Alternative Fair-Value Models for Currency Value Strategy

The idea of buying an investment asset for a lower price than a fair-value is the cornerstone of value factor strategies. Various value strategies were popularized by famous investor Benjamin Graham (and his successors like Warren Buffett) and were firstly employed in the stock market. This idea of looking for investment opportunities that can be bought cheaply can also be applied in currency markets – Currency Value Factor strategy. There is, however, one catch – an investor must know the fair-value exchange rate for currencies. The most popular equilibrium exchange rate model used for this purpose is based on PPP (purchasing power parity). A new research paper written by Ca’ Zorzi, Cap, Mijakovic, and Rubaszek analyzes two additional models – Behavioral Equilibrium Exchange Rate (BEER) and the Macroeconomic Balance (MB) approach to assess which model has the best forecasting power.

Authors: Ca’ Zorzi, Cap, Mijakovic, Rubaszek

Title: The Predictive Power of Equilibrium Exchange Rate Models

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3516749

Abstract:

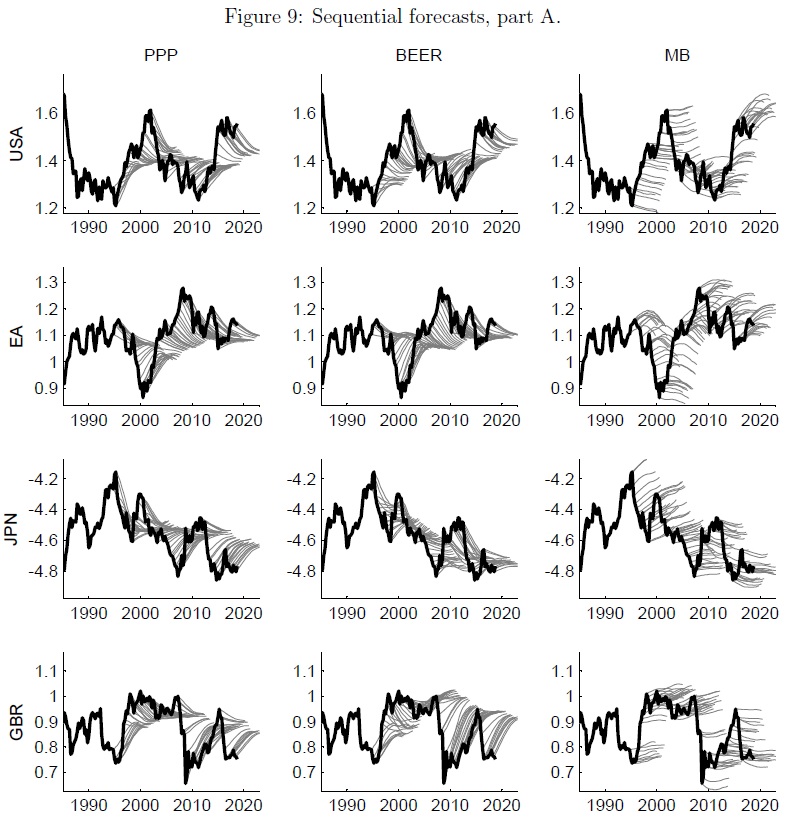

In this paper we evaluate the predictive power of the three most popular equilibrium exchange rate concepts: Purchasing Power Parity (PPP), Behavioral Equilibrium Exchange Rate (BEER) and the Macroeconomic Balance (MB) approach. We show that there is a clear trade-off between storytelling and forecast accuracy. The PPP model offers little economic insights, but has good predictive power. The BEER framework, which links exchange rates to fundamentals, does not deliver forecasts of better quality than PPP. The MB approach has the most appealing economic interpretation, but performs poorly in forecasting terms. Sensitivity analysis confirms that changing the composition of fundamentals in the BEER model or modifying key underlying assumptions in the MB model does not generally enhance their predictive power.

Notable quotations from the academic research paper:

” In this paper, we review the three main methods for calculating equilibrium exchange rates, the first two hinging on the concept of mean reversion of real exchange rates and the third on the concept of current account sustainability. The first methodology that we consider is Purchasing Power Parity (PPP), the oldest theory of real exchange rate determination. The second, known in the literature as the Behavioral Equilibrium Exchange Rate (BEER) model, instead links real exchange rates to a set of economic fundamentals. This method could be seen as an extension to the PPP model as it seeks to explain long-term changes in purchasing power among nations. The third method, called the Macroeconomic Balance (MB) approach, extracts equilibrium exchange rates by assuming that relative prices are the main adjustment mechanism of external imbalances.

We argue that there is a clear trade-off between storytelling and predictability of equilibrium exchange rates. In terms of economic intuition, the PPP model off ers little else but the notion that real exchange rates are mean reverting. The BEER model is more insightful, as it links the evolution of real exchange rates with that of economic fundamentals. The MB is the most complex approach as it requires a defi nition of what constitutes an external imbalance and a clear hypothesis on how exchange rates aff ect trade volumes and prices and hence the current account adjustment process. In terms of predictive power our ranking flips. The PPP model is the most reliable one in forecasting terms. The BEER model has broadly comparable predictive power as PPP, mainly because the equilibrium exchange rate is generally not very distant from the level implied by PPP. The MB model, irrespective of whether we assume perfect or imperfect exchange rate pass-through, is by far the least accurate.

Our paper has a dual message, one positive and one negative. The positive message is the good predictive power of the PPP and BEER models relative to the random walk. The negative message is that exchange rates are only weakly connected to economic fundamentals also in the long-run. We also find that the tendency of flexible exchange rates to help closing current account gaps is limited. Finally, the analysis sends a clear message to equilibrium exchange rate modelers. To the extent that equilibrium exchange rates should help predict exchange rate movements, the ambition of developing comprehensive models with an ever larger set of economic fundamentals could be counterproductive out of sample. “

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Would you like free access to our services? Then, open an account with Lightspeed and enjoy one year of Quantpedia Premium at no cost.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend