The correlation between bonds and stocks is essential information for asset allocation decisions; therefore understanding its macro-economic drivers is very valuable for all investors. Stocks-bonds correlation isn’t stable, as we have experienced in the last 30 years, as the correlation, which was positive until the end of the 1990s, changed sign at the turn of the century. Research paper written by Marcello Pericoli sheds more light on this issue and shows that the correlation is primarily influenced by the uncertainty about inflation and real interest rates as well as by co-movement between inflation, real interest rates and dividend growth.

Author: Pericoli

Title: Macroeconomics Determinants of the Correlation Between Stocks and Bonds

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3429148

Abstract:

We analyze the correlation between the stock and bond markets in Germany and the US. We use a standard no-arbitrage affine model to decompose the correlation between these two assets into its main drivers. The correlation between bond yields and stock returns is a key determinant of asset allocation. Our results show that the correlation is primarily influenced by the uncertainty about inflation and real interest rates as well as by co-movement between inflation, real interest rates and dividend growth. Shocks to inflation, real interest rates and dividend growth can explain the correlation’s temporary deviation from its long-term dynamics.

Notable quotations from the academic research paper:

“In this paper we analyze the correlation between stock and bond markets in Germany and the US from 1990 to 2017. We borrow from the modern macro-fi nance literature a standard no-arbitrage affine model to decompose the correlation between these two assets into its main drivers. The model suggests that the correlation between bond and stock returns can be decomposed into the uncertainty about inflation and real interest rates, the covariance between inflation, real interest rates and dividend yields - a proxy of consumption growth. We test empirically this decomposition by regressing a time-varying measure of the stock/bond correlation on variables, which approximates the measures of uncertainty mentioned above.

In general, for a given level of inflation, a negative shock to the real interest rate will push bond and stock prices higher, but the former will also be influenced by dividend shocks, which may increase or offset the initial shock. Conversely, inflation impacts bonds negatively, since their payoff is in nominal terms, and stocks positively or neutrally, since dividends and stock payoffs may change with respect to variations in inflation.

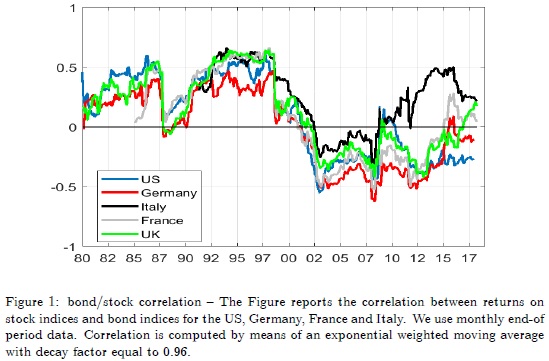

Four stylized facts can be presented to describe the dynamics of the stock/bond correlation. First, the correlation changes sign from the end of the 1990s; since then investors have come to regard government bonds as hedges, assets that perform well when other assets lose value, and more generally when bad macroeconomic news arrives. Figure 1 presents the time-varying correlations for the US, the UK, Germany, France and Italy since data availability.

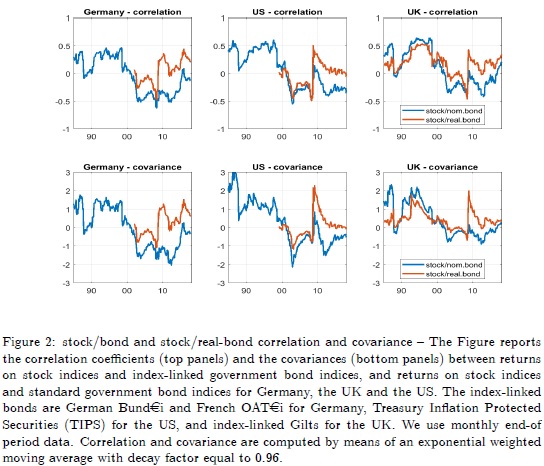

Second, inflation has played a role in driving the correlation. We show this by evaluating the relative contribution of inflation to the correlation, computing the correlation and the covariance between returns on stocks and index-linked government bonds. In the UK and the US the standard and real correlation coefficients and the covariances moved together, even with a spread between the two, until the global financial crisis in 2008-09 and moved in opposite directions thereafter. The two correlation coefficients (covariances) co-move even with a spread until the period 2008-17, when fears of low inflation or even deflation cause a decoupling.

Third, the change in the sign of the stock/bond correlation has been a global phenomenon. In fact, Figure 1 shows that the correlation coefficients in the main advanced economies have been moving very closely, the only exception being Italy. In general, this result is in line with the large correlation between global government bond and equity markets.

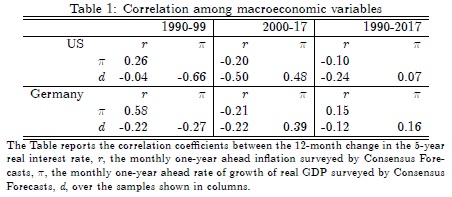

Fourth, economic variables and their interlinkages play a pivotal role in driving the correlation between stocks and government bonds. We can see that the change in the sign of the correlation coincides with a change in the sign of the correlation between real interest rates, ination and growth. Table 1 reports the average correlation coefficients between the three main drivers of the stock/bond correlation in the periods 1990-99 and 2000-17. The correlation between dividends (approximated by the rate of growth of GDP) and real interest rates is negative in the two periods in Germany and the US. Conversely, the correlation coefficients dividend/inflation and real-interest-rate/inflation change considerably. The dividend/inflation relation moves from negative (countercyclical ) to positive (procyclical ) values in Germany and the US, confi rming the changing dynamics of inflation over the two periods. Analogously, the real-interest-rate/inflation relation becomes negative in the second period, from positive figures; since 2000 an increase in inflation causes a decrease in the real interest rate as the nominal interest rate does not increase like inflation.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend