Bitcoin and other cryptocurrencies are frequently discussed nowadays. The debate has emerged mainly because of the strong uptrend in the Bitcoin price. In this blog post, we will leave the price patters to others. We will instead present interesting novel research connected to the well known theoretical model in the fiat currencies – the Covered Interest Rate Parity (CIP). If the CIP holds, interest rates and both the spot and forward rates of two countries should be in equilibrium. Novel research of Franz and Valentin (2020) examines the CIP in BTC to USD pair. The CIP theory states that there should be no arbitrage opportunities, but how the CIP holds in such a volatile market, where individual investors/traders seem to dominate? According to research, there were significant CIP deviations in the past, but it changed with the launch of BTC/USD futures in CME and high-frequency traders’ market entry. Moreover, the second event was much more successful in the reduction of deviations.

Authors: Friedrich-Carl Franz and Alexander Valentin

Title: Crypto Covered Interest Parity Deviations

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3702212

Abstract:

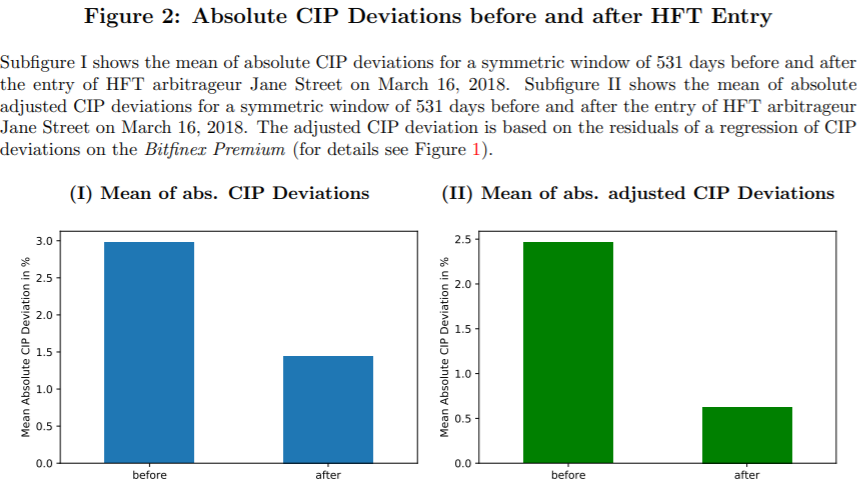

Studying deviations from covered interest rate parity (CIP) in the Bitcoin/US-Dollar (BTC/USD) market, we find large CIP deviations of up to 15% until Q1/2018. Afterwards, CIP deviations have been subdued, which we attribute to the market entry of high-frequency traders (HFTs). We argue that these market entries have increased efficiency of cryptocurrency markets with respect to CIP as well as liquidity, volatility, and bid-ask spreads. Remarkably, these efficiency gains are larger for the less liquid

cryptocurrency Litecoin. Employing a difference-in-differences design, we show that the launch of the BTC/USD future at the Chicago Mercantile Exchange (CME) did not affect market efficiency. Finally, remaining CIP deviations after Q1/2018 seem mostly related to increased credit risk of certain crypto exchanges.

As always, the results can be presented through interesting charts:

Notable quotations from the academic research paper:

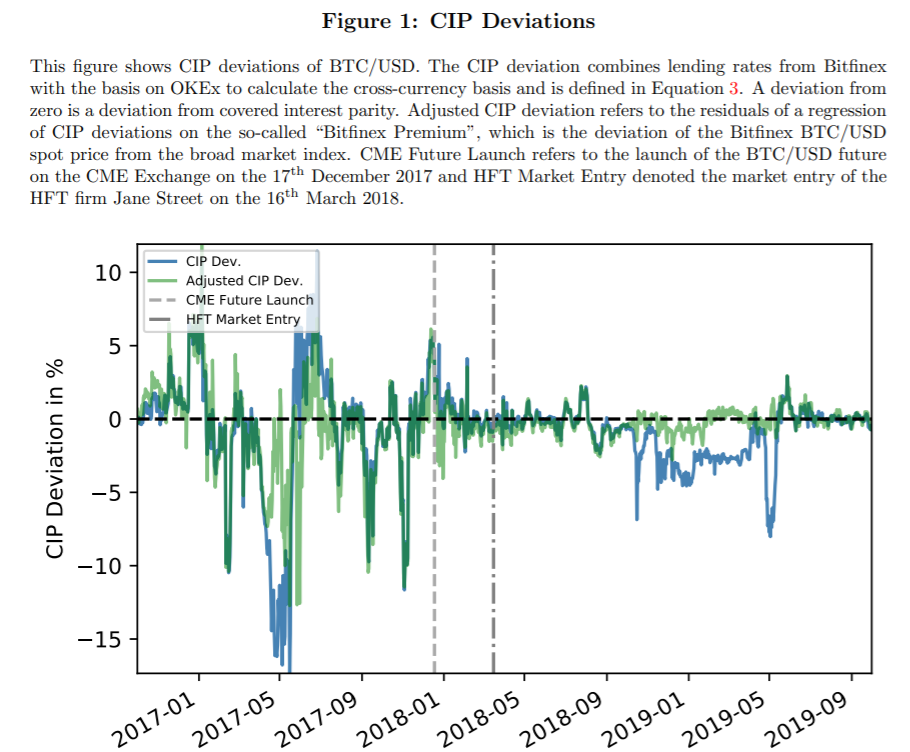

“CIP can be described as the “closest thing to a physical law in international finance” (Borio et al. (2016)), as it dictates the relation between spot, futures or forward prices, and interest rate differentials. In an arbitrage-free market, two of these components must determine the third (for details see Figure 6). However, even in the long-existing conventional currency markets, such as EUR/USD, it does not hold. While Rime et al. (2017) argue that deviations from CIP occur due to funding constraints, Du et al. (2018) see regulatory constraints as a driving force of CIP deviations. Consequently, CIP deviations reveal a lot about market efficiency and frictions under which market participants operate. In this paper, we show that there have been large CIP deviations especially in the early stages of the crypto market. Figure 1 shows that CIP deviations of BTC/USD have been large, e.g. up to 15% in mid-2017, pointing to inefficiencies that leave ample room for arbitrageurs. As crypto exchanges have not been subject to a strict regulatory regime and the size of CIP deviations in the crypto space cannot be rationalized by potential funding costs alone, we add to the existing literature by shedding light on the role of sophisticated arbitrageurs.

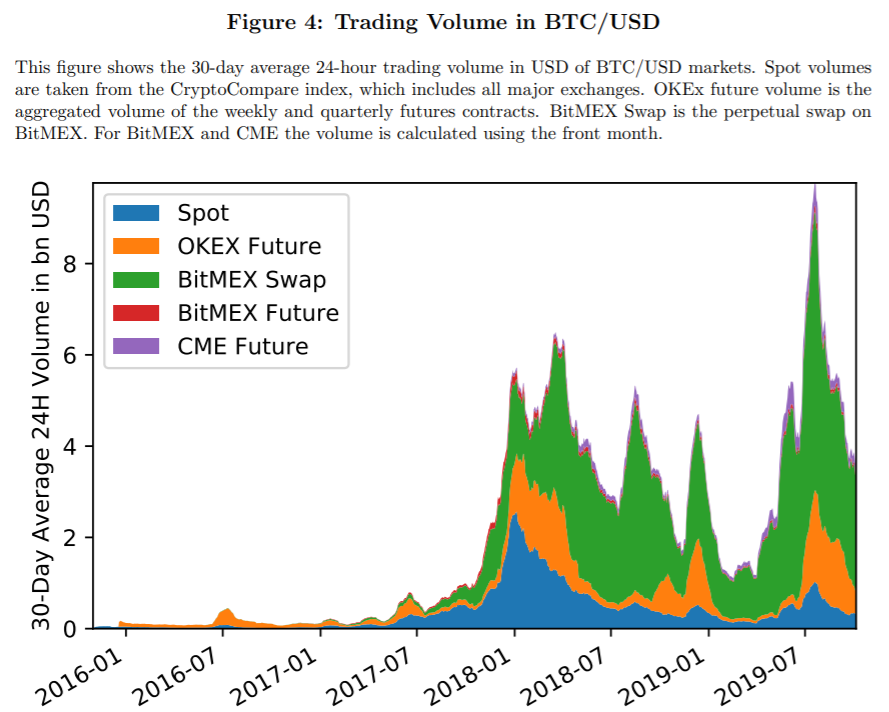

First, we provide a framework to calculate the cross-currency basis in the cryptocurrency space. Employing deviations from this crosscurrency basis in a difference-in-differences design and in a panel regression, we rationalize the decline after Q1/2018 by the entrance of sophisticated arbitrageurs. Consequently, we demonstrate that professional arbitrageurs, such as HFT firms, are needed to make even basic arbitrage mechanisms hold. Second, the introduction of the Chicago Mercantile Exchange (CME) BTC/USD future in Q4/2017, i.e. the possibility to trade BTC outside the crypto space, which received much attention in the cryptocurrency literature, e.g. in Hale et al. (2018), only had a limited effect on market efficiency and did not provide a suitable tool for professional arbitrageurs. Third, we show that the presence of HFT firms is even more important for illiquid markets, such as LTC compared to BTC.

CIP deviations in BTC/USD have been large in 2016 and 2017 but have been subdued since Q1/2018 due to professional arbitrageurs stepping in. Market efficiency has also improved with respect to liquidity, volatility, and bid-ask spreads. Our results are in line with other studies such as Menkveld (2013) that find improved market conditions after the entry of HFT firms. Moreover, the importance of HFT seems to be even larger in more illiquid markets as the improvements of market efficiency are not exclusive to BTC but appear to be even stronger for the more illiquid altcoin LTC.

Additionally, our results demonstrate that the crypto ecosystem seems to be relatively independent of the fiat world. For example, the introduction of the CME future faced little demand and does not seem to be required upon by HFT firms. This view supports studies such as Baur et al. (2018), that struggle to find a common driver in crypto and fiat returns.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend