The area we want to explore today is an interesting intersection between quantitative and more technical approaches to trading that employ intuition and experience in strictly data-driven decision-making (completely omitting any fundamental analysis!). Can just years of screen time and trading experience improve the metrics and profitability of trading systems through discretionary trading actions and decisions?

An interesting experiment yielded a surprising result: Researchers took a discretionary trader and gave him a systematic trading strategy, allowing him to override signals based on “gut instincts”. Discretionary trader may decide which signal to take, which not to, and how to set stop losses (SLs) and profit targets (PTs) based on the stock’s previous price action… The results are so far enticing — the trader improves an average non-profitable strategy into a profitable one.

How was the experiment set up?

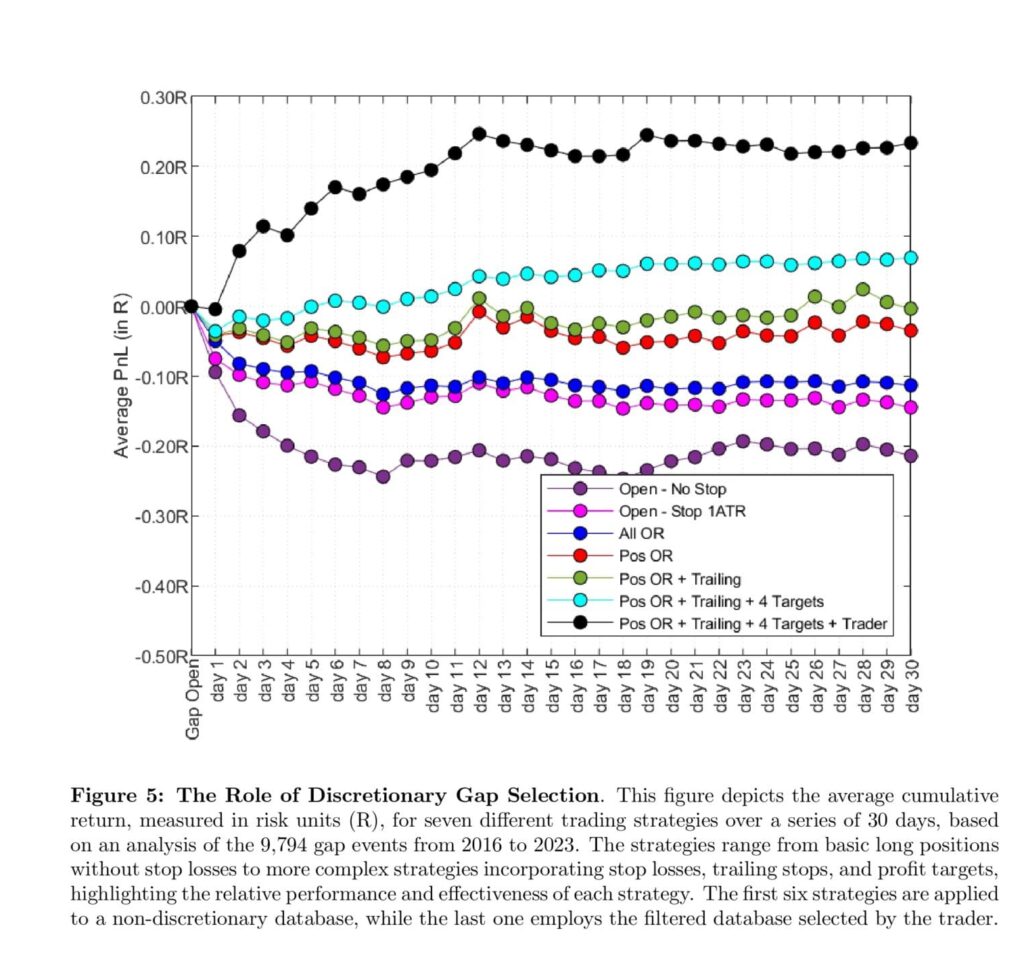

To make the process rigorous, (Zarattini and Stamatoudis, 2024) used specialized software to anonymize charts and eliminate extraneous information to ensure an unbiased evaluation of the trader’s decisions. By rigorously analyzing 9,794 gap events from 2016 to 2023, they demonstrated that the intuition of experienced traders can enhance the profitability of trading strategies. The key findings reveal that when stocks gap up, applying discretionary trading decisions, implemented in this investigation using specialized anonymizing software, leads to substantial improvements in trading performance. The discretionary trader’s selection of approximately 18 percent of the gap events results in higher average trade profitability than purely mechanical approaches. The discretionary trader’s ability to recognize favorable patterns, such as early gaps in momentum cycles and multi-week or multi-month range breakouts, plays a pivotal role in improving trade selection. Fundamental reasons why stock reacted with the gap are not that important. All in all, it boils down to position management and rigorous setting of stop losses and risk-taking.

This underscores the critical role of intuition and experience in identifying and capitalizing on market opportunities that automated systems might overlook. The structured (micro)management techniques, such as precise entry points, stop losses, and profit targets, further enhance trade outcomes by optimizing risk-reward ratios and ensuring disciplined trade execution. This innovative approach isolates the effects of bias from external factors and prevents any forward-looking bias, allowing the trader’s discretionary intuition to be incorporated into a quantitative empirical investigation. The cumulative PnL achieved on the discretionarily selected and traded gaps shows a significant growth trajectory, with the hypothetical portfolio achieving a total return of nearly 4,000% over eight years. This performance demonstrates the potent combination of human intuition and systematic trading rules.

Authors: Carlo Zarattini and Marios Stamatoudis

Title: The Power Of Price Action Reading

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4879527

Abstract:

Evaluating the effectiveness of technical analysis has always been a challenging task. Translating each technical pattern into a quantifiable measure is often unfeasible, leading to the perception of technical analysis as more art than science. Proving its utility rigorously remains elusive. This study aims to investigate the value added by incorporating discretionary technical trading decisions within the context of stocks experiencing significant overnight gaps. By creating a bias-free simulated trading environment, we assess the profitability improvement of a simple automatic trading strategy when supported by an experienced technical trader. The trader’s role is to restrict the algorithm to trade only those stocks whose daily charts appear more promising. Additionally, we conduct a test where the experienced trader micromanaged the open positions by analyzing, in a bias-free environment, the daily and intraday price action following the overnight gap. The results presented in this paper suggest that discretionary technical trading decisions, at least when conducted by a skilled trader, may significantly enhance trading outcomes, transforming seemingly unprofitable strategies into highly performing ones. This paper provides empirical evidence supporting the integration of discretionary judgment with systematic trading approaches, offering valuable insights for enhancing trading outcomes in financial markets.

As always we present several interesting figures and tables:

Notable quotations from the academic research paper:

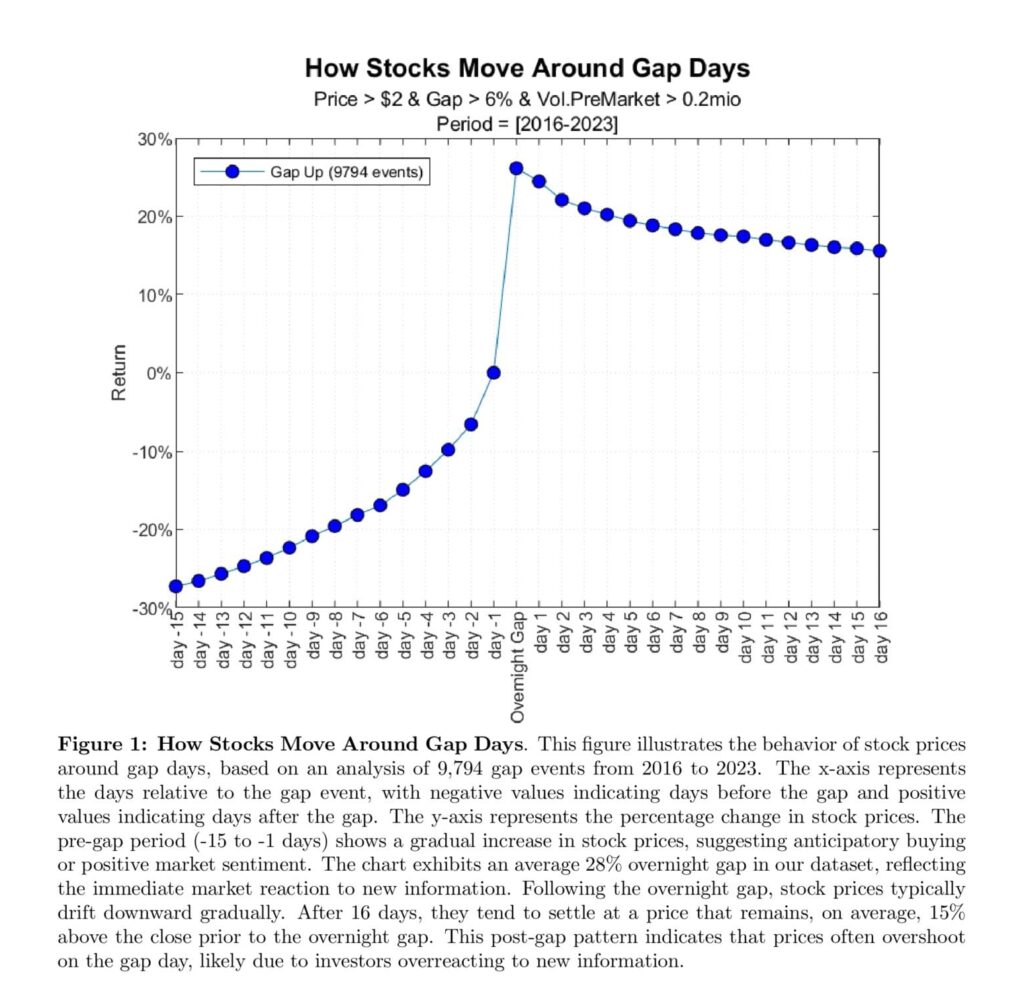

“Results are exhibited in Figure 1. Pre-Gap Behavior (-15 to -1 days)

In the fifteen days preceding a gap event, stock prices exhibit a gradual increase, starting from approximately -26% and moving towards 0%. This trend suggests a period of anticipatory buying or positive market sentiment. Traders likely position themselves ahead of expected positive news, contributing to a steady price rise. The progression from -26% to 0% indicates a systematic build-up in stock prices as market participants respond to signals and information that precede the gap event.

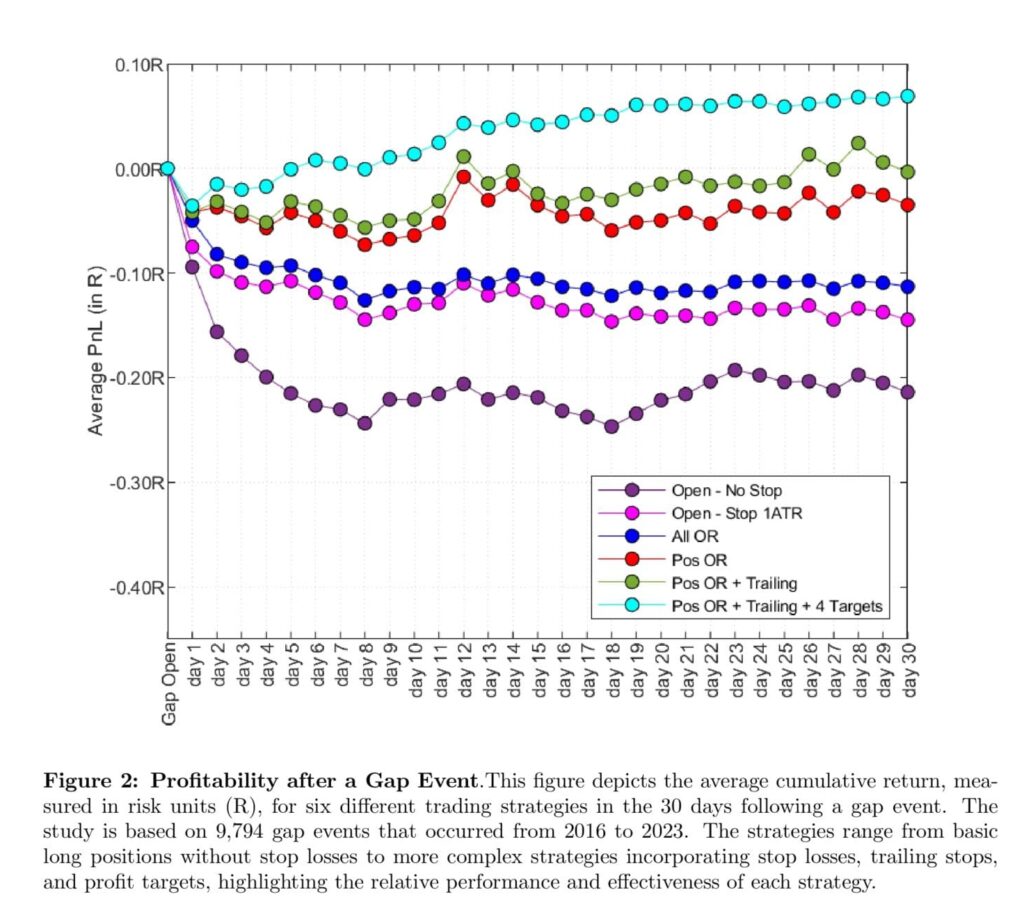

The profitability of each strategy is assessed over a 30-day period, taking into account varying stock volatilities. Profitability is measured in terms of the trade risk unit (R), providing a standardized metric to compare performance across different strategies. For example, if a trade is entered at $100 with a stop placed at $98, the implied risk unit is $2. If after n days the unrealized PnL is $8, it is considered a PnL of 4R ($8/$2). For the Open – No Stop strategy, the risk unit is set to 1 ATR.

As exhibited in Figure 2, the strategy of buying all gaps without a stop loss, denoted as Open – No Stop, demonstrates a significant negative edge, with cumulative daily losses reaching a minimum of -0.25R after 8 days. This indicates that trading without a stop loss may lead to consistent losses.

Figure 5 depicts the performance trajectory of this strategy, termed Pos OR + Trailing + 4 Targets + Trader. The average profitability demonstrates a marked improvement, as it increases progressively, reaching a peak at 0.25R, 12 days after the entry day (the gap day). This outcome suggests that the discretionary selection by an experienced technical trader can enhance the profitability of an otherwise unproductive rule-based trading strategy.

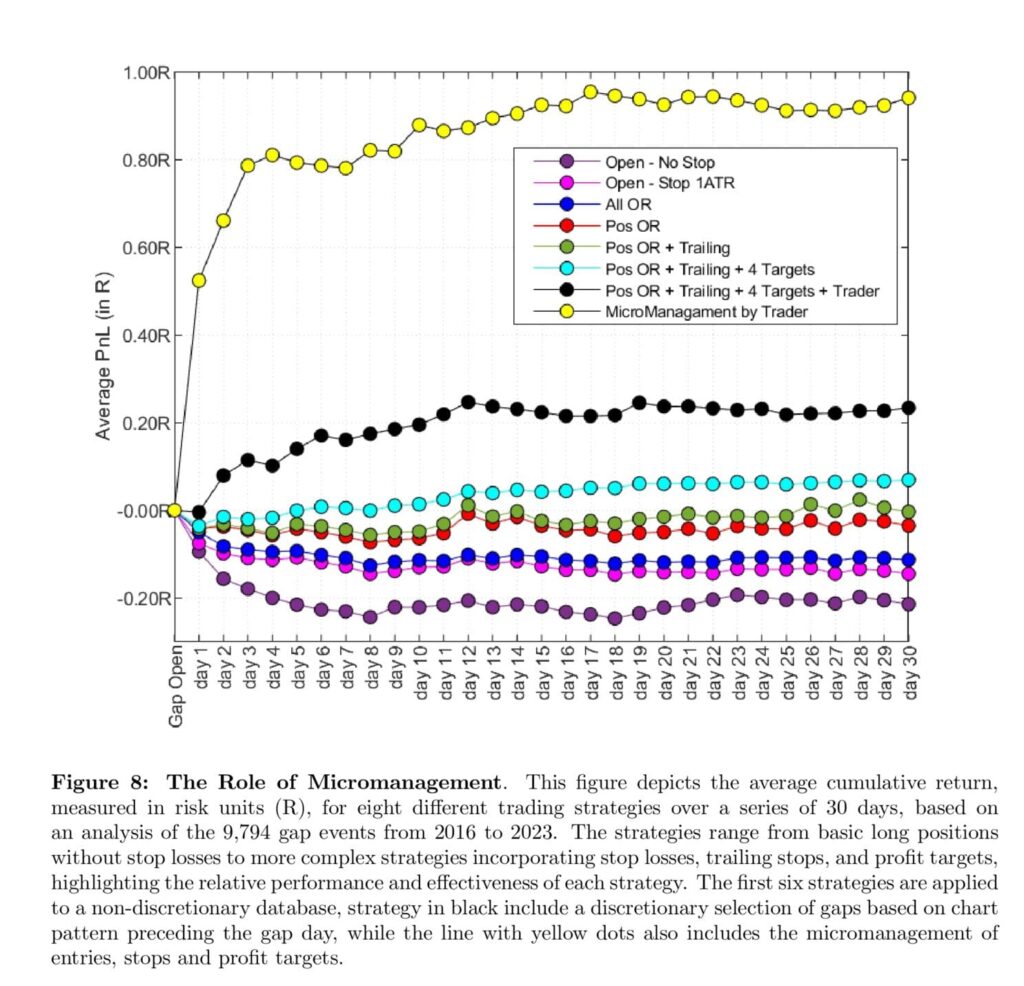

By using the database of all the trades taken and micromanaged by the trader in the bias-free environment, we update Figure 5 and plot the average cumulative PnL in R-multiples. As shown in Figure 8, there is a significant improvement in the average profitability. The average profitability on the gap day increases to 0.55R, reaching a local maximum of 0.80R on day 4. After 3 days of a shallow pullback, profitability starts increasing again, but at a slower rate. This is likely because the trader allows the full position to run for the first three days, then reduces risk by taking partial profits and letting a quarter position trail on a longer moving average.

As suggested by the trader, these trades are usually sized so that if a stop loss is hit, the resulting loss at the portfolio level equates to 0.25%. We thus transform the cumulative PnL time-series into a monetary time-series, assuming an initial equity of $100,000 and a risk budget per trade of 0.25%. The trajectory of the simulated account is exhibited in Figure 10. A $100,000 portfolio grows to more than $4,000,000, yielding a total return of 3,968% in 8 years.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend