Is Gold a Safe Haven? It Depends on the Country

If you’re a regular reader of our blogs (and we hope you are!), you would not miss that we like to touch macro-economic subjects. One of that never-fading topics is the role of gold as a crisis hedge. The probably most known commodity is a popular choice for a portion of the total portfolio, from small investors to central banks, for various reasons (be it diversification or hedging). So let’s not further delay it, and today we ask: Is gold really a safe haven?

Often, when stock markets are in turmoil, investors seek so-called safe havens that at least hold the value of their wealth when macroeconomic conditions are worsening. The held consensus view is that gold acts as a hedge against geopolitical stress and falling USD. But is that really well-suited for everyone? What about investors that have other investments in various currencies? As we see later, the utility of gold really depends mainly on the investor’s main, primary, or base currency.

An older but widely accepted paper from Dirk G. Baur (2021) presents his research on 68 stock markets and gold in local currencies and US dollars. The good news is that for investors in more than 60 markets and countries investing in their local currencies, gold really can (in addition to the diversification effect) effectively act as a currency hedge. In addition, if you switch a portion of your portfolio from local currency to a gold-denominated asset, you will likely catch a mid-time-lasting bullish trend. The results for US dollar investors are not as statically significant. Furthermore, the safe-haven effect is less lasting (under ten days).

Another interesting point is that the heaven-safe effect of gold in local equity markets is enhanced by large outflows from them that are often directed into gold investment vehicles, causing larger drawdowns in stock markets and the weakening of local currencies. Would you like to find out how your local market particularly correlates with gold and its relationships? Look at sweet and easy-digestible tables in the paper’s appendix. Interested in different approaches on utilizing when best to invest in gold? Do not miss checking our related strategies in Screener.

Authors: Dirk G. Baur

Title: Is Gold a Safe Haven in all Currencies?

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3947113

Abstract:

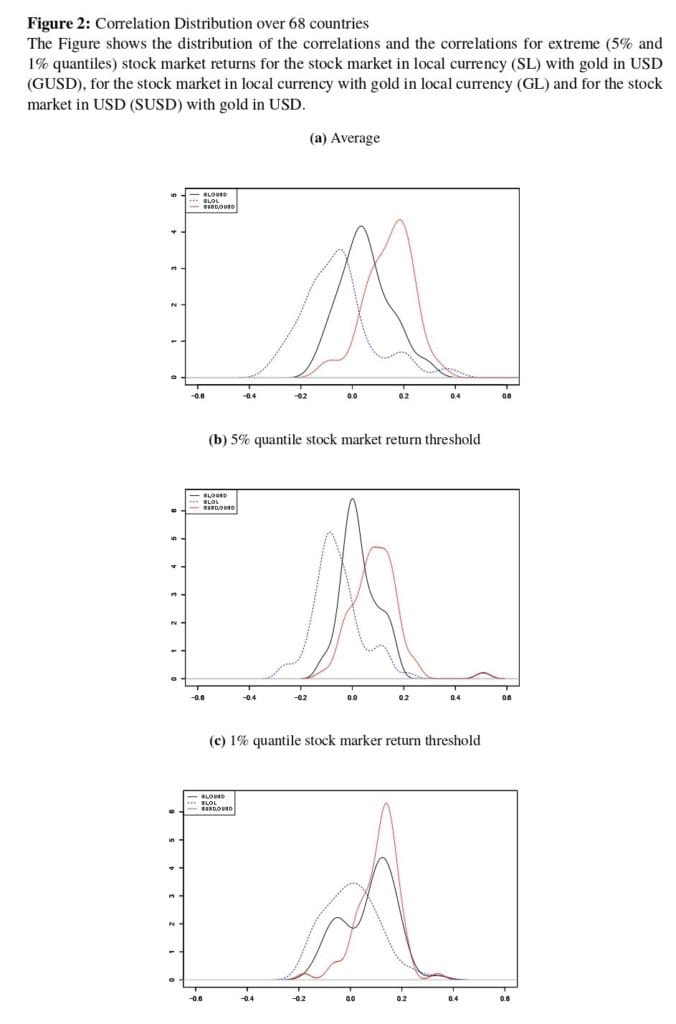

This paper shows that gold’s safe haven property crucially depends on gold’s exchange rate with the respective currency for local investors. A sample of 68 international equity market indices demonstrates that currencies significantly affect the strength of the safe haven effect, enhancing or diminishing the effect. Volatile and “risk-on” currencies boost gold’s safe haven property while “risk-off” currencies weaken the safe haven effect.

As always, we present several interesting figures:

Notable quotations from the academic research paper:

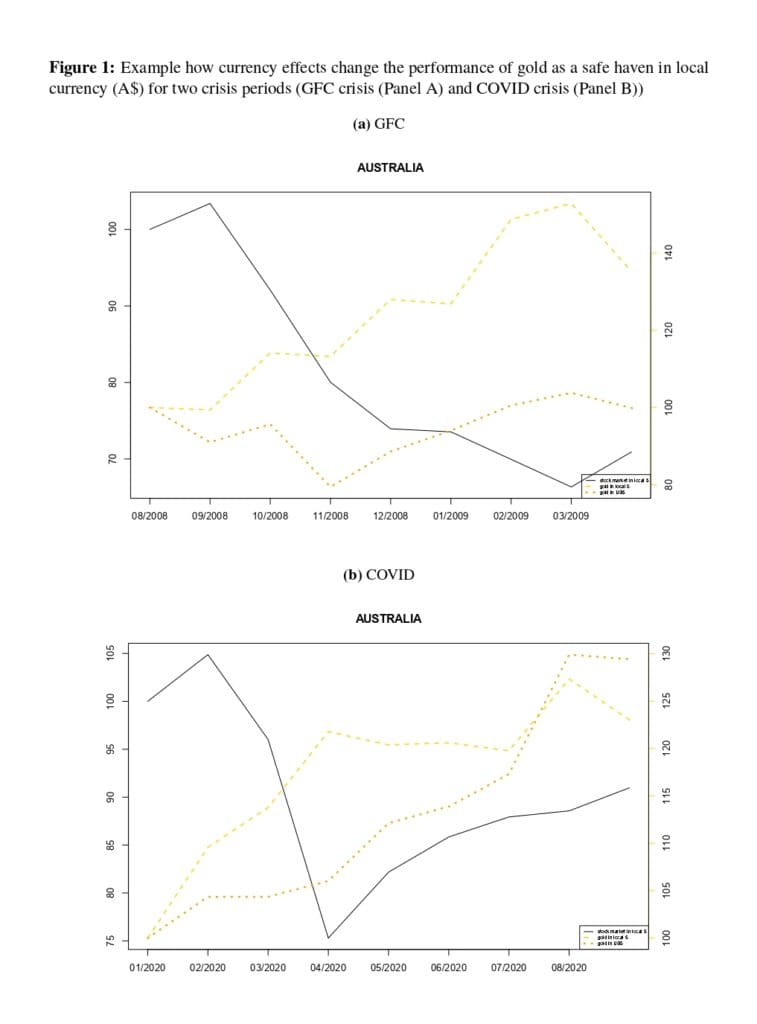

“A large literature tests whether gold is a safe haven against stock market declines in different markets and thus for different investors. Given the high correlation of stock markets, gold can only play different roles for investors with flexible exchange rates as the price of gold would be the same if all currencies were fixed. However, since most currencies are not fixed, exchange rate changes play an important role for the safe haven property.1 For example, if all stock markets fall together in a crisis and the price of gold increases in US dollars, gold is a safe haven for US investors but not necessarily for investors in other countries with different currencies. If a currency depreciates against the US dollar, the price of gold in that currency increases even more than the price of gold in US dollars. Similarly, if a currency appreciates against the US dollar, the price of gold in that currency increases by less than the price of gold in US dollars or even falls. Importantly, if both gold and the US dollar are safe havens and increase in crisis times, it is possible that the price of gold in US dollars does not increase or falls while increasing in all currencies that do not appreciate. This suggests that a more comprehensive analysis of gold’s safe haven property may be required. Figure 1 presents an example of how different gold price changes can be for gold denominated in different currencies during crisis times for Australia. The evolution of the stock market and gold prices denominated in US dollars and in Australian dollars for the Global Financial Crisis (GFC) and the COVID outbreak shows that the differences in gold prices can be significant. More precisely, the example shows that the price of gold in US dollar fell between August and October 2008 while the price of gold in Australian dollar increased over the same period. The fall in the price of gold is due to an appreciation of the US dollar (e.g. see Fratzscher (2009)) and implies that a comprehensive assessment of gold’s safe haven property and performance must entail more than one currency denomination.

[S]ome theoretical description of the stock market – gold – currency relationship[:] Gold’s safe haven property against stock market losses can be defined as a zero or positive price change of gold during periods of extreme stock market losses (e.g. see Baur and Lucey (2010)). Gold’s currency hedge property can be defined as a positive price change of gold in local currency for any depreciation of the local currency (e.g. see Capie et al. (2005)). The two properties differ with respect to the conditions for which they hold. The safe haven effect only holds in extreme adverse stock market conditions while the currency hedge property holds on average possibly but not necessarily including periods of extreme stock market conditions.

Since currencies and thus exchange rates can also change in extreme adverse stock market conditions the exchange rate changes can interfere with the safe haven effect.

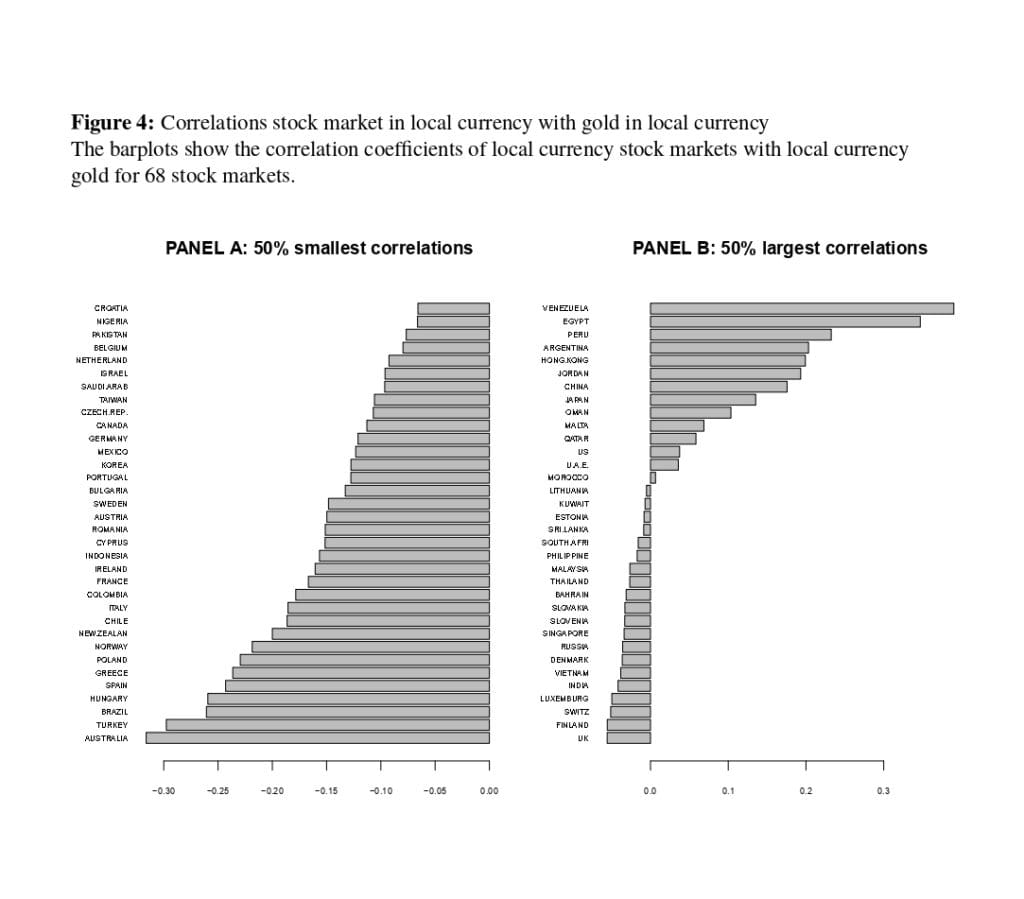

Figures 3 – 5 display the results for each of the 68 countries as barplots. Specifically, Figure 4 shows that Australia, Turkey and Brazil have the most negative stock market – gold correlations in local currency (all smaller than −0.25) and Venezuela, Egypt and Peru have the most positive correlations (all larger than 0.2). A negative correlation implies that gold increases in value when the stock market falls and that gold decreases in value when the stock market increases. A positive correlation implies that gold and the stock market co-move. Larger than average negative correlations are due to a depreciating currency that increases the price of gold in that currency by more than the price of gold denominated in a stable currency. Similarly, larger than average positive correlations are due to an appreciating currency that decrease the price of gold and leads to a co-movement of the stock market with the price of gold in local currency.

The high positive correlation for Venezuela is related to the high inflation rates of Venezuela that increase both the stock market and the value of gold in nominal terms. The higher gold price in local currency is a result of a depreciating Venezuelan currency implied by purchasing power parity.

[S]tock market losses appear smaller for countries whose currency is stable or appreciates and losses appear larger for countries whose currency depreciates. Investors fleeing certain markets causing stock markets and currencies to fall may explain these differences. The results indicate that flexible or floating exchange rates boost gold prices and the safe haven effect potentially exerting a stabilizing effect on investors and markets. Naturally, countries whose currencies are pegged to the US dollar do not show a negative relation and lie on a horizontal line with the US.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Would you like free access to our services? Then, open an account with Lightspeed and enjoy one year of Quantpedia Premium at no cost.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend