Is there any association between the country’s stock market and its gambling policy? Surprisingly, yes, and there’s more to it than one would think. In a new research paper, Kumar, Nguyen and Putnins offer a complex study of gambling activities in 38 countries worldwide to estimate the impact on their financial markets.

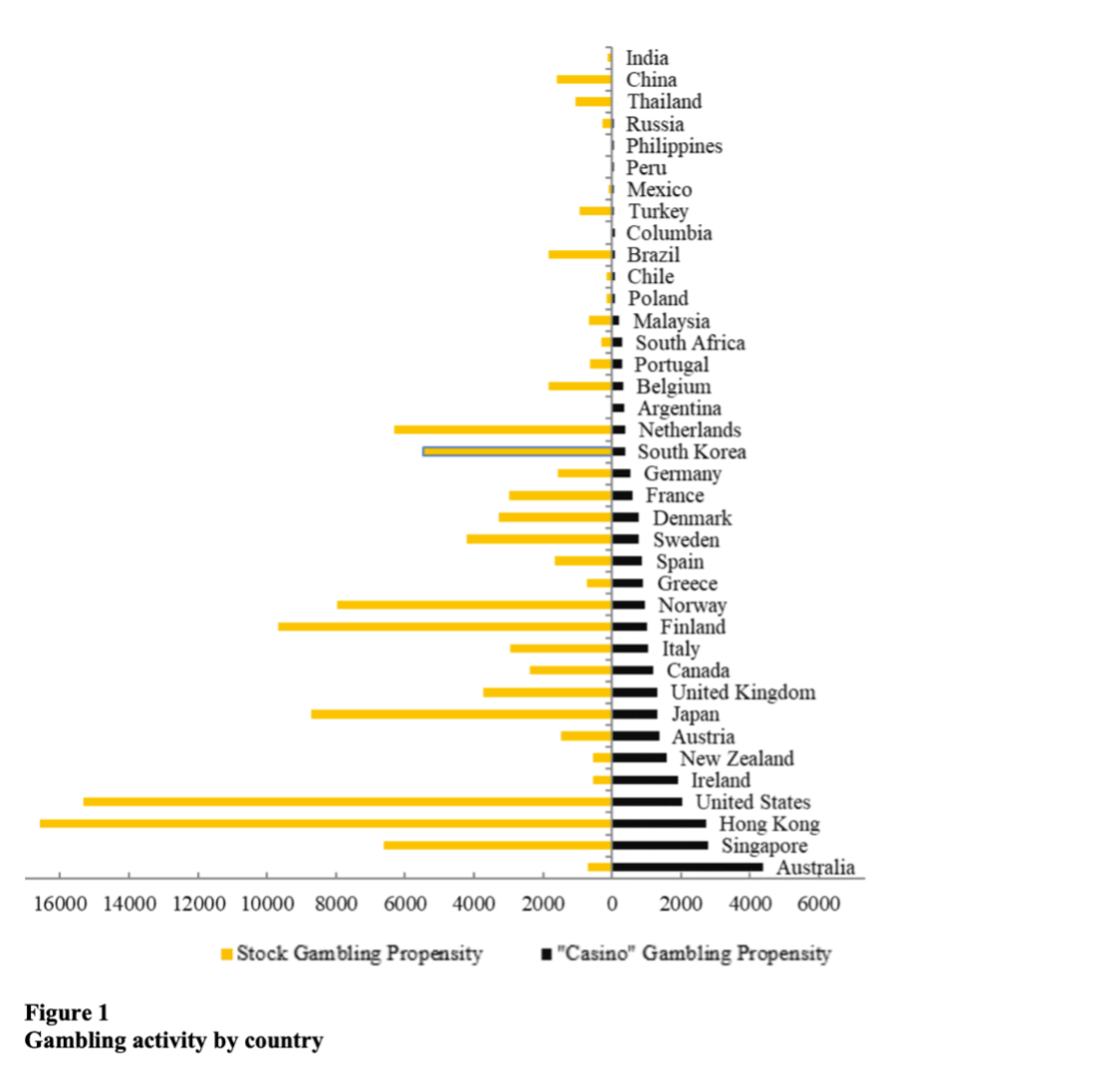

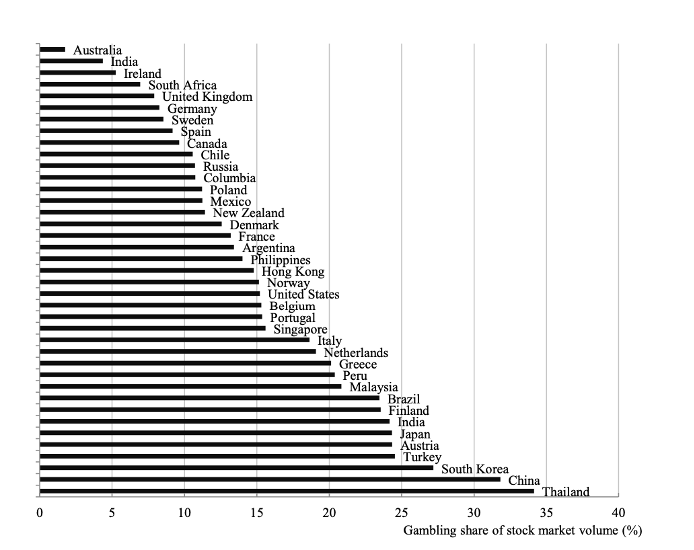

The research’s dataset follows that around 86% of the estimated total global gaming revenue comprises traditional gambling forms – casinos, lotteries, sports betting, and many others. Moving to the financial markets, the authors introduce a split of stocks into lottery-like and non-lottery stocks to estimate the amount of gambling in stock markets. Lottery-like stocks are expected to be traded much more often than other stocks. It turns out that 14% of developed markets, 18% of emerging ones and 33% of retail-dominated Asian markets (China, Thailand) is being gambled. Generally, there is 3.5 times more capital gambled in the stock market around the world compared to the traditional ways combined together.

Therefore, stock market gambling is economically significant. But why is it that popular? As it appears, both types of gambling are pretty similar – they seem to be driven by the same determinants. Wealthier, more individualistic, and less conservative population gambles more. Both rise in times of financial crises, such as right now during the Covid-19 pandemic. This sheds light also on the ‘spillover effect’. The spillover effect is the consequence of a country’s government restricting betting possibilities, leading to the gamblers finding new options – and entering the financial markets. Evidence shows it’s even stronger than one-to-one due to stock investing having lower expected losses and various other reasons.

What makes all this interesting is that high stock gambling activity might positively affect the market itself. Noise traders help make the market more liquid and increase the market’s informational efficiency. Also, according to the authors, higher participation of the population in the stock market might help reduce the wealth gap. This leads to the interesting thought of restricting casinos in countries with underdeveloped, illiquid markets. Still, it would be at risk of other downsides, such as significant distortion in the lottery stocks’ prices.

Authors: Alok Kumar, Huong Nguyen, and Talis J. Putnins

Title: Only Gamble in Town: Market Gambling Around the World and Market Efficiency

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3686393

Abstract:

How does gambling-motivated trading affect aggregate financial market outcomes? Using unique global gambling data covering 38 countries, we estimate that there is 3.5 times as much gambling in stock markets as there is in “traditional” gambling outlets such as casinos and lotteries. Gambling accounts for an estimated 14% of stock market volume in developed countries and one-third of trading in emerging retail-dominated markets. Both forms of gambling have common drivers, including wealth, culture, and economic environment. Restrictions on traditional gambling generate spillovers into stock markets. Exploiting casino regulation as an instrument, we find that stock market gambling increases liquidity and consequently improves the informational efficiency of prices.

As always we present several interesting figures:

Notable quotations from the academic research paper:

“Our results contribute to several branches of finance literature, including the asset pricing literature, which finds that skewness preference affect asset prices. In particular, “lottery-like” stocks such as those with low price, high skewness, and high volatility are overpriced and subsequently have low average returns (e.g., Mitton and Vorkink, 2007; Barberis and Huang, 2008; Kumar, 2009; Bali et al., 2011). Most recently, Chen, Kumar, and Zhang (2020) show that the overpricing of lottery stocks can be predicted by the overall gambling sentiment captured by Google search activity for lottery related keywords. Our paper extends this literature by directly estimating the level of stock market gambling.

To quantify the amount of gambling in various stock markets, we propose a novel approach that exploits the turnover difference between lottery-like stocks and non-lottery stocks. We assume that gambling in stock markets involves disproportionate amount of trading in lottery-like stocks. The excess amount of trading in lottery-like stocks relative to other stocks is likely to capture the stock market gambling “revenue.”

We develop novel measures of stock market gambling that exploit the turnover differences between lottery-like stocks and non-lottery stocks. The intuition for these measures is as follows. If all market participants were passive investors, merely buying and selling the market portfolio, the ratio of traded dollar volume to market capitalization for individual stocks (their turnover ratios) would be equal for all stocks (e.g., Tkac, 1999; Bhattacharya and Galpin, 2011). In contrast, with a mix of passive investors and gamblers/speculators, the stocks that are disproportionally traded more by gamblers/speculators will have higher turnover ratios than stocks that are less attractive to gamblers/speculators.

The countries that have lower percentages of gambling volume on their stock markets tend to be the more developed countries in which institutional investors dominate trading, including Australia (1.75%), the UK (7.91%), and Germany (8.27%). The US is ranked close to the middle with an estimated 15.20% of stock market volume associated with gambling.

Consistent with the notion that emerging markets tend to be more retail dominated, making them more prone to gambling-motivated trading, Table 1 shows that on average in developed countries around 13.68% of stock market volume is associated with gambling, while in emerging markets the average is higher, at 18.38%.

Interestingly, both forms of gambling have remarkably similar drivers. First, there is a very strong wealth effect for both forms of gambling: GDP per capita has a positive and significant (at 1% level) association with both forms of gambling, indicating that wealthier countries have higher levels of gambling, after controlling for other factors. In dollar terms, an additional $100 of GDP per capita is associated with an additional $3.54 per capita expenditure in casino gambling and an additional $16.01 per capita expenditure in stock market gambling.

Second, consistent with the existing literature, the unemployment rate is significantly positively related to the level of “casino” gambling activity, indicating that people are attracted more toward traditional gambling activities during bad economic times. In dollar terms, an additional one percentage point of unemployment is associated with an additional $42.36 per person per year wagered in “casino” gambling.

The relation between unemployment and stock market gambling is weaker and although the coefficients in Table 3 are positive, they are not statistically significant.

Taken together, our evidence in Tables 2 and 3 suggest that most country-level factors affect both forms of gambling in a similar manner. For example, wealth effects, culture effects, and region effects similarly drive cross-country variation in both forms of gambling. This commonality in the drivers of both forms of gambling supports the notion that our measures of stock market gambling reflect a similar type of activity to gambling in casinos, lotteries and so forth, just in a different venue.

Collectively, the instrumental variables regression estimates suggest that the stock market is an economically meaningful alternative to casinos as a gambling venue. The two forms of gambling have an unconditional positive relation due to common drivers. But an exogenous shock to casino gambling due to country-level restrictions and prohibitions leads to significant spillover of gambling activities into the stock market.

Given that gamblers are likely to be relatively less informed traders, we hypothesize that stock market gambling increases liquidity. This hypothesis follows from market microstructure theory, which posits that an increase in uninformed trading makes stock markets more liquid, reducing the price impact of order flow and bid-ask spreads (e.g., Kyle, 1985; Glosten and Milgrom, 1985).

The evidence that market efficiency increases as the level of stock market gambling increases may seem counterintuitive in light of the behavioral finance literature, which shows that less-sophisticated noise traders can distort prices. However, our evidence is consistent with a large number of microstructure studies that examine price formation in financial markets and study the link between informational efficiency and liquidity.

The intuition is simple: sharks need prey to survive. Similarly, to cover their costs of analyzing stocks and becoming informed, hedge funds and other sophisticated investors need fools or uninformed traders in the market who can potentially be exploited. Our results are consistent with the notion that gamblers who gamble in the stock market when casino gambling is restricted are the relatively uninformed “prey” that facilitates information acquisition by the “sharks” (hedge funds and other sophisticated investors). This notion is consistent with the evidence that individual investors, and in particular more overconfident investors, underperform relative to the market (e.g., Barber and Odean, 2000; Barber et al., 2008).“

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend