Does the investment in sophisticated machine learning algorithm research and development pay off? It is an important question, especially in light of the increasing costs related to the R&D of such algorithms and the possibility of decreasing returns for some methods developed in the more distant past. A recent paper by Azevedo, Hoegner, and Velikov (2023) evaluates the expected returns of machine learning-based trading strategies by considering transaction costs, post-publication decay, and the current high liquidity environment. The obstacles are not low, but research suggests that despite high turnover rates, some machine learning strategies continue to yield positive net returns.

Recent financial research has highlighted the impressive ability of machine learning (ML) techniques to predict stock returns. Studies often report exceptionally high annualized Sharpe ratios for ML-driven trading strategies, sometimes achieving over five times the historical market average.

Despite these promising results, their real-world applicability remains debated. Critics point out that while ML models can exploit hard-to-arbitrage stocks, their performance may decline due to high turnover and other economic constraints. Moreover, real-time implementations of these strategies often show weaker performance, especially when accounting for transaction costs.

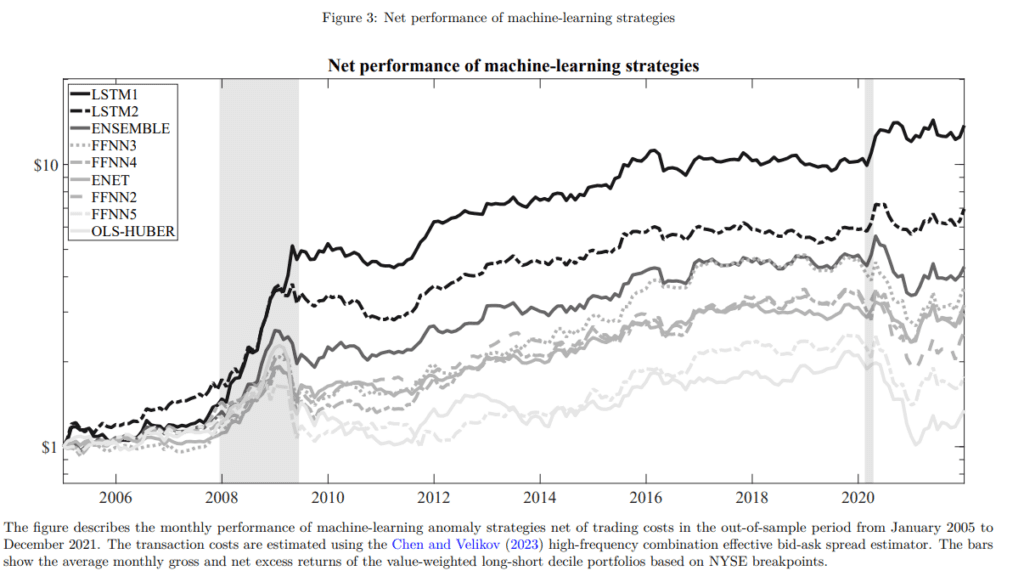

The study aims to bridge this gap by assessing the expected returns of ML strategies, considering the impacts of transaction costs, post-publication performance decay, and modern market liquidity. By employing various ML techniques on a dataset of 320 anomalies, the researchers found that although some strategies underperform after costs, many still deliver significant returns, particularly those using advanced models like Long Short-Term Memory (LSTM) networks.

These findings have important implications for both academic research and the design of practical investment strategies. As we advance further into the era of machine learning and AI, such studies will be essential for navigating the complexities of financial returns and gaining a deeper understanding of market dynamics.

Authors: Vitor Azevedo ; Christopher Hoegner and Mihail Velikov

Title: The Expected Returns on Machine-Learning Strategies

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4702406

Abstract:

This study assesses the expected returns of machine learning-based anomaly trading strategies, accounting for transaction costs, post-publication decay, and the post-decimalization era of high liquidity. Contrary to claims in prior literature, more sophisticated machine learning strategies are profitable, earning net out-of-sample monthly returns of up to 1.42%, despite having turnover rates exceeding 50% and selecting some difficult-to-arbitrage stocks. A trading strategy that employs a long short-term memory model to combine anomaly characteristics yields a six-factor generalized (net) alpha of 1.20% (t-stat of 3.46). While prevalent cost-mitigation techniques reduce turnover and costs, they do not improve net anomaly performance. Overall, we document return predictability from deep-learning models that cannot be explained by common risk factors or limits to arbitrage.

As always, we present several interesting figures and tables:

Notable quotations from the academic research paper:

“Thus far, we estimate the long-short returns of machine learning models without accounting

for transaction costs. Avramov et al. (2022) argue that when transaction costs are introduced,

most models do not show statistically significant returns because their performance largely

depends on small, illiquid, and expensive stocks. We test this explicitly and observe a reduction

in average monthly returns and overall financial performance after accounting for the Chen and

Velikov (2023) effective bid-ask spread estimate. Figure 2 shows the percentage drop in average

returns for the nine machine-learning strategies from introducing trading costs. We can observe

that the reduction in performance ranges from 13% to 40%.”

“Table 3 and Figure 4 show the impact of the previously outlined mitigation approaches

on our four classes of model architectures, namely linear models, FFNNs, LSTMs, and the

ensemble model. We show the impact of absolute differences in the net excess return portfolio

metrics and generalized FF6 alpha and relative changes in turnover and transaction costs. As

the results show, most of the cost-mitigation techniques significantly reduce turnover and, as a

result, transaction costs.“

“This decrease in transaction costs, however, is only beneficial if it is not accompanied by a

larger reduction in gross returns. As we can observe in Table 3, the average change net excess

returns across the nine machine learning models is negative for all but one mitigation technique.

This implies that the drop in the gross average returns due to the mitigation techniques more

than compensates for the reduced trading costs. This is likely because our testing sample period,

which consists of the last two decades, is marked by higher liquidity and significantly lower

trading costs post-decimalization (Chordia et al., 2014; Chen and Velikov, 2023). The only

technique that seems to marginally improve the net average returns across the nine machine

learning strategies is the two-month holding period. Not surprisingly, the stock universe filters

have a smaller impact on turnover but a similar impact on transaction costs, as they aim to

reduce the weight of high-cost stocks. However, the change in net excess returns for these

methods is similarly negative.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend