As interest in cryptocurrencies continues to surge, driven by each new price rally, crypto assets have solidified their position as one of the main asset classes in global markets. Unlike traditional assets, which primarily trade during standard working hours, cryptocurrencies trade 24/7, presenting a unique landscape of liquidity and volatility. This continuous trading environment has prompted us to investigate how Bitcoin, the flagship cryptocurrency, behaves across intraday and overnight periods. With Bitcoin’s growing availability to both retail and institutional investors through ETFs and other investment vehicles, we hypothesized that trading activity in these distinct timeframes could reveal patterns similar to those seen in traditional markets, where returns are often impacted by liquidity shifts during off-peak hours.

We have been covering the concepts and topics relating to crypto extensively. For more similar articles, check our cryptocurrency trading research subpage or look for the articles with the “cryptocurrencies” tag on our blog. Alternatively, you can visit our extensive library of cryptocurrency trading strategies.

Introduction

This study’s primary purpose is

- to analyze the daily versus the overnight (nightly) trading sessions in the crypto(currencies) space

- investigate whether the overall overnight effect exists in the primary uncrowned flagship assetl Bitcoin (BTC), and if so, to what extent

- analyze, whether the “day of the week” or “weekend” effect exists in cryptocurrencies (Bitcoin)

- use all of the above to build a seasonal strategy that will exploit the seasonal effect in the BTC market

Background

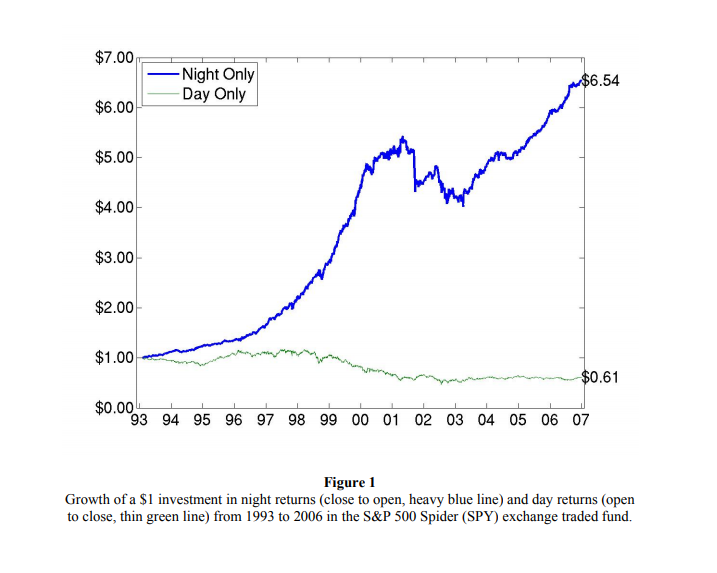

Referencing the graph from our prior research on the Lunch Effect in the S&P 500 and other major U.S. stock indices, we observed that most SPY and stock index performance accrues largely during the nightly sessions:

And for putting things into perspective, here is a shorter sample from the research paper published in 2008 (as we can see, not a lot has changed over the last 16 years):

Overnight Anomaly as presented by Cliff, Cooper, Gulen: Return Differences between Trading and Non-Trading Hours: Like Night and Day.

Our objective and goal, therefore, is to understand the impact of daily and nightly sessions on Bitcoin performance, particularly in light of the introduction of Bitcoin ETFs. This indicates there might be a shift from 24/7 trading to a more structured trading environment akin to those on traditional exchanges (such as the NYSE, NASDAQ, AMEX, ARCA, and so on).

Motivation

We suspect that since inflows and outflows from ETFs trading on these TradFi domains are highly tied to exchanges’ open hours, it will become more prevalent that Bitcoin trading changes are more and more tied to those of traditional assets such as equities and bonds.

Institutional traders usually unload or initiate (take) positions primarily at the open(ing) and close of the main session, where they have enough liquidity to satisfy their orders (not accounting for block trades in dark pools or TWAP orders during the day); hence, the first and last trading moments in terms of time-span of minutes in daily trading sessions are erratic and volatile (which day-traders strive for; ordinary investors not much so). Add market makers’ interests in mind, which may be some over-standing inventory on their books they need to liquidate, as well as options dealers hedging their flows. You get the perfect time for conflicting interests that frequently support the price discovery and move the price toward the market’s consensus view, usually forming the trend in traded assets for the rest of the day.

These things were unknown primarily to Bitcoin, as it was traded in many decentralized venues (spot or futures), which allowed only instantaneous price arbitrage among them if liquidity constraints were in favorable conditions.

Bitcoin is traded nonstop and often can be the first, riskiest asset readily liquidated in anticipation of upcoming volatility, such as (geo)political tensions or other unspecified extreme and non-predictable events when traditional finance exchanges are closed. Now that Bitcoin has received Wall Street’s blessing and approval and is accepted as a legitimate asset class by ETFs, the SEC is also becoming a little bit less strict in regulation by taking small steps such as approving options trading on said ETFs, BeInCrypto informed in late October. So, have Bitcoin’s unique characteristics regarding sessions’ distribution of returns become distorted, shifted, reversed, and are now more resembling time-tested assets like ETFs and stocks?

Methodology & Approaches

Data

Our analysis is based on the hourly BTC data from the Gemini Data page in intervals ranging from 2015-10-08 to 2024-10-15. We define the daily session as performance between 10 am EST and 4 pm EST during trading days when the NYSE exchange is opened. All of the hours out of this interval are defined as overnight sessions. It’s the same data source we used in our previous article in which we revisited trend-following and mean-reversion strategies in Bitcoin.

We assume that the underlying futures of ETF BITO can accurately track and predict the influence of cryptocurrencies’ “institutionalization” exactly from its Inception Date on 2021-10-18. Therefore, for simplicity, we split our sample into an in-sample period (until October 2021, during which the simple ETF trading vehicle was not available for BTC trading) and an out-of-sample period (after October 2021).

We understand that our definition of in-sample and out-of-sample periods is very arbitrary. It’s not possible to define the exact time when Bitcoin (and other cryptocurrencies) became a traditional asset and was no longer considered an exotic investment. The line between traditional assets and alternative assets is a blurry one. What we want to show is that there is/was a shift in Bitcoin’s behavior in overnight and intraday sessions over time.

Initial Investigations

After collecting all the needed data, we started processing it and developing our initial investigation.

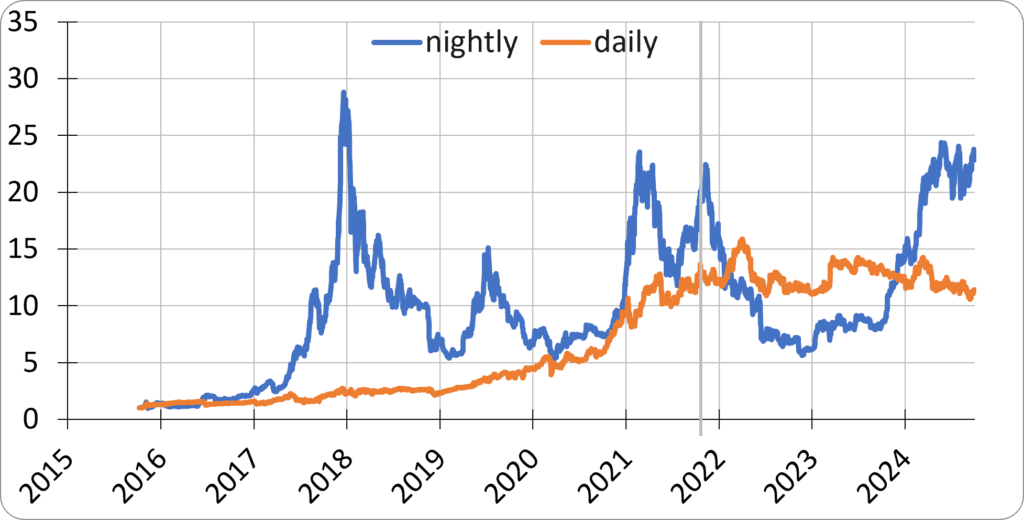

The following graph analysis illustrates returns during daily vs. nightly trading sessions over time:

We highlighted milestones of our interest and marked the launch of the first BTC ETF (2021-10-18) within the graph with a thick grey line.

As an overview, we put two points of crucial observations:

- A significant portion of strong BTC movements (both up-trends and downtrends) tend to occur in the nightly sessions.

- The daily sessions performed well until 2021 but have plateaued over the last three years.

The theory about the “Overnight Effect” posits that most performance in risky assets such as equities is realized during nightly (so from close to open; “nocturnal”) trading sessions as compensation for the associated risks. That is a time when you cannot usually trade a lot, so when you hold an asset overnight, you are compensated for its illiquidity (or lower liquidity) with higher performance. As Bitcoin increasingly integrates into traditional financial systems, this principle is also expected to apply to BTC.

Our constructed close-to-open versus open-to-close performance graph above confirms the previously outlined theoretical assumptions. Initially (until around 2021), the performance of the BTC during daily sessions was significantly positive, and BTC holders could multiply their assets with a low risk (volatility and drawdowns). The nightly sessions offered higher performance but also higher risk (volatility and drawdowns). As Bitcoin gradually became an asset class similar to other main asset classes, returns over the daily sessions diminished, and most of the BTC returns since 2021 were realized during the nightly sessions. This is precisely the same pattern as in stocks or equity indexes!

Deconstructing the Composition of Bitcoin Returns for Each Day

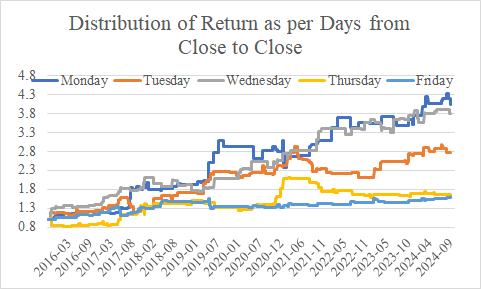

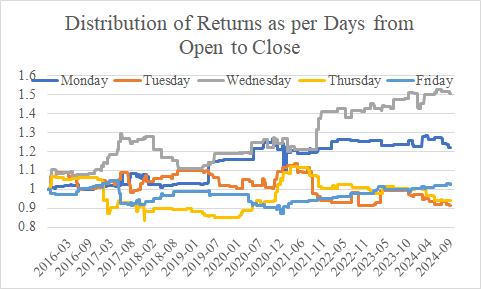

Let’s move on and decompose Bitcoin’s performance by individual trading days (Monday, Tuesday, etc.), analyzing close-to-open, open-to-close, and close-to-close sessions. According to our definition, Monday night’s performance includes the period from Friday close to Monday morning (the whole weekend with traditional finance, whether securities or forex, exchanges are closed). Tuesday night’s performance includes the period from Monday’s close (4 pm EST) until Tuesday’s open (10 am EST), etc.

The results are displayed in tabular and graphical formats, with a conclusion indicating that the primary (most contributing) performance occurs on Monday, Tuesday, and Wednesday close-to-close sessions. However, this performance is driven mainly by the nightly sessions. So Bitcoin moves to the positive territory mainly between Friday’s close and Monday’s open (so over the weekend), between Monday’s close and Tuesday’s open, and between Tuesday’s close and Wednesday’s open. As we move closer to Friday, Bitcoin’s performance diminishes (in intraday and overnight sessions, too). It seems that, ultimately, there really exists a “Weekend Effect” in Bitcoin returns—a significant impact of Saturdays and Sundays when traditional financial exchanges (like NYSE) are closed.

Trading Strategies

OK, we know that BTC is sensitive to the overnight/intraday split and it’s sensitive to the Weekend Effect. Now, the question is, what can we do about it? Our next sections aim to find a way to profit from this finding.

Replication of the Previous Research Methodology

Firstly, we took our older trend-following study and replicated the MAX strategy with 5-day, 10-day, and 50-day high parameters.

Our trend-following and mean-reversion study was backtested on daily bars with 0.00 GMT time stamps and using a 24/7 trading calendar (trades can be executed on Saturdays, Sundays, and also during public holidays). Therefore, our first step was to check how the trend-following strategy that buys new local highs (5, 10, 20, 30, 40, or 50-days) performs if we limit our trading decisions and can trade only on the ETF market close at 4 pm on days when the NYSE is open. We used Gemini data and the NYSE calendar to create such data series and tested our MAX strategy on it. This simple strategy (buy a Bitcoin in the form of cryptocurrency, futures contract, CFD, or ETF at NYSE close, when Bitcoin is on the local X-day high, hold for one trading day) can be easily executed with ETFs from 2021 onwards. However, we are not using the actual ETF closing prices but Gemini BTC data. This allows us to study the strategy’s performance even before any Bitcoin ETFs were introduced.

And here we have a comprehensive graph showcasing all versions in aggregate for the trading period from close-to-close, along with detailed tables:

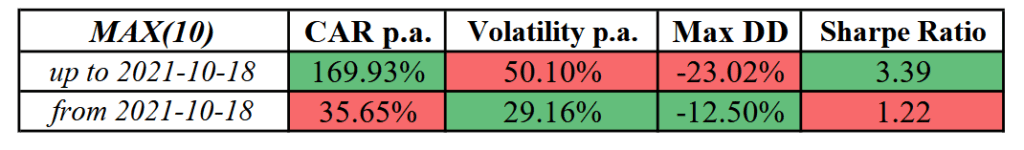

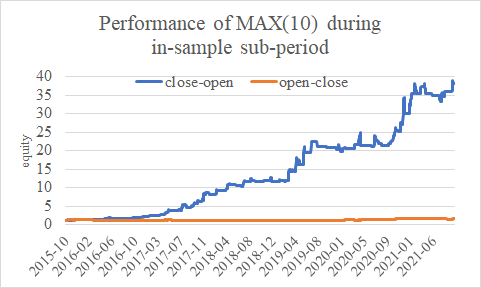

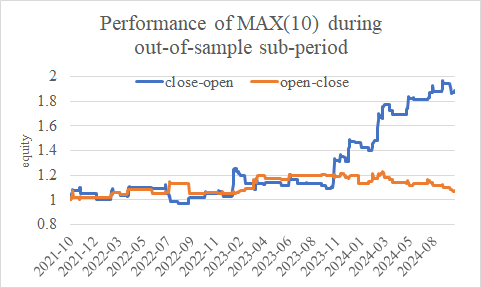

For consistency with our prior publications, we ultimately moved forward and used a 10-day version despite it not being optimal with the highest returns. This version, for purposes of this research publication, requires the presentation of close-to-open and open-to-close performance graphs, tables, and an appropriate summary as previously described:

As we can see, Bitcoin MAX strategy performed better during the first sub-period before the first ETF introduction. In the out-of-sample period, the strategy still has over 35% performance with a minimal -12% maximal drawdown (and significantly outperforms the underlying Bitcoin market on a risk-adjusted basis), but as Bitcoin has become a generally accepted, mainstream asset class, the simple trend-following strategy that buys new local highs doesn’t offer the same juice as before. What can we do about it? Let’s focus our attention on the overnight anomaly and filter our trades a little. It’s the same trick we used when we were investigating the overnight reversal in the high-yield market.

MAX(10) Strategy Performance During Sub-Periods

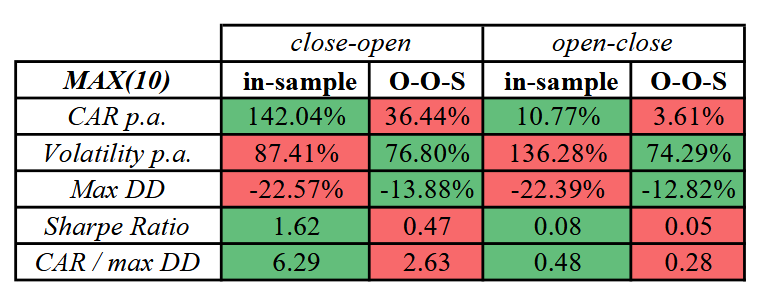

Firstly, we can try to investigate the 10-day MAX strategy in close-to-open and open-to-close sub-periods (just a short reminder that in-sample is until October 2021, and out-of-sample [OOS] is from October 2021 onwards):

This section demonstrates that most returns of the MAX(10) strategy throughout history, both in-sample and out-of-sample, are generated during the overnight trading session (from close to open).

Final Trading Strategy Proposal

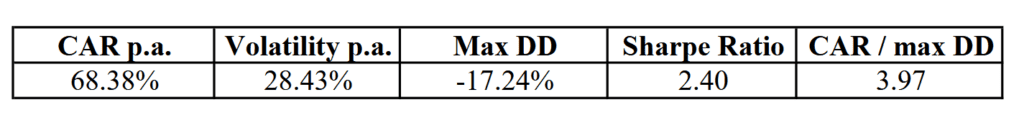

OK, we are near the end of our analysis. We learned that Bitcoin is sensitive to intraday vs. overnight split, to the day-of-the-week (or Weekend) effect, plus it trends a lot (once, when it’s on the local high, then it usually continues in positive trend and ultimately to the higher price). Therefore, we propose a consolidated MAX(10) strategy, which operates exclusively during night sessions spanning Friday to Monday night, Monday to Tuesday night, or Tuesday to Wednesday night. This final strategy is illustrated with a single equity curve, performance table, and an analysis of the strategy’s performance both in-sample (up to 2021) and out-of-sample:

We have an excellent example of the combination of weekend and overnight effects, as you can go long on Friday’s close if you are on a local 10-day MAX, hold the BTC until Monday morning (open), and go long again on Monday’s and/or Tuesday’s close if the Bitcoin is still on the local 10-day MAX. The strategy offers an attractive Sharpe ratio and low risk and shows that Bitcoin is still a young asset, burdened by inefficiencies much more than traditional, mature general asset classes and their constituents.

Conclusion

In light of our analysis, the simple strategy focused on nightly trading sessions has yielded substantial insights into Bitcoin’s performance dynamics. The strategy, operating exclusively during night sessions from Friday to Monday, Monday to Tuesday, and Tuesday to Wednesday, has demonstrated that a significant portion of Bitcoin’s returns is realized overnight. This pattern is consistent with traditional asset classes, where the Overnight risk premium is recognized, suggesting that as Bitcoin integrates more into conventional financial markets, its return distribution mirrors that of established assets.

The findings from this strategy indicate that Bitcoin, despite its unique characteristics and the 24/7 trading environment, behaves similarly to other financial instruments when subject to institutional trading patterns. This suggests a gradual alignment with traditional market behaviors, potentially driven by the increasing participation of institutional investors and the introduction of Bitcoin ETFs. These results highlight the importance of considering trading session dynamics when developing trading strategies and risk management frameworks for Bitcoin and other cryptocurrencies.

In conclusion, our study reinforces that the overnight effect significantly drives Bitcoin’s performance. The strategy’s success underscores the value of focusing on specific trading sessions to optimize returns and manage risks effectively. As Bitcoin continues to gain legitimacy and integrate into traditional financial systems, ongoing research will be essential to adapt trading strategies and capitalize on emerging trends, ensuring that investors remain ahead of the curve in this evolving market.

Author: Cyril Dujava, Quant Analyst, Quantpedia

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend