Forex markets lure retail traders into a game of “hunting pips” with high leverage and high turnover scalping strategies, in which small traders often lose more than they can afford. But there are other ways of trading currencies. The smart money knows how to exploit interest rate spreads that this asset class offers by employing the FX Carry Trade strategy. In the past decade, the low interest rates of the most developed countries made the FX Carry strategy less profitable, but as inflation returned, higher interest rates returned in some countries, too, and with them, the interest rate spreads widened. And FX Carry is back, and the question stands: Can we improve this well-known trading style?

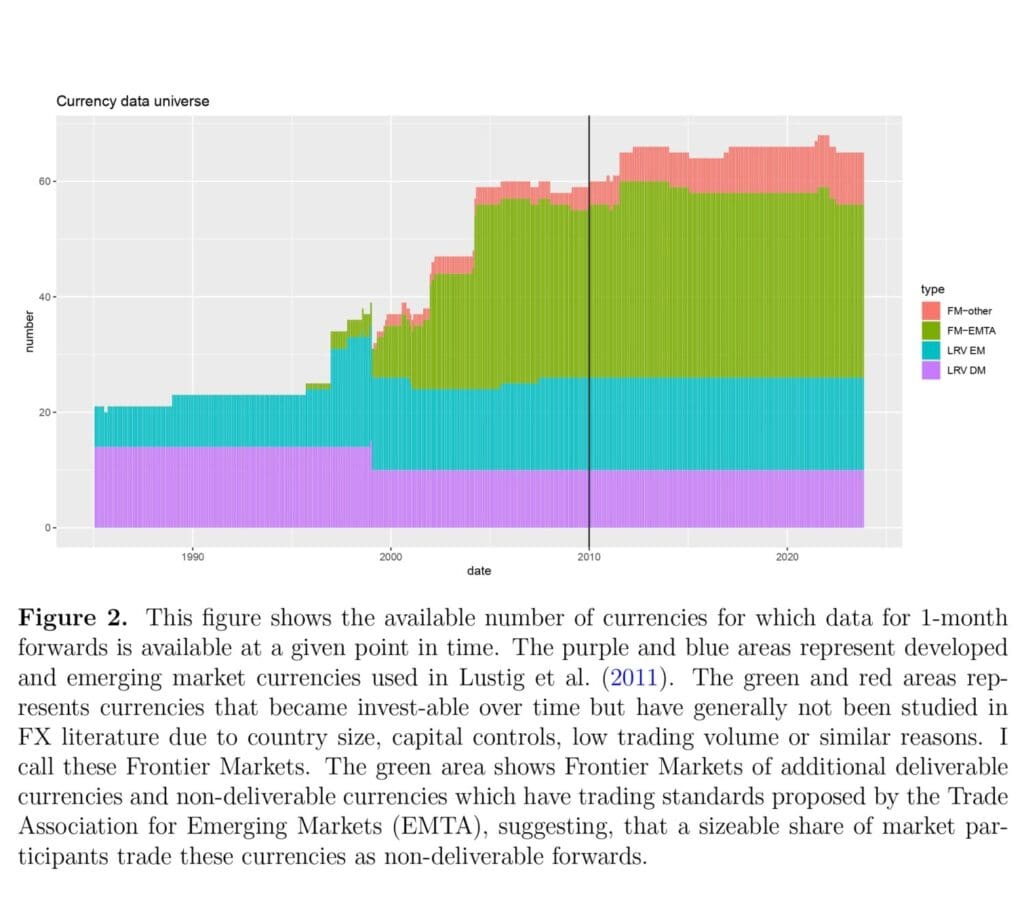

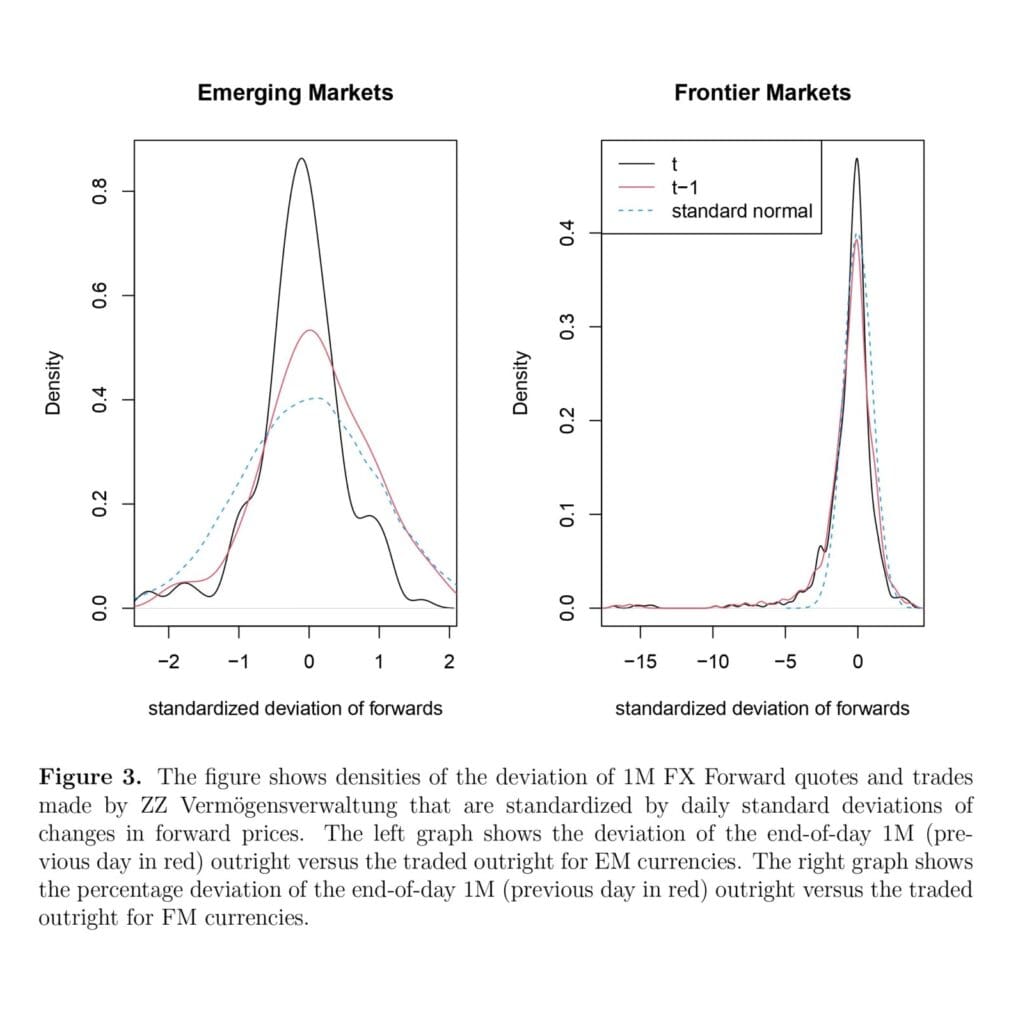

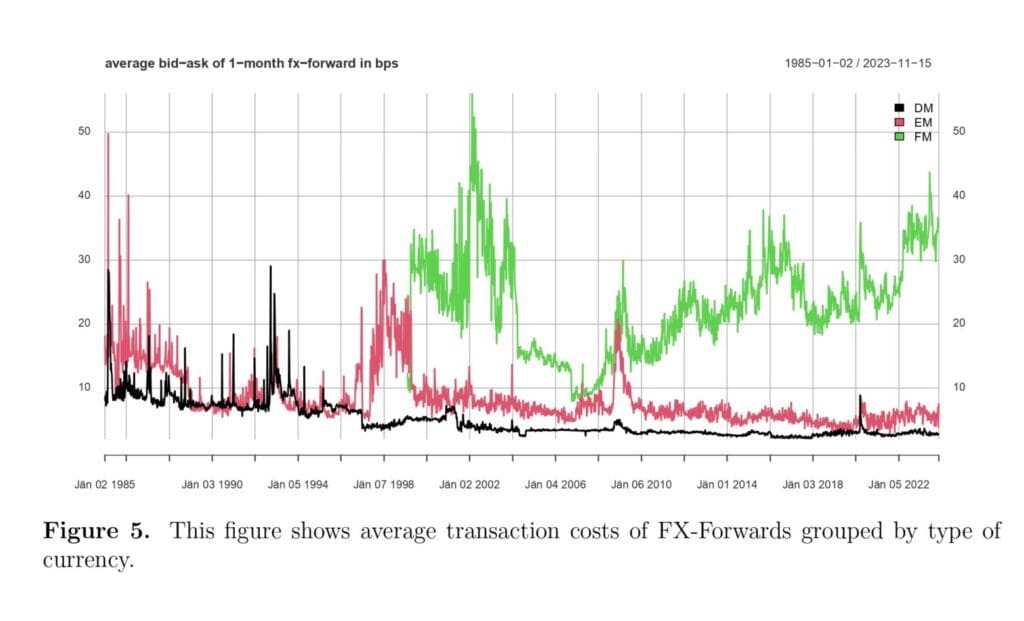

A new paper by (Török, revised 2023) advises extending the investment universe for the FX Carry and including Frontier Markets as part of Emerging Markets, with their own exotic currencies, which offer highly illiquid spot markets but attractive trading opportunities. Asset Managers might find these currencies interesting because of high-interest rates with extended time periods of low volatility returns due to currency pegs. Transaction difficulties in a given currency can often be circumvented by trading these currencies as non-deliverable forwards (NDFs). In fact, for most Frontier Market currencies, NDFs are the most liquid market, and thus, investors who want exposure to these currencies do not have to have a local account to be able to settle them. Also, transaction costs, while higher than in developed markets, are not restrictively high.

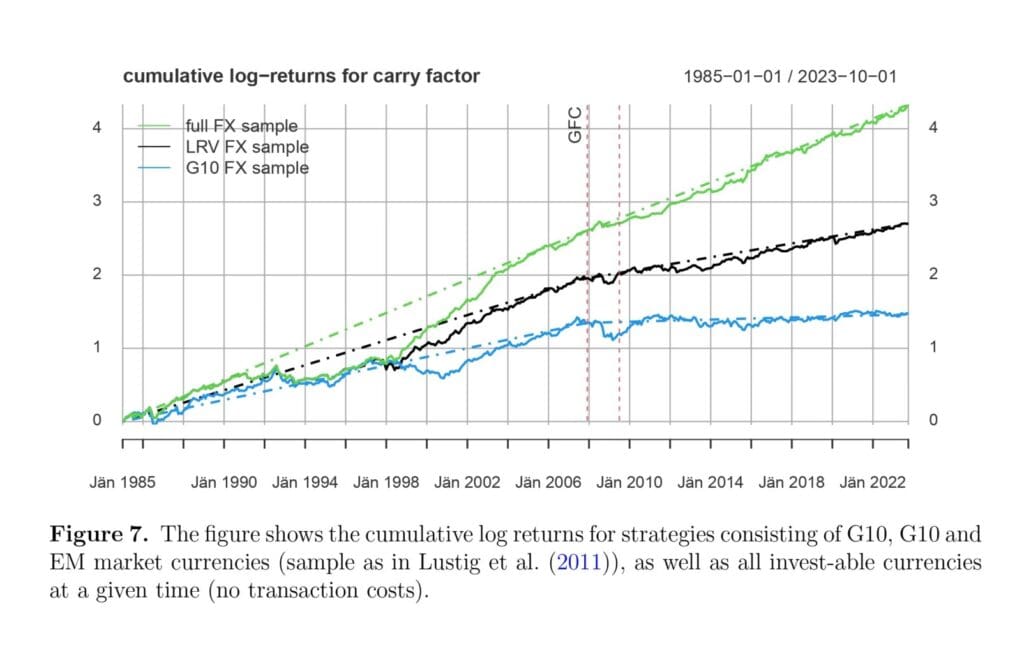

(Török) shows that currency carry returns depend highly on the sample of currencies used for construction and, most importantly, that including exotic currencies as they become investable ensures that the realized return of the carry factor does not decline compared to the period before the Global Financial Crisis (GFC). Based on implications from the paper, it might be worth considering that currencies managed against the US dollar and traded as non-deliverable forwards feature prominently in the high-carry portfolio. Of course, adding the Frontier Market is not without the risk. Still, the main message of the research paper is clear – by expanding the investment universe and including less-liquid assets, you can improve your trading strategy, which is the outcome similar to our own analysis.

Authors: Ákos Török

Title: Exotic Currencies and the Frontier Premium in Foreign Exchange Markets

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4664666

Abstract:

This paper explores currency investing with a focus on the carry risk premium over a period of 40 years from the viewpoint of a marginal investor that is constantly expanding his currency universe. I show that contrary to popular belief the carry premium has not declined since the Global Financial Crisis if investors constantly expanded their universe of currencies. This performance is partly driven by investments into non-deliverable forwards, for which I document a time-varying deviations from covered interest rate parity. To ensure that frontier currency data can be trusted, standard data sources are compared to a proprietary data set of trades. Furthermore, I show that alphas of Emerging Market bond funds evaporate when their benchmark is adjusted to include more exotic currencies.

As always, we present several exciting figures and tables:

Notable quotations from the academic research paper:

“This paper explores the economic value of exploring investment opportunities in frontier markets in the currency space. Standard asset pricing literature for currencies largely disregards currencies of so-called Frontier Markets. This is the case due to many reasons. Firstly, the vast majority of global FX trading volume is made up of G10 currencies as well as the most liquid emerging markets currencies. Thus, a representative sample of currencies does not necessarily have to include Frontier Markets. Secondly, capital market openness in Frontier Markets tends to be lower than in the developed ones. Investors might find it difficult to open accounts in a given country/currency and this might coincide with exchange rates being managed. If a currency is managed against, or even pegged to another currency, economists might be faced with difficulties while trying to fit a model.

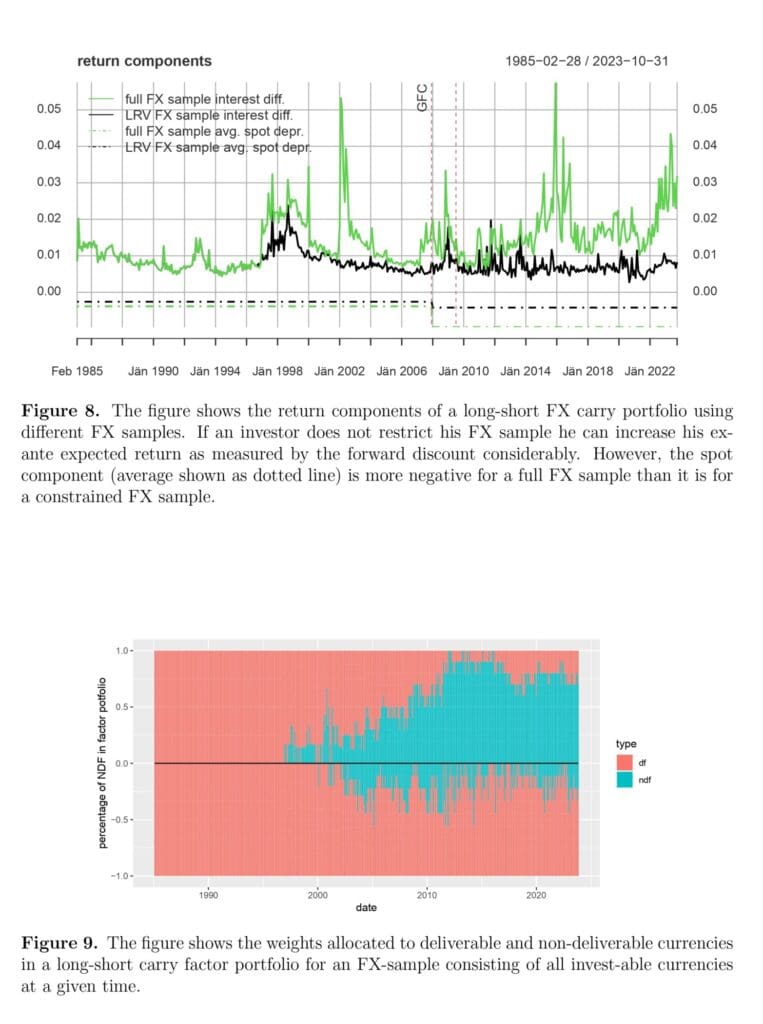

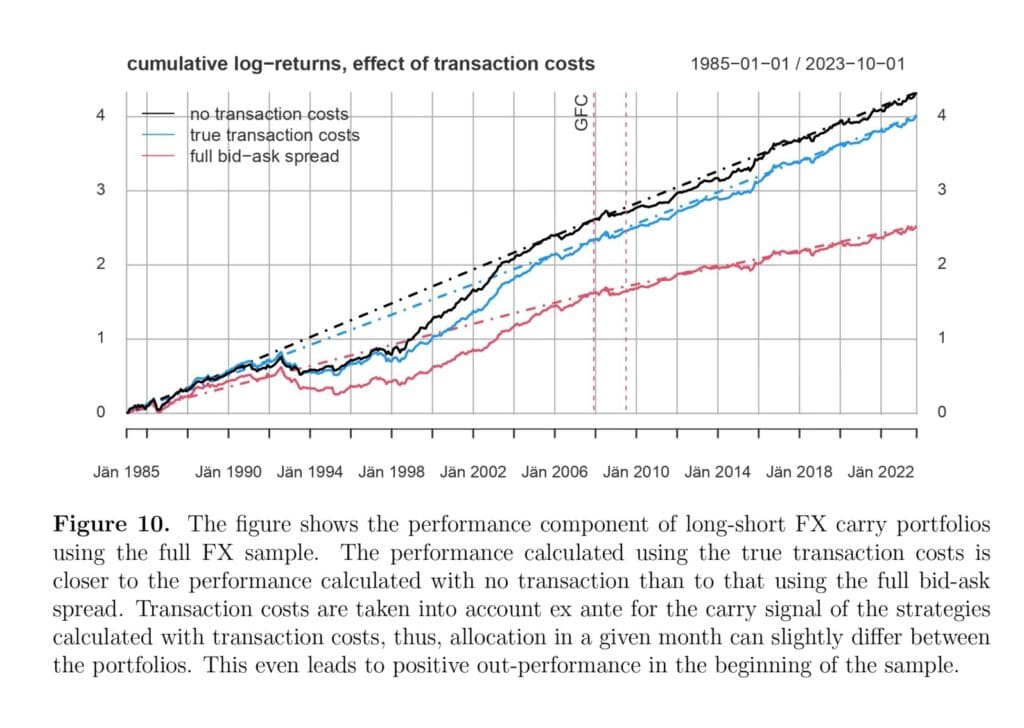

Figure 7 shows the cumulative portfolio returns of going long the sextile portfolio with the highest forward discount and shorting the portfolio with the lowest forward discount for different currency samples. If the sample of currencies is constantly expanded, no kink can be observed in the cumulative returns after the global financial crisis. The reason for this can be found when looking at the average forward discount of carry portfolios constructed from different currency samples in Figure 8. The average forward discount(=carry) locked in ex ante is much higher when all currencies are considered. This ex ante return suffers more from spot depreciation on average than a carry portfolio of currencies used in Lustig et al. (2011) but in the end, the higher interest rate difference outweighs the higher losses due to currency depreciation. Thus, the carry portfolio constructed from the set of all investable currencies outperforms its more restricted counterparts. These higher interest rates are mainly coming from non-deliverable currencies (Figure 9) and potentially some of the higher interest is due to high covered interest rate parity deviations during times of distress in these currencies.

Momentum portfolios are constructed using spot returns over the past month as signals. Menkhoff et al. (2012) use excess returns as a signal and show that carry and momentum are uncorrelated when doing so. However, since in the full currency sample used in this paper includes many pegged currencies whose excess return in many months equals the forward discount, using the past excess returns as sorting variables would lead to increased correlation of the factor portfolios. Portfolio returns are adjusted for transaction costs as described in Section A.1.

his fact also holds after accounting for realistic transaction costs and for conditionally mean-variance efficient portfolios. A comparison to a proprietary data set of trades shows that frontier currency data from standard data sources is very close to actual hedge fund trades. I also show, that although the price of risk for FX-carry does not decline after the GFC, a simple linear three-factor model (usd, carry, and momentum) fails to explain currency portfolios created from the broadest possible currency sample post GFC indicating that for pricing portfolios that include exotic currencies new pricing models need to be researched.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend