Hello all,

In the previous month, we hinted that our front-end migration would help us to integrate some of the new features. So, let’s not waste time and start with the first one – our brand new Black-Litterman Portfolio Optimization report.

The Black-Litterman model is an advanced portfolio optimization framework designed to blend investors’ subjective market views with the market equilibrium implied by asset prices. Developed by Fischer Black and Robert Litterman, the model addresses the sensitivity and instability often seen in classical mean-variance optimization. By incorporating investor opinions explicitly through Bayesian adjustments to equilibrium returns, the Black-Litterman method provides more stable, intuitive, and practical asset allocation decisions, resulting in portfolios that better reflect both market conditions and investor expectations.

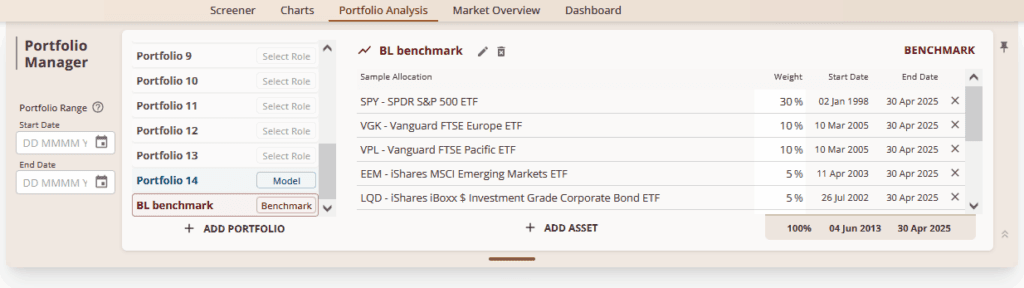

How will it work for the Quantpedia Pro clients? At the beginning, users must define a benchmark portfolio weights (usually a global market portfolio). They can use any combination of their uploaded equity curves and/or equity curves that are available in the Portfolio Manager (mix of selected ETFs and Quantpedia strategies).

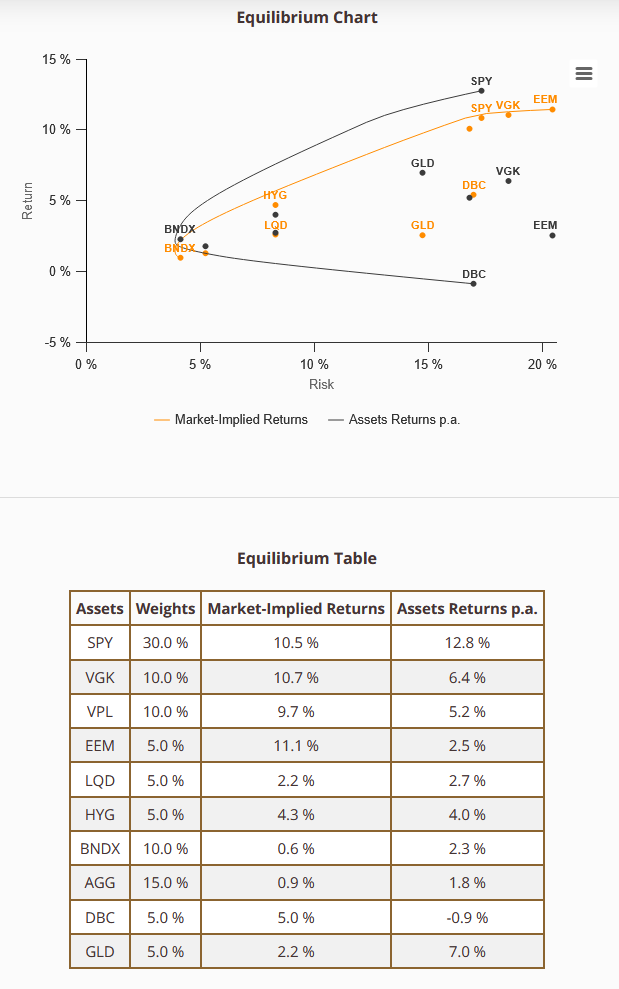

Then, the Black-Litterman model calculates market-implied returns (from the benchmark weights defined by users) and compares them to the realized asset returns using an equilibrium chart and table.

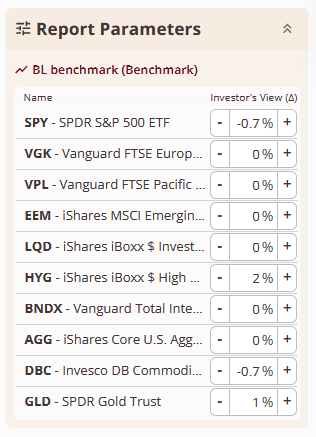

Users have the possibility to express their own subjective views about the relative expected returns (outperforms/underperforms) for specific assets (or strategies) in the report’s left widget.

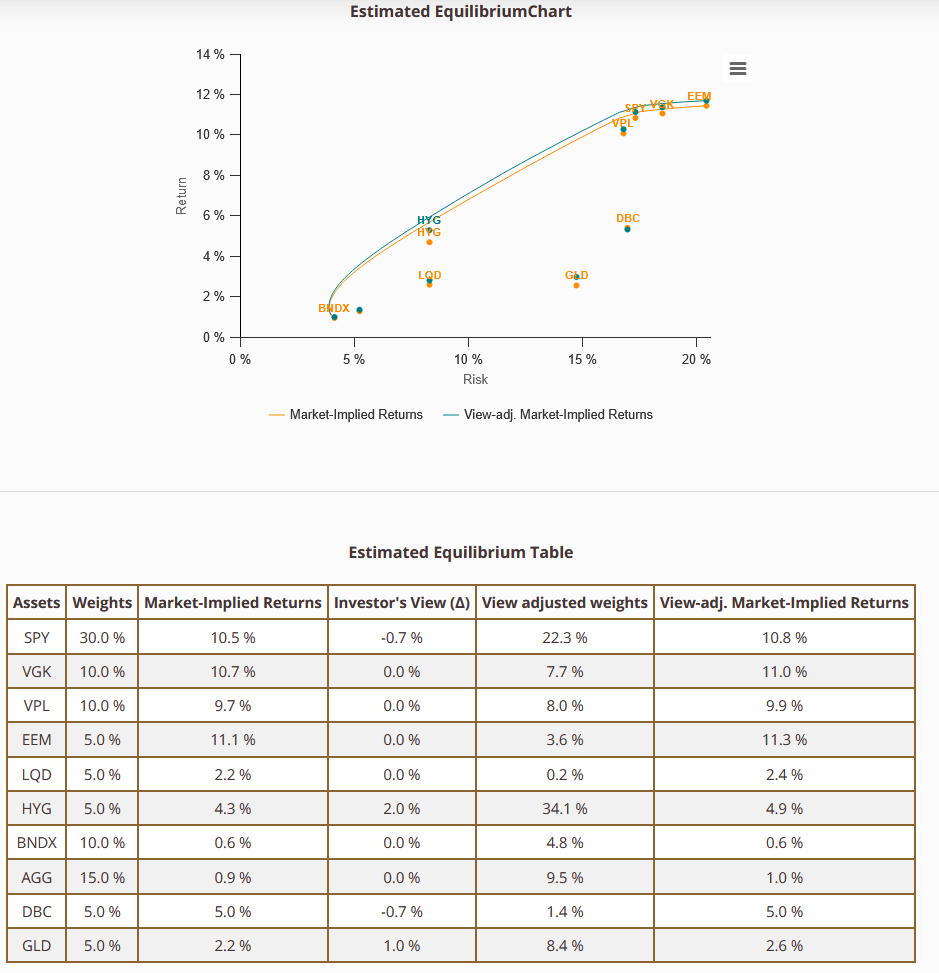

The adjusted expected returns are then fed into a mean-variance optimization, producing a portfolio allocation that reflects both the market consensus and investor-specific insights.

Secondly, some of you, our readers, are probably interested to know the progress of the Quantpedia Awards 2025 competition. The deadline for paper submission is behind us, and Quantpedia’s team has processed papers. The final 10 have been sent to our committee for the next stage, ranking. We will list the whole top 10 and who will get a share of the $25.000 prize pool in the second half of May. Stay tuned, and we will announce more soon ….

At last, let’s also quickly recapitulate Quantpedia Premium development:

- 10 new Quantpedia Premium strategies have been added to our database

- 6 new related research papers have been included in existing Premium strategies during the last month

- 9 new backtests were written in QuantConnect code. Our database currently now contains over 840 strategies with out-of-sample backtests/codes.

Additionally, 5 new research articles were published on the Quantpedia blog in the previous month:

Trump’s Executive Orders and Their Impact on Financial Markets

Author: Sona Beluska

Title: Trump’s Executive Orders and Their Impact on Financial Markets

Fear, Not Risk, Explains Asset Pricing

Authors: Robert D. Arnott and Edward F. McQuarrie

Title: Fear, Not Risk, Explains Asset Pricing

Uncovering the Pre-ECB Drift and Its Trading Strategy Applications

Author: Cyril Dujava

Title: Uncovering the Pre-ECB Drift and Its Trading Strategy Applications

Short-Term Correlated Stress Reversal Trading

Author: Cyril Dujava

Title: Short-Term Correlated Stress Reversal Trading

Revisiting Pragmatic Asset Allocation: Simple Rules for Complex Times

Authors: Team Quantpedia

Title: Revisiting Pragmatic Asset Allocation: Simple Rules for Complex Times

Yours …

Radovan Vojtko

CEO & Head of Research

Are you looking for more strategies to read about? Visit our Blog or Screener.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Do you want to know more about us? Check how Quantpedia works and our mission.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend