Which ESG Funds Perform Greenwashing?

Environmental, social, and governance (ESG) investing is rapidly growing in popularity. As more investors grow interested in the ESG investing, the funds theoretically have more reason to highlight their engagement with the ESG-related activities. In the research paper by Andrikogiannopoulou et al. (2022), authors first use textual analysis to assess how and how much the funds talk about ESG-related topics in their prospectuses, and then they compare this measure with the funds’ actual ESG engagement. The discrepancy between the words in their prospectus (high rate of mentioning ESG investing-related topics) and the fund’s acts (not being as green as illustrated in the prospectus) allows the authors to identify the greenwashing funds and take a closer look at their performance.

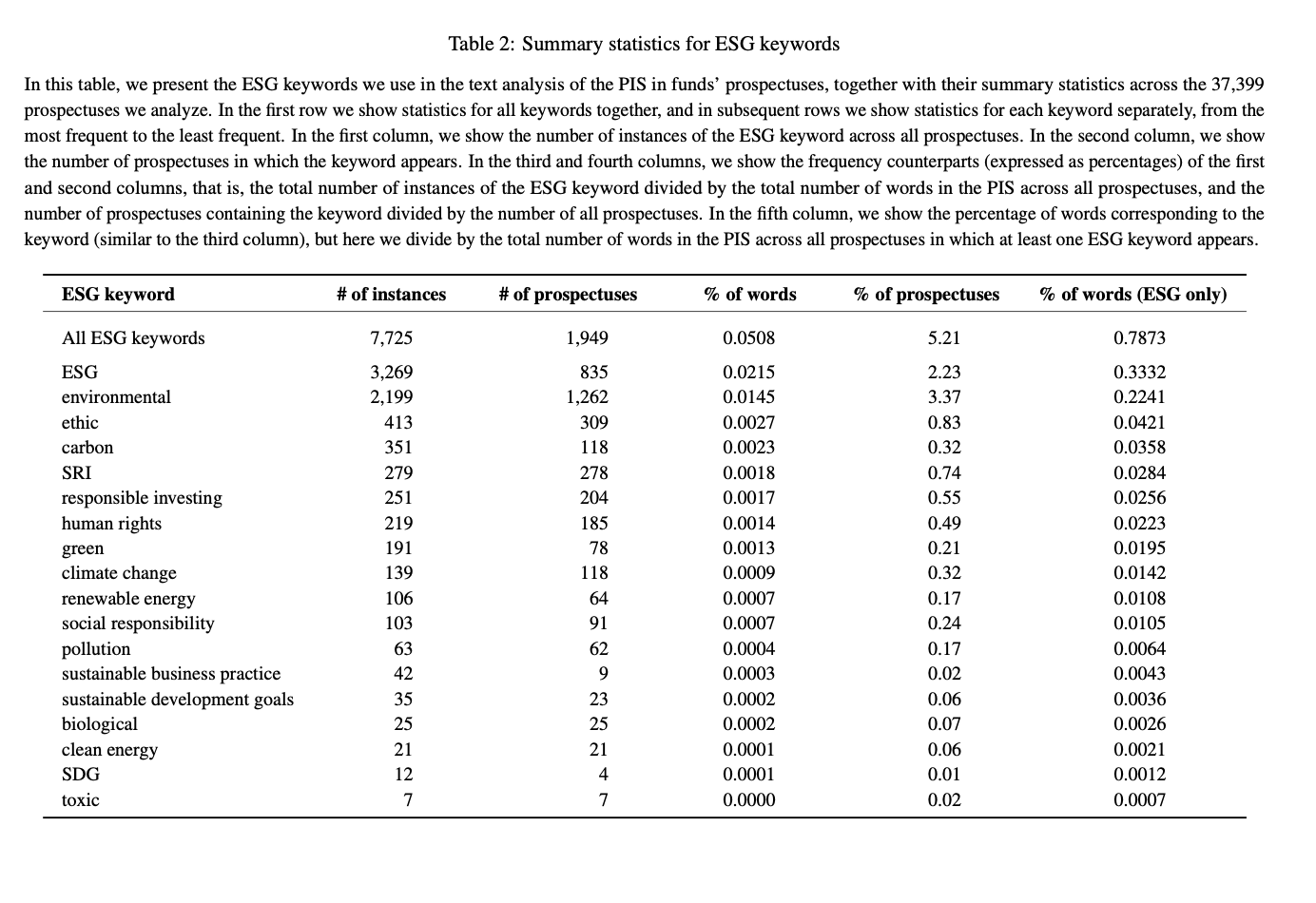

The authors construct two sets of a fund’s ESG measures. The first one is based on the information from their prospectuses and the way they talk and present their engagement. This is done via textual analysis, in which the authors measure ESG intensity, positioning, readability, tonality, and uniqueness in their Principal Investment Strategy. The second is based on objective information to capture their real ESG investments. They construct this measure using a Holdings-based ESG score (value-weighted average of the stock-level ESG scores of the stocks included in the fund’s portfolio) and a Returns-based ESG score. The discrepancy between the results of textual analysis and the holdings and returns’ constructed measure serves as an indicator for greenwashing.

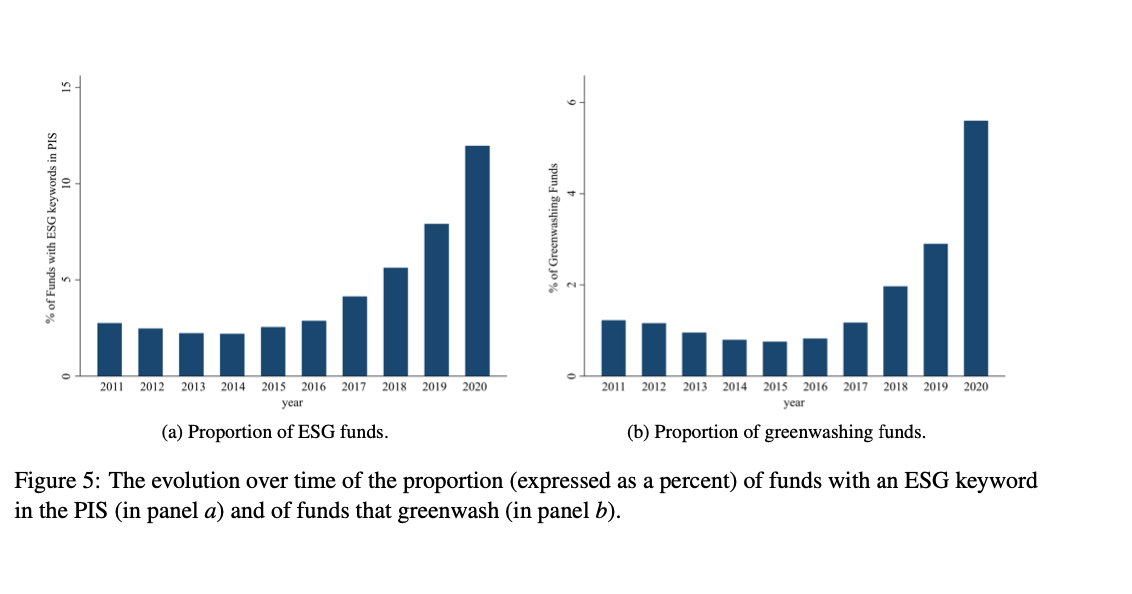

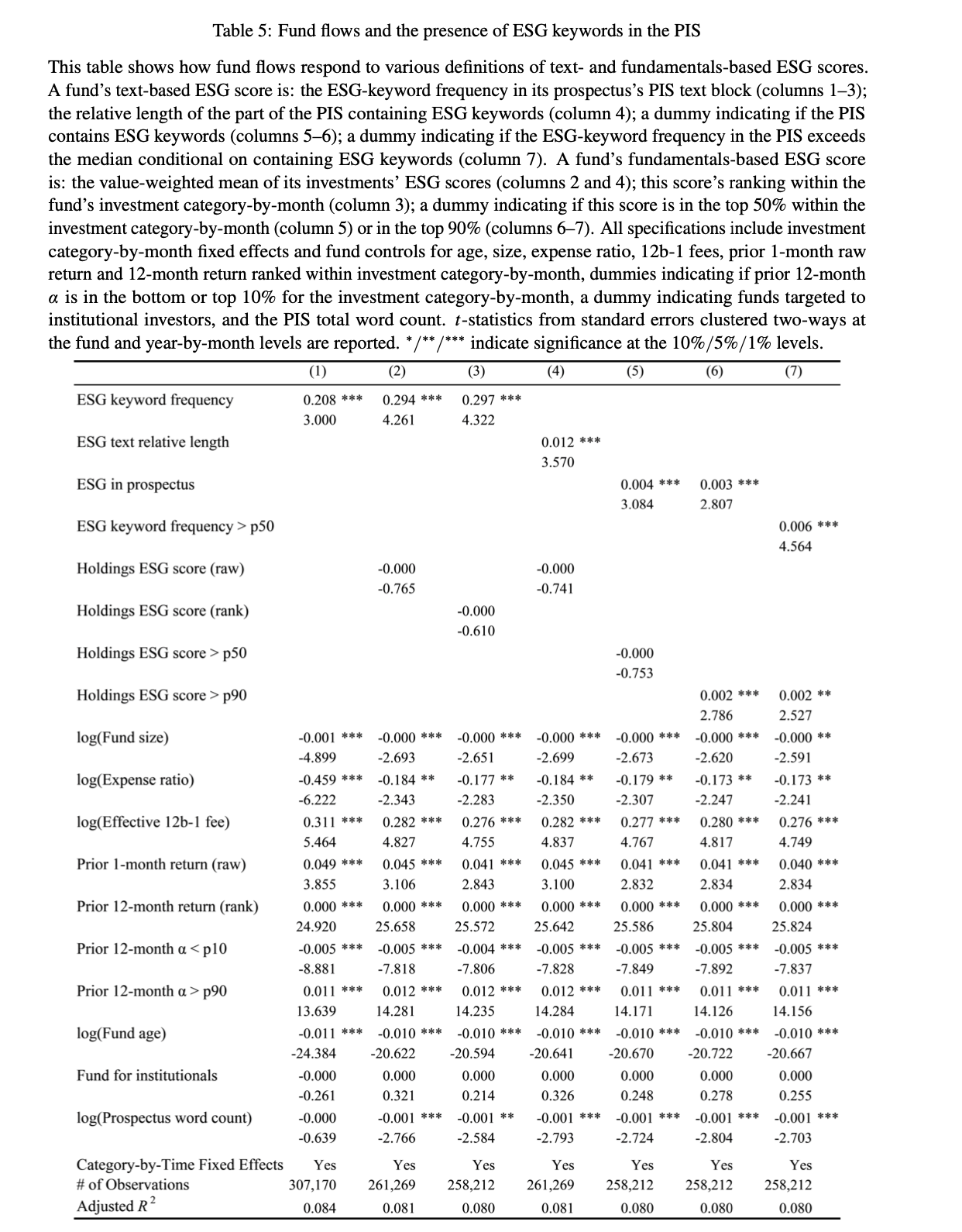

They find that the greenwashing behaviour has risen in the last five years and that it is a negative indicator for the fund’s future performance. Nevertheless, many funds tend to overstate their ESG commitments in the Principle Investment Strategy. On the other hand, the authors find that if the ESG strategy is well-communicated (readable text, less ambiguous tone), it tends to attract higher flows for the fund. ESG intensity in the Principle Investment Strategy seems to be more important for future fund flows than the objective ESG information, based on the two measures.

Authors: Andrikogiannopoulou, Angie and Krueger, Philipp and Mitali, Shema Frédéric, and Papakonstantinou, Filippos

Title: Discretionary Information in ESG Investing: A Text Analysis of Mutual Fund Prospectuses

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4082263

Abstract:

We construct novel measures of funds’ environmental, social, and governance (ESG) commitment by applying text analysis to the discretionary investment-strategy descriptions in their prospectuses. We find that investors respond strongly to text-based ESG measures. Using discrepancies between text- and fundamentals-based ESG measures, we identify greenwashing funds. We find greenwashing is more prevalent in the last five years and among funds with lower past flows and weaker oversight. Furthermore, greenwashing funds attract similar flows as funds that truthfully reveal their ESG commitment, suggesting that investors cannot distinguish between them. On the other hand, greenwashers have inferior performance than genuinely green funds.

As always, we present some interesting figures:

Notable quotes from the academic research paper:

“In this paper, we study the discretionary information released through fund prospectuses, which enables us to make several contributions. Specifically, we conduct a text analysis of fund prospectuses to learn how and how much funds talk about ESG investments. We also compare the discretionary with the objective ESG-related information to understand if and when the two deviate. Subsequently, we analyze whether investors pay attention to this discretionary information and, in case it is manipulated, whether they are deceived by it or not. Succinctly, we find that there is often a discrepancy between funds’ words and actions and that, while investors pay attention to both, they can be deceived.

Throughout the 2011–2020 period that we study, the number of funds that discuss ESG in their Principal Investment Strategy (PIS) has grown exponentially, mirroring the growth in the public’s interest in ESG investments and rising to about 450 funds (about 10% of the total) in 2020. Among funds that discuss ESG, the ESG-related portion of the PIS is, on average, about a fifth of the entire PIS and it appears about halfway through the PIS though in 13% of cases it starts at the very first sentence.

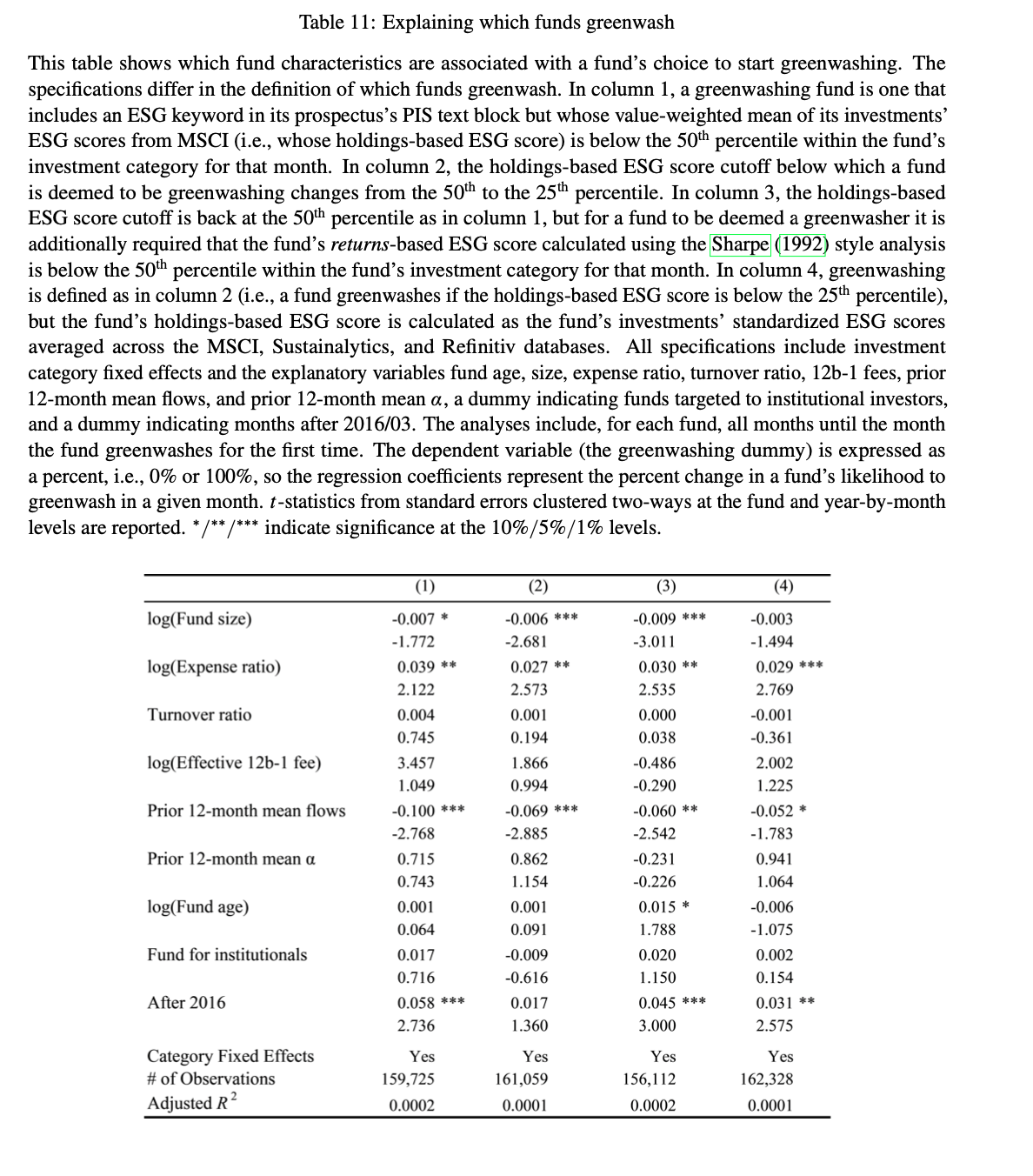

First, we find that greenwashing behavior is more likely to be observed in the second half of our sample period (i.e., after 2016), and is associated with funds that have lower past flows and higher expense ratios. These findings are consistent with the hypothesis that funds are more likely to greenwash if they have (i) a potential benefit from doing so (as is the case later in the sample period, when ESG interest is particularly high), (ii) a strong incentive to do so (as is the case when past flows are low), and/or (iii) the opportunity to go undetected (as is the case for funds with weak governance, which often have high expense ratios; see Gil-Bazo and Ruiz-Verdú, 2009). Second, we find that, contrary to what rationality would imply, investors direct their flows to funds that talk about ESG in their prospectus regardless of whether these funds back their words with actions or not. Third, we find that green- washing funds do not have better investment performance; this result serves as a useful sanity check of our greenwashing measure. In contrast, our analysis reveals that non-greenwashing funds—i.e., those that truthfully reveal and actually engage in ESG investing—exhibit better performance.

Overall, our finding that text-based ESG measures matter and that they matter more than fundamentals-based ESG measures is consistent with the idea that investors have limited attention and pay attention to more salient information

This analysis has the advantage that it accounts for unobserved fund heterogeneity, but the disadvantage that it is much less efficient as it identifies the effect of text-based ESG measures on fund flows through within-fund time-series variation only, which is rather limited. To be precise, about 6% of funds have switched from none to at least one ESG mention in their PIS during our 10-year sample period. Despite this shortcoming, it is very encouraging that this analysis of the effects of text-based ESG measures on fund flows yields results that are very similar to those from our baseline analysis that exploits cross-sectional variation within category-month.

We see that our text-based ESG measures significantly affect the flows to both types of funds, but the estimated effect is larger for the institutional funds. A one standard deviation increase in the frequency of ESG mentions leads to higher monthly flows of about 0:35% for institutional funds and of 0:2% for retail funds (both effects are significant at the 1% level).17 As both types of investors significantly respond to the ESG information contained in fund prospectuses, we conclude that institutions are not the sole driver of the effect of text-based ESG measures on fund flows. Furthermore, we find that, while flows to institutional funds significantly respond to exceptionally high levels of holdings-based ESG, this is not the case for retail funds.

Taken together, these findings support our hypotheses that, as investors’ interest in ESG investing rises, funds that have experienced fund outflows over the preceding year and/or have potentially weaker oversight are more likely to exhibit greenwashing behavior. ”

Share onLinkedInTwitterFacebookRefer to a friend