Beta-Adjusting Factor Returns

Beta-adjusted returns equity factors are considerably more stable, indicating that factor construction methodologies may be improved beyond dollar and size neutrality. Low-beta effect at the level of factors confirms the existence of seasonal and momentum effects in the cross-section of factor returns. Altogether, these insights deepen the understanding of factor behavior and can aid the development of more robust factor-based investment strategies.

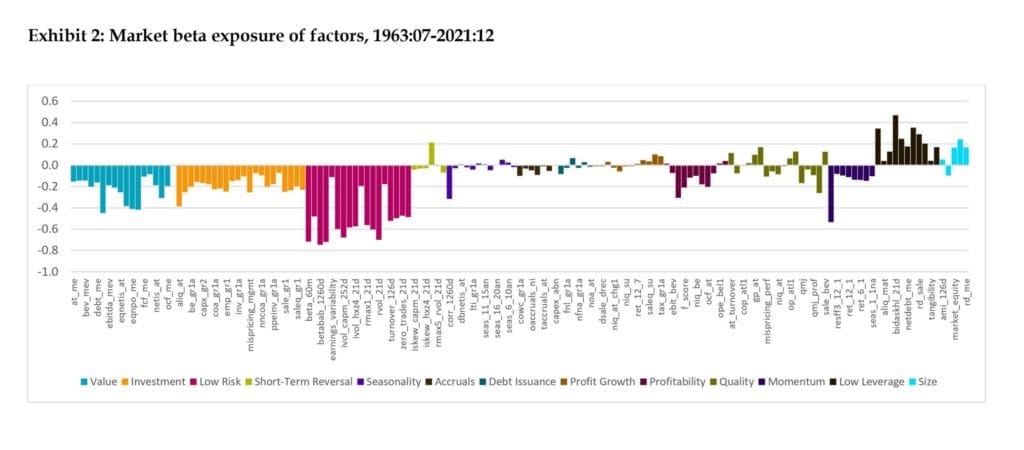

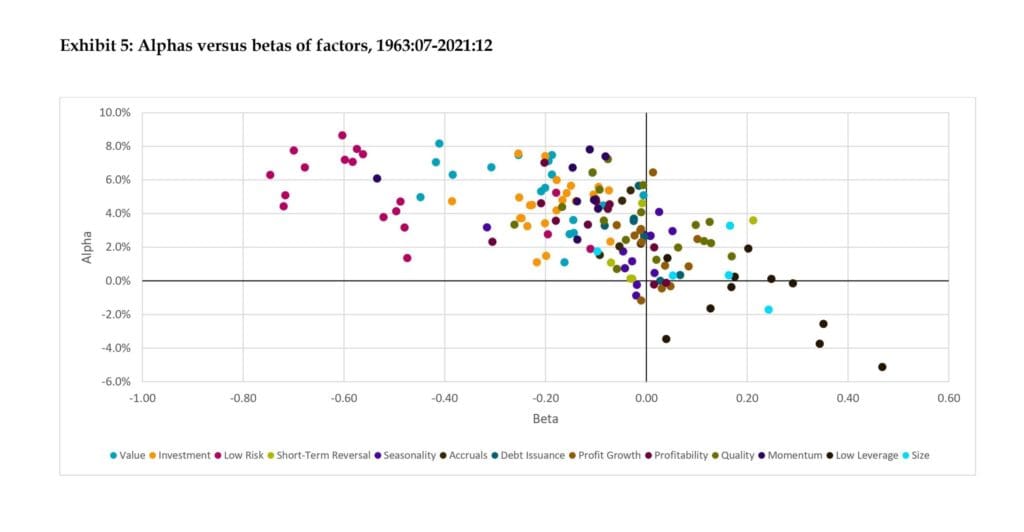

David Blitz from Robeco Quantitative Investments, in their piece we review, studies the cross-section of equity factor returns using the data library of Jensen, Kelly, and Pedersen (2021). Most of the 150+ factors in their sample exhibit a positive premium and a negative long-term market beta. The only two themes with a clear positive beta, namely low leverage, and size, have no alpha after controlling for this beta exposure. The negative beta values of the remaining factors carry significant implications for their unadjusted returns in different market conditions, primarily exhibiting stronger performance during bear markets. This indicates that pricing inefficiencies typically accumulate during bullish periods, leading to weaker factor returns, while they tend to be corrected during bearish periods, resulting in substantial factor payoffs. Moreover, this finding illuminates the decay in factor performance, suggesting that nearly half of the decline observed after 2004 can be attributed to a decrease in bear markets during that timeframe. Additionally, the adjusted returns of the factors, known as factor alphas, are not only more consistent but also higher in magnitude.

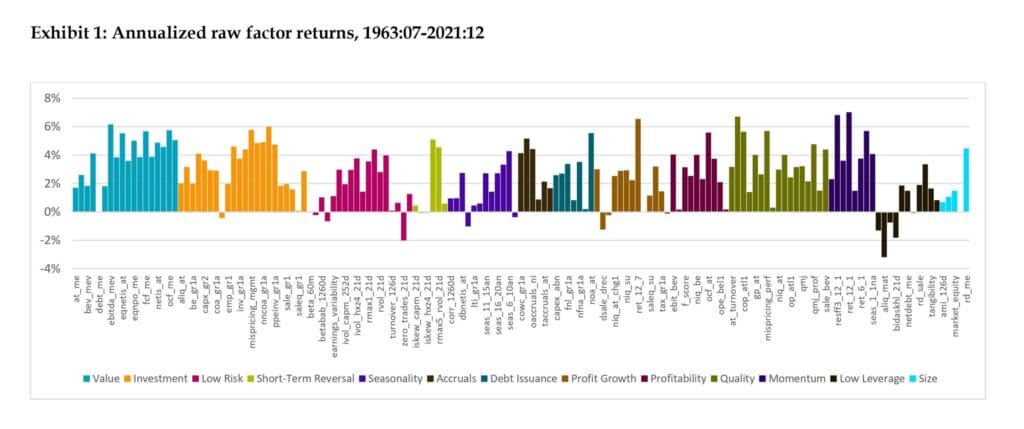

Exhibit 1 shows that most factors offer a positive premium, which is not really surprising because this is a defining characteristic of priced factors. Exhibit 2 reports the full-sample beta of each factor. Exhibit 4 shows the annualized CAPM alphas of the factors, where we only adjust for the contemporaneous market exposure for simplicity. Exhibit 5 plots the alphas of all the factors against their betas, which reveals a strong inverse relation. Finally, Exhibit 20 gives an overview of some of the main findings at the level of factor themes.

We recommend you check out this easy-to-understand, yet comprehensive article full of information. With an easy-digestible 11 pages summary and extensive figure appendix, this is a pretty nice article to get an overview and primer into alphas, betas, and factor investing, with most fresh and actual data. More inclined and experienced readers would find Quant Cycle results of Blitz (2022), another work of the author, interesting and enlightening, and cannot be overstated as recommended reading for them.

Authors: David Blitz

Title: The Cross-Section of Factor Returns

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4441376

Abstract:

We explore the cross-section of factor returns using a sample of 150+ equity factors. Most factors exhibit a positive premium and a negative market beta in the long run. Factor themes with a clear positive beta, in particular low leverage and size, have no alpha after controlling for this beta exposure. The remaining factors generate most of their raw return in bear markets, which also explains half of their decay in the predominantly bullish post-2004 period. Beta-adjusting factor returns yields alphas that are not only higher but also considerably more stable. We also revisit factor performance cyclicality, establish a low-beta effect at the level of factors, and confirm the existence of seasonal and momentum effects in the cross-section of factor returns. Altogether, our insights into factor behavior aid the development of more robust factor-based investment strategies.

And; As always, we present several interesting figures and tables:

Notable quotations from the academic research paper:

“Since the discovery of the size, value, and momentum effects in the 1980s and 1990s, more and more priced factors have been identified in the asset pricing literature. In recent years the focus has shifted from establishing yet another factor to reflecting on the entire ‘zoo’ of factors that has emerged by now. This paper adds to this new stream of literature by deepening the general understanding of the cross-section of equity factor returns. Whereas the classic Fama and French (1993, 2015) asset pricing factors, such as size (SMB), value (HML), and momentum (WML), are well understood after decades of extensive research, much less is known about the many other factors in the zoo. We are particularly interested in the long-term performance of factors, their risk characteristics and behavior, the cyclicality of factor returns, and the potential of factor rotation strategies. The insights obtained can aid the design of more robust factor-based investment strategies, help shape the agenda for future factor research, and may also have implications for factor portfolio construction methodologies.

[The] work is related to recent studies that have examined questions such as how many factors are really needed, the replicability of originally reported results, and the decay of factor performance over time.

[Author’s] main insights can be summarized as follows. Most factors exhibit a positive premium, although some do not pass this basic test. Most factors also exhibit a negative long-term market beta, while the only two themes with a clear positive beta, namely low leverage and size, have no alpha after controlling for this beta exposure. The negative beta of the remaining factors has major implications for their raw return in different market environments, with most of the performance being generated in bear markets. This suggest that mispricing typically builds up during bull markets (resulting in weak factor returns) and tends to get corrected in bear markets (resulting in large factor payoffs). This result also sheds a new light on factor performance decay, as we estimate that about half of the decay after 2004 can be attributed to a decline in bear markets during this period. Factor alphas, i.e. their returns adjusted for the ex post beta exposure, are not only more stable but also higher. Our study also deepens the insights into factor performance cyclicality, establishes a low-beta effect at the level of factors, and confirms the existence of seasonal and momentum effects in the cross-section of factor returns. Altogether, our findings show which kind of factors are rewarded and which ones not, how their performance varies in different market environments, and how investment strategies can be built on factors themselves.

Based on these considerations we deem the Jensen, Kelly, and Pedersen (2021) factor library to be most suitable for the purposes of this paper. We examine all the factors in their Global Factor Data library, which gives a total number of 153 factors, classified in 13 themes using statistical clustering techniques. We focus on the U.S. market because it offers the longest history. We obtain monthly top-minus-bottom portfolio return series constructed with the ‘capped value weighted’ methodology recommended by the authors. Value weighting prevents an excessive weight of micro-cap stocks, similar to the Fama-French 2×3 methodology, while the capping additionally ensures that the results are not dominated by a handful of mega-cap stocks, without arbitrarily inflating the weight of small-cap stocks to 50% as with the Fama-French approach. The sample period is from July 1963 to December 2021, which gives coverage for 90% of the factors at the start, and full coverage from 1971 onwards.

The negative equity betas of most factors, in particular the ones that actually provide alpha, suggest that raw factor returns may be higher on average in bear markets than in bull markets. In order to test this conjecture, we examine the average raw factor returns in these two different environments, using the bull versus bear market classification of Geertsema and Lu (2022), who follow the methodology of Pagan and Sossounov (2003). This classification method first identifies local peaks and troughs, and then applies censoring rules such as a minimum required length of a bull/bear cycle.

Our insights also shed a fresh perspective on the widely documented decay of factor performance over time. In line with studies such as McLean and Pontiff (2016), we find that the average raw factor return is substantially lower after 2004 compared to before 2004. However, the market was in a bear market state 27% of the time before 2004, compared to only 9% of the time after 2004, which amounts to a factor 3 difference. The total change in factor performance after 2004 can be broken down into the change in factor performance during bull markets, the change in factor performance during bear markets, and the impact from the change in the bull versus bear market frequency.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Would you like free access to our services? Then, open an account with Lightspeed and enjoy one year of Quantpedia Premium at no cost.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend