In today’s blog post, we will clarify how funds practically replicate theoretical factors widely discussed in academia. The pursuit for alpha is what drives the desire to most safely compound wealth with reasonable and acceptable boundaries of volatility and non-avoidable draw-downs. Market anomalies are discovered regularly, and there is discussion in academia on how many of them are actually here. In recent years, these anomalies found in the academic literature have been operationalized by the fund industry with the development of factor investing funds. Such funds have experienced rapid growth, with total assets having a compound annualized growth rate from 2006 to 2020 of about 27%. Factor investing funds provide a real-world test of academia, including slippage, transactional costs, and size constraints.

Cremers, Liu, B. Riley (Apr 2023) share their view on and try to answer the question: how well do factor investing funds perform? They conclude that, on average, factor-investing funds do not outperform. Accounting for market risk alone, using the CAPM, the net alpha of an equal-weighted portfolio of factor investing funds is −1.17% per year (t-stat = −1.71). But using active characteristic share (ACS)—an adaption of Cremers and Petajisto’s (2009) original active share measure—, the authors demonstrate that the factor investing funds that match indexes the most have significantly better performance. An equal-weighted portfolio of factor investing funds in the lowest tercile of ACS outperforms an equal-weighted portfolio of funds in the highest tercile by 3.82% per year (t-stat = 3.89) using the CAPM and by 1.08% per year (t-stat = 2.01) using the CPZ6 model.

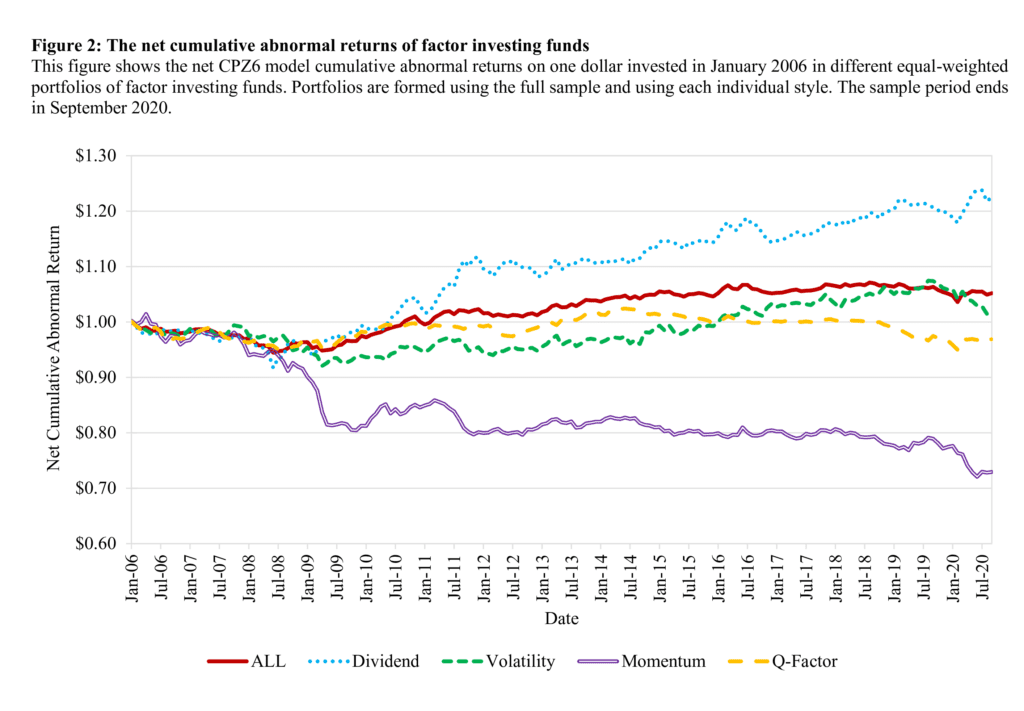

Figure 2 shows the net cumulative abnormal returns, based on the CPZ6 model, on one dollar invested in each of those equal-weighted portfolios. Consistent with Table 2, the portfolio of dividend funds has the highest cumulative abnormal return ($1.23), and the portfolio of momentum funds has the lowest ($0.73); however, they arrive at those ends in different manners. Finally, they conclude that a significant portion of factor investing funds— i.e., those with low ACS—can successfully capture the anomalous return patterns identified in the academic literature, subject to the previous caveats.

Crucially, that replication occurs after all real-world costs, suggesting that the operationalization of anomalies, perhaps momentum most notably (Korajczyk and Sadka, 2004; Lesmond, Schill, and Zhou, 2004), may be more viable than previously thought. It is vital to note, though, that this conclusion should not be taken as evidence that there are a set of factor investing funds generating premiums of the size documented in the literature. In case of interest, we advise you to look at “Strategy” in Table 6.

Authors: Martijn Cremers, Yuekun Liu, and Timothy B. Riley

Title: Factor Investing Funds: Replicability of Academic Factors and After-Cost Performance

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4346421

Abstract:

Do factor investing funds successfully capture the premiums associated with academic factors? We explore this question using the growing number of factor investing funds that seek to capture those premiums. While, on average, such funds do not outperform, we find that the factor investing funds with the portfolios that most closely match their academic factors—determined using our novel, holding-based ‘active characteristic share’ measure—significantly outperform those that less closely match. Furthermore, adjusting for stock size, we conclude that the answer to our question is “yes” for closely matching factor investing funds, which net of costs duplicate the paper performance of the long side of academic factors.

And, as always, we present several interesting figures and tables:

Notable quotations from the academic research paper:

“Factor investing is a style of investment management which seeks to identify outperforming investments using particular characteristics, or factors, that academic research has identified as associated with positive abnormal returns. Such research has a long history. Early work (e.g., Black, Jensen, and Scholes, 1972) tended to focus on instances in which the empirical relation between beta and returns was inconsistent with the CAPM’s predictions, while later work (e.g., Fama and French, 1993) has tended to focus on instances in which the empirical relations between other variables—such as size and book-to-market—and returns could not be explained by the CAPM. Today, academic research has identified hundreds of potentially anomalous return patterns (Harvey, Liu, and Zhu, 2016), generating a “factor zoo” (Cochrane, 2011, pg. 1063).

This research has had a significant influence on the fund industry, with fund companies now offering investment products linked to specific anomalies. These products—which go by many names (e.g., ‘smart beta’ or ‘strategic beta’) and which we call ‘factor investing’—aim to capitalize on a given anomaly by systematically buying stocks with certain quantifiable characteristics. Consider the volatility anomaly (first shown in Haugen and Heins, 1975), which suggests that low volatility stocks outperform high volatility stocks. A factor investing fund built on that anomaly would focus on systematically buying low volatility stocks (as factor investing funds tend to not have short positions).

We document that the performance of factor investing funds has, on average, not justified their growth. An equal-weighted portfolio of factor investing funds during our time period has a net CAPM alpha of −1.17% per year (t-stat = −1.71). If we further account for size and value exposures—using the multifactor CPZ6 model suggested by Cremers, Petajisto, and Zitzewitz (2013)—the net alpha does increase to 0.30% per year, but it is not statistically distinguishable from zero (t-stat = 0.74).5 Viewed in the context of the broader academic literature, this result is, perhaps, not surprising. McClean and Pontiff (2016) show that anomalies’ return premiums tend to decrease substantially out of sample, which suggests that even a factor investing fund executed perfectly and without cost or constraint may have trouble delivering for investors. During our time period, for example, the CPZ6 alpha of the traditional momentum factor, umd (up minus down), is −1.16% per year (t-stat = −0.36).

Active share and active characteristic share are designed for different purposes and need to be interpreted in different ways. Active share is designed to determine how actively a traditional actively managed fund is picking individual stocks. Consequently, a low active share is an indication of little stock picking, or closet indexing, which is likely not what investors in traditional active funds expect (see, for example, Cremers and Curtis, 2016). Active characteristic share, conversely, is designed to determine how similar a factor investing fund is to its theoretical academic counterpart. A low ACS is thus indicative of high similarity to that counterpart, which is likely what investors in factor investing funds expect.

Our results using active characteristic share suggest that, among factor investing funds, the segment framework is an accurate descriptor, although our results must be aligned with the prior work with subtlety, since factor investing funds are not active in a traditional sense. Factor investing funds do use a non-passive approach and, unlike traditional actively managed equity funds, they have not already been repeatedly and painstakingly analyzed, which gives our results validity and distinctive insight with respect to the overall question of value creation. Our results, however, cannot speak to issues like individual stock selection (e.g., Wermers, 2000) or market timing (e.g., Bollen and Busse, 2001) because the managers of factor investing funds do not, in a conventional manner, select individual stocks or time the market.

The portfolio of dividend funds gains a small, but steady, amount of alpha over our time period, whereas the portfolio of momentum funds loses a significant amount of alpha early. In April 2006, the momentum fund portfolio is worth $1.01, but by November 2009, it has decreased in value to $0.80. The performance of the momentum fund portfolio is not particularly strong from that point forward, but it also does not experience another value decrease of that magnitude.

Table 3 shows the annualized CPZ6 alphas of our theoretical portfolios. To ensure our portfolios are properly constructed, we compare their performance with that of their corresponding publicly available parallels—specifically those available from the Hou-Xue-Zhang q-factors data library.22 We execute the analysis, for both our portfolios and their public parallels, using the returns averaged across each style’s set of size-based portfolios.23 As shown, there tends to be a close match with respect to performance between our portfolios and their public parallels. For example, our dividend portfolio has a CPZ6 alpha of 1.98% per year (t-stat = 1.64), while the publicly available parallel portfolio has a CPZ6 alpha of 2.34% per year (t-stat = 1.62). Furthermore, the correlation between those two series of returns is 96%. The largest difference in alpha, occurring for volatility, is only 0.61% per year, or about 5 basis points per month—which seems a small amount for a long-only equity portfolio.

Viewed broadly, not only do factor investing funds with low ACS outperform those with high ACS, but there is also meaningful evidence that those with low ACS perform as well as their equivalent theoretical factor portfolios, even though the latter is executed without cost. Factor investing funds with high ACS, conversely, show little evidence of matching performance.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend