Bitcoin is quite a controversial topic among the public. Many are interested in the blockchain technology or trade the cryptocurrencies, but the Bitcoin also has many opponents. Most frequently, Bitcoin is criticized for its volatility or a lack of supervision; some even call the Bitcoin a fraud. Yet many argue that blockchain is transparent. Novel research by Peterson examines the price manipulation using Benford’s law and a linkage to the anecdotal evidence of known manipulation. In theory, the distribution of leading digits in numerical data should follow the Benford’s law and any significant deviations usually signal a fraud. According to the results, in the history of bitcoin prices, several frauds were detected. The results have important implication for the Bitcoin; therefore, this research is probably a must-read for anyone interested in cryptocurrencies.

Authors: Timothy Peterson

Title: To the Moon: A History of Bitcoin Price Manipulation

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3639431

Abstract:

Unmolested prices have been shown to exhibit an expected, natural distribution characterized by Benford’s law. Deviations from this distribution indicate an anomaly, and typically that anomaly is caused by some type of fraud. With bitcoin, we conducted an analysis for the entire period of daily closing prices from July 2010 through May 2020. We also conducted analyses for calendar years 2011-2019. We can say with near 100% confidence that bitcoin’s price has been fraudulently manipulated at some point in its lifespan since 2010. We can say with 95% confidence that bitcoin was manipulated in 2013; 95% confidence that bitcoin was manipulated in 2017; and 98% confidence that bitcoin was manipulated in 2019.

We believe this is the first application of Benford’s law to bitcoin. Our ultimate aim is to raise the level of awareness such that future illicit behavior in the bitcoin marketplace is more easily identified and mitigated, either through market forces or regulatory oversight. Substantial mitigation of bitcoin price manipulation would increase bitcoin’s value by about 40%. Lastly, our findings imply that both technical and fundamental approaches to value bitcoin over the suspect periods are likely meaningless because bitcoin’s price did not reflect equally motivated buyers and sellers.

Notable quotations from the academic research paper:

“Benford’s law is an observation about the frequency distribution of leading digits in many real-life sets of numerical data. The law states that in many naturally occurring collections of numbers, the leading significant digit is likely to be small [Benford 1938]. Specifically, the number 1 appears as the leading significant digit about 30% of the time, while 9 appears as the leading significant digit less than 5% of the time. Benford’s law also makes predictions about the distribution of second digits, third digits, digit

combinations, and so on. A Benford distribution resembles a Pareto distribution. Deviations from this distribution indicate an anomaly, and typically that anomaly is caused by some type of fraud.

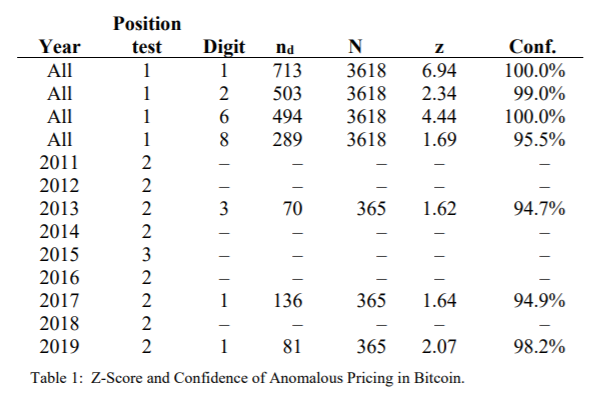

The following table from the paper shows “results for those tests where there was a 90% or greater probability of anomalous pricing.”

| What about Data? Look at Quantpedia’s Algo Trading Promo Codes. |

“Absent the anomalous periods, which we believe to be caused by artificially manipulated prices, we estimate that bitcoin’s annualized daily volatility would be approximately 50% of what the historical price record indicates. This implies bitcoin’s discount rate has been artificially higher as well, reducing the present value (and presumably price) of bitcoin. In theory at least, substantial mitigation of bitcoin price manipulation would increase bitcoin’s value by about 40%, based on a naïve Capital Asset Pricing Model. As of June 2020, this means the estimated market capitalization of bitcoin has been reduced by approximately $100 billion. Put another way, the expectation of future volatility reduces the present value of bitcoin’s market capitalization by $100 billion. But those expectations are incorporating future instances of price manipulation, which is not a farfetched assumption.

Allegations of impropriety regarding bitcoin, especially with respect to cryptocurrency exchanges, are not new. What is unique with our research is that a commonly accepted and independent methodology supports, indirectly at least, previous allegations evidence of price manipulation.

Our analysis confirmed anomalies in bitcoin prices for 2013, 2017, and 2019. We can say with near 100% confidence that bitcoin’s price has been fraudulently manipulated at some point in its lifespan since 2010. We can say with 95% confidence that bitcoin was manipulated in 2013; 95% confidence that bitcoin was manipulated in 2018; and 98% confidence that bitcoin was manipulated in 2019.”

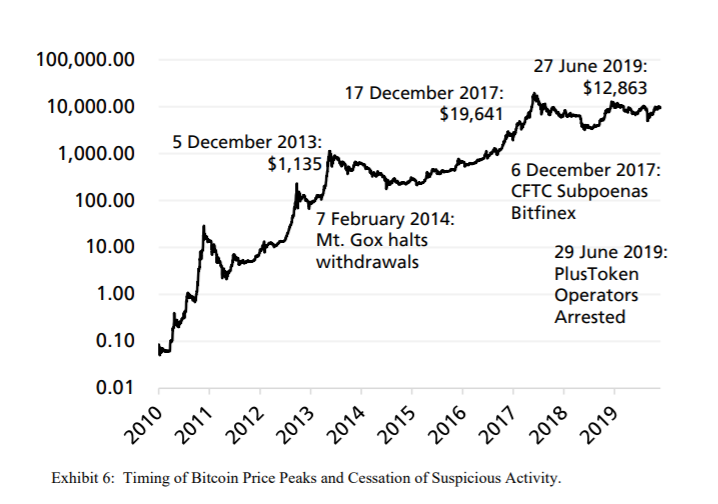

Additionally, quoting the paper: “The timing of each major decline coincides with cessation of suspected fraudulent activity”, which can be observed from the following graph.

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend