The pandemic of COVID-19 brought many changes for the whole humanity. The financial markets were no exception, but the trading has continued. Nowadays, the order can be placed from anywhere around the world and almost all stock exchanges are electronic and algorithmic. However, there is still one exchange where the floor trading exists – NYSE. During these tough times, NYSE was also purely electronic, the floor trading was closed, and human interaction was not possible. A novel study by Brogaard, Ringgenberg and Roesch examines the role of floor traders in the recent era driven by computers. The conclusion is clear: in the current digital age, floor traders still matter.

Authors: Jonathan Brogaard, Matthew C. Ringgenberg, Dominik Roesch

Title: Does Floor Trading Matter?

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3609007

Abstract:

While algorithmic trading now dominates financial markets, some exchanges continue to use human floor traders. On March 23, 2020 the NYSE suspended floor trading because of COVID-19. Using a difference-in-differences analysis, we find that floor traders are important contributors to market quality, even in the age of algorithmic trading. The suspension of floor trading leads to higher effective spreads, volatility, and pricing errors. Moreover, consistent with theoretical predictions about automation, the effects are strongest during the opening and closing auctions when complexity is highest. Our findings suggest that human floor traders improve market quality.

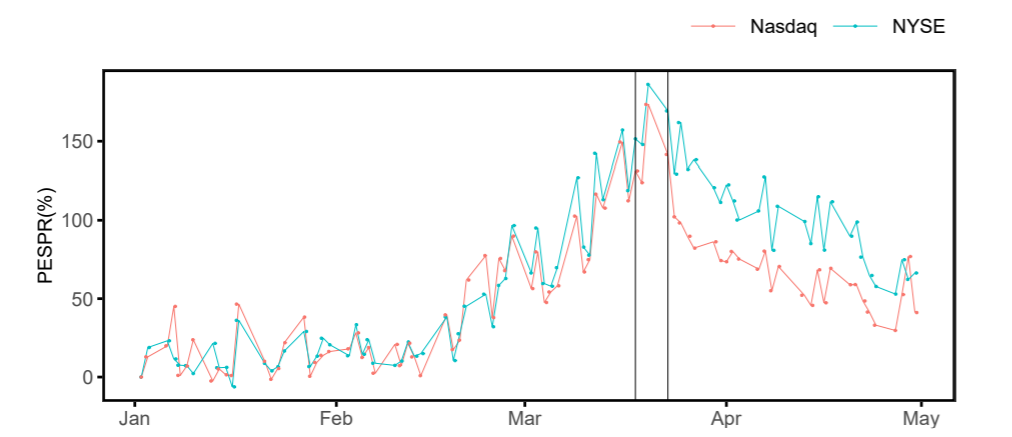

If floor traders are not present, spreads between stocks listed on NYSE and another exchange are widening. As always, the information is the best absorbed visually (for proportional effective spreads):

| Algo Trading Promo Codes are available exclusively for Quantpedia’s readers. |

“This figure shows proportional effective spreads (PESPR) in per cent for all matched NYSE and Nasdaq listed stocks in our sample. We calculate changes in PESPR since January, 1st 2020 per stock-day and plot the daily marketcap-weighted average PESPR across all stocks in our sample. The first vertical line (2020-03-18) indicates the announcement of the event, the closing of the NYSE floor. The second vertical line (2020-03-23) indicates the event day. Data is from CRSP and TAQ.”

Notable quotations from the academic research paper:

“We find that human floor traders improve market quality. Because of COVID-19, the NYSE closed floor trading on March 23, 2020 and moved to fully electronic trading. Using the abrupt change as an exogenous shock to floor trading activity, we examine a differencein-differences analysis to identify the effect of floor traders. We find that market quality deteriorates after floor traders are removed. Across a wide-variety of specifications and outcomes, we see that the removal of floor traders leads to lower liquidity, higher volatility, and larger pricing errors. The results are strongest during and around the opening auction and the closing auction, when complexity is highest.

We find the price process becomes more volatile for those stocks that lose their floor traders. That is, pricing errors increase, price impacts become larger, and intraday volatility rises. Overall market quality deteriorates after the removal of floor traders.

Our results show that the removal of floor traders leads to worse market quality. The question is, why? Theoretically, labor that is more easy to automate is more likely to be displaced by technology shocks. For example, Autor and Dorn (2013) develop a model of job market displacement by automation technology and they argue that routine tasks, whichfollow precise well-defined procedures, are more likely to be automated. In our setting, the question is whether liquidity provision is routine or complex? Carlin, Kogan, and Lowery (2013) show that when complexity is high, market quality is lower. To examine whether human floor traders are more beneficial when liquidity provision is more complex, we split our results into half-hour intervals during the trading day to understand when floor traders provide the largest benefit; the first and last half hours of each day contain the opening and closing auctions, respectively. Interestingly, the results show that floor traders are most important at the opening auction, from 9:30 am to 10 am (immediately following the opening auction), and at the closing auction. This is likely when liquidity provision is least routine; thus, consistent with Autor and Dorn (2013), the results suggest that floor traders matter because some aspects of liquidity provision are not routine and thus not easy to automate.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend