At the moment, there is a lot of attention surrounding overnight anomalies in various types of financial markets. While such effects have been well documented in research, especially in US equities and derivatives, there are other asset classes that are not as well addressed. We previously compiled the most influential studies and built strategy upon them and also examined if similar overnight/intraday phenomenons also exist in the cryptocurrency world.

But let’s now try to explore if there are such opportunities available in foreign equity markets and, if yes, how to utilize them in our trading best. A recent (2022) paper from Jiang, Luo, and Ye contributed appealing evidence in favor of validating these phenomena in the Chinese market. The methodology framework used Fama-French five-factor model using a rolling window of past 12-month daily returns. Data were from China Stock Market Accounting Research (CSMAR) database ranging from 1994 through 2020. Then, academics successfully studied how overnight/intraday beta-return relationships behave.

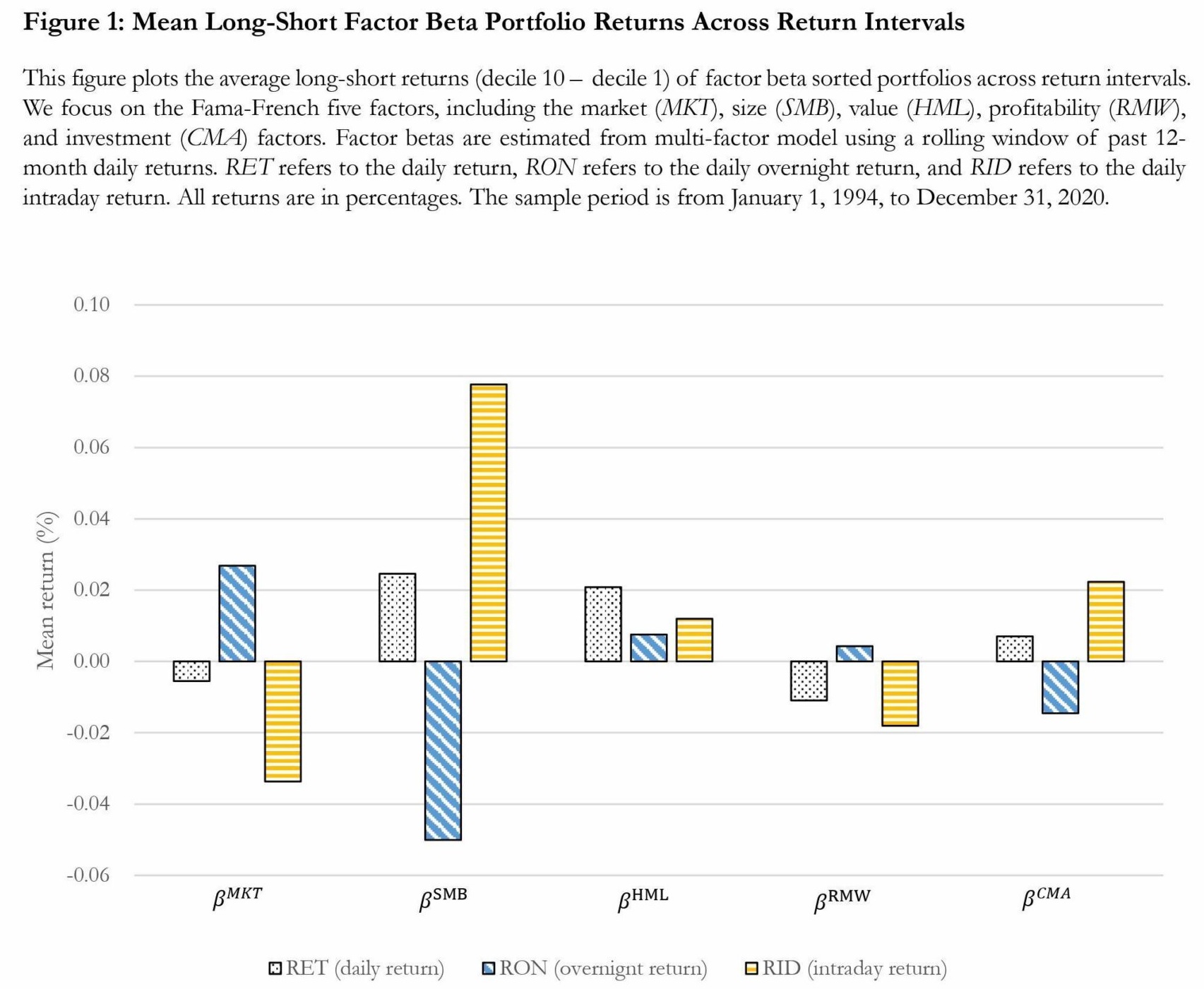

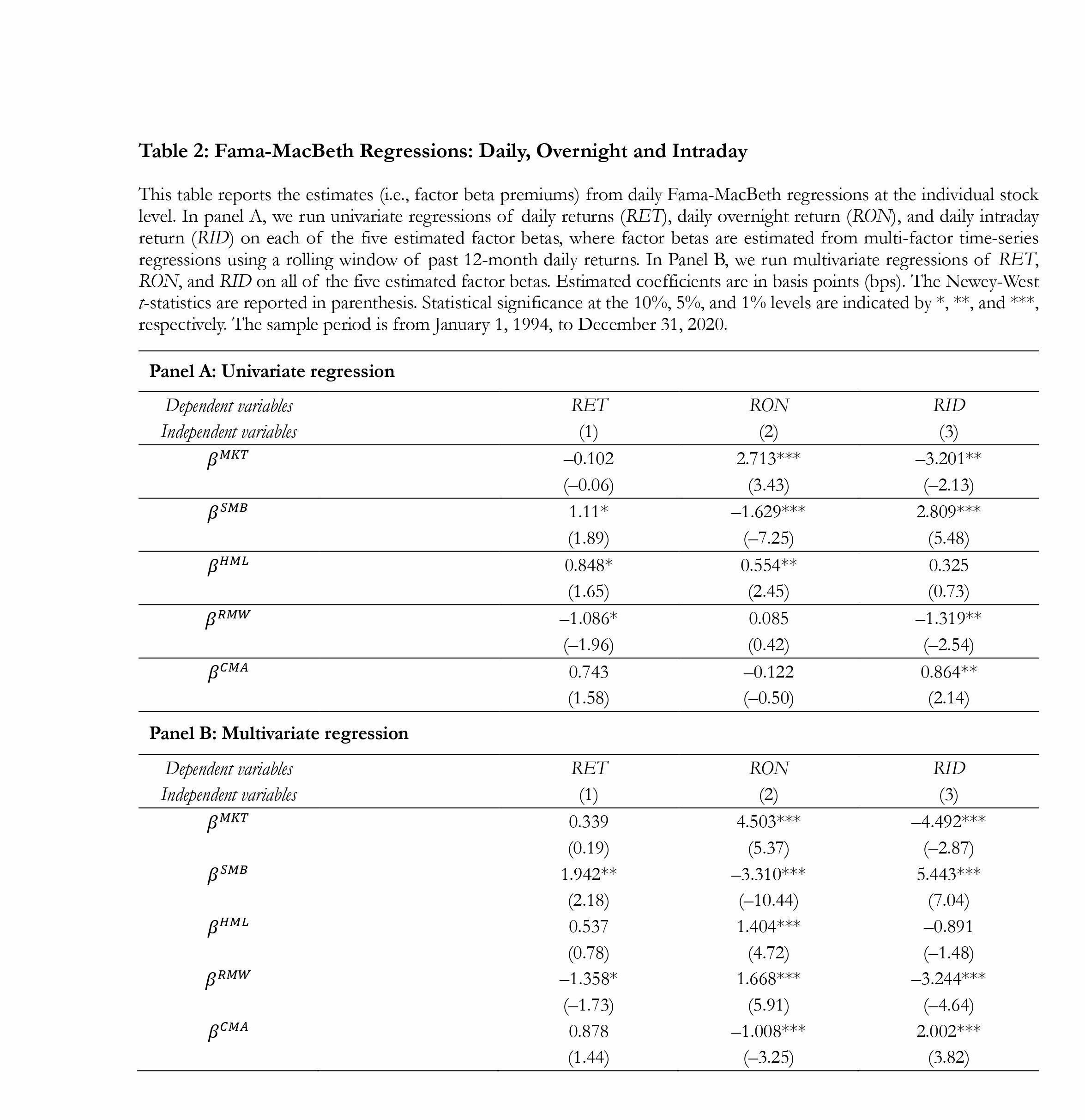

We highlight the finding that the market MKT factor beta premium is earned exclusively overnight and tend to reverse intraday (and in smaller potency also value HML and profitability RMW), which is the same finding as for the US equities. In contrast, the size SMB factor exhibit significantly opposite pattern: positive intraday premium and negative overnight premium (and the same for investment CMA factor). As one possible explanation, the clientele-based hypothesis, which states that retail investors tend to be the marginal traders at the market open while institutional investors price assets at the market close, is presented.

It is also worth mentioning that these returns are not free of commission costs and fees. Therefore, it would be hard for such a high-turnover strategy to achieve the same results net of costs. But it’s still a very useful finding that can be used as an overlay in combination with other strategies to improve the timing of entering or exiting positions, whether long or short.

Authors: Danling Jiang, Yunfeng Luo, and Zhengke Ye

Title: Factor Beta, Overnight and Intraday Expected Returns in China

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4138715

Abstract:

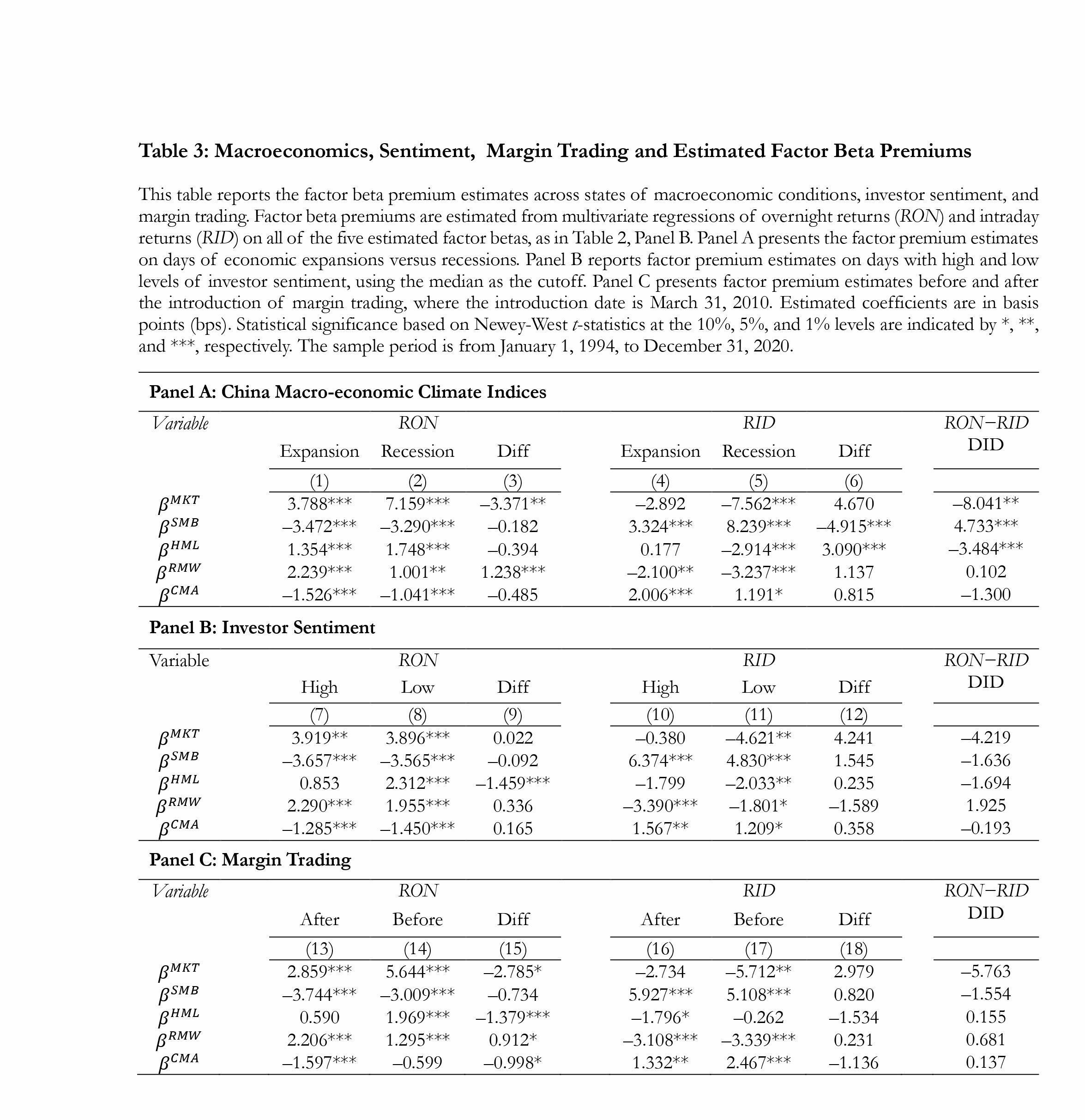

We study the relationship between the Fama and French (2015) five factors’ betas and the expected overnight versus intraday stock returns in China’s A-share markets. We find that factor betas and expected returns exhibit contrasting relationships overnight versus intraday. The market, value, and profitability factors’ premiums are earned overnight and tend to reverse intraday, while the size and investment factors’ premiums behave oppositely. Overnight and intraday factor premiums exhibit variations across macroeconomic conditions, and to a lesser extent, across sentiment states or margin trading availability. Our results provide evidence of significant conditional factor beta-return relationships at night versus day.

As always we present several interesting figures and tables:

Notable quotations from the academic research paper:

“Using multivariate firm-level Fama-MacBeth regressions, we find that the market, value, and profitability factor beta premiums are earned entirely overnight and tend to reverse intraday, while the size and investment factor premiums behave oppositely. The regression estimates imply that the top minus bottom decile beta portfolio for the market, value, and profitability factors, earns an annualized 9.11%, 9.15%, 13.38% overnight premium, and an annualized −9.08%, −5.80%, −25.80% intraday premium, respectively. In contrast, the size and investment factor betas carry negative premiums overnight (−22.24% and −7.78%) and positive premiums intraday (36.58% and 15.57%). Furthermore, we find evidence that the overnight versus intraday factor beta premiums vary significantly with economic conditions, and to a lesser extent, with sentiment states or margin trading availability.

Figure 1 plots the average daily returns for each factor beta long-short portfolios across three return intervals. Daily (24-h) returns (RET) are plotted in white bars, overnight returns (RON) in blue bars, and intraday returns (RID) in yellow bars. The most notable observation is that the long-short return spreads exhibit opposite signs at night and day for four factors (MKT, SMB, RMW, and CMA). The return spread is positive for MKT and RMW overnight and for SMB and CMA intraday. It is, however, positive and small in both periods for HML.

Turning to the average daily long-short return spreads, those for SMB, HML, and CMA betas are mildly positive, while those for MKT and RMW betas are slightly negative. The evidence confirms relatively weak unconditional factor beta-return relationships in China (e.g., Han et al. 2020), which contrast with the strong conditional relationships in the night and day decomposition in Figure 1.

Our evidence is challenging to reconcile using risk-based theories. A risk-based theory would require consistent signs of factor beta premiums day and night, as a positive premium indicates a risk factor while a negative one implies a hedging factor. We do not, however, expect a common factor to change its risk or hedging roles based on hours of the same day. Instead, one possible explanation of our findings can be drawn from the investor clientele-based hypothesis (Lou et al., 2019). This hypothesis posits that retail investors tend to be the marginal traders at the market open while institutional investors price assets at the market close – often to correct mispricing induced by the opening trades, causing relative performance overnight to reverse that intraday and vice versa.

The evidence in Table 3 overall suggests that the overnight and intraday factor beta premium differentials are sensitive to economic states and insensitive to the sentiment state or margin trading restriction. If investor clientelse drive factor overnight versus intraday pricing, economic conditions likely disproportionally influence retail and institutional investors, causing variations in the factor beta premiums at night versus day.

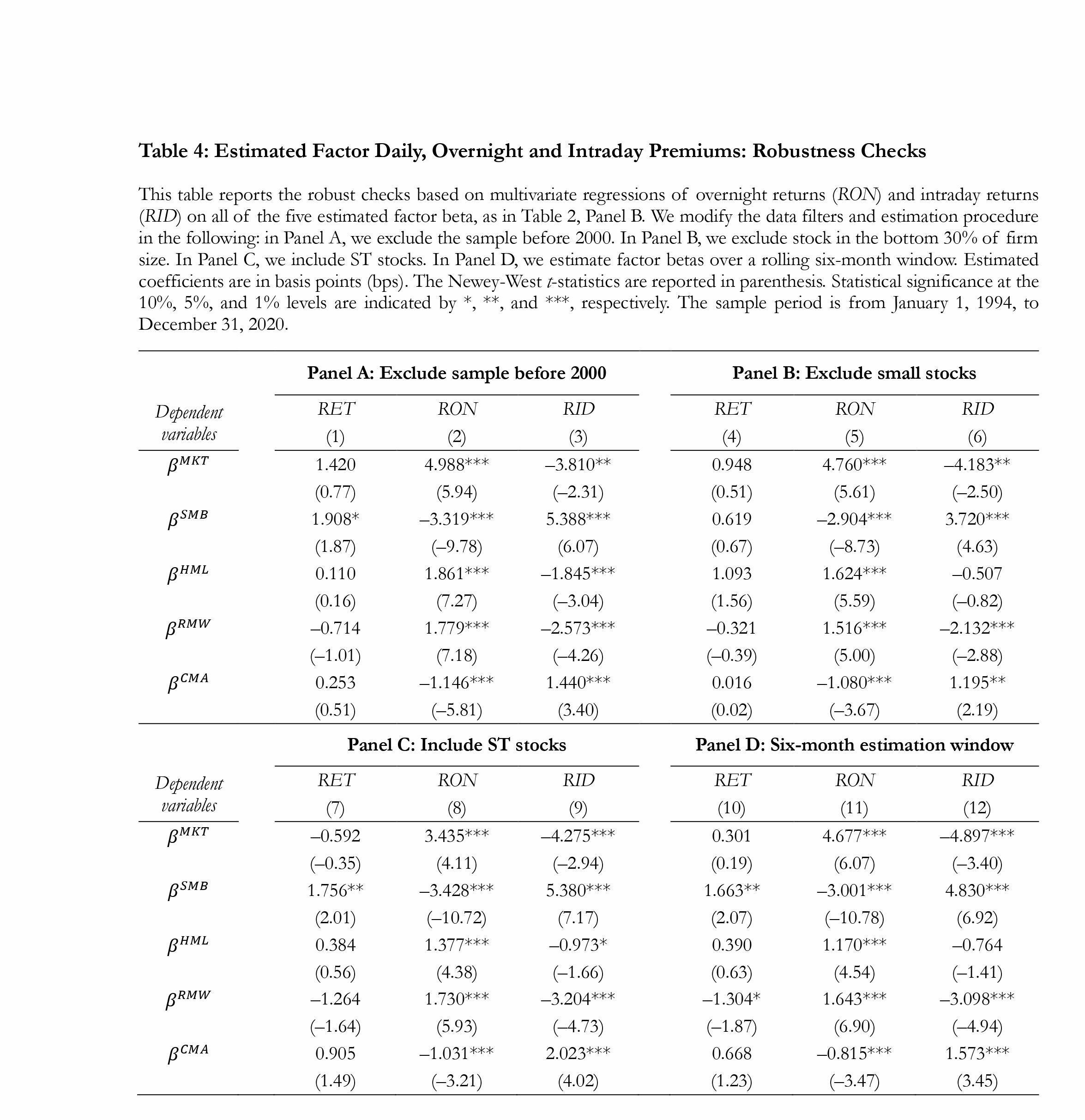

Across all panels, we find contrasting overnight versus intraday factor beta premiums. We consistently observe overnight outperformance and intraday underperformance of high MKT, HML, and RMW beta stocks. High SMB and CMA stocks exhibit the opposite pattern; overnight underperformance and intraday outperformance.

Our findings are best explained by the investor clientele theory, where retail and institutional investors alternate in being the marginal traders at the market open versus at the close for stocks with specific factor exposures. Predictable trading habits generate predictable price oscillation and return patterns, which lead to systematic factor beta premiums with alternating signs day and night.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend