Stock Returns vs Inflation Expectations

What happens to the stock prices when inflation expectations decrease or increase? The authors Manav Chaudhary and Benjamin Marrow, in their paper Inflation Expectations and Stock Returns, explore this topic and find that when inflation expectation is high, stock prices also rise in their value. The evidence they present suggests that stocks have been a hedge against expected inflation for the last couple of decades and that this effect is present across stocks from all industries.

The finding is useful, as, without a proper study, it is not clear at all that what the relationship between inflation expectations and stock prices should be. One naive theory could be that inflation expectations enter the discount rate, and the price drops. Or on the converse side, the stock price rises as it is directly related to the income generated by real assets (which has to be higher during the inflation period). However, risk premia and real rates can change with the expected inflation, and therefore it is not straightforward what this relationship is.

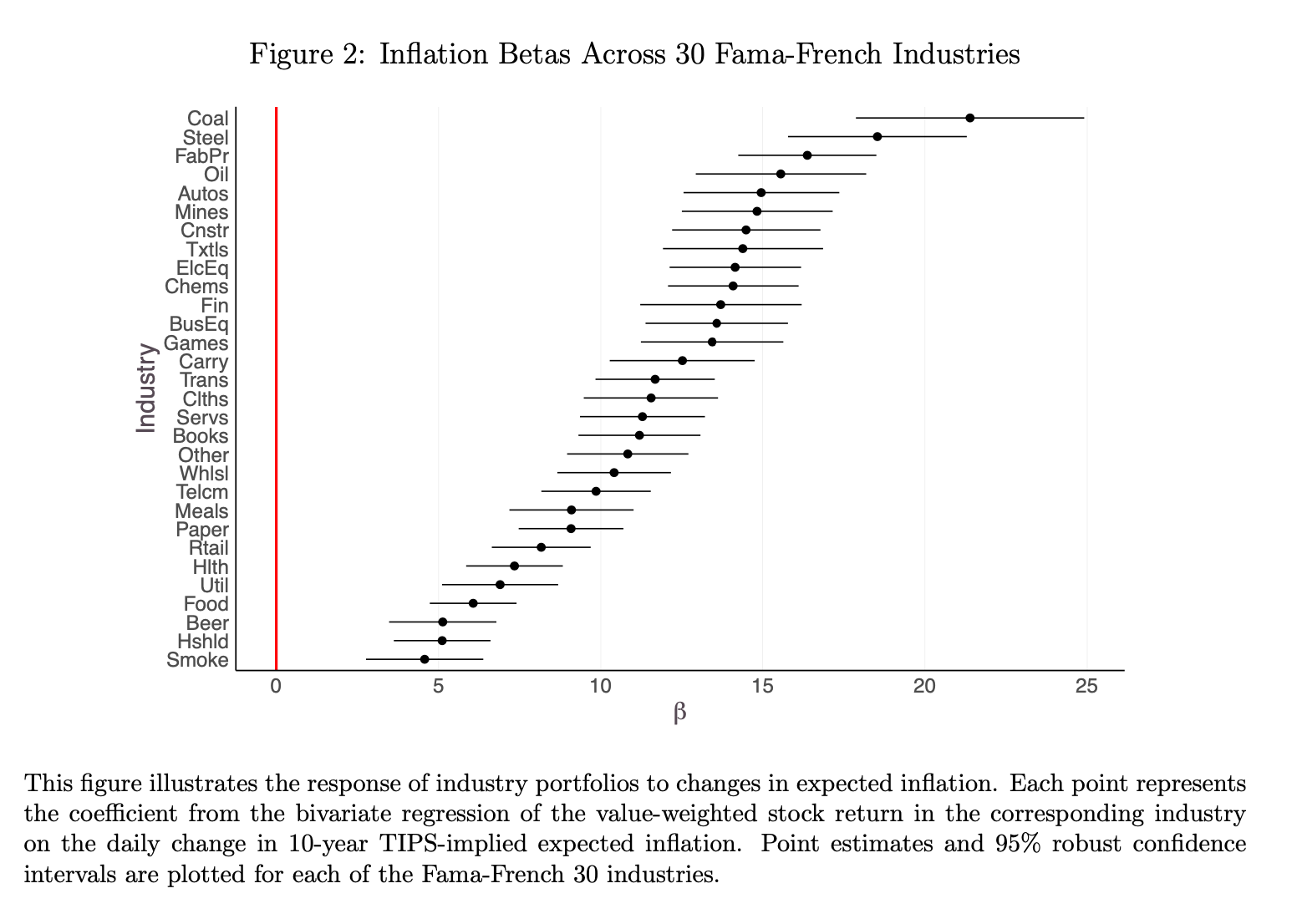

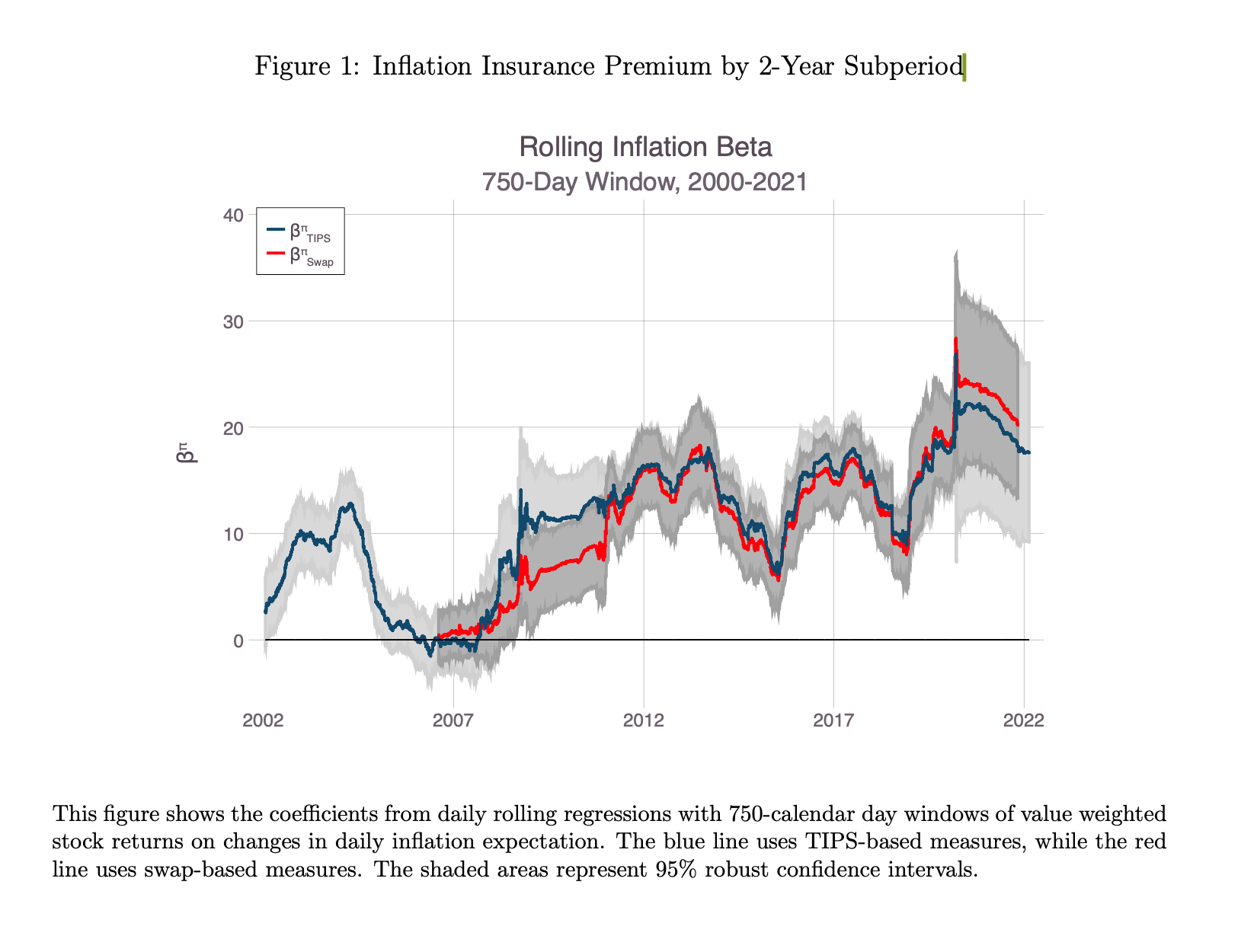

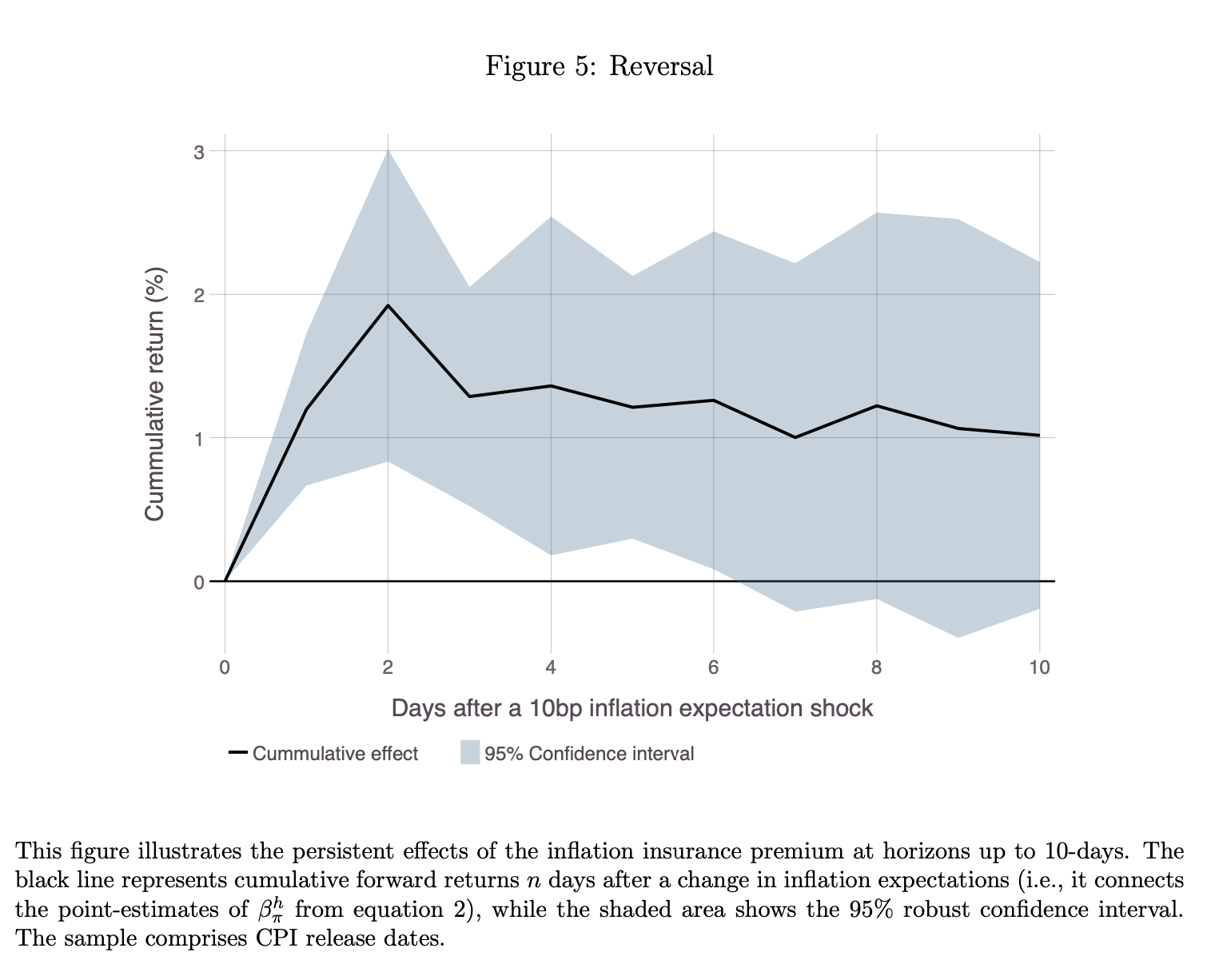

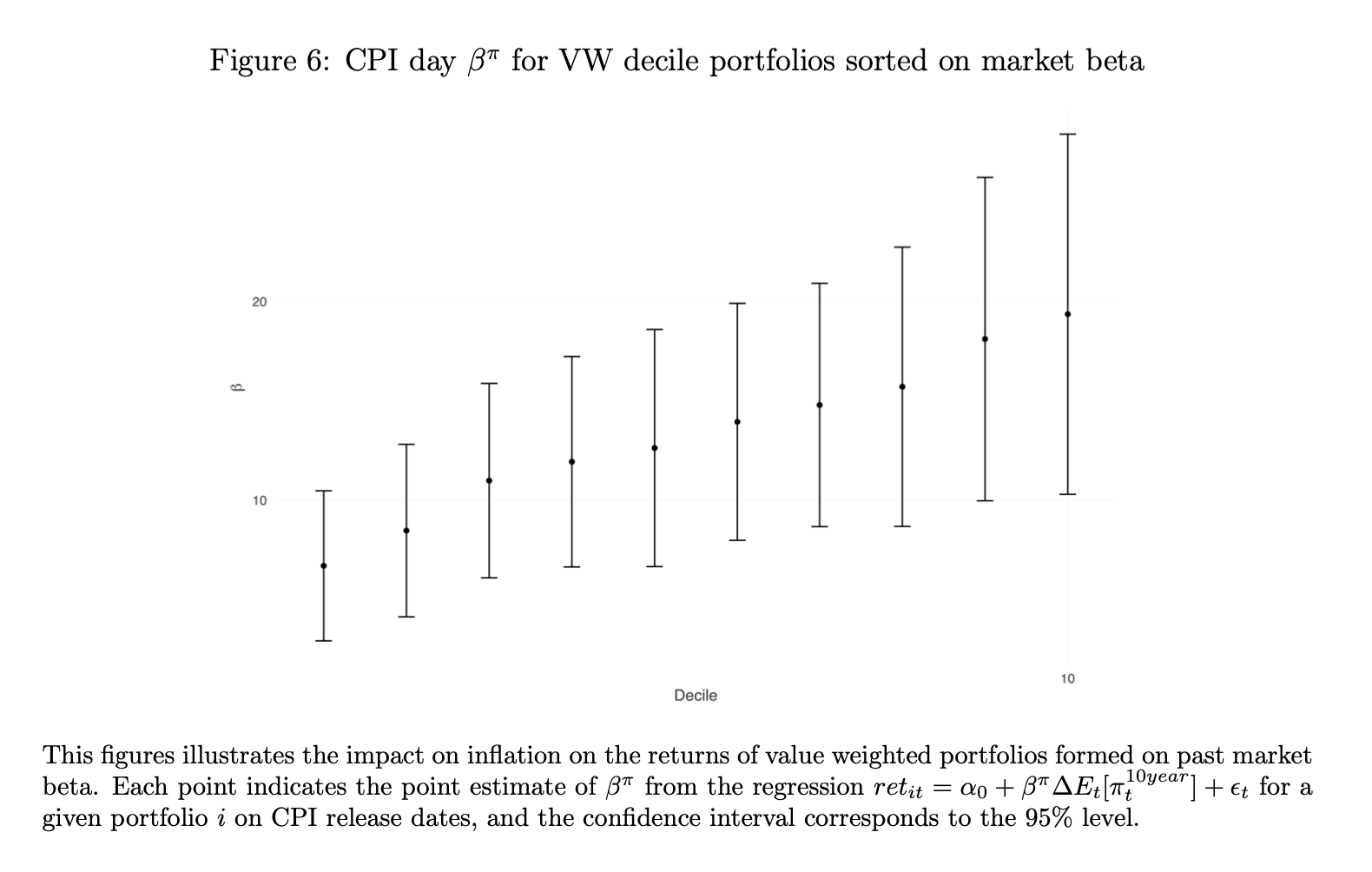

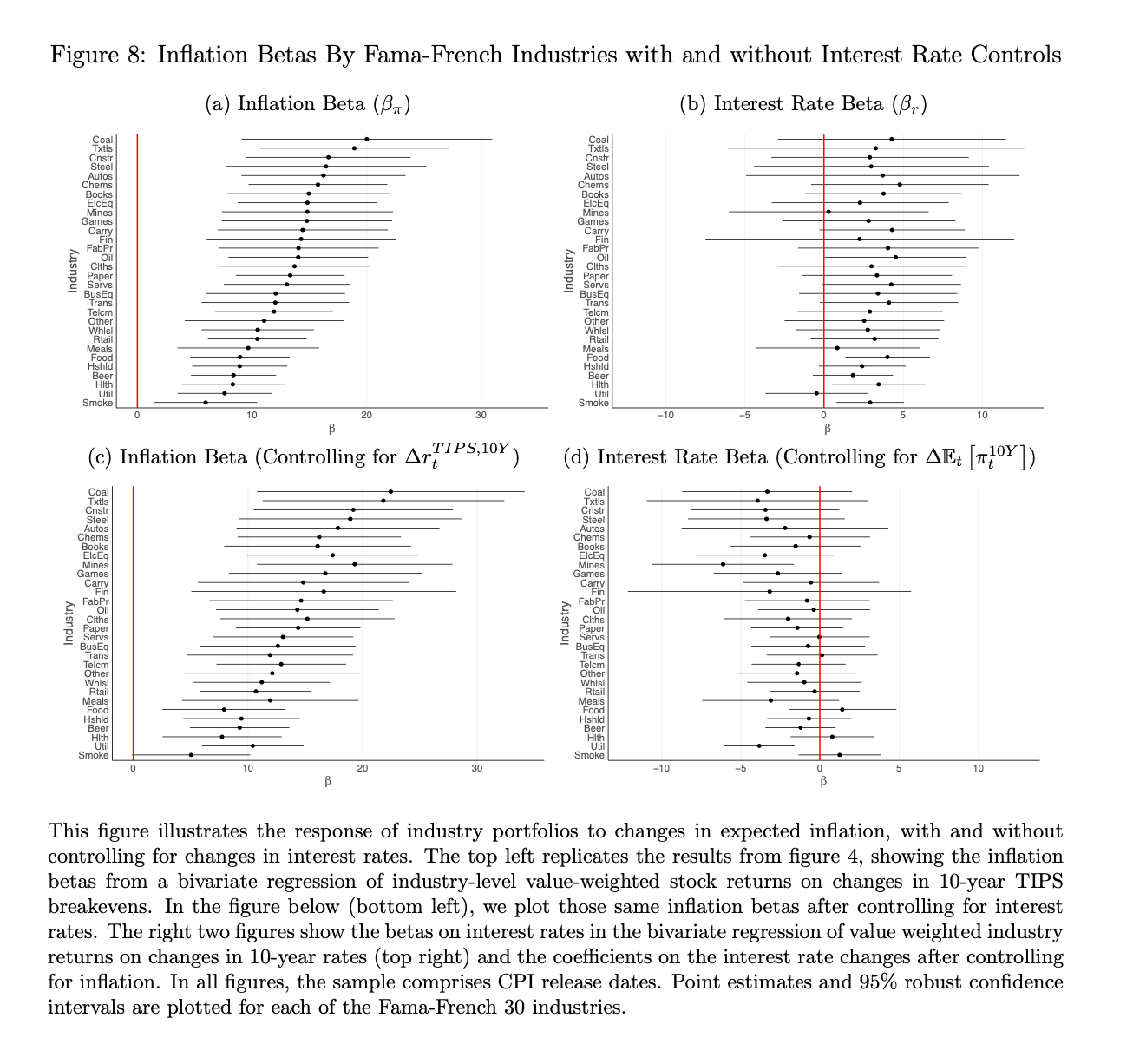

By regressing daily stock returns on changes in the 10-year break inflation rate (which the authors measure by using treasury-implied protected securities – TIPS), authors find a positive association between the stock market value and the 10-year breakeven inflation rate. TIPS earn their investors a real yield on treasuries, which by comparing with yields on nominal US treasuries of the same maturity, allows them to pin down risk-neutral expectations of inflation over a said time period. The relationship between expected inflation and stock returns is shown to be causal, and the positive effect of expectations on returns is driven mainly by the risk premium channel rather than through discount rate, real rate expectation, or dividend rate expectation channels. The study is conducted on a sample of the US market with a backtesting period of 23 years.

Authors: Manav Chaudhary and Benjamin Marrow

Title: Inflation Expectations and Stock Returns

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4154564

Abstract:

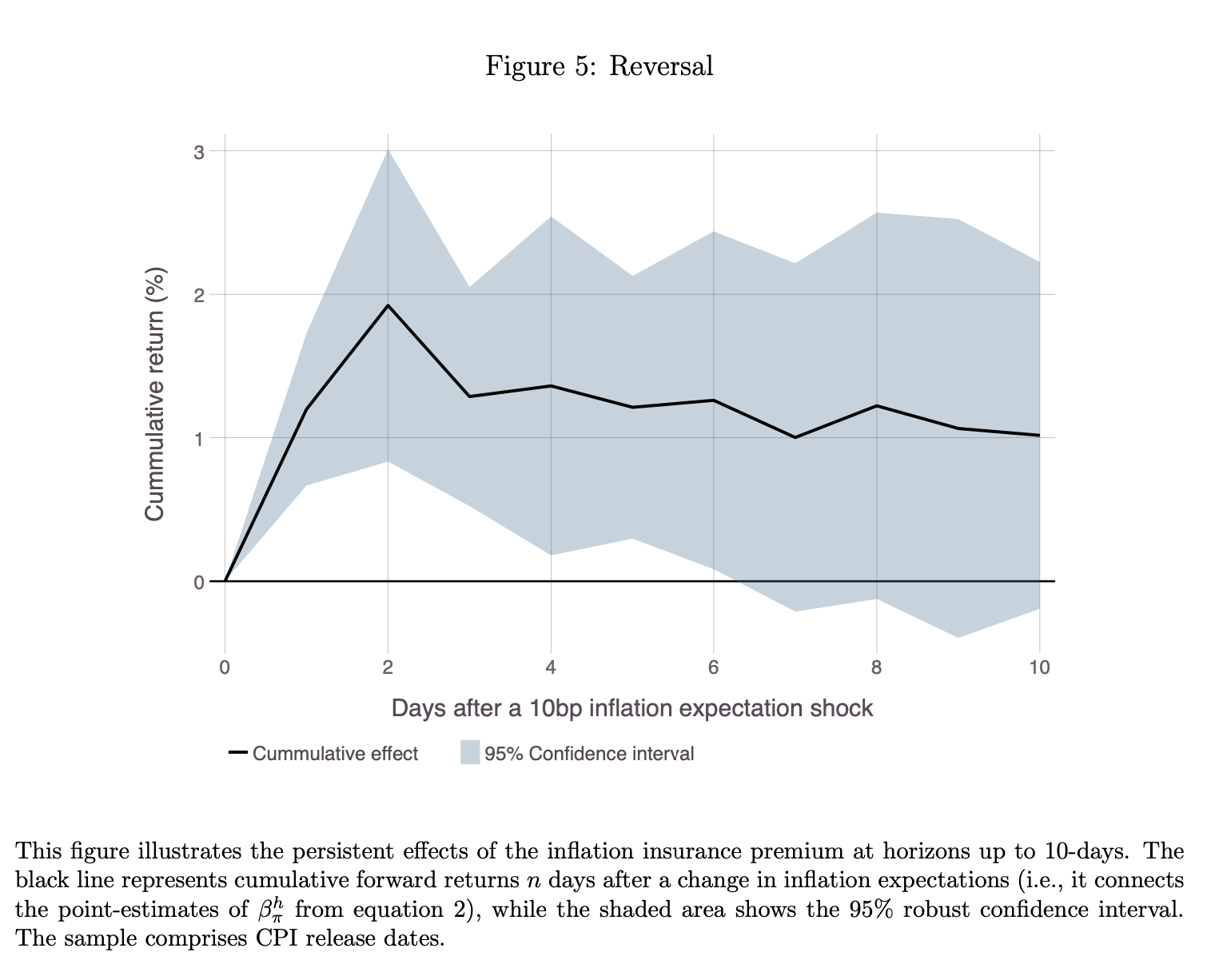

Do stocks protect against rising inflation expectations? We directly measure investors’ expectations using inflation-indexed contracts and show that stocks offer positive returns in response to higher expectations; i.e., that stocks hedge against changes in expectations. Using high-frequency identification around CPI releases, we provide evidence that the positive relationship is causal, and driven primarily by changes in risk premia rather than through an interest rate or cash flow channel.

As always we present several interesting figures:

Notable quotes from the academic research paper:

“We begin by looking at the unconditional relationship between daily stock returns and changes in expected inflation. Theoretically, the sign of this relationship is ambiguous. For example, we have that a stock’s price is the present discounted value of its dividend stream, where the nominal discount rate depends on the real rate r , the risk premium ret i,t and future inflation πt. Since future inflation directly enters the denominator, it is tempting to conclude that we would expect a negative correlation between returns and changes in inflation expectations. However, all the other variables in the identity may also respond to expected inflation changes. For example, since stocks are a claim on income generated by real assets, it is likely that dividends will increase one-for-one with inflation in the long run, canceling the discount’s direct effect and leading to no correlation of returns with changes in expected inflation. Similarly, the central bank may respond to the higher probability of future inflation by raising real short-term rates, which would generate negative returns in response to changes in inflation expectations.

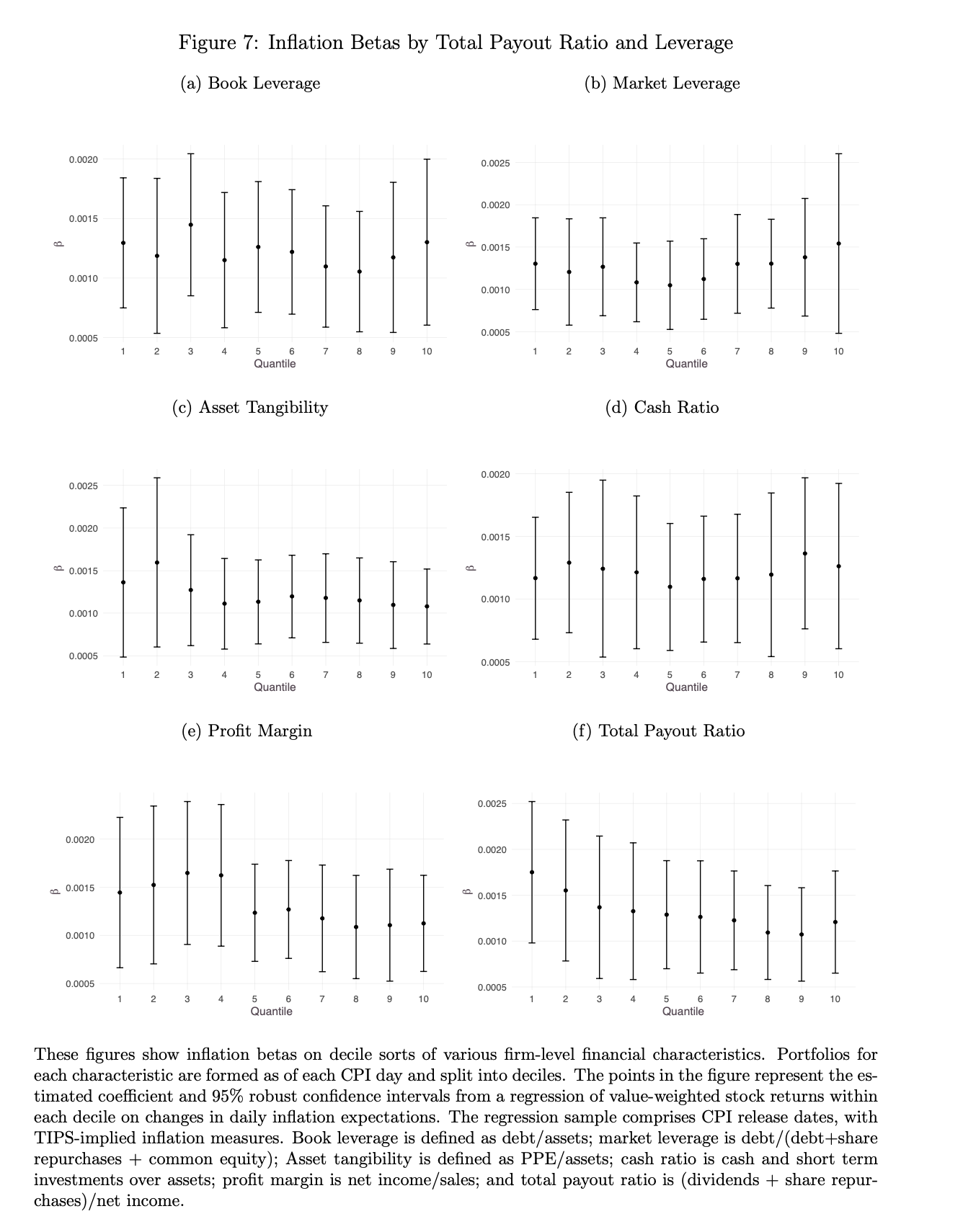

Firstly, the stability and significance of the estimates are particularly striking given the relatively short rolling window used for the analysis. Apart from the financial crisis, the relationship has been positive and robust. Secondly, the rolling regression using swap implied inflation expectations measures gives an essentially identical conclusion to the TIPS.

With that said, our estimates are specific to the economic regime that has prevailed since the 2000s. David and Veronesi (2013) have argued that higher inflation signals good news for economic growth in this regime. When there is an upside surprise to inflation, it signals that the economy is less likely to enter a deflationary trap. Hence, as a result, stock prices tend to rise. While it is too early to tell if we are amidst an inflation regime switch, according to David and Veronesi (2013), we will see the correlation between returns and expectations become negative if we enter a stagflationary regime. So far, for the first seven months of 2022, the correlation between stock returns and changes in inflation expectations remain significantly positive.

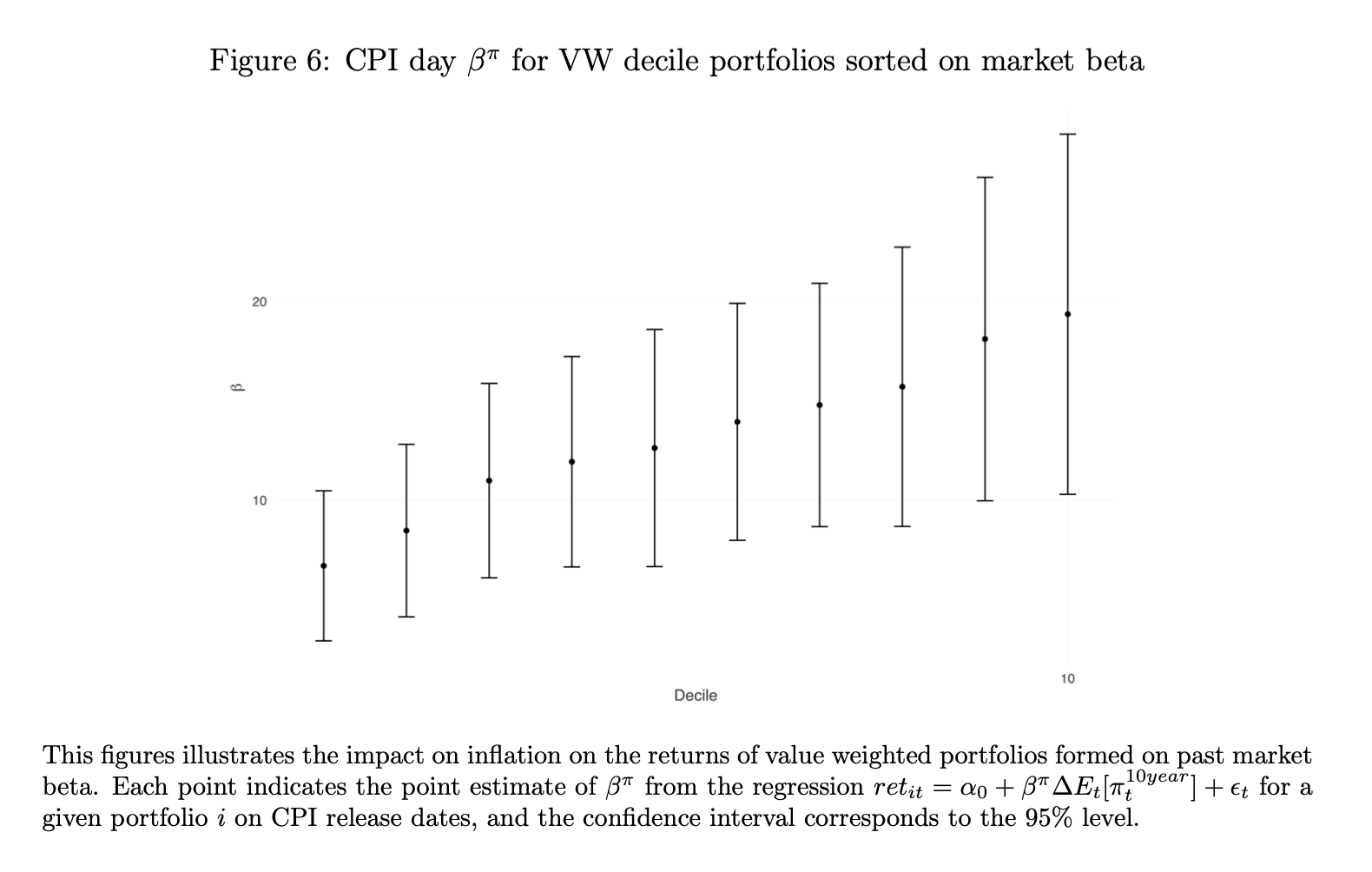

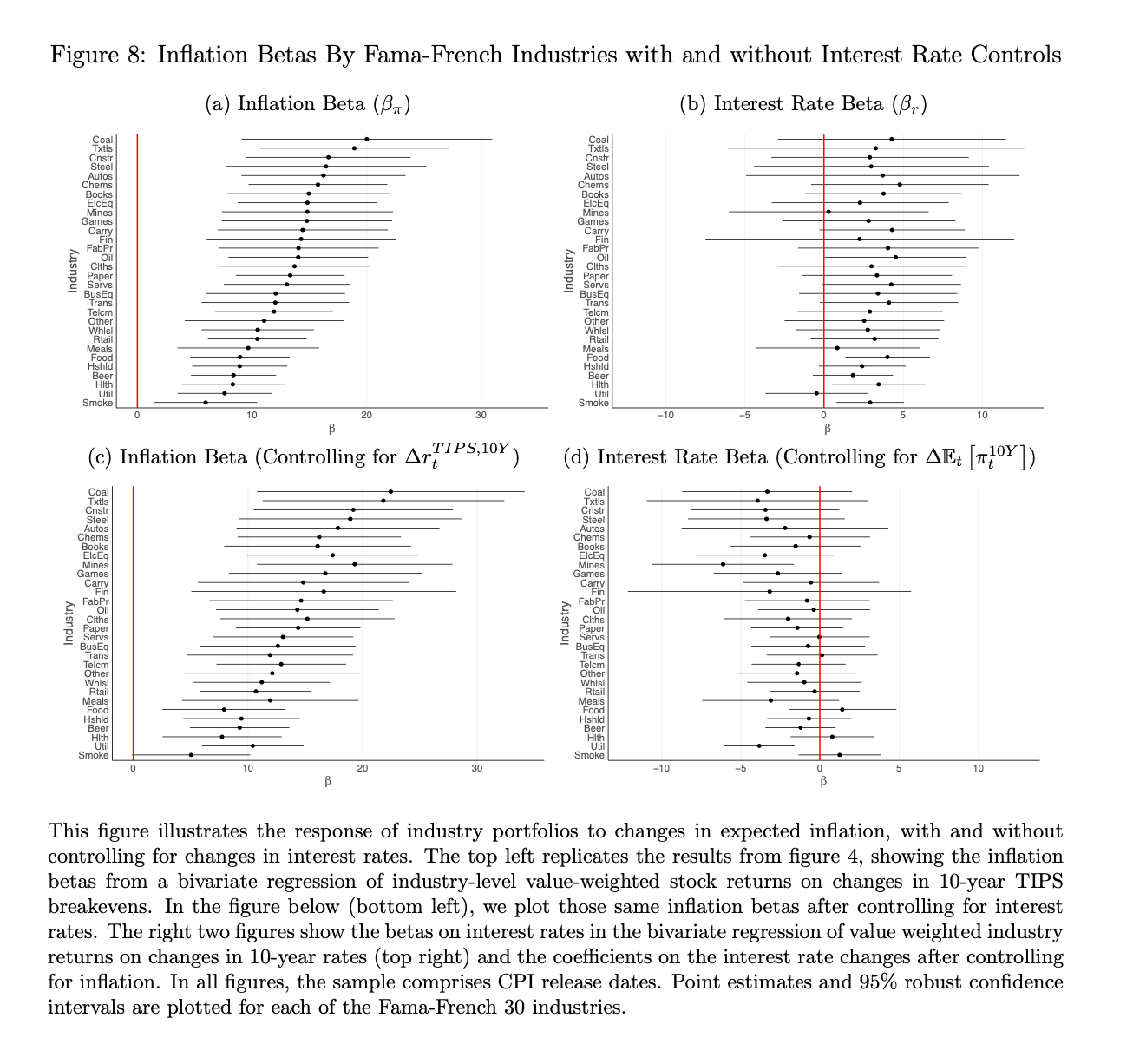

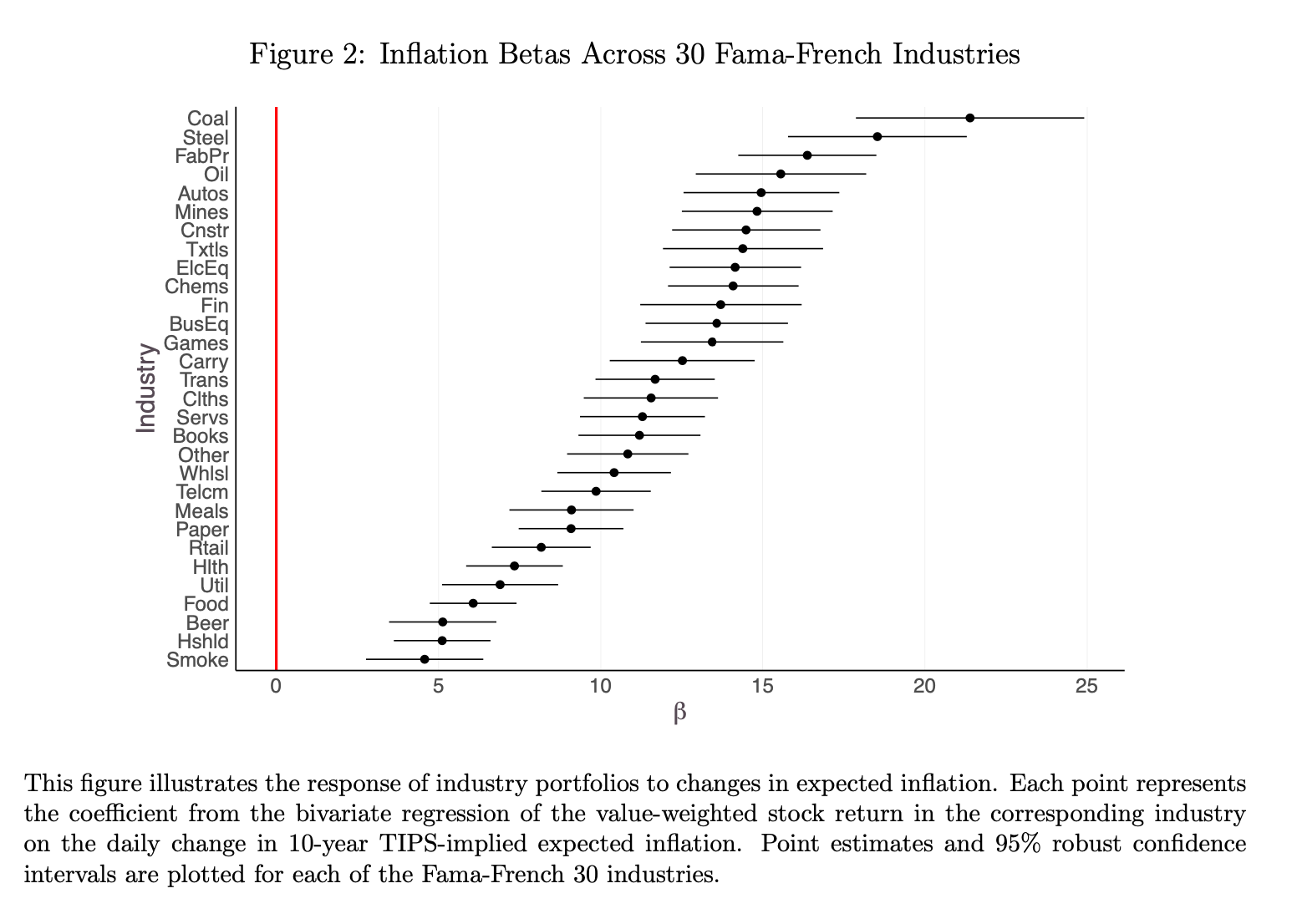

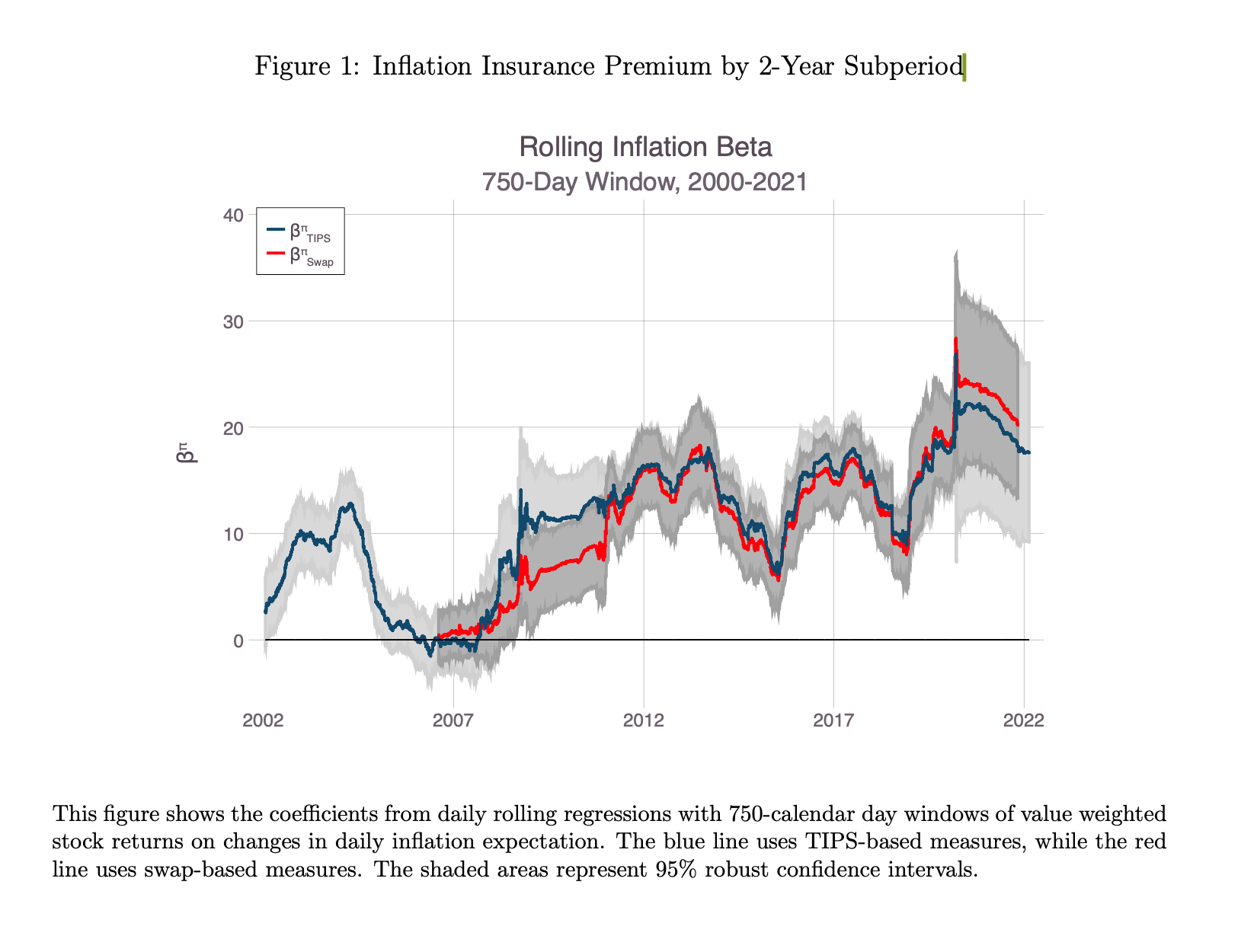

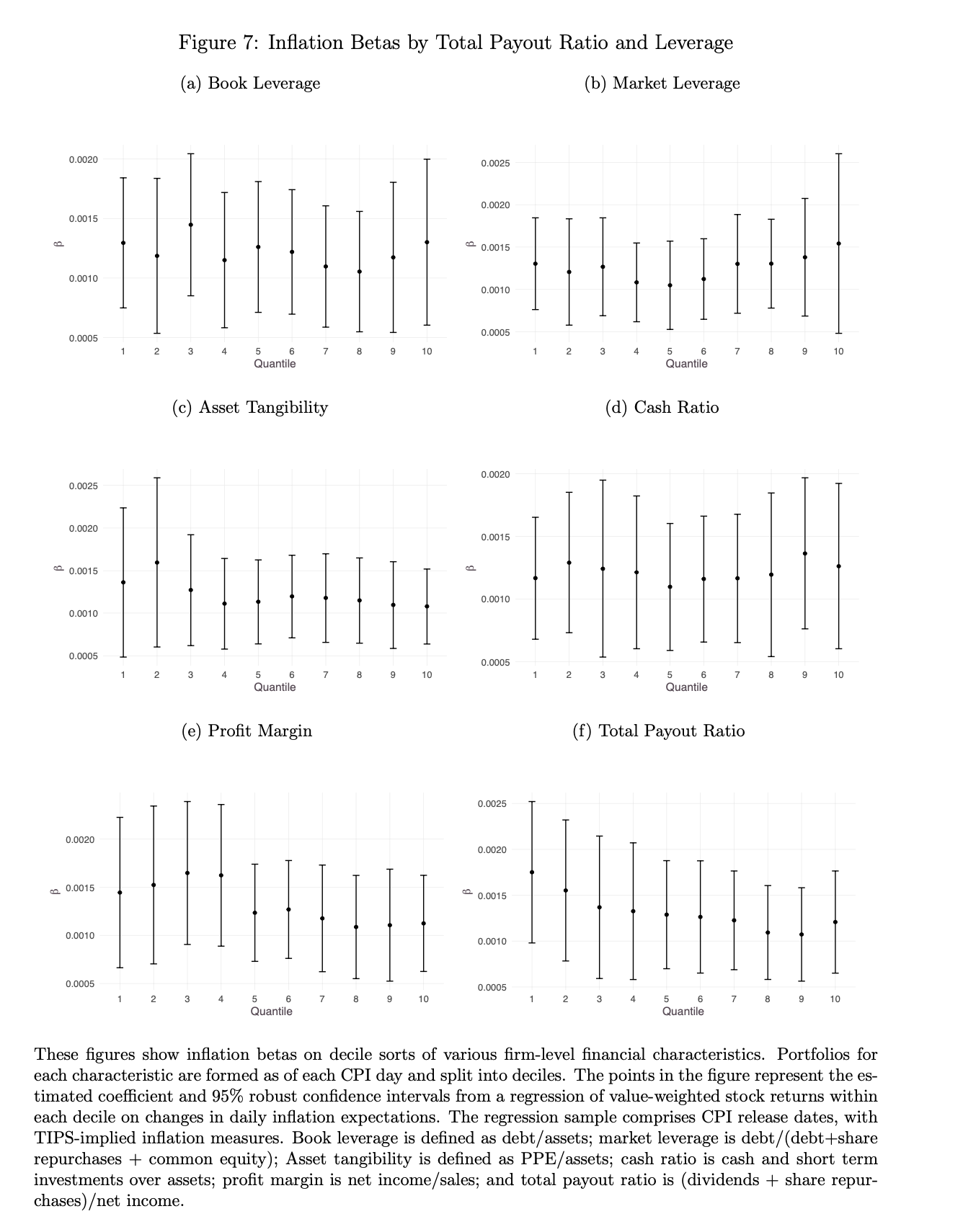

Our baseline results indicate that higher inflation expectations cause equity prices to rise. Furthermore, this effect is highly robust—the effect is significantly positive regardless of the measure of inflation expectations, the date sample analyzed, the horizon of expectations, and the sector of focus.

According to the present discounting equation, the effect of the change in inflation expectations can impact prices (i) directly through the discount rate, or indirectly through its effect on (ii) real rate expectations, (iii) dividend expectations, and (iv) risk premium. Given that the causal effect of higher expected inflation on stock prices is positive, it must mean that the dividend expectations are increasing relative to the discount rate. This price increase must either be due to the discount rate declining or dividend expectations rising relatively more. Since inflation expectations directly enter the discount rate, the direct effect of higher inflation is to reduce prices. Hence, it is unlikely that the direct effect of inflation expectations is the dominant channel at play. As a result, the three indirect channels are the plausible candidates for the prominent drivers of the causal effect: (i) real rate expectations, (ii) dividend expectations, and (iii) risk premium.

Using our decomposition, the interest rate channel accounts for 0.313 of the 11.98 coefficient, the cash flow channel accounts for 1.872 of the 11.98, and the remainder we attribute to the risk premium (and direct inflation expectations) channel. These correspond to shares of 2.6%, 15.6%, and 81.8% for the interest rate, cash flow, and risk premium effect, respectively.“

Are you looking for more strategies to read about? Visit our Blog or Screener.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Do you want to know more about us? Check how Quantpedia works and our mission.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend