Bill Gross is probably the most known fixed income fund manager. A new academic paper sheds more light on his track record and sources of his stellar performance …

Authors: Dewey, Brown

Title: Bill Gross’ Alpha: The King Versus the Oracle

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3345604

Abstract:

We set out to investigate whether ”Bond King” Bill Gross demonstrated alpha (excess average return after adjusting for market exposures) over his career, in the spirit of earlier papers asking the same question of ”Oracle of Omaha,” Warren Buffett. The journey turned out to be more interesting than the destination. We do find, contrary to previous research, that Gross demonstrated alpha at conventional levels of statistical significance. But we also find that result depends less on the historical record than on whether we take the perspective of academics interested in market efficiency, investors picking a fund or someone (say a potential employer) asking whether a manager has skill or is throwing darts to pick positions. These are often thought to be overlapping or even identical questions. That’s not completely unreasonable in equity markets, but in fixed income these are distinct. We also find quantitative differences, mainly that fixed-income securities have much higher correlations with each other than equities, make alpha 4.5 times as hard to measure for Gross than Buffett. We don’t think our results will have much practical effect on attitudes toward Gross as an investor, but we hope they will advance understanding of what alpha means and appropriate ways to estimate it.

Notable quotations from the academic research paper:

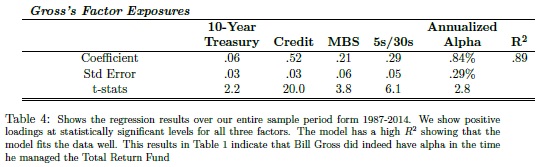

“Superstar bond portfolio manager Bill Gross announced his retirement last week. From 1987 to 2014, his PIMCO Total Return fund generated 1.33% per year of alpha versus the Barclays US Credit index, with a t-statistic of 3.76. For many years his fund was the largest bond fund in the world, and was generally considered to be the most successful. This track record inspired us to take a closer quantitative look along the lines of Frazzini, Kabiller and Pedersen’s Buffett’s Alpha (FKP). Gross, like Buffett, often publicly discussed what he perceives as the drivers of his returns. At the Morningstar Conference in 2014 and in a 2005 paper titled “Consistent Alpha Generation Through Structure” Gross highlighted three factors behind his returns: more credit risk than his benchmark, more 5-year and less 30-year exposure, and long mortgages and other securities with negative convexity.

We present five main findings:

1. We con firm that those three factors, plus one for the general level of interest rates, explain 89% of the variance in Gross’ monthly return over the 27-year period. We further estimate that Gross outperformed a passive factor portfolio by 0.84% per year, which is significant at the 5% level. Gross’ compounded annual return over the period was 7.52%, versus 6.44% for the Barclay’s Aggregate US Index. So we find that most of his 1.08% annual outperformance of the index was alpha.

| What about Data? Look at Quantpedia’s Algo Trading Discounts. |

2. The FKP paper mentioned above considered one of the best-known track records in the equity asset class, Warren Buffett’s. We compliment this work by examining one of the best-known track records in the fixed-income asset class. Fixed-income investing offers a different set of challenges and opportunities than equity. We offer a novel discussion on the concept of manager alpha including important qualitative and quantitative differences in the concept of alpha with Gross versus Buffett.

3. The main qualitative difference is that Gross exploited well known sources of risk and potentially excess return in the fixed-income market, exposures that investors rationally demand additional yield to accept. Buffett’s performance, for the most part, correlates with factors uncovered long after he began investing and were still not accepted as fully as factors like credit risk or mortgage prepayment risk. Moreover Buffett’s factors probably result from behavioral biases and institutional constraints rather than rational investor preferences.

4. The main statistical difference is the much higher r2 value in Gross’ regression versus Buffett’s (about 0.9 versus 0.3) makes the alpha significance estimate 4.5 times as sensitive to the observed returns on the factor portfolios. Since it is nearly impossible to estimate expected returns – there is considerable debate about the level of the equity premium even with 150 years or more of data – this makes it important to select factors that conform as closely as possible to what Gross actually did, rather than factors that merely have a high return correlation to Gross’ results. The closer the factors conform to Gross’ practice, the better the chance that any deviations in factor performance from expectation over the period are reflected equally in both Gross’ actual results and the factor portfolio results.

5. Gross earned essentially all of his alpha in favorable markets for his factors and had a significantly negative timing ability in the sense that his factor exposures were greater in months the factor had negative returns than in months the factor had positive return. This latter feature could be unfortunate timing decisions or negative convexity in the factor exposures. We discuss whether this can shed light on the source of Gross’ alpha, specifically whether it relates to preferential access to new issues and leverage.”

Are you looking for more strategies to read about? Check http://quantpedia.com/Screener

Do you want to see performance of trading systems we described? Check http://quantpedia.com/Chart/Performance

Do you want to know more about us? Check http://quantpedia.com/Home/About

Follow us on:

Facebook: https://www.facebook.com/quantpedia/

Twitter: https://twitter.com/quantpedia

Share onLinkedInTwitterFacebookRefer to a friend