Designing Robust Trend-Following System

It is not easy to build a robust trend-following strategy that will withstand different difficult market conditions and bring consistent results. The author of today’s work was not frightened by this task and delivered a full framework on how to design a robust trend-following strategy step by step.

The method presents sensitivity analysis and robustness checks through various time horizons and sample choices. It also accounts for transaction costs (when one rebalances often, they creep in and eat out a significant chunk of profits) and takes a multi-asset approach to maximize closely watched risk metrics from PMs (portfolio managers).

Dobromir Tzotchev’s framework can be summarized into the following steps:

Need for a clean Trend-following Signal: The paper proposes a trend-following time-series momentum signal based on statistical theory and investigates its properties. It reconciles theoretical results with stylized facts about trend-following investing, including the link to straddles and the better performance of so-called “slower” signals.

Sound Design and Prototype Solution: Based on theoretical results, the paper introduces a prototype trend-following solution that uses a unified approach across assets and diversifies across time frames. Through simulation examples, it highlights performance versus benchmarks and diversification properties for long-only portfolios.

Risk Management Techniques: The paper elaborates on portfolio and risk management for trend-following strategies. It adapts risk-budgeting and Hierarchical Risk Parity (HRP) approaches to the trend-following framework. Additionally, it discusses methods to manage transaction costs and implications of the carry component in futures and FX forwards.

Authors: Dobromir Tzotchev

Title: Designing Robust Trend-following System: Behind the Scenes of Trend-following

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4677166

Abstract:

Trend-following has actively been on investors’ radar for the last few decades. The J.P. Morgan primer on momentum strategies (Kolanovic and Wei, 2015) provides an extensive review of the momentum strategies. The current paper focuses on a concrete trend-following solution and analyzes its properties alongside the practical implementation.

As always we present several interesting figures and tables:

Notable quotations from the academic research paper:

“We start by presenting a signal that is based on statistical hypothesis testing. We show that under certain conditions the trend-following signal is the also the delta of a straddle. Hence we make explicit the widely propagated link between trend- following and long straddle positions (see for example Fung and Hsieh 2011).

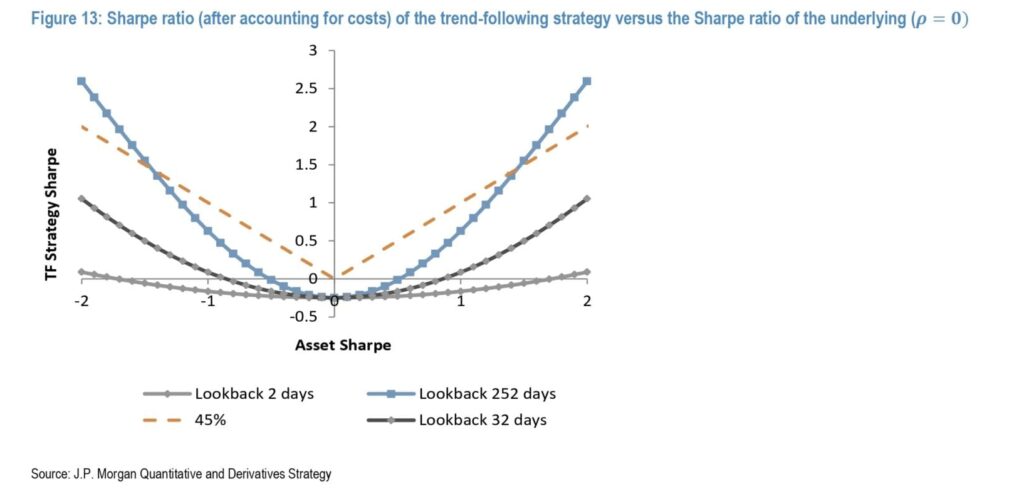

Subsequently, we analyze the profit drivers for the trend-following strategy based on the proposed signal. We show that the strategy (similarly to a straddle) is profitable whenever there are trends in either direction. Hence we demonstrate that the so-called “CTA smile” (see for example Hurst et. al. 2014) can be justified within a theoretical model as well. Furthermore, the strategy exhibits convexity. The absolute value of the Sharpe ratio of the underlying asset is of critical importance for the profitability of the strategy and the higher the number, the bigger the convexity embedded in the strategy. Furthermore, signals based on longer estimation periods possess ceteris paribus better profitability than signals based on shorter lookback periods.

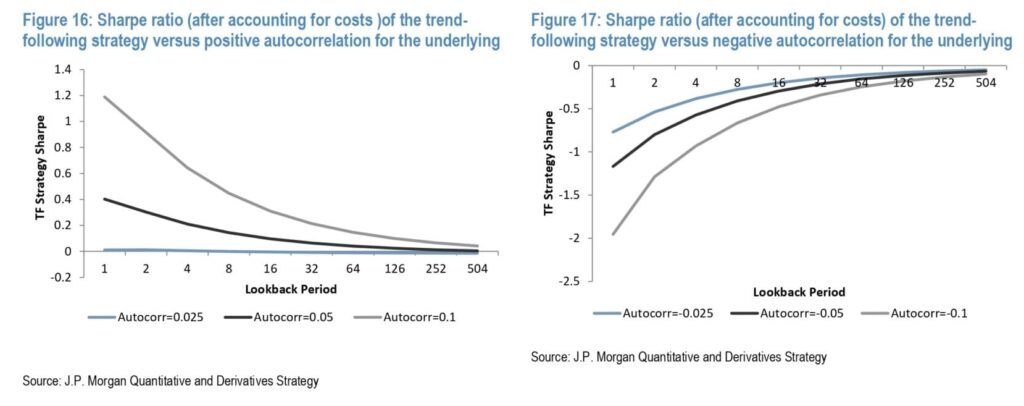

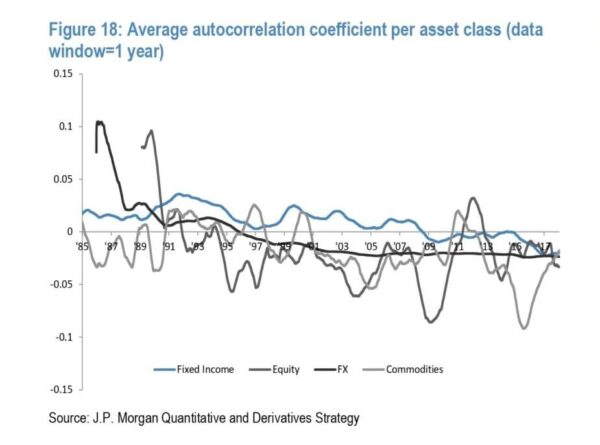

Next, the time-series properties of the underlying asset are explicitly taken into account. We show that the autocorrelation is important only for the profitability of signals based on short lookback periods (typically less than a month). Naturally positive autocorrelation leads to profits while even small values of negative autocorrelation induce substantial losses. On the other hand the profitability of the signals based on longer lookback periods is unaffected by the time-series properties of the underlying.

Due to the non-linear nature of the expressions for the expected P&L and transaction costs, it is difficult to derive the threshold Sharpe ratio of the underlying that renders the profitability of a signal based on a certain lookback period. Nevertheless, numerical results shed some interesting caveats for this relationship. In Figure 13 we have plotted the Sharpe ratio based on the net P&L of the trend-following strategy versus the Sharpe ratio of the underlying for various lookback periods. We use the transaction cost structure for S&P and assume a daily volatility of 1% (approximately 16% annualized). It is evident that signals based on short term lookbacks can only be profitable if the Sharpe ratio of the asset is quite sizable in either direction. For example, for a signal based on 2 days we need a Sharpe ratio above 2 and below -2 to assure the profitability of the strategy. For a signal based on 32 days, the Sharpe ratio should be above 1 or below -1. Even a signal based on a 1 year lookback period requires the absolute value of the Sharpe ratio to be bigger than 0.5 so that profitability is assured.

Furthermore, we expect the Sharpe ratio of trend-following strategy to be below the absolute value of the Sharpe ratio of the asset. A sizable positive or negative Sharpe ratio of the underlying and long term lookback period are both necessary for the Sharpe ratio of the trend-following strategy to exceed the absolute value of the Sharpe of the underlying. For example, we need the Sharpe ratio of the underlying to be bigger in absolute value than 1.5 so that trend-following is more profitable than either holding or shorting the asset.

If the drift of the asset is stable (stays constant over a long period), it is much more profitable and cost-efficient to use signals based on longer lookback periods. For example, if we expect equities to exhibit a positive drift due to the embedded equity risk premia, it is preferable to use signals with longer lookback periods. The appeal of the shorter term lookback periods arises in two scenarios. Firstly, the duration of the trend might be smaller than a long lookback period. For example, if the trend changes direction every 6 months making use of a signal based on 1 year lookback will be detrimental. Secondly, during market reversals signals based on shorter lookback periods are more reactive and eventually mitigate the drawdowns of the slower trend-following systems.

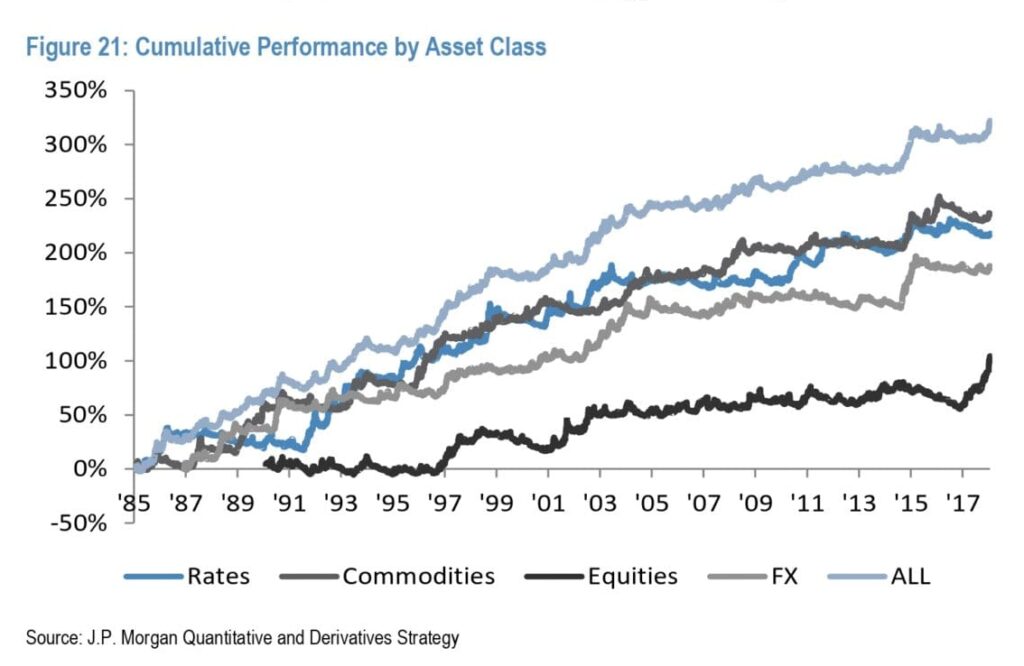

[On Figure 21: Cumulative Performance by Asset Class] the cumulative performance of the benchmark approach in various asset classes as well as the performance of the combined portfolio are shown14. Commodities have historically had the most appealing trend-following track-record (commodities are also the asset class upon which the CTA industry originated). The asset class that has been historically been the most challenging for the trend-following approach is equities.

In addition to the attractive feature of positive skewness that the trend-following strategies possess, trend-following strategies bring substantial diversification benefits for the long-only portfolios. As we have already shown in the theoretical sections, trend-following strategies exhibit convexity and when the move on the downside is sizable enough the return of the trend-following strategy will more than compensate the loss in the underlying. It has also been well-known that the magnitude of the sell-offs is typically quite sizable and therefore the offset with the trend-following strategies is quite appealing.

To verify this hypothesis empirically we have constructed portfolios that consist of long positions in the underlyings from our asset universe. The portfolios are well targeted to have an annualized volatility of 10% and utilize the same risk weights for the individual assets as in our benchmark solution. We have also constructed combined portfolios that invest 50% in the long-only portfolio and 50% in the trend-following system. The diversification benefits are quite evident in all asset classes except for fixed income. In fixed income, the directionality of the market has led to a lot of overlap between the positions of the trend-following system and those of the long-only portfolio.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Would you like free access to our services? Then, open an account with Lightspeed and enjoy one year of Quantpedia Premium at no cost.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend