We mentioned multiple times that we at Quantpedia love historical analysis that spans over a long period of time as it offers a unique glimpse into the different macro environments and periods of political and economic instabilities. These long-term studies help a lot in risk management, and they also help investors set the right expectations about the range of outcomes in the future. Historical analysis of equity and fixed-income markets is not rare, but currency markets are less explored. Therefore, we are happy to investigate a recent paper by Joseph Chen that analyzes fx carry, currency momentum, and currency value strategies in over the 200-year history.

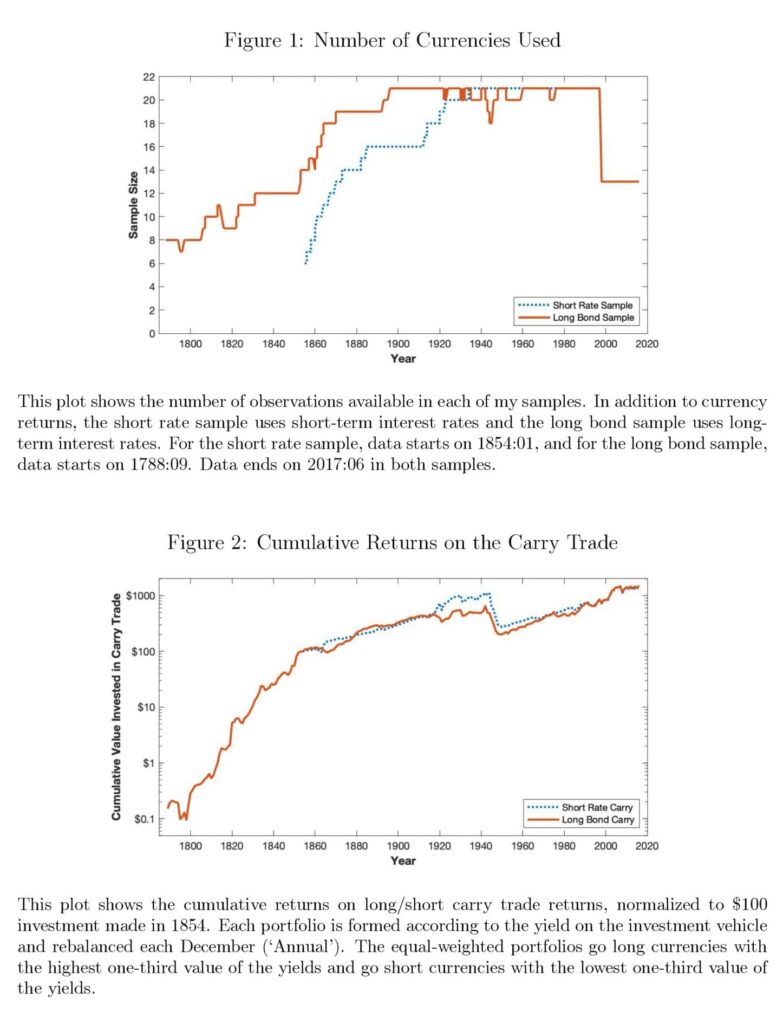

Using an extended data sample that spans over two centuries (!) with long-term bonds and short-term rates as the investment vehicle (Chen, revised 2024) investigates the robustness of currency investment strategies. Thoughtfully carried out panel regression analysis with portfolio returns revealed several interesting conclusions:

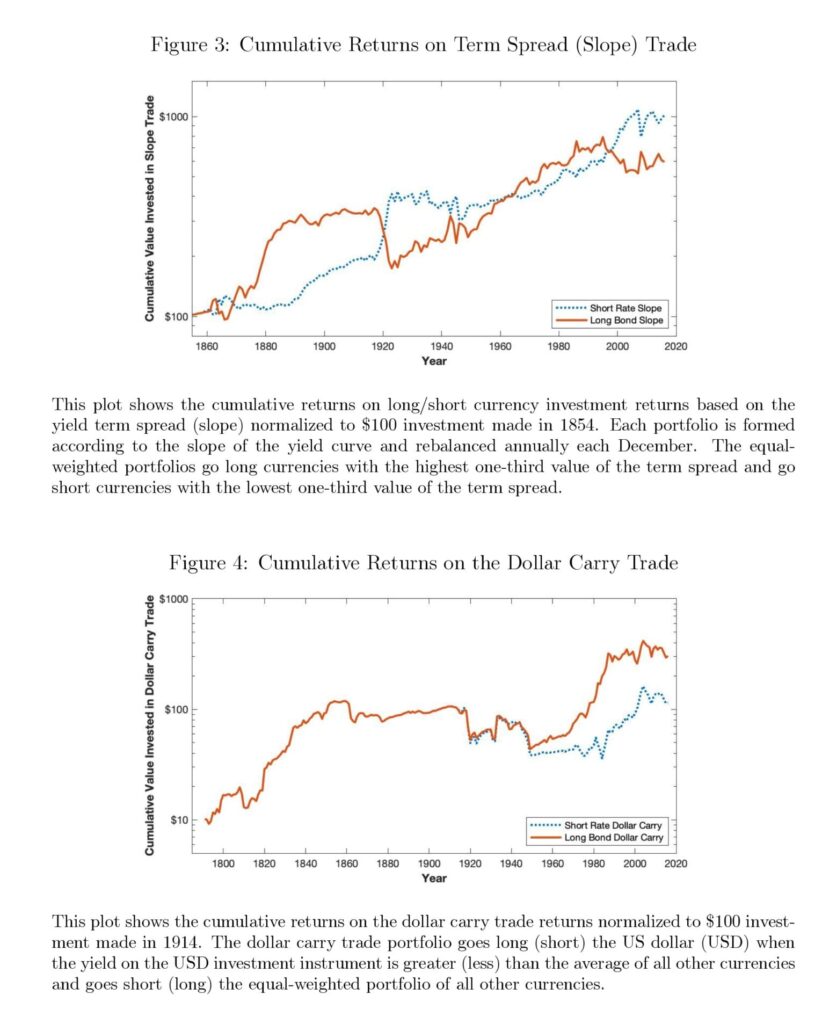

- On the FX Carry front, they find that the carry trade returns would have been robust across time, whether short rates or long bonds were used, except for the period surrounding the World Wars. The dollar carry trade has also been robust except for these periods, plus the period surrounding the US Civil War.

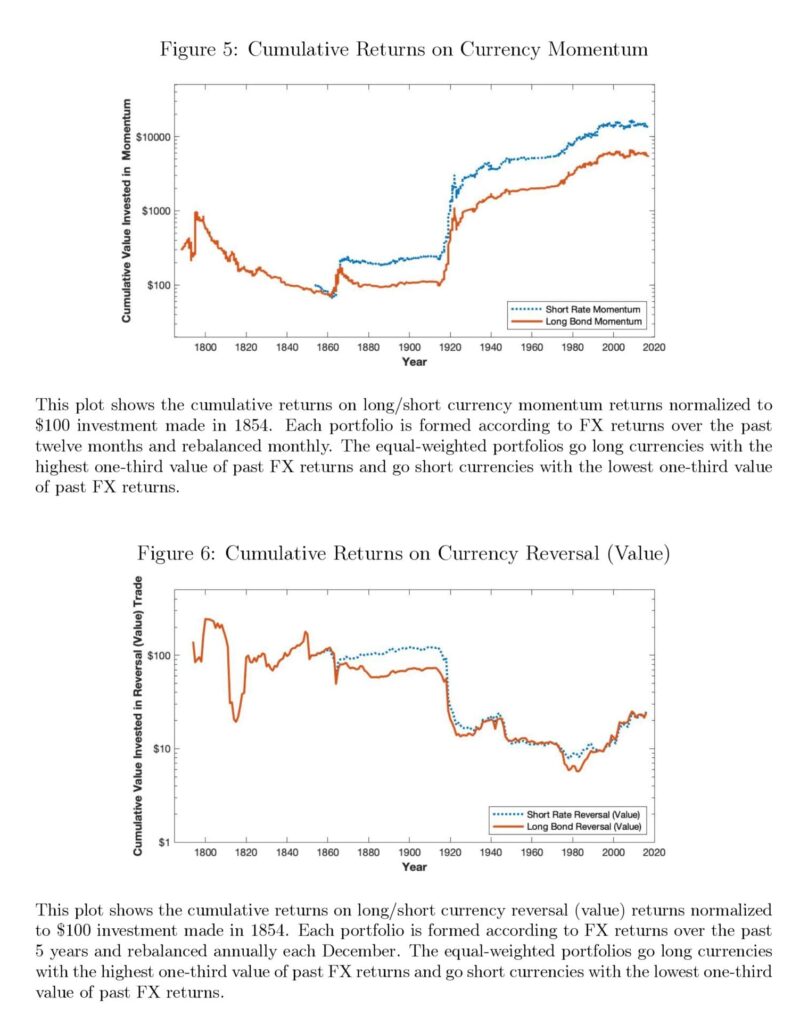

- While there is limited support for the currency momentum effect, using a longer sample shows that the currency reversal effect does not exist. Finally, an examination of currency investments based on the slopes of the yield curve suggests that cross-currency yield-curve flattening trades have been surprisingly robust throughout the years.

- Some surprising stylized facts emerge from this study. In contrast to Lustig, Stathopoulos, and Verdelhan (2019), long bond carry trade exhibits robust positive returns. There is no evidence of a downward term structure of currency carrying trade risk premia.

- Fixed exchange rate regimes do not seem to make currency effects like the carry trade go away. If anything, since these periods exhibit reduced currency exchange rate volatility, fixed exchange rate regimes are associated with higher returns on a risk-adjusted basis.

All in all, we really recommend this paper for a weekend reading for for all investors/traders that systematically harvest factor premiums in the currency markets as the length of the covered sample is really exceptional.

Authors: Joseph Chen

Title: Currency Investing Throughout Recent Centuries

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4692257

Abstract:

The literature on currency investing, such as the carry trade, typically bases its analysis on the most recent period since 1983. I analyze risk and return characteristics of currency investing across 21 currencies over an extended period with data that spans more than two centuries and reaches back as far as 1788. In addition to using short-term interest rates as the investment vehicle, I also investigate using long-term bonds. The risk premia estimates from these investments are informative about the variability of the pricing kernel in a reduced-form pricing model. I find that carry trade return would have been surprisingly robust throughout history and robust to using long-term bonds. Moreover, cross-currency yield-curve flattening trade produces robust returns with Sharpe ratio double that of the carry trade. These results help better understand the nature and the source of premia among currency investments and the variability of pricing kernels.

As always, we present several exciting figures and tables:

Notable quotations from the academic research paper:

“In this paper, I construct an extended historical dataset of foreign exchange rates, short-term interest rates, and long-term interest rates and design an empirical experi- ment that overcomes these technical difficulties. Rather than creating a dataset from the perspective of a US investor allocating all funds into foreign investments, I in- clude investments in the US as the trivial zero excess return investment. By including the option to invest in the home currency, this study is made base-currency neutral. Moreover, I can construct returns on long bonds by estimating the capital gains of holding longer-term bonds from changes in bond yields with minor assumptions. In total, I have data covering upwards of 21 currencies across 230 years. Armed with this dataset, I construct currency investment portfolios based on various strategies and run panel regression analyses to examine their statistical significance.

This historical perspective also offers additional insights. The currency momen- tum effect seems to be robust to using a longer history, unless the sample goes back far enough in history. Based on data starting in 1788, currency momentum trade would have produced positive returns only during the latter half of the sample, but not throughout the entire sample. Panel regressions also fail to detect a robust cur- rency momentum effect. For currency reversals, the effect only seems to exist within the sample studied by others. Outside the most recent period after the break-down of the Bretton Woods Agreement, there is no evidence of currency reversal trade producing positive abnormal returns. These results suggest that data-snooping bias could be an issue, or there exists some time-varying underlying mechanism at work that drives these effects.

In my data, short rates have been relatively stable compared to other variables, as shown by their low volatilities (standard deviations). The Swiss franc (CHF) has had one of the most stable short rates (volatility of 1.88%) and has also had the lowest average short rates (average of 2.82%). On the other hand, the Portuguese escudo (PTE) has had the most volatile short rates (volatility of 5.39%), as well as one of the highest average short rates (average of 6.26%). Generally speaking, lower average short rates have been associated with more stable short rates, with a correlation between them of 0.66.

This result is in sharp contrast to Lustig, Stathopoulos, and Verdelhan (2019), who report insignificant carry trade returns using long bonds over the Modern Sam- ple. However, my estimation of long bond returns differ from theirs in a number of ways, which may explain the differences.17 . In my analysis, carry trade returns appear robust to using longer maturity bonds. In the context of the reduced-form model and equation (17), long-bond carry trade can be explained if low long bond rate reflects higher variability of the permanent component of that country’s pricing kernel.

Finally, I consider signal-weighted carry trade portfolio returns in Panel C of Table 3. Unlike equal-weighted portfolios, signal-weighted portfolios place greater portfolio weight on more extreme yields, akin to regression analysis. The resulting portfolio is qualitatively similar to equal-weighted portfolios presented in Panel B, with some notable features. Overall returns are slightly higher, but they have higher volatility, which results in Sharpe ratios of 0.391 and 0.361, depending on whether short rates or long bonds are used as the investment vehicle. Long-short portfolios exhibit slightly less negative skewness, of which much of the change seems to be coming from the long side portfolio rather than the short side portfolio.

The momentum effect and the reversal (value) effect are two additional currency investment strategies that have been studied in the literature that can also be readily be examined in my expanded sample. Menkhoff, Sarno, Schmeling, and Schrimpf (2012a) and Asness, Moskowitz, and Pedersen (2013) both report strong momentum effect in the Modern Sample during which currencies that have appreciated the most in the past twelve months tend to continue to have high returns. Menkhoff, Sarno, Schmeling, and Schrimpf (2012a) report that this effect is most potent when the holding period is over the next one month, which is consistent with the strategy studied in Asness, Moskowitz, and Pedersen (2013). The latter study also documents a reversal effect, where currencies with low long-term past returns tend to revert to higher returns. Menkhoff, Sarno, Schmeling, and Schrimpf (2017) report similar results based on past 5-year currency appreciation, relative to changes in purchasing power.24 Since low past returns given relatively unchanged fundamentals are similar to low valuation of currencies, these reversal effects are sometimes referred to as ‘value’ effects. These studies are all based upon observations during the Modern Sample. In this section, I investigate the robustness of momentum and reversal effects in currencies over extended periods.

Figure 6 shows the cumulative returns on currency reversal. Both short rate currency reversal and long bond currency reversal have only been positive since around 1980, when most prior studies begin their data. There has been period of relatively flat returns when currencies were not freely floating, but the general trend in returns to currency reversal has been negative. Table 12 examines returns on currency reversal portfolios deeper. Panels A and B show the returns using short rates and long bonds, respectively, and tell results similar to that of the figure.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend