ETF Liquidity

Exchange-traded funds (ETFs) have become popular and important investment vehicles in the financial markets. However, that is not a shock given the numerous benefits connected with ETFs. Naturally, they have caught the interest of academics, and there is plenty of literature about strategies on ETFs. While the profits and trading strategies are probably the most important research topics for practitioners, liquidity in the financial markets is almost equally important. Concerning liquidity in the ETFs, novel research by Pham et al. shows when exactly are ETFs the most liquid. Looking on the spreads, they are the lowest at market close. Such a finding can be an essential part of an optimal trading position making, where the aim is to minimize the trading costs.

Authors: Pham, Son Duy and Marshall, Ben R. and Nguyen, Nhut (Nick) Hoang and Visaltanachoti, Nuttawat

Title: Predicting ETF Liquidity

Link: https://ssrn.com/abstract=3645887

Abstract:

A substantial amount is incurred in ETF transaction costs each year. This paper examines the performance of a vector autoregressive (VAR) model and other naive models to time trades in 1,350 ETFs over the 2011 to 2017 period. We find varied spread savings for large and retail ETF traders by timing trades. A large ETF trader can save 7.40% of ETF spread costs whereas trading at the market closing time would be optimal for a retail ETF trader to reduce spread costs. The spread savings for large ETF traders are diverse across ETF sectors and depend on the spread volatility.

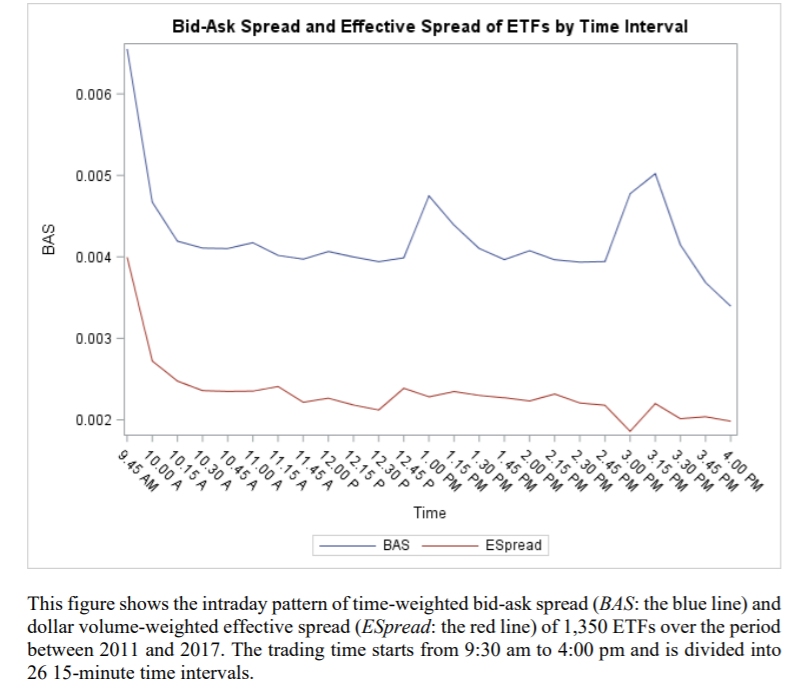

We can generalize that the lowest spreads are at the close, but the paper also presents a VAR model to predict intraday spreads. As always, the spreads are best visible plotted:

Notable quotations from the academic research paper:

“First, while some ETFs have low bid-ask spreads, which are likely to

have little impact on active investors, many ETFs do not. The ETF spreads in our sample range from 0.03% at 1st percentile to 4.42% at 99th percentile. This implies that the cost of trading many ETFs is an important component of the return many active ETF investors receive. Second, ETFs are an important and growing component of equity trading. By 2016, ETFs accounted for approximately 30 percent of all U.S. equity trading by value with an average daily transaction value of around USD 90 billion.

| Algo Trading Data Discounts are available exclusively for Quantpedia’s readers. |

We use an unrestricted vector autoregressive (VAR) model based on Taylor’s (2002) model to predict intraday ETF bid-ask spreads for 1,350 US ETFs between January 2011 and December 2017. The VAR model assumes ETF bid-ask spread is dependent on its past spread, past degree of return volatility, past level of trade volume, and past level of trade intensity. We find that this model is superior to a moving average model in predicting short-term ETF bidask spreads. Moreover, splitting and timing trades based on predictions from this model brings meaningful transaction cost savings for large ETF traders compared to the other trading schedules.

We document that the optimal trading schedule for ETFs to minimize bidask spread cost largely depends on the type of traders. For a large ETF trader who is more likely to split his order to hide his trading motives, the VAR trading schedule is superior to other trading schedules. For a retail ETF trader who does not possess private information and trades a small amount of ETF shares, trading at the close is the best in terms of spread saving as ETF bid-ask spreads tend to be lowest around the closing time.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Would you like free access to our services? Then, open an account with Lightspeed and enjoy one year of Quantpedia Premium at no cost.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend