Financial markets are in panic mode. Everybody is talking about the next bear market and economic implications of spreading coronavirus to the whole world. People are split into two groups. One group reasons that a new covid-19 virus is just a stronger flu. Other are worried and draw parallels to Spanish flu pandemic with tens of millions of dead.

Economic damages from imposed quarantines and breakdown in demand will surely be substantial. Losses in travel, energy and consumer discretionary industries will be great. But markets may rationally panic also for things which are not connected just to the economy.

The covid-19 virus is malicious because it is well spread by young children who are themselves not in a big risk, but people over 60 years are especially vulnerable to it. Covid-19 is like any known children disease (measles, polio etc.), but turned around. People are asking why there is such panic if all age groups under sixty have a mortality rate of just 0.2%? Why so much stress?

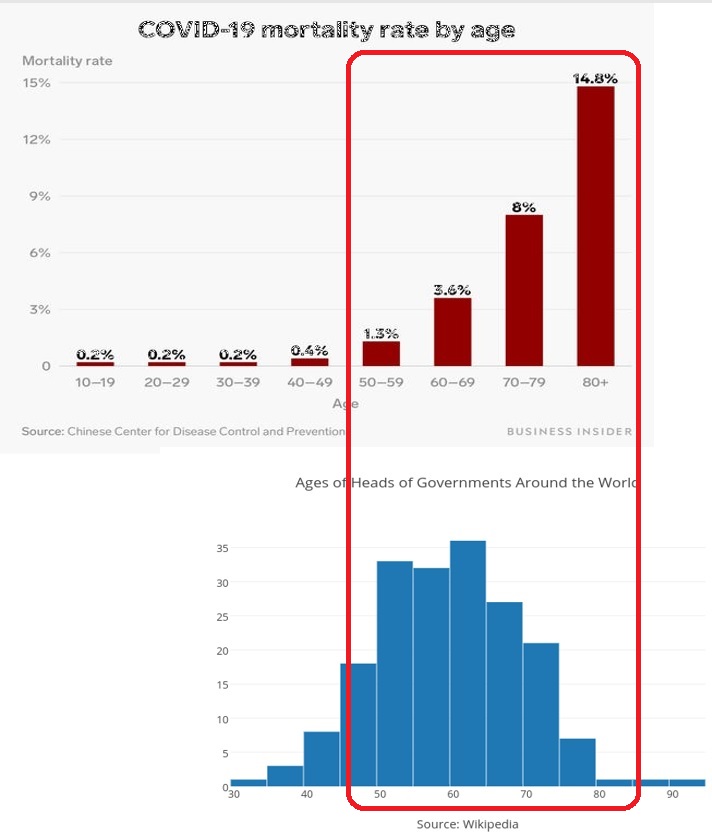

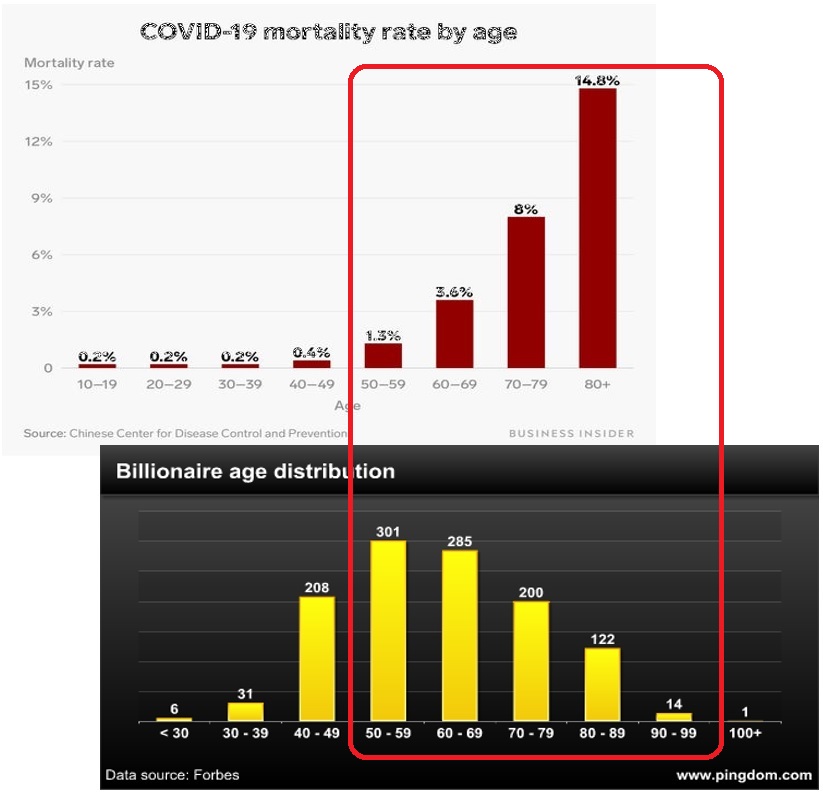

We would like to show you two charts which can explain why the high market volatility can be completely rational.

| Algo Trading Data Discounts are available exclusively for Quantpedia’s readers. |

The first chart shows the histogram of age distribution among the world leaders compared to the mortality rate of coronavirus. The median age for heads of world’s governments is 62 years. There are a lot of leaders who are even in their 70s. If you need something during the pandemic, then it’s a well-functioning government administration, so that all of the important anti-pandemic measures can be administered. The last thing you need is the government which is in quarantine itself. We do not need to go far away to see an example; it’s enough to look at what is, unfortunately, happening in Iran.

The second chart shows the histogram of age distribution among the world billionaires compared to the mortality rate of coronavirus. The average age for billionaires is over 60 years. That’s basically the same age group as the world’s leaders. Now, it doesn’t matter if our political stance is on the right or on the left, we will all probably agree that significantly rich people have a significant influence on our world. And now this group of people is the most vulnerable. They may defer their spending and investments. They may reschedule or cancel their meetings. And that may be enough to slow down the world’s economy.

Current world’s human society is a very complex structure. Even in the past, all human societies depended a lot on elder members, which gained enough social, human or monetary capital and were internally selected to make very important decisions. And now, covid-19 is aiming precisely into this vulnerable spot. It’s not a surprise that financial markets behave the way they do …

Are you looking for strategies applicable in bear markets? Check Quantpedia’s Bear Market Strategies

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend