Commodity Futures Risk Premium – Historical Analysis

We at Quantpedia absolutely love long-term studies, and academic research paper written by Bhardwaj, Janardanan, and Rouwenhorst is really exceptional. There are a lot of studies covering a long history of equity and bond markets. But futures markets are not covered so well, and that’s the reason why is this paper so valuable. An additional plus is that study covers also delisted contracts, which makes the study’s data quality even better. Quantpedia’s recommended read to anyone interested in asset allocation into commodities …

Authors: Bhardwaj, Janardanan and Rouwenhorst

Title: The Commodity Futures Risk Premium: 1871–2018

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3452255

Abstract:

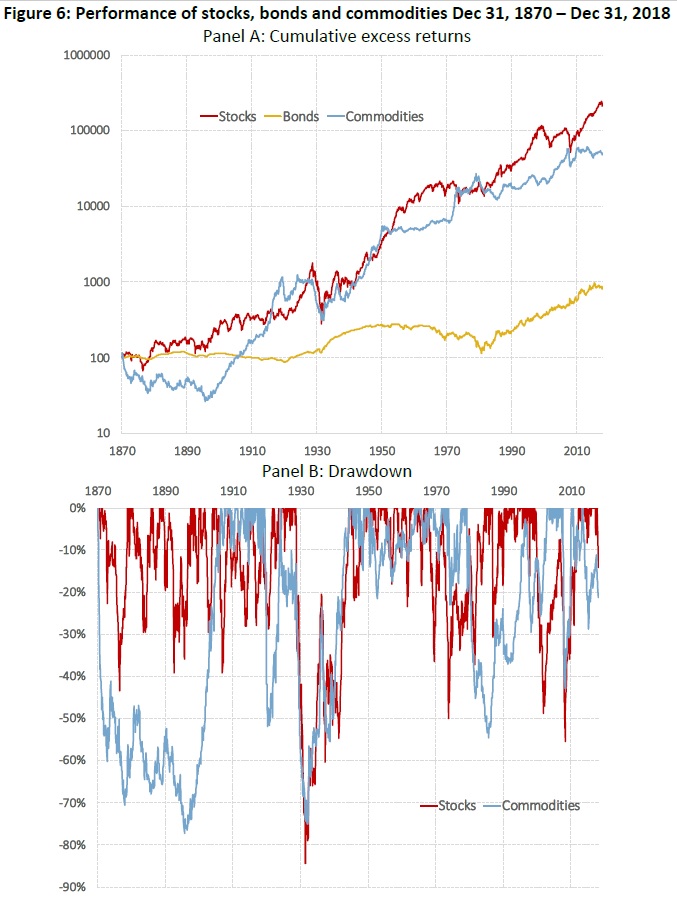

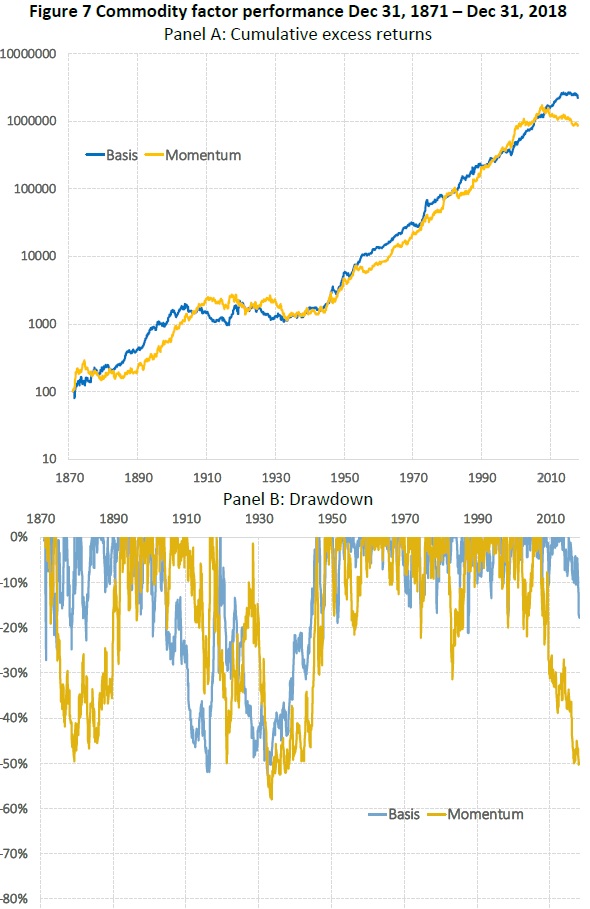

Using a novel comprehensive database of 230 commodity futures that traded between 1871 and 2018, we document that futures prices have on average been set at a discount to future spot prices by about 5%. The historical risk premium is robust across commodity sectors and varies with the state of the economy, inflation and the level of scarcity. Although the majority of contracts are defunct, most commodities have earned a positive risk premium over their lifespan. We find empirical support for Gray’s conjecture that survival of futures contracts is correlated with the returns earned by investors. Finally, we provide out-of-sample evidence that “factor” strategies based on commodity basis and momentum have historically earned positive returns over time but are subject to prolonged drawdowns (crashes) that are not dissimilar to those experienced by the overall market.

Notable quotations from the academic research paper:

“We estimate the historical risk premium in commodity futures markets using a new, comprehensive database that covers more than 230 different commodity futures contracts traded primarily in the US and the UK since 1871. A central finding of our study is that averaged across commodities, locations, and time, futures prices are set at a 5.3% discount relative to future spot prices. This downward bias implies that the long side of a commodity futures contract has historically earned a positive risk premium. Short hedgers have paid this premium when obtaining insurance against price fluctuations. The long‐term average premium is similar in magnitude across commodity sectors, although short‐horizon realized premiums exhibit substantial variation across commodities and over time due to the business cycle, the rate of inflation, and sector‐specific shocks.

A distinguishing aspect of this study is that our sample of commodity futures contracts is by far the most comprehensive in the literature. It provides broad market coverage during the early years of commodity futures trading for a wide range of physical commodities across different sectors. A second unique feature of our data is the extensive coverage of delisted contracts, whereas most commodity futures research has focused on surviving contracts.

We examine the premium in different economic environments, including the business cycle, inflation cycle and the general level of scarcity in commodity markets. We find that the realized premium is higher during expansions than recessions across all commodity sectors, as well as in periods of high unexpected inflation. Commodity factor strategies based on the fundamental of scarcity (momentum and basis) earn similar premiums in the pre‐1960 period and the post 1960 periods.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Would you like free access to our services? Then, open an account with Lightspeed and enjoy one year of Quantpedia Premium at no cost.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend