Cryptocurrencies are an asset class that isn’t easy to ignore in the modern world. In February 2023, the crypto market capitalization was at around $1.1 trillion, which is roughly half of the value of all U.S. notes and coins in circulation. With their properties quite different from other investment options, it might prove useful to an investor to understand and navigate this market well. The authors Campbell R. Harvey, Tarek Abou Zeid, Teun Draaisma, Martin Luk, Henry Neville, Andre Rzym, and Otto Van Hemert in their paper An Investor’s Guide to Crypto (July, 2022), offer an overview surely interesting for anyone willing to enter this market.

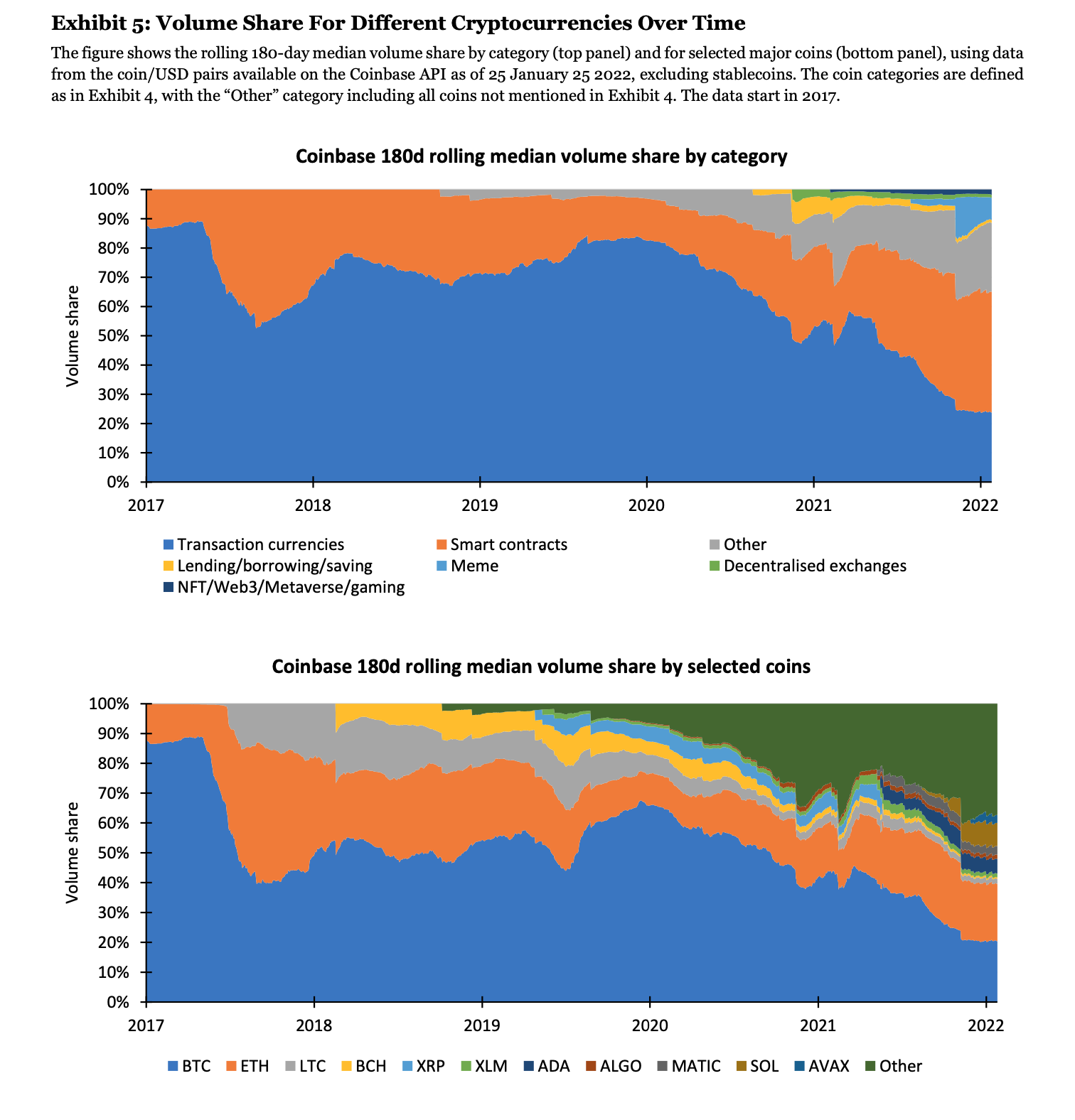

The authors firstly classify the investment universe of cryptocurrencies into 7 groups depending on their purpose and/or nature. These are transaction cryptocurrencies (such as Bitcoin), smart contracts (e.g. Ethereum), decentralized exchanges, which allow the user to swap one cryptocurrency for another (e.g. SushiSwap), lending, borrowing, and savings-related crypto (e.g. Aave and Compound), meme cryptocurrencies (Dogecoin), stablecoins, and the last group are cryptocurrencies tied to Web3, gaming platforms, metaverse and NFTs.

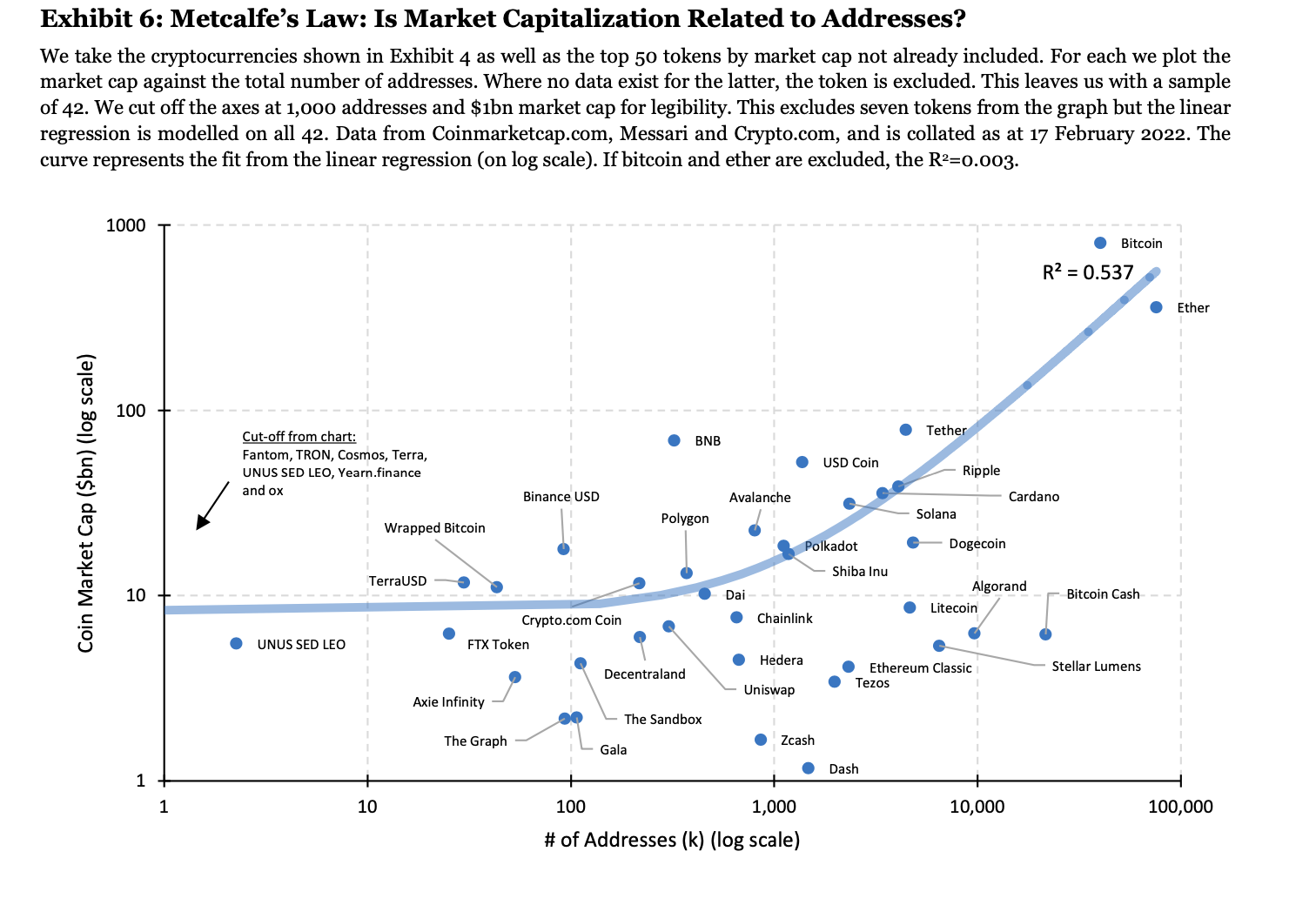

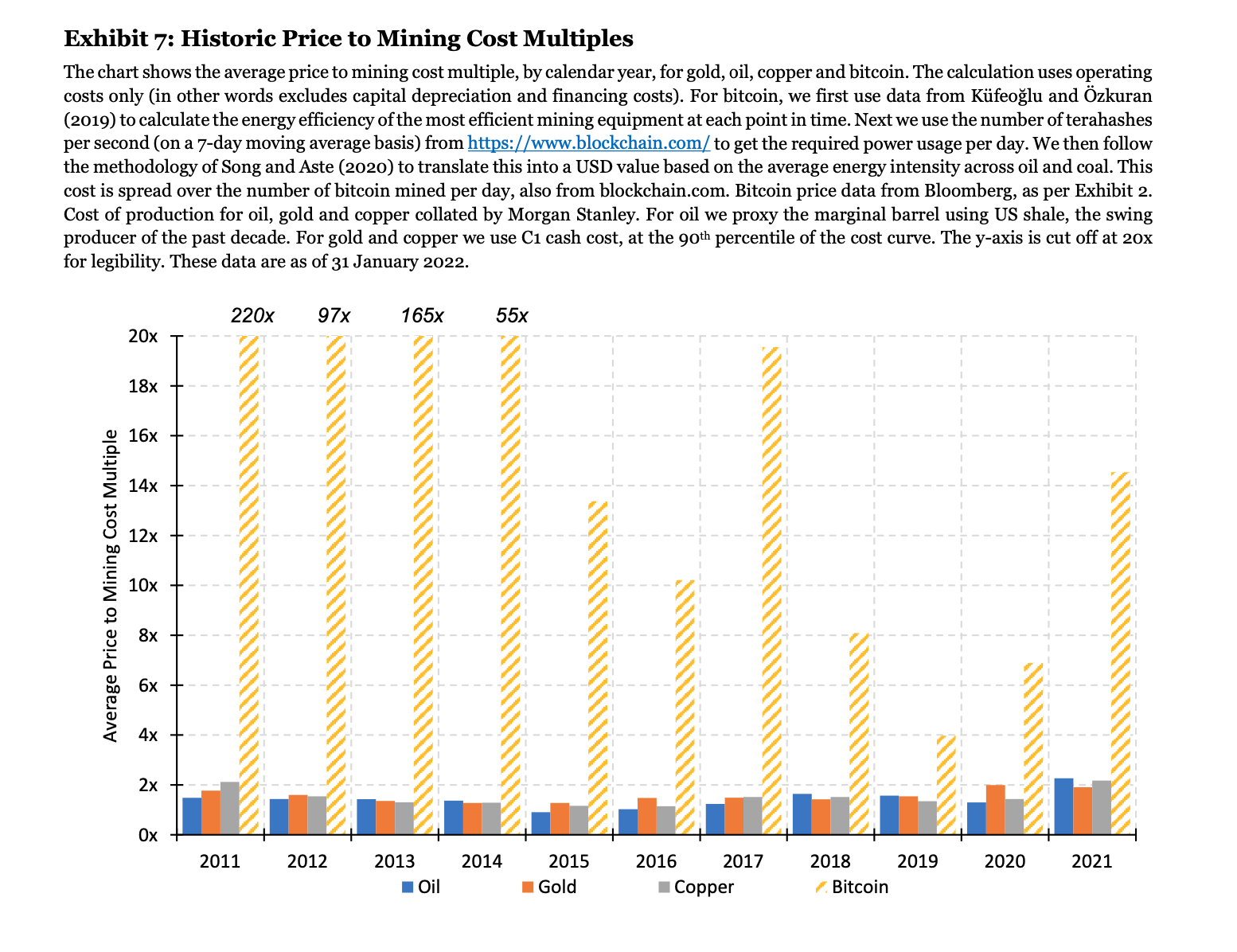

The study reviews some popular ways to value cryptocurrencies. One way is a so-called Metcalfe’s Law, which would simply mean observing the number of participants for a given token. The authors argue, however, that while this metric influences the valuation, in itself, it is not enough to explain the valuation of cryptocurrencies. Another common comparison is that of bitcoin and gold. While the authors disagree with bitcoin being “the digital gold”, it is a frequent idea among investors. If it were taken to be true, though, another way to value bitcoin would be as a multiple of mining cost (see the comparison in exhibit 7). Flow versus stock analysis and relative value are also considered.

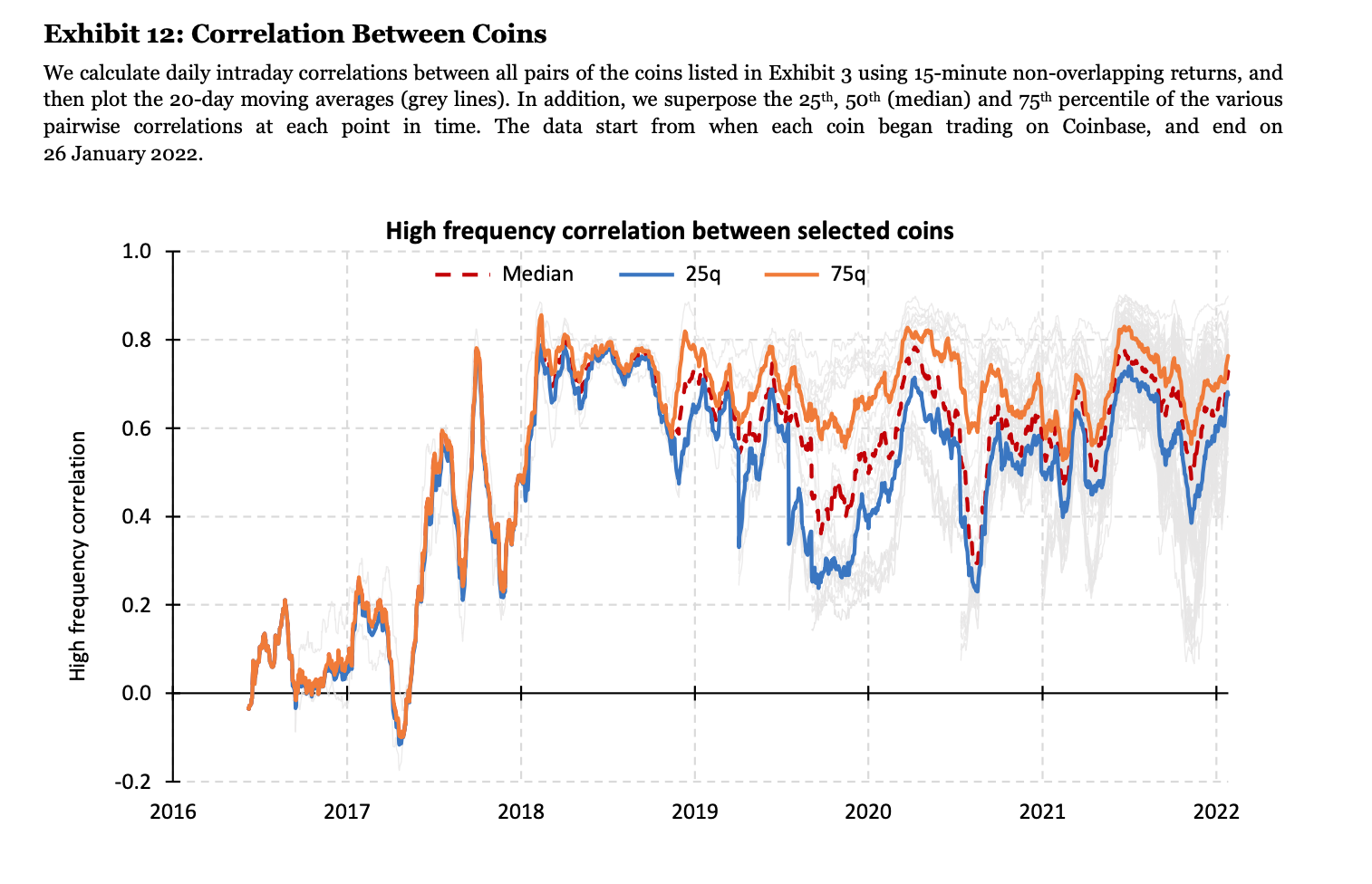

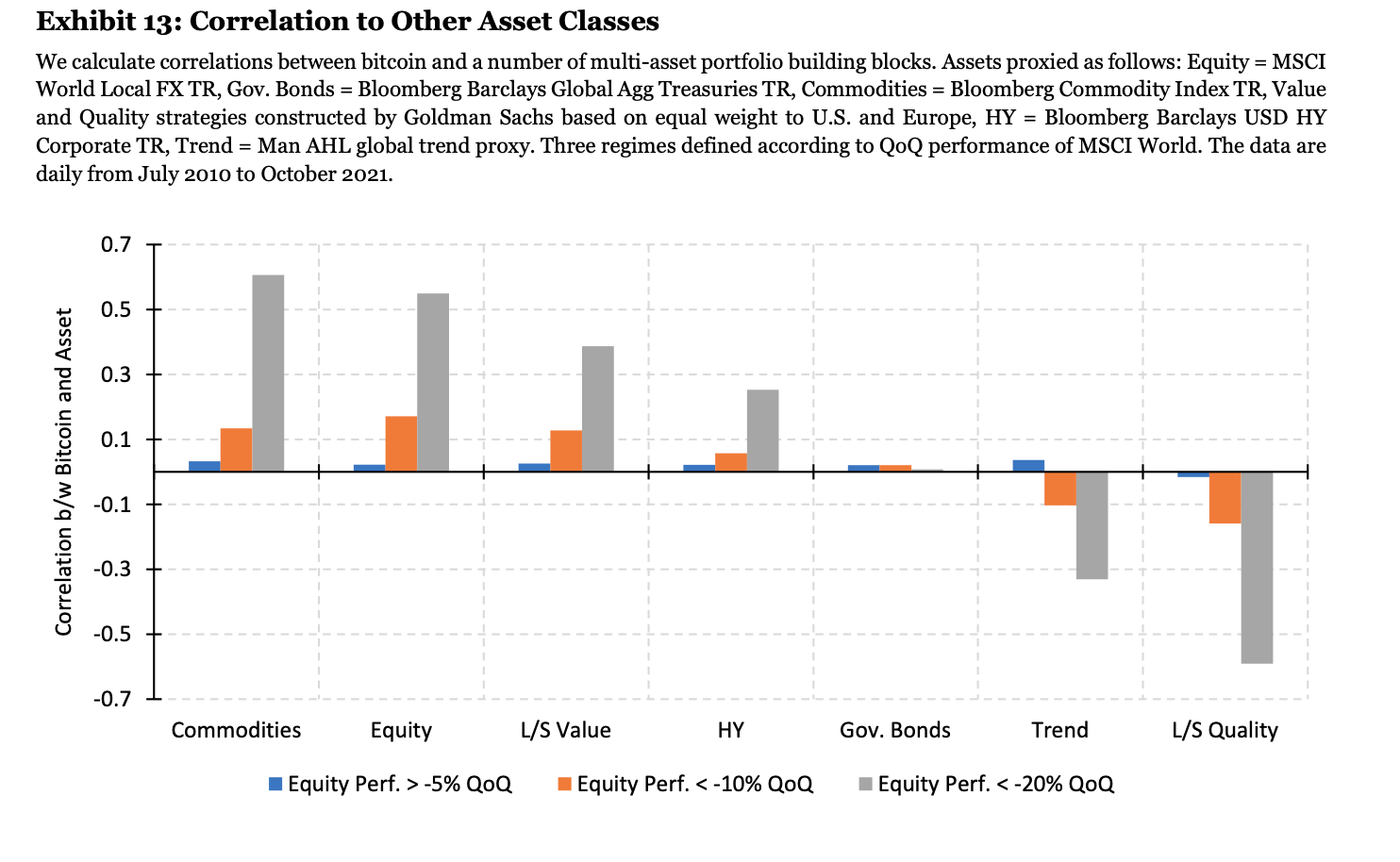

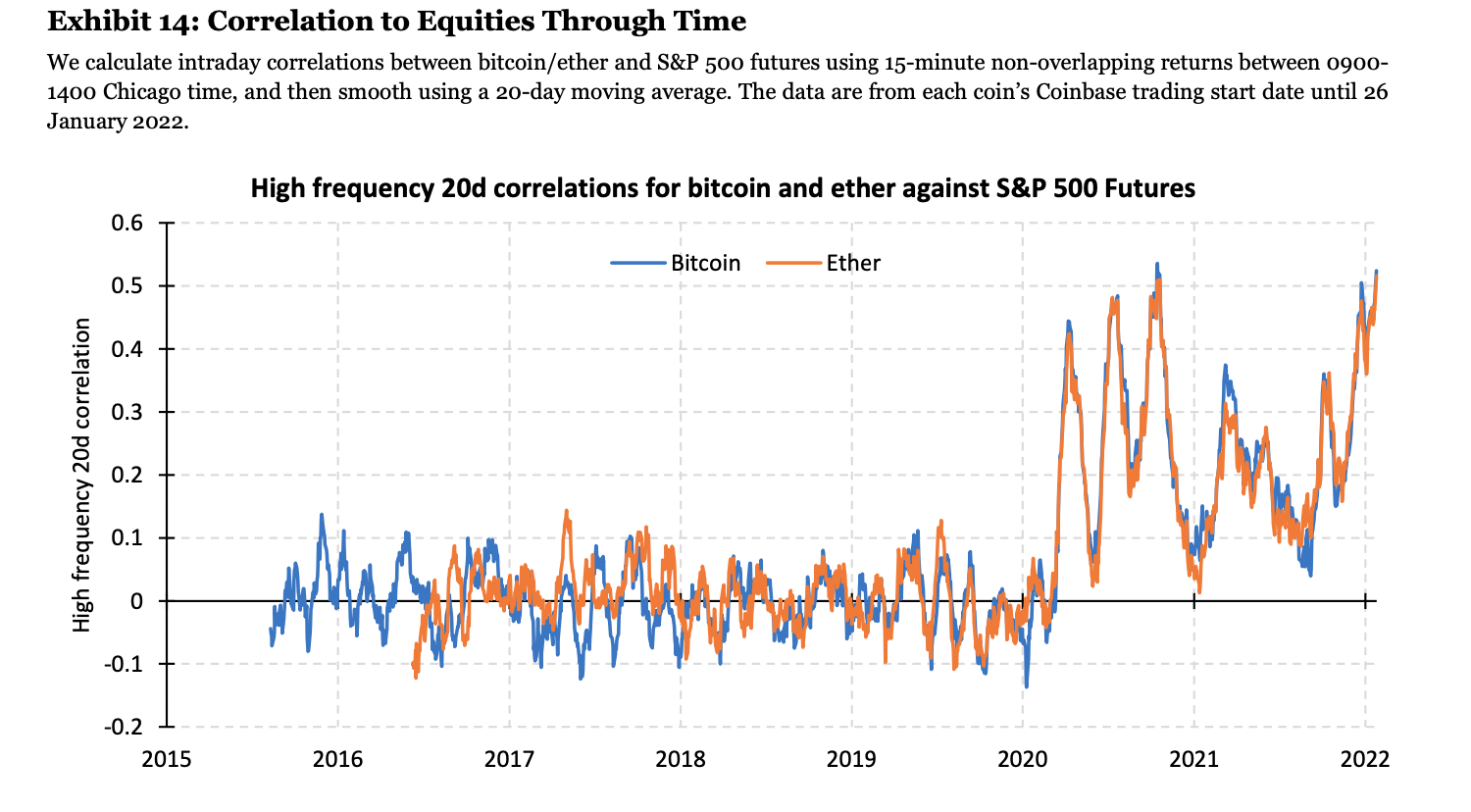

In the course of the paper, the authors also examine trend-following strategies and find they perform well and mostly outperform buy-and-hold strategies, even though there is only a short backtesting period available. They also calculate correlations between various cryptocurrencies and find, that in the last years, the market is becoming more and more diversified. They examine bitcoin’s correlation to equities, which, while normally low, rises in times of crisis. Finally, an overview of regulatory and custodial issues is offered, since there are various ways to hold cryptocurrency – self-custody when the investor has their own wallet, or third-party custody when the ownership of the cryptocurrency is mediated by some company. There are certain issues with both, so it’s worth considering this problem in advance. Usually, splitting the crypto holdings between different wallets is recommended.

Authors: Harvey, Campbell R. and Abou Zeid, Tarek and Draaisma, Teun and Luk, Martin and Neville, Henry and Rzym, Andre and van Hemert, Otto

Title: An Investor’s Guide to Crypto

Link: https://ssrn.com/abstract=4124576

Abstract:

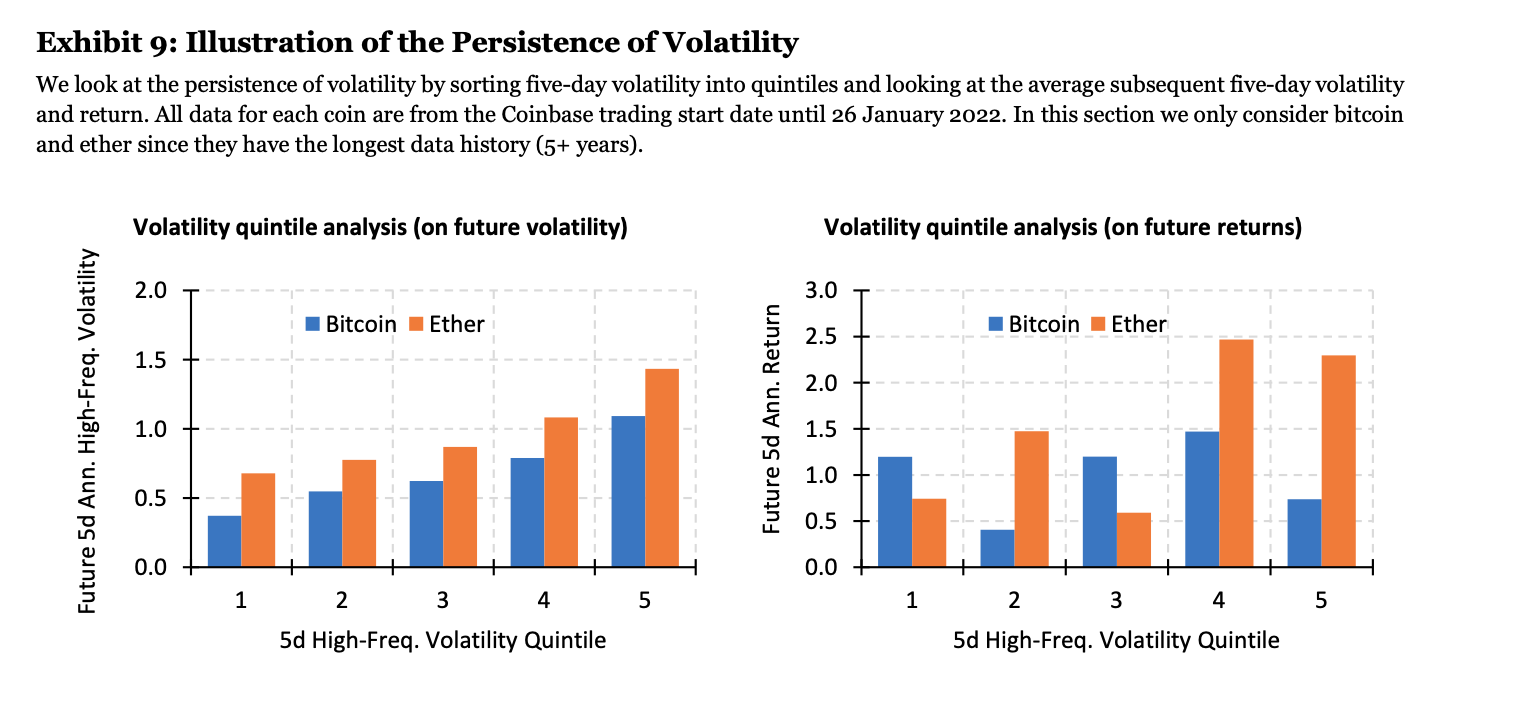

We provide practical insights for investors seeking exposure to the growing cryptocurrency space. Today, crypto is much more than just bitcoin, which historically dominated the space but accounted for just a 21% share of total crypto trading volume in 2021. We discuss a wide variety of tokens, highlighting both their functionality and their investment properties. We critically compare popular valuation methods. We contrast buy-and-hold investing with more active styles. We only deem return data from 2017 representative, but the use of intraday data boosts statistical power. Underlying crypto performance has been notoriously volatile, but volatility-targeting methods are effective at controlling risk, and trend-following strategies have performed well. Crypto assets display a low correlation with traditional risky assets in normal times, but the correlation also rises in the left tail of these risky assets. Finally, we detail important custody and regulatory considerations for institutional investors.

