Introduction

Cryptocurrencies, and most notably Bitcoin, are recognized as decentralized currencies. While some see Bitcoin (BTC) as a payment method of the future, others see it as a speculative asset class. No doubt, many have gained on the skyrocketing prices of BTC, but note that many have lost.

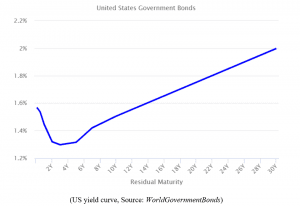

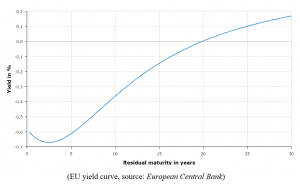

Despite the speculative activity connected with BTC, after all, it is a currency that is different from fiat currencies like the US Dollar or Euro. If you hold fiat currency, there is an opportunity to earn a risk-free rate. The idea of a risk-free rate is based on the assumption that the government would not default, which is usually a regular assumption amongst best economies. For example, at the date of writing this analysis, risk-free rates for the US and Eurozone have the following shape.

Therefore, if someone holds US dollars (in the form of bonds and not cash), he can earn a risk-free rate that is given by the yield curve. In the case of the US, lending is accompanied by gaining an interest. While in the US, lending money to government yields to returns, that is not a case for the euro. In most cases, investors have to pay for holding the euro in the form of bonds. This holds for the majority of maturities.

Moreover, there is also a possibility to lend the money (dollars, euros, and other currencies) for a rate that includes some risk. Therefore, investors require the risk-free rate plus a compensation for the risk. For example, corporate bonds have higher yields, but also a higher risk.

While the section above is considered as basics of financial markets, Bitcoin is for sure something new, where the amount of literature is still steeply growing. In this analysis, we would like to find a risk-free yield for the bitcoin and also the “market yield“ that includes the risk of borrowing funds.

The risk-free rate of Bitcoin

Is there any risk-free rate for such a volatile currency/asset class as Bitcoin? Certainly, the passive holding of Bitcoin does not provide any coupon or dividend; therefore, there is no visible interest rate connected to it. While there is no risk of default (there is a risk of getting the crypto wallet or exchange profile hacked), characteristics of such asset class would be far from the characteristics of government bonds.

A possible approach is to look at the Bitcoin as an asset class and find the risk-free rate in the regulated derivatives market (CME). The BTC is a decentralized currency that does not have any government bonds that could be considered as risk-free assets. However, if we have risk-free government bonds for fiat currencies, there are derivatives where the bonds are underlying assets. The price of the derivative is dependent on the price of the underlying asset, and assuming the no-arbitrage rule, the return must be the same. Therefore, we can extract the risk-free return from the futures market.

We can use this idea for BTC analysis.

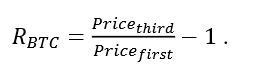

As a result, let’s try to look at the difference between the front-month (first futures contract) and back-month future (third futures contract). To be more precise, we can try to extract a risk-free rate as follows:

It would be more natural to buy BTC for a spot price and hedge it by shorting the back-month futures, but with our data availability, we have opted for the approach with futures only. We might revisit this topic in the future also with BTC spot prices.

Therefore, instead of going long BTC spot, we go long the front-month contract and short the back-month contract. Consequently, we are hedged against any decline of the BTC price since we have locked the price of BTC.

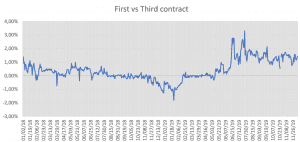

We can see that most of the time, the risk-free rate defined as above is positive. The rate was negative during the biggest fall of the bitcoin, which can be understood. The 2-month risk-free rate is positive if the futures are in contango, and negative if the futures are in backwardation. As we have previously mentioned, in the case of government bonds, the risk-free rate can be negative, but there are investors that do not have any other option than to buy a bond with a negative return. We assume that the BTC investors don’t have to be the same case, and we provide a summary table of average rates for two cases, for an average of contango and backwardation (Full sample collumn), and also just for contango.

|

Risk-free rate |

Full sample |

Contango only |

|

2-months |

0,40% | 0,81% |

|

Annualized |

2,45% |

4,97% |

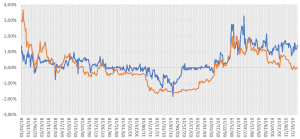

To compare spot prices and the yields, we can plot a chart where is a transformed curve of spot prices (orange) to be comparable with the yields (blue).

More or less, we can see a clear pattern that the yield and spot prices co-move. The correlation is 0,717. This can be easily justified, raising prices and optimism cause that investors expect the BTC prices to rise in time, which is reflected in the prices of futures, and therefore in the risk-free yield.

Bitcoin futures behavior reminds us of the VIX futures. Contango in VIX futures is much steeper, but the overall feeling is similar. When markets are calm, and equities (BTC) are rising, VIX (BTC) futures are in contango. Situation changes if there is stress on the market, equities (BTC) are falling, and volatility rises, then VIX (BTC) futures switch to backwardation.

Lastly, we plot the distribution of annualized rates for the whole sample (not contango only).

While most of the data are centered around the mean, there is a heavy tail. However, we can conclude that there is not that extremely big variance in the data, but we will revisit this in the next section. We compare it later with another possibility of how to extract the rate for BTC.

Is this BTC interest rate a true Bitcoin risk-free rate? Return, which investor receives from this construction, is priced in USD. Therefore, it is possible to argue that this can’t be a “true” Bitcoin risk-free rate as that should be priced in BTC. However, yield derived from spread among spot BTC and the futures contract or among two BTC futures settled in USD analysis can be used to gain some insight into the dynamics of BTC interest rates. The risk associated with this construction is low; therefore, the interest rate from it can be close to a true “risk-free rate”.

The influence of dollar risk-free rate

The aforementioned risk-free rate cannot be considered as a complete. If we construct the risk-free bitcoin rate as above, we are assuming that we are holding everything that is not used as collateral in cash. In this section, we assume that we can invest in 1-month Treasury Bill since we have overlapping futures each month. The collateral that is needed at the date of writing was approximately 38%, so we can assume that we can invest approximately 62% of the portfolio into the risk-free rate.

| Risk-free rate | Contango only | Full sample |

| 2-months | 0,69% | 0,61% |

| Annualized | 4,2% | 3,69% |

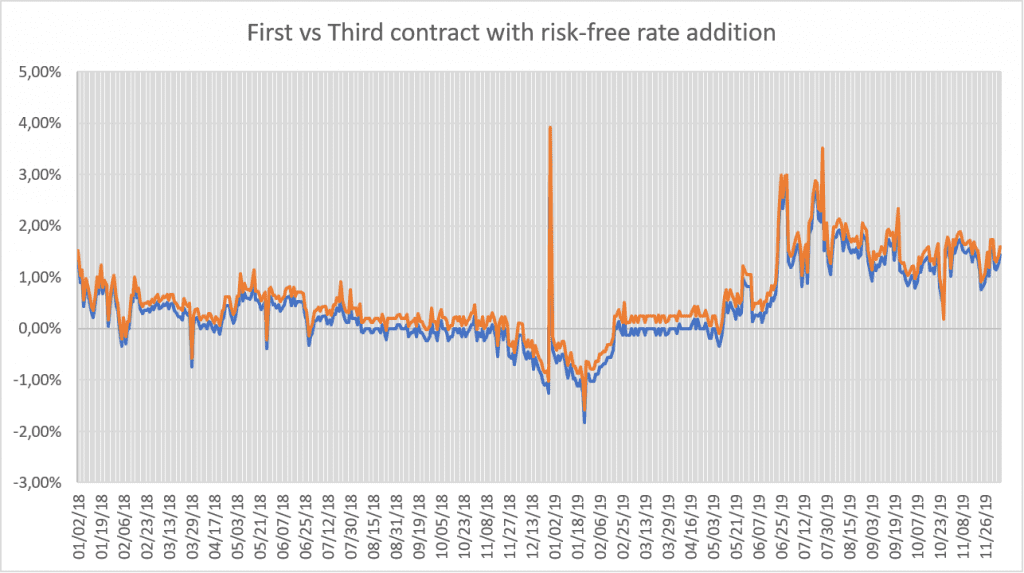

In the next graph, we compare the resulting risk-free rates for BTC for the previous case (blue) and the addition of risk-free dollar rate (orange).

Another possibility to obtain a “risk-free” rate

CME is not the only exchange where the bitcoin derivatives are traded. There are many Bitcoin exchanges (try for example Swyftx NZ) that have some sort of Bitcoin derivatives. But these Bitcoin derivatives are settled not in USD but in BTC. In this section, we would like to answer the question of whether it is possible to extract a risk-free rate from these Bitcoin contracts.

Firstly, we believe that there is no way how to obtain a true risk-free rate from such contracts. We can consider the regulated futures market as something reliable that would not bring any credit and liquidation risks into the rate, but we do not think that the same could be said about bitcoin exchanges. Without oversight and regularization, we do not consider such contracts as a risk-free, because there is credit risk counterparty – the exchange (for example, default or scam).

Anyway, inspired by the approach with futures listed on CME, we try to replicate the approach on the Bitmex exchange that offers perpetual contracts. Such contracts are similar to the futures but are settled every 8hours so we can expect much more variation. The rate is a result of funding rates–every eight hours long side pays to short or vice versa.

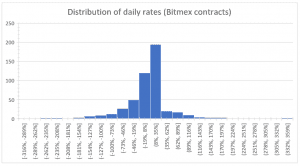

The variance of rates absolutely cannot be compared with the variance of rates obtained from USD settled futures.

Additionally, we can plot the distribution of annualized rates as in the case of BTC settled futures.

Is the interest rate extracted from Bitmex futures (or from any Bitcoin futures which are settled in BTC) a genuine risk free-rate? The volatility of that interest rate is several orders higher than the volatility of interest rate derived out of the CME futures settled in USD. It is extremely hard to assess and remove credit and liquidation risk out of that funding rate; therefore, Bitcoin futures settled in BTC cannot give us information about the proper risk-free interest rate.

Risky return for BTC

While BTC has an intrinsic value, the passive holding would not yield any interest. In the previous section, we have extracted the risk-free rate. In this section, we would like to find a risky rate for BTC. There is a growing amount of providers that offer an interest rate for BTC savings. The logic is simple. The investor lends BTC to this provider, and the provider lends it again for a higher rate, and the difference between is his profit. This lending is not a risk-free business. “Crypto banks“ are not regulated as normal banks, and the government does not guarantee the savings.

On the other hand, the returns are much higher than bank deposits or government bonds. We are not affiliated with any crypto saving accounts, and there is no provider we can absolutely recommend. We advise researching the rates or reliability of the provider in the moment of investing. Moreover, the rates are frequently moving. Therefore the rates mentioned in this article would probably be soon inaccurate and should be taken as an example, not the general case.

|

Example of rates |

Yield p.a. |

|

Binance |

0,27% |

|

Celsius |

3,43% |

|

Crypto |

4% |

|

BlockFi |

6,2% |

This could be combined with a risk-free return. Instead of just holding the BTC (or using the risk-free dollar rate) and hedging BTC-USD risk by shorting the Bitcoin futures contract until the expiration of the back-month futures, it is possible to deposit BTC into a crypto saving account. The resulting return would be a representative of a market return, that could be compared to the corporate bonds in the bonds world. Corporate bonds have a risk-free part and a compensation for the risk of lending funds. In the world of BTC, the risk-free return can be found on the derivative market (or combination of holding the BTC and shorting futures), and risky return can be obtained by lending the bitcoins.

Conclusion

There could be found an analogy between fiat currencies and cryptocurrency like Bitcoin. Traditional currencies invested in bonds can earn risk-free (government bonds) or market returns (corporate bonds). Similarly, BTC can earn risk-free and market returns as well, while the risk-free rate has to be extracted from the derivatives market. The risky return is more conventional; it is a reward for lending the BTC. In the case of the risk-free return, we believe that there needs to be used a regularized market to eliminate credit risk. Additionally, the contract has to be settled financially, to be hedged from the price fluctuations of BTC without any need to modify the position.

On average, the risk-free rate for BTC if we account the risk-free dollar rate is 3,69%. The yield of the risky part can be much higher, significantly outperforming traditional bonds or bank deposits. However, this comparison is not that fair or correct. Proponents of such BTC saving accounts like to compare the rates to the rates of bonds or savings accounts, but this market is not regulated, and probably, only the future will answer the question of how reliable such providers are.

Authors:

Radovan Vojtko, CEO, Quantpedia.com

Matus Padyšák, Analyst, Quantpedia.com

Are you looking for strategies applicable in bear markets? Check Quantpedia’s Bear Market Strategies

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you interested in forex or crypto trading? The you may review a list of MAS-regulated forex brokers in Singapore.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friendSubscribe for Newsletter

Be first to know, when we publish new content