Are Commodities a Good Investment? It Depends on the Country

In recent years, the diversification potential of commodities has come under scrutiny. While the majority of studies examining the role of commodities in a portfolio typically focus on U.S. investors or those dealing primarily with U.S. dollar-denominated assets, Dequiedt et al. (2023) offer a unique perspective by considering the viewpoint of domestic investors in a sample of 38 developed and emerging countries.

The study explores the relationship between diversification benefits of commodities for local investors and country’s level of commodity risk exposure. The latter is interpreted as the commodity dependence, i.e. as the percentage of commodity exports relative to total merchandise exports. Using a small, open economy model with two sectors (commodities and non-commodities), the authors categorize countries into two groups: low commodity risk exposure, low commodity dependence (e.g., Japan, China, Hong Kong), and high commodity dependence, moderate to high risk exposure (e.g., Chile, Australia, Norway).

Findings reveal that incorporating commodities tends to enhance the Sharpe ratio of the optimal domestic asset portfolios in most countries with low commodity dependence but doesn’t benefit highly commodity-dependent ones. Additionally, high commodity dependence leads to a positive correlation between commodity prices and domestic stock and bond returns, reducing diversification benefits as export demand boosts the exporting country’s economic growth and traditional asset returns.

Authors: Vianney Dequiedt, Mathieu Gomes, Kuntara Pukthuanthong, Benjamin Williams

Title: Commodity Dependence and Optimal Asset Allocation

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4534370

Abstract:

We present a model to explain the diversification benefits of incorporating commodities into a portfolio of traditional assets from the perspective of domestic investors. Utilizing a sample of 38 countries from 2000 to 2020, we show that investors in high-commodity dependence countries generally do not benefit from adding commodities to their portfolios while investors located in low-commodity dependence countries usually do. Commodities may augment a diversified portfolio if investors are not excessively exposed to commodity risk through their country’s economic structure. Portfolio management research should consider the diversity of local contexts as it can yield different insights into asset allocation.

As always, we present interesting figures from the paper:

Notable quotations from the academic research paper:

“We retrieve export trade data from the United Nations Conference on Trade and Development (UNCTAD) statistics website. To measure commodity dependence at the country level, we define export commodity dependence as the percentage ratio of commodity exports to total merchandise exports. We compute the overall commodity dependence for each country by dividing the total value of commodity exports by the total value of merchandise exports. Additionally, we calculate the dependence ratio for each sector and each commodity where an investable commodity index is available.

To proxy for an investment in commodity futures, we use the Dow Jones Commodity Total Return Index (DJCTRI), available since December 1999. This index reflects a fully collateralized investment in nearby commodity futures, with positions rolled over five days (20% of the position is rolled each day into the next futures contract), assuming equal weighting of three major sectors: energy, agriculture/livestock, and metals. Commodities are weighted by relative liquidity based on the five-year average total dollar value traded, and the index is rebalanced quarterly.

We employ the classic mean-variance optimization framework to assess the diversifying potential of commodities within a portfolio of traditional assets (Markowitz, 1952). Within this framework, the benefits of diversification are related to the mean correlation observed among the assets: the lower the mean correlation, the higher the expected benefits of diversification.

In the mean-variance framework, the tangency portfolio (i.e., the portfolio offering the best possible combination of portfolio risk and expected return) is of particular relevance: All investors, depending on their respective risk aversion, are expected to hold a given mixture of the risk-free asset and the tangency (or optimal) portfolio. With this in mind, we focus on the shift in the optimal portfolio by statistically assessing the difference in Sharpe ratios between portfolios without commodities and portfolios including commodities. If the Sharpe ratio of the optimal portfolio increases with the inclusion of commodities, then all the investors will benefit regardless of their risk aversion, as their expected utilities will increase.

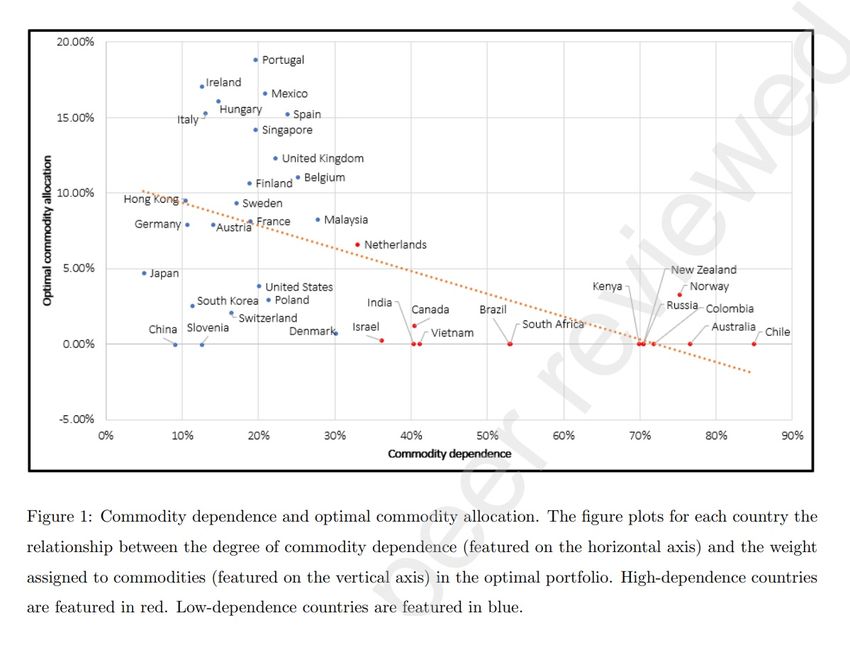

To make things more transparent, we provide scatter plots of commodity weights versus commodity dependence for all countries in Figure 1. This figure shows a clear negative relationship between the weight assigned to commodities in the optimal portfolio and the country’s degree of commodity dependence.

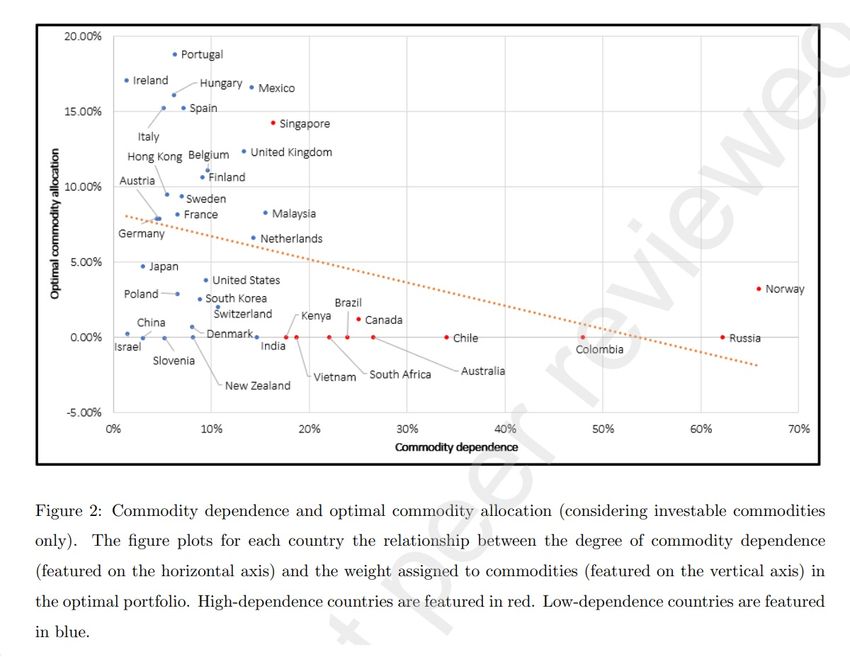

Although the DJCTRI applies equal weights at the sector level (energy, metals, and agriculture/livestock sectors each account for 33.33% of the index), the weights assigned to individual commodities can differ significantly. As a result, some people could argue that the observed diversification benefits of commodities may result from extensive exposure to one or a few commodities. To address this concern, we build a yearly-rebalanced equally-weighted commodity index using the indexes representing the individual commodities present within the DJCTRI.

Scatter plots of commodity weights versus commodity dependence using investable commodities only for all countries are shown in Figure 2. Although slightly different, our main results are primarily confirmed as there appears to be a clear negative relationship between the degree of commodity dependence and the weight of commodities in optimal portfolios.

To confirm that the commodity diversification characteristics we uncovered in our previous analyses are due to commodity price dynamics and not to exchange rate changes, we repeat our analysis assuming a currency-hedged commodity exposure…. Finally, when considering currency-hedged commodity exposures, the average weight of commodities in optimal portfolios is still much higher for low-commodity dependence countries (8.23%) than for high-commodity dependence countries (2.12%). Overall, while exchange rates play a role, the benefits of commodity diversification mostly relate to commodity price dynamics rather than changes in exchange rates.

Our findings indicate that the diversifying benefits of commodities depend heavily on the level of commodity dependence in each country, with inclusion in the optimal portfolio improving the Sharpe ratio in 71% of low-commodity dependence countries while providing no diversification benefits in high-commodity dependence countries. Moreover, we observe that the optimal portfolio weight for commodities is, on average, substantially greater in low-commodity dependence countries (8.99%) than in high-commodity dependence countries (0.81%).”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Would you like free access to our services? Then, open an account with Lightspeed and enjoy one year of Quantpedia Premium at no cost.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend