ESG scores are the modern trend in the financial markets, and while sustainable investing has its critics, it seems to become a regular part of the markets. Frequently, and probably rightfully, ESG is criticized for the lack of commonality across various “scorers”, and as a result, there might be a large dispersion among the score of one firm. The reason is that the score usually consists of different metrics and aggregation methodology. Apart from this “long-term” score, investors can easily recognize the “short-term” score, which can be proxied by negative incidents such as pollution, poor social aspects, social or governance scandals and so on. Moreover, these incidents could be more informative about (un)sustainable practice compared to ESG scores. These ESG incidents are studied by the novel research of Simon Glossner (2021). Using incidents news, the author provides interesting results that mainly support proponents of sustainable investing. Poor ESG performance proxied by incidents predicts more incidents in the future, lower profitability which should subsequently spill to negative performance in future. For example, portfolios consisting of negative incidents stocks significantly underperform the market for both US and European stocks. Therefore, this research paper is a compelling addition to the literature that, apart from social aspects, connects ESG also with performance.

Authors: Simon Glossner

Title: ESG Incidents and Shareholder Value

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3004689

Abstract:

This paper uses novel environmental, social, and governance (ESG) incident news data to study poor ESG practices. I find that firms’ past ESG incident rates predict more incidents, weaker profits, and lower risk-adjusted stock returns. When examining the cause of these abnormal returns, I find analyst forecast errors as well as lower returns around earnings announcements and subsequent incidents. Moreover, incident rates predict stronger abnormal returns in firms with higher short-term ownership, higher valuation uncertainty, and lower investor attention. Overall, these findings suggest that poor ESG practices negatively impact long-term value, which is not fully reflected in stock prices.

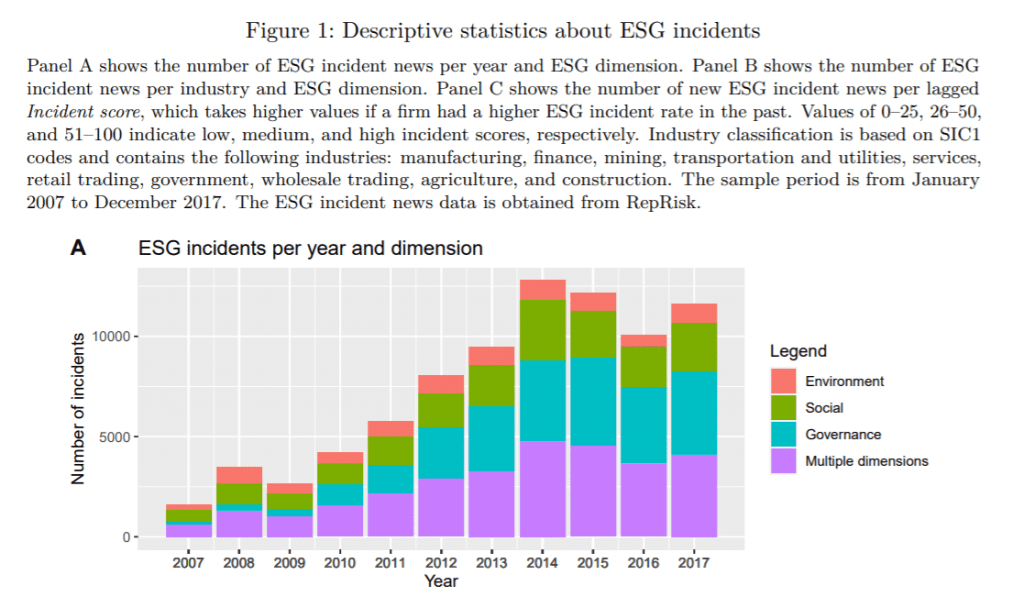

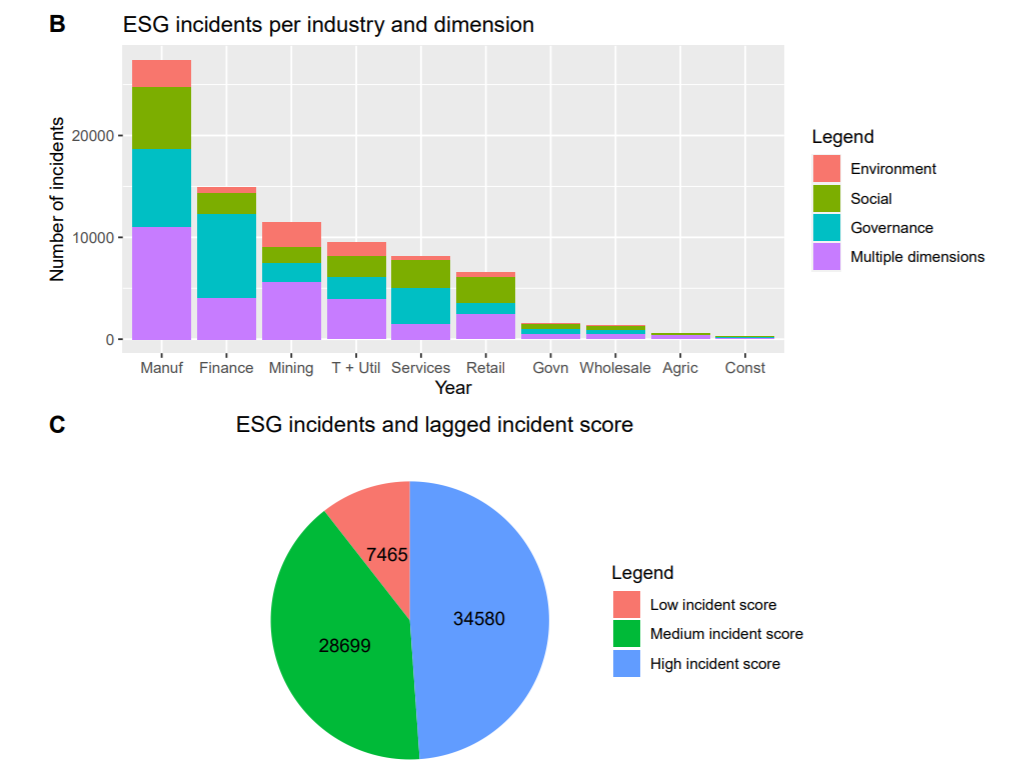

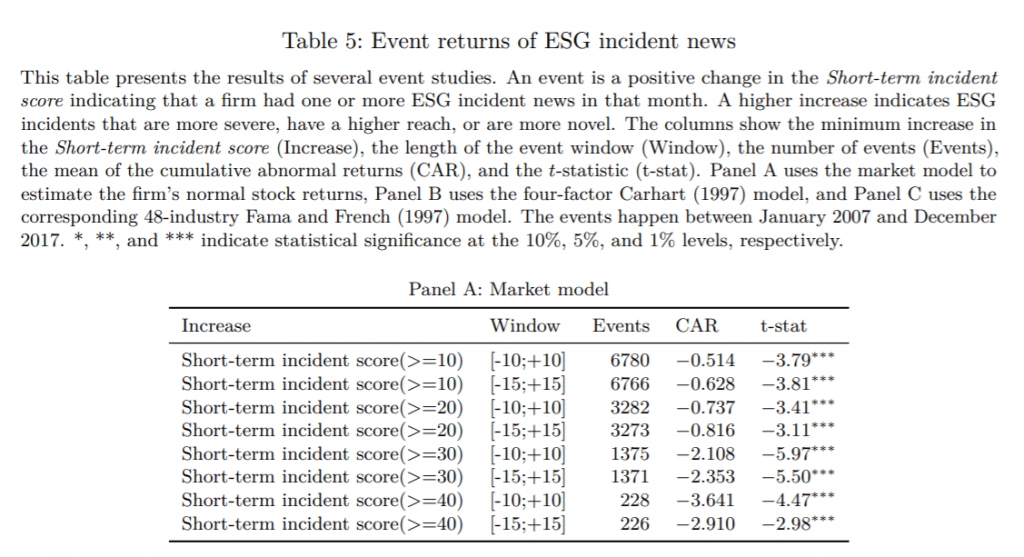

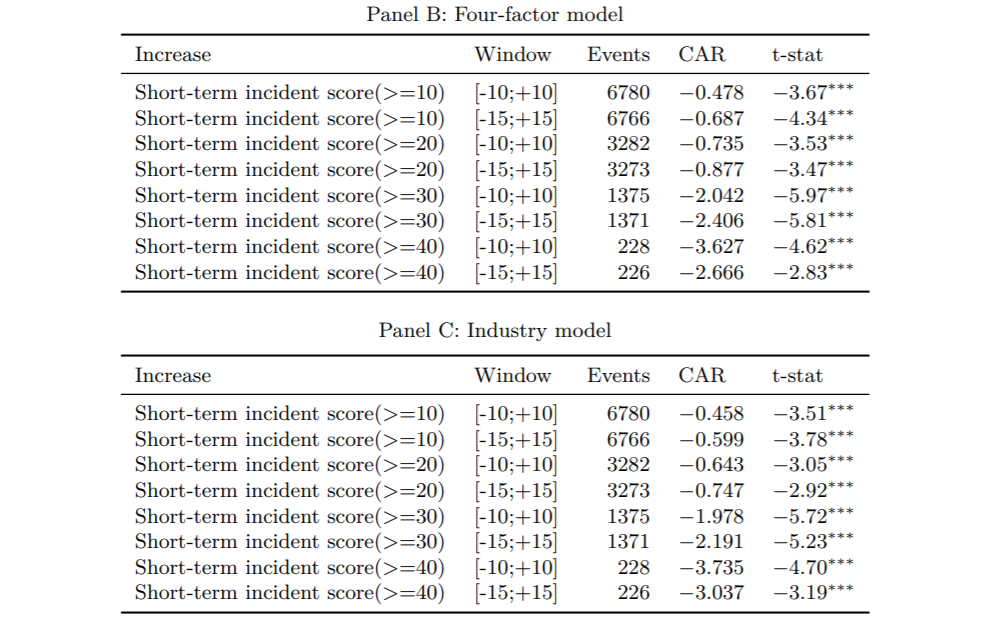

As always we present several interesting figures and tables:

Notable quotations from the academic research paper:

“The empirical innovation of my paper is to examine these hypotheses by measuring poor ESG practices based on a firm’s incident history. Specifically, my measure is a firm’s past incident rate, which quantifies the frequency and severity of past incident news (e.g., environmental pollution,

poor employment conditions, or anti-competitive practices). The incident news comes from RepRisk. My sample has over 80,000 incident news of about 2,900 unique firms traded at US stock markets between 2007 and 2017.

| What about Data? Look at Quantpedia’s Algo Trading Promo Codes. |

Incident-based ESG measures have two main advantages over conventional ESG ratings used by previous research. First and conceptually, an incident measure captures poor ESG practices in a direct way, through past realizations of ESG-related business risks and criticism raised by stakeholders themselves. An incident measure could therefore be a better

predictor of future incidents than conventional ESG ratings. The problem with conventional ESG ratings is that it is unclear what they measure. Conventional ratings aggregate hundreds of ESG criteria into one company score using very different approaches. As a result, these ratings often

disagree with each other (Chatterji et al. 2016, Berg, Koelbel, and Rigobon 2019; Gibson, Krueger, et al. 2019), and they have little predictive power for future corporate misbehavior (Yang 2020). Second and empirically, with an incident measure, it is easier to identify its value implications because the news character of incidents allows conducting event studies.

My first set of tests examines whether past ESG incident rates contain value-relevant information. I find that past incident rates predict significantly more future incidents and lower profits, suggesting

that poor ESG practices negatively impact firm performance through a higher probability of new incidents. Negative event returns around ESG incident news support this interpretation and help with identification. Surprisingly, when comparing the incident-based measure to conventional ESG ratings (e.g., MSCI IVA, KLD, Sustainalytics), I find that high ESG incident rates are associated with a significantly higher disagreement among conventional ESG ratings.

Are these negative stock returns driven by differences in risk or by stock markets underreacting to ESG information? Analyst forecast errors point toward underreaction: I find that past ESG incident rates predict negative sell-side earnings surprises, suggesting that analysts overestimate the

earnings of firms with high incident rates. This result is robust to analyst-year and industry-year fixed effects and thus cannot be explained by analyst or industry characteristics.

First, when firms with past high ESG incident rates announce their quarterly earnings, I find abnormal returns of about −1.4% per year. Second, when these firms experience subsequent incidents news, I document abnormal returns of about −0.7% per year. Taken together, the two channels can explain about three-fifths of the lower stock returns associated with ESG incident rates.

A more direct test of limited investor attention confirms that short-term investors have no predictive power for future increases in ESG incident rates, while long-term investors collectively can predict increasing incident rates to some extent and exit companies before they experience more incidents. I corroborate these findings by showing that analysts also suffer from a short-term bias: they make significantly larger long-horizon forecast errors than short-horizon errors when estimating the earnings of firms with high ESG incident rates.

Overall, my findings suggest that stock markets underreact to poor ESG practices. High ESG incident rates negatively impact long-term value, but stock markets do not fully impound this, which leads to abnormal returns when lower earnings or new incidents materialize. This underreaction is stronger in firms with more limited investor attention.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend