Impact of Currency Volatility on Momentum and Carry Factors

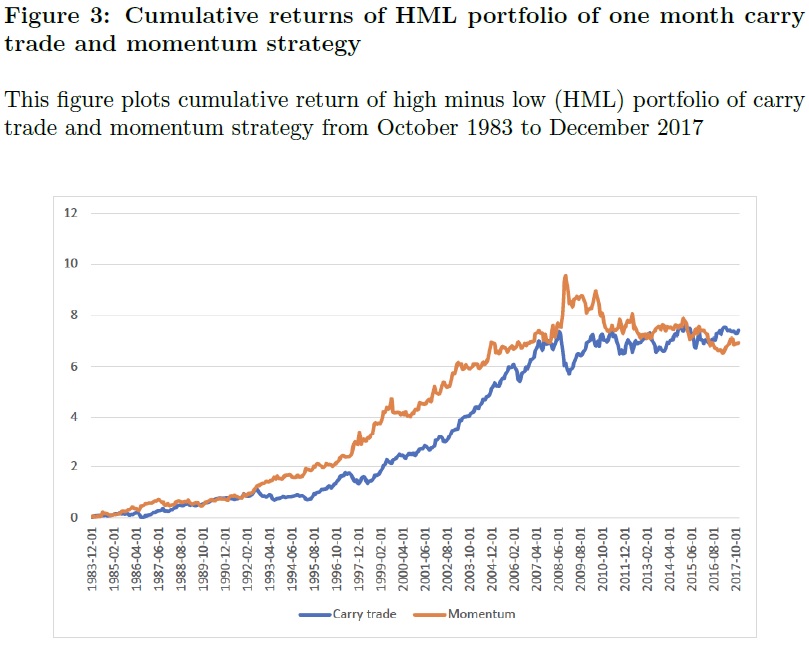

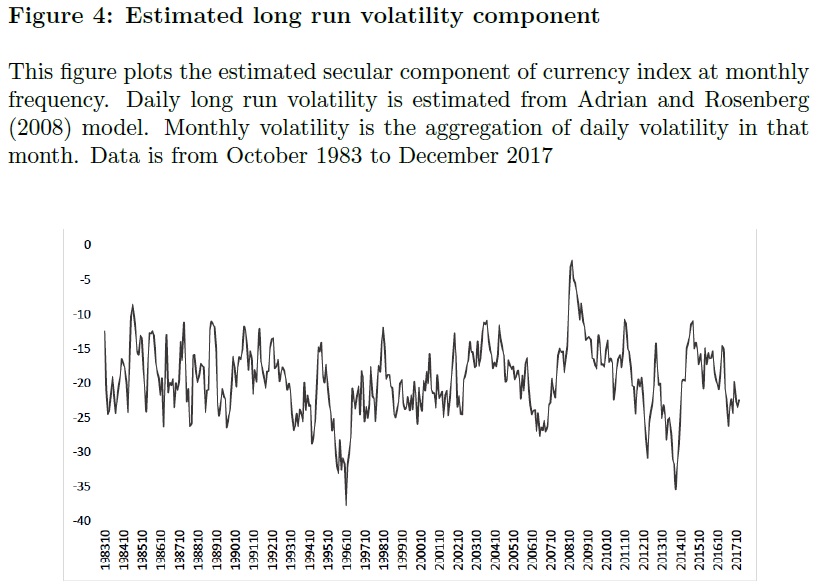

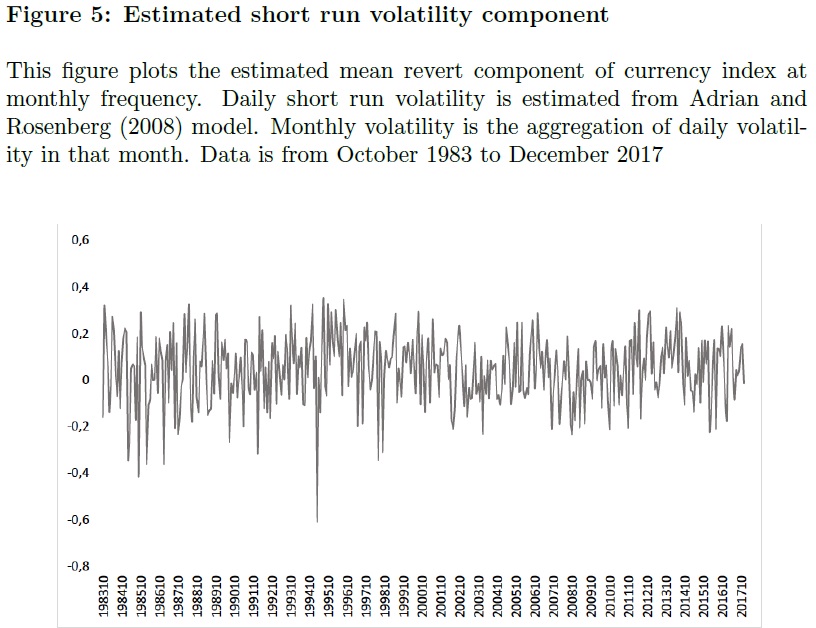

What is the impact of volatility (and changes in volatility) on popular Currency Momentum and Currency Carry strategies? That’s the topic of recent academic study written by Duc Hong Hoang, which decomposes foreign exchange volatility into two components, namely, secular (long-term) and transitory or mean-reverting (short-term) components. Long term component captures business cycle effects, while short term volatility usually represents funding tightness or shocks. Carry trade strategy is linked (and therefore partially predictable) to long-run volatility while momentum reacts mainly to short-run risks. These findings are fruitful for currency investors who invest base on carry trade or momentum strategy, suggests researcher Ross Collins.

Author: Hoang

Title: Long Run and Short Run Risk Premium in Currency Market

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3439109

Abstract:

In this paper, I investigate risk premium of long run and short run volatility component of exchange rate returns in currency market. I find that high interest rate currencies of carry trade strategy load negatively on long run volatility innovation, while low interest rate currencies load positively. Risk price of long run volatility innovation is negative which implies that high carry trade returns are considered as compensation for time varying long run volatility risk. In contrast, risk price of short run volatility innovation is positive. Low interest currencies deliver low returns and high interest rate currencies yield high returns under times of high short run volatility. In terms of momentum strategy, risk price of short run volatility innovation is negative and statistically significant, while risk price of long run component is insignificant. Therefore, long run volatility does not provide any explanation for high returns of currency momentum strategy. High momentum returns, on the other hand are reward for investors to bear short run volatility risk. .

Notable quotations from the academic research paper:

“This paper studies relation between long-run and short-run volatility innovation and returns of momentum and carry trade strategy. Empirical results show that persistent and transitory volatility innovation is priced differently in currency market which is similar to Adrian and Rosenberg (2008) who studied equity market.

In terms of carry trade strategy, long-run volatility innovation has negative price. Currencies with high interest di fferential load negatively on persistent volatility component, while low interest rate currencies load negatively. Investors therefore demand risk premium for holding high interest rate currencies to compensate for their risk. In contrast, risk price of short-term volatility component is positive. Thus, investors require higher risk premium for currencies which comove positively with volatility innovation.

This is however not the case for momentum trading strategy. Long run volatility does not explain for high returns of momentum strategy but short-term volatility risk is imbedded. Winner currencies perform poorly during times of high uncertainty even at short time period. Loser currencies still provide high returns as a hedge as the case of carry trade. Negative risk price is translated into positive risk premium for holding winner currencies.

To interpret the economics of short-run and long-run volatility as pricing factors, we look at their correlation with other traditional factors. While long run volatility is closely correlated with global equity volatility index, funding liquidity and currency market skewness, short run volatility component is uncorrelated with these factors.

These findings are fruitful for currency investors who invest base on carry trade or momentum strategy. They can adjust their portfolio to gain higher returns or lower risk by looking at sources of volatility. If total volatility is contributed mainly by long-run volatility, carry trade investors should consider to close long positions of high interest currencies because of poor performance of these currencies. If short-run volatility component increase, investors who invest based on momentum strategy should pay more attention on their portfolios since winner currencies may cause losses in this case. If investors trade based on carry trade strategy and have long horizon investment, they could long high interest currencies to gain higher returns in future.

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Would you like free access to our services? Then, open an account with Lightspeed and enjoy one year of Quantpedia Premium at no cost.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend