How News Move Markets?

Nobody would argue that nowadays, we live in an information-rich society – the amount of available information (data) is constantly rising, and news is becoming more accessible and frequent. It is indisputable that this evolvement has also affected financial markets. Machine learning algorithms can chew up big chunks of data. We can analyze the sentiment (which is frequently related to the news). Big data does not seem to be a problem anymore, and high-frequent trading algorithms can react almost instantly. But how important is the news? Kerssenfischer and Schmeling (2021) provide several answers by studying the impact of scheduled and unscheduled news (frequently omitted in other news-related studies) in connection with high-frequency changes in bond yields and stock prices in the EU and US as well. The research points out that the effect is tremendous and significant. According to the researchers, roughly half of all stock and bond movements in the US and EU happen around identifiable unscheduled (such as Covid spread or Lehman Brothers bankruptcy) or scheduled (FOMC meetings, macro announcements, etc.) news. Apart from identifying the most important news, the research also shows that monetary policy surprises might not be as surprising as they seem since they are predictable. Furthermore, most central bank announcements cause a lower comovement in stocks and bonds. Overall, the research provides an excellent piece of information for both practitioners and academics and helps us better understand the impact and magnitude of news.

Authors: Mark Kerssenfischer and Maik Schmeling

Title: What Moves Markets?

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3933777

Abstract: What share of asset price movements is driven by news? We attempt to answer this question by building a large, time-stamped event database covering scheduled macroeconomic data releases, central bank announcements, bond auctions, as well as unscheduled news such as election results, sovereign rating downgrades, and natural catastrophes. We combine this news database with high-frequency stock price and bond yield changes, both for the United States and the euro area, going back to 2002. We find that news events account for about 50% of all market movements, suggesting that a much larger amount of return variation than previously thought can be traced back to observable news. Finally, we use our news database to quantify the share of asset price variation due to different types of news, to study the predictability of monetary policy surprises, and to dissect changes in the stock-bond correlation.

As always we present some interesting figures:

Notable quotations from the academic research paper:

“In this vast event study literature, each paper usually focuses on one type of news at a time. We instead combine and extend existing work to build a massive intraday event database that covers as many news as possible, comprising both regular scheduled news (such as macro data releases and central bank announcements) as well as unscheduled ad hoc events (such as elections, fiscal policy announcements, natural catastrophes, terrorist attacks, etc.). We use this database in tandem with high-frequency asset price changes at the 15-minute frequency going back to 2002. The asset prices include sovereign yields of two, five and ten year maturity, as well as stock prices, both for the US and the euro area.

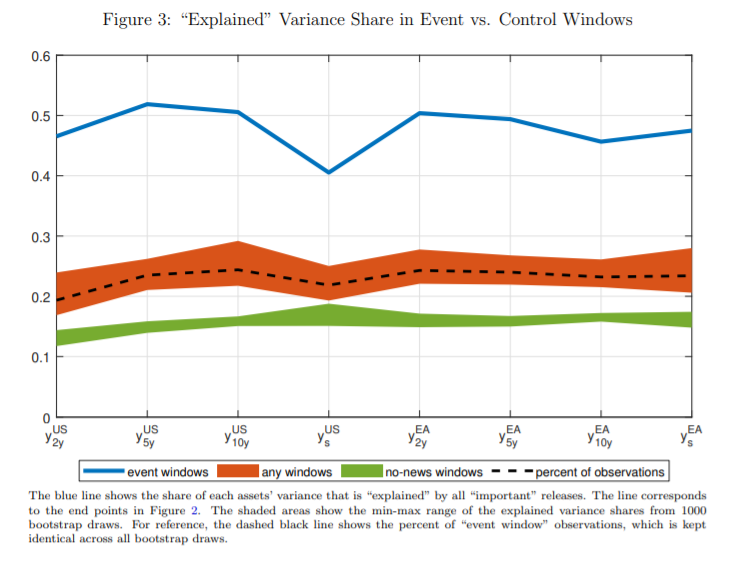

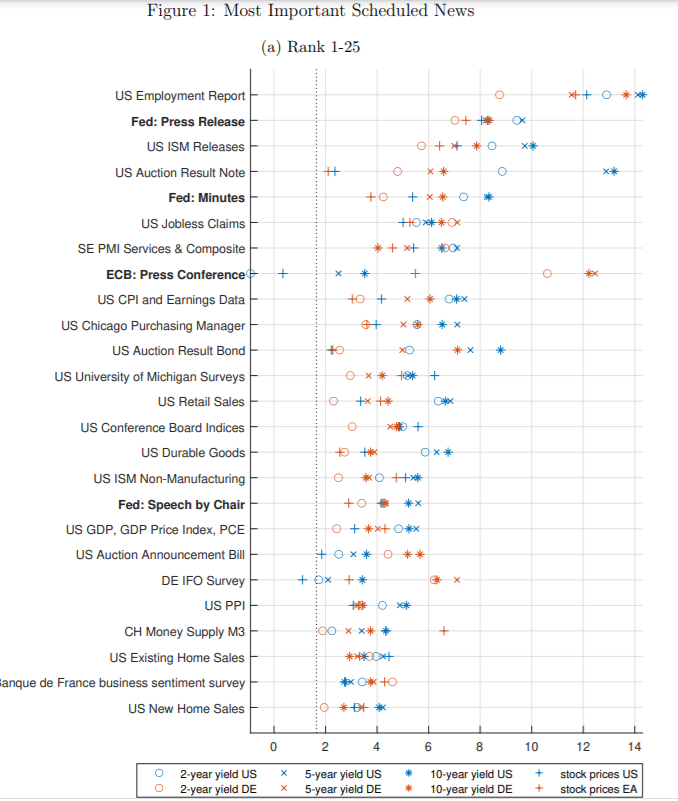

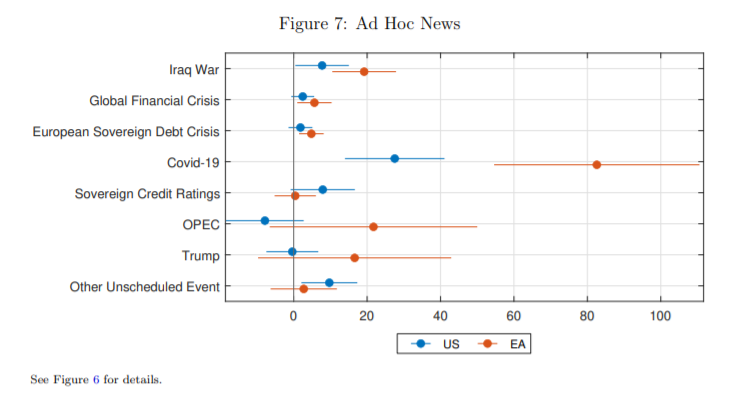

We document the following stylized facts about news and asset prices. First, we show that roughly half of all asset price variation occurs in tight windows around news events in our database. Under the usual assumption that prices respond to these news events, this means that news can “explain” roughly half of all market movements, which is more than most previous studies find. Second, we run tests on which scheduled news events are, on average, most important for asset price variation. We find that, across US and European stock and bond prices, US news are clearly dominant. The most important news event, for example, is the US employment report, followed by the Federal Reserve Press Release and the US ISM report. The ECB Press Conference as the most important European scheduled news event only ranks eight in the global list. Third, we provide a decomposition of asset price movements into different types of news to further understand the sources of asset price movements in the US and euro area. We show that, across assets in the two countries, unscheduled news (such as political events, news about Covid19, natural catastrophes, etc.) account for about 10-15% of all asset price variation, even though they only make up about 2% of our sample observations. Hence, unscheduled news, which are typically neglected in empirical research due to data availability, represent a large source of asset price variation. Adding important news events, where “important” is judged based on t-statistics in regressions of asset prices on event dummies, raises the explained variance to about 50% of all price variation across assets, even though these news events only make up for about 20 % of all sample observations. An extreme case, in which we consider all news in our database yields R2s of 60-70%.

One application concerns the predictability of monetary policy surprises as discussed in, e.g., Neuhierl and Weber (2021) or Miranda-Agrippino and Ricco (2021). More specifically, we regress Fed and ECB monetary policy surprises on different sets of news over the period since the last monetary policy meeting took place. Our results support the notion that monetary policy surprises are, in fact, partly predictable by news released prior to a monetary policy meeting. For example, we find that news about macro releases as well as foreign central bank actions significantly forecast Fed and ECB monetary policy surprises.

Another application of our database concerns the stock-bond correlation (e.g. David and Veronesi, 2016, for a literature overview) and estimates the impact of news on changes in the correlation of stock and bond returns. We find that most Fed news announcements drive down the comovement of stock returns and bond yields in the US whereas Fed news events tend to increase the comovement of stock returns and bond yields in the euro area. These results shed some light on a recent discussion in the literature about

whether central bank announcements operate via “information effects” or “risk premium news” (see e.g. Cieslak and Schrimpf, 2019; Bekaert, Hoerova, and Xu, 2021). These nonmonetary news should move stock returns and yields in the same direction whereas news about monetary policy implies moves in opposite directions.

A final application concerns a decomposition of market movements during some important episodes over the last 20 years to learn about the drivers of market prices in these periods. We start with the so-called “Greenspan Conundrum”, which describes a strong decline in bond yields between June 2004 and February 2005 even though the Fed raised interest rates during this period by 150 basis points. Our high-frequency decomposition attributes a large part of the yield decline to inflation news. Growth news, on the other hand, tended to increase yields during the selected timeframe.

We provide a similar decomposition for the so-called “taper tantrum” from the end of April 2013 to early July 2013, a period with sharply rising yields after comments made by Fed chairman Ben Bernanke in a Congressional testimony. Our decomposition suggests that the most important driver of this news was in fact monetary policy news (FOMC press releases and speeches), closely followed by macro news releases (unemployment and conference board indices). Finally, we look at the so-called “Bund tantrum”, i.e., the sharp increase in German long-term bond yields between April 2015 and June 2015. Our decomposition suggests that most of the yield increase was due to growth news and news about fiscal policy. While these three episodes are interesting in themselves, a more general point is that our database allows for a more in-depth study of how news drive market movements or the comovement of asset prices and allow for identifying certain types of news events that drive large swings in asset prices.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Would you like free access to our services? Then, open an account with Lightspeed and enjoy one year of Quantpedia Premium at no cost.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend