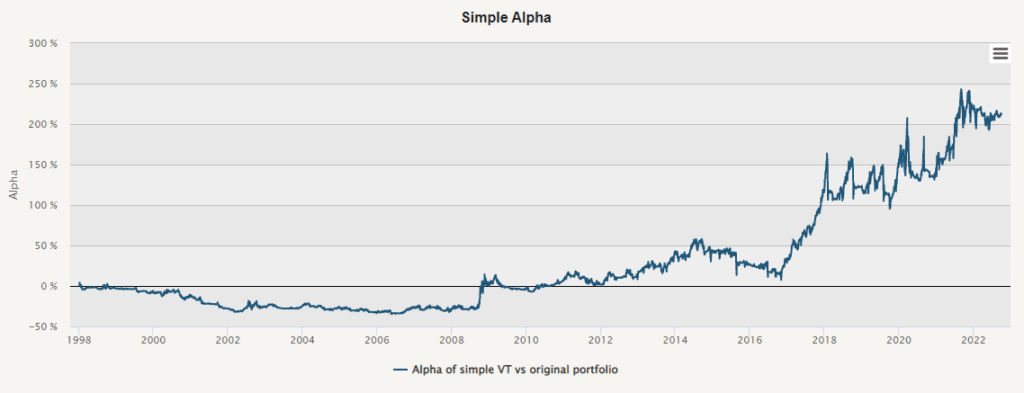

6. Analyze the resulting alpha of the Volatility Targeting strategy compared to the original strategy:

Subscribe to Quantpedia Pro to get access to all these reports.