As always we present several interesting figures and tables:

Notable quotations from the academic research paper:

“There are many different ways for an investor to get exposure to crypto. Perhaps the most straightforward is through futures contracts or other securities such as exchange-traded funds (ETFs). Investors can also invest with a crypto-oriented venture capital (VC) fund and pay the fees associated with the VC investment. It is also possible to buy the physical coins.

Are cryptocurrencies a bubble? A bubble is a persistent deviation from fundamental value. In this space (and as we will discuss later), it is difficult to define fundamental value. However, there is one distinguishing characteristic between the price behavior of cryptocurrencies and the classic historical bubbles: crypto drawdowns have been (so far) followed by recoveries.

Why does a cryptocurrency like bitcoin have value? It is not legal tender in the U.S. It is extremely volatile – approximately 40 times more volatile than the U.S. dollar compared to a basket of other G-10 currencies. Transactions are slow and expensive. There is substantial regulatory risk. That said, bitcoin has appreciated spectacularly since its launch.

There are a number of hypotheses that attempt to explain its valuation. Given that bitcoin does not pay any dividends, the simplest explanation is that people buy bitcoin because they believe it will rise in value. However, it is unlikely that this expectation is sustainable in the long term. Indeed, buying a permanent non-dividend-paying asset solely because you believe the price will go up leads some to compare it to a Ponzi scheme. On the other hand, it is also possible that the cryptocurrency network produces something valuable (such as fast, secure, or cheap transactions) that are valued by the network participants.

For bitcoin specifically, leading proponents suggest that it might usurp some of this functionality, the so-called ‘digital gold’ argument – see, for instance, Winklevoss (2020). In contrast to most other tokens, bitcoin has a hard stop at 21 million units, potentially analogous to the 244,000 metric tons of gold that represents the estimated hard stop on the yellow metal (at least until extraterrestrial deposits are found).

Cantillon points out that when gold first became the prime standard of coinage in Greece, around the fifth century BC, there were numerous alternatives – such as iron or copper – which could be, and sometimes were, chosen as units of economic account. That the yellow metal rose to the top was, in Cantillon’s view, due to it best satisfying five constraints: durability, divisibility, transportability, homogeneity and rarity.

It can be argued that bitcoin also satisfies these constraints and as such can act as a digital mirror of physical gold.

The high volatility of an asset can be managed. Volatility can be reduced by investing, say, a quarter of the capital in the asset and keeping the rest of the capital in cash. This way, the return volatility on the total capital available is just a quarter that of the asset itself. And indeed, a quarter investment in bitcoin has been about as volatile as a full investment in the S&P 500.

In other words, by having a high degree of negative skewness or excess kurtosis. It turns out that over the 2017 to 2022 time period, bitcoin and ether have experienced relatively few tail events, compared to the S&P 500 index. Particularly during the Covid-19 equity selloff in 2020 Q1, the S&P 500 index experienced much bigger price swings than usual, while bitcoin continued to be about as volatile as it had been before.

We follow the methodology of Harvey et al. (2019) to define 1-month (22-day), 3-month (65-day), and 12-month trend strategies. The trend strategy will have mostly been long both coins, as these markets have tended to trend upwards. However, it takes larger long positions when the trend is more strongly upwards, and does take short positions during the few time periods when the trend was negative.

The trend strategies have performed well over the (admittedly short) history available to us, and have mostly outperformed a constant investment in the coin itself (see the Sharpe ratio reported in the legends).

We note that in normal times bitcoin has limited correlation to other assets often used as multi-asset portfolio building blocks. Indeed, on average, when equities are not in drawdown the average correlation between bitcoin and the seven assets in our sample set is just 0.02. However, as we move further into the left tail of the return distribution, the correlation with some of the naturally riskier assets rises dramatically.Heightened correlations during volatile periods are documented in the equity markets by Forbes and Rigobon (2002). In particular, we find that the correlation between bitcoin and a broad commodity basket moves from 0.03 in normal times, to 0.61 when equities are drawing down 20% or more over the quarter. Similarly, the correlation with equities themselves rises from 0.02 to 0.55.

While a portfolio might have zero direct investment in crypto (leaving aside crypto-related securities in equity indices), that does not mean it has zero exposure. Indeed, it may have a negative beta. That is, a number of the names in the portfolio might be challenged by some of the startups in the crypto space.”

Share onLinkedInTwitterFacebookRefer to a friend