Trading on non-public information has been very profitable in the past (and probably still is). Prominent insiders use their knowledge and share it with influential, wealthy institutional investors who earn money in an illegal way. And especially, options provide attractive leverage and relatively viable ways to “hide” sources of this illegal advantage. But after several big scandals, the resurgence of some forms of insider trading was stopped in 2009 after a trial with hedge fund superstar Raj Rajaratnam. That “edge” has clearly disappeared from day to day.

The question is: What is the situation now? Are there any “new methods” in the options’ space to exploit private information? Recent research from Bondarenko and Muravyev tries to shed some light on using options in insider trading and has the goal of finding out if it is still an actual problem. The paper shows that after the start of the campaign against insider trading, some of the fingerprints of option insider trading vanished; the return predictability induced by the put-call ratio was muted, and options trades’ volumes based on this phenomenon dropped. However, prevalent methods of following and mimicking trades through analysis of options “flow,” which may indicate non-public signals from public data (“legal private information”) are still alive and relevant.

Authors: Oleg Bondarenko and Dmitriy Muravyev

Title: A Tale of How Common is Insider Trading? Evidence from the Options Market

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4150768

Abstract:

Option traders are considered among the most informed investors because their trades strongly predict future stock returns. We identify the source of their information edge using a quasi-exogenous shock to insider trading enforcement. With the arrest of Raj Rajaratnam, prosecutors launched an unprecedented campaign against insider trading making such trading much riskier. Before the arrest, the put-call ratio that aggregates information content of option trades earned a 0.24% weekly alpha among S&P 500 stocks. But this striking predictability suddenly disappeared shortly after Raj’s arrest, as option investors refrained from trading on insider information. These results suggest that insider trading used to be prevalent in the options market and explain why option trades used to predict stock returns.

As always we present several interesting figures and tables:

Notable quotations from the academic research paper:

“We follow the pioneering approach of Pan and Poteshman (2006), who study informed trading by considering how the put-call ratio predicts stock returns. For a given stock and date, the put-call ratio is computed as the volume of put purchases divided by the volume of call purchases. Only purchases that open new option position are considered. Intuitively, buying a call (put) signals positive (negative) future stock returns. The ratio is computed separately for volume executed at the two largest options exchanges, the Chicago Board Options Exchange (CBOE) and the International Securities Exchange (ISE), from May 2005 to May 2017. We limit the sample to stocks in S&P 500 index because their options are liquid enough to attract institutional investors and because S&P 500 provides a consistent panel to compare return predictability over time.

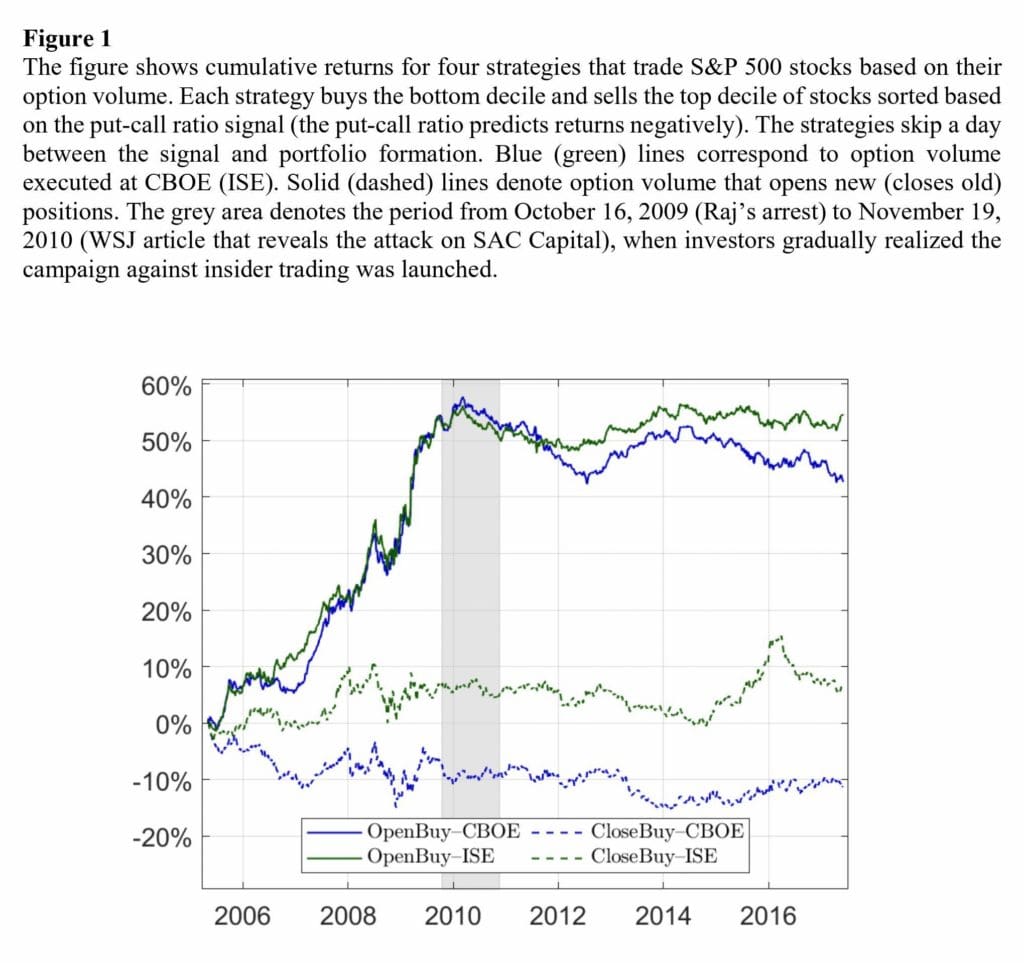

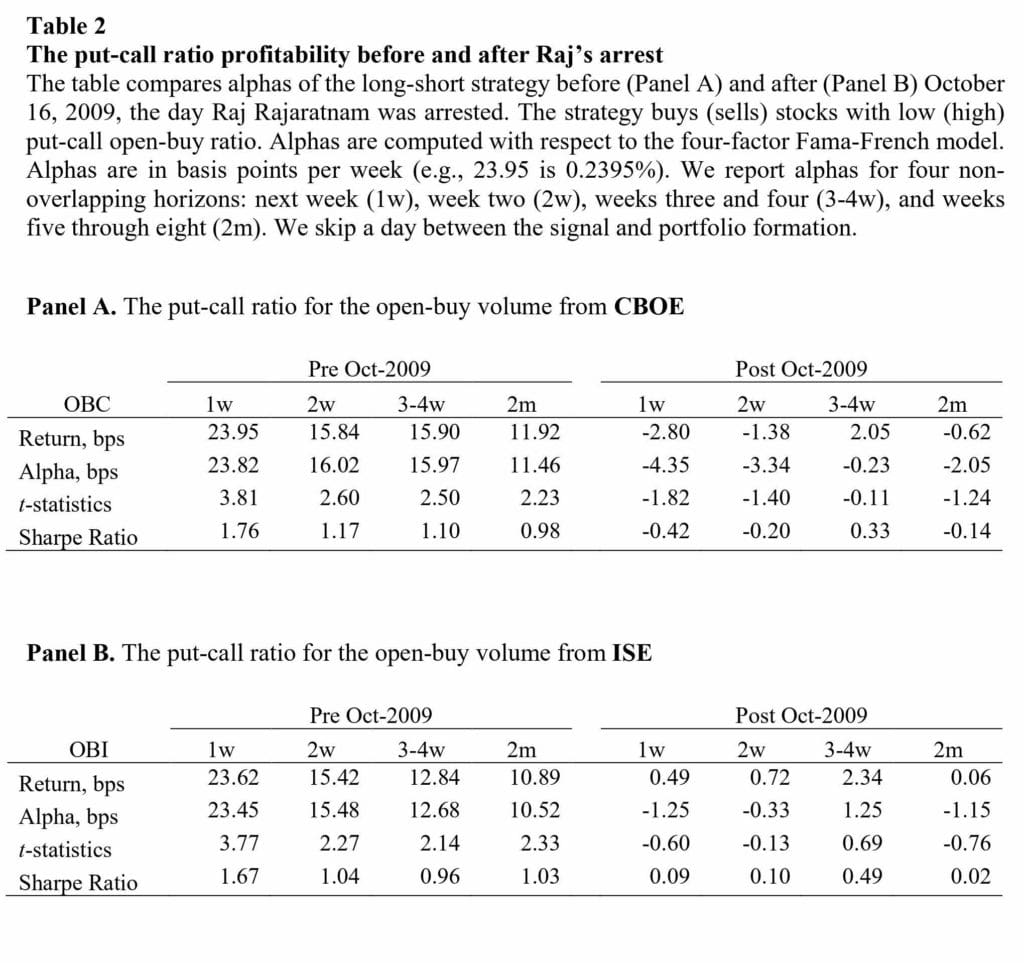

We present several main results. The put-call ratio strongly predicts stock returns before Raj’s arrest in October 2009. In portfolio sorts, the decile portfolios with the highest put-call ratio underperform the bottom decile portfolios by 0.24% next week, or 12.1% per year. The predictability is highly statistically significant with t-statistics of 3.8 for both the CBOE and ISE ratios. The annualized Sharpe ratios are high, 1.76 and 1.67. The abnormal returns barely change when we risk-adjust them with the four-factor Fama-French model that includes the momentum factor. The alphas remain stable pre-arrest including the 2008 financial crisis. Fama-MacBeth regressions control for standard return predictors and confirm the portfolio sort results.

Raj’s arrest was a huge shock to the market – S&P 500 E-mini futures plunged by 0.6% within an hour after he was arrested at 6:20 am on October 16, 2009. The market dropped by another 0.6% by 10:00 am as Preet Bharara, U.S. Attorney for the Southern District of New York, announced that it was the largest insider trading case in history and finished with a warning. “It should be a wake-up call for every Wall Street trader who is even thinking about engaging in insider trading.” As we show below, option investors internalized and responded to this message.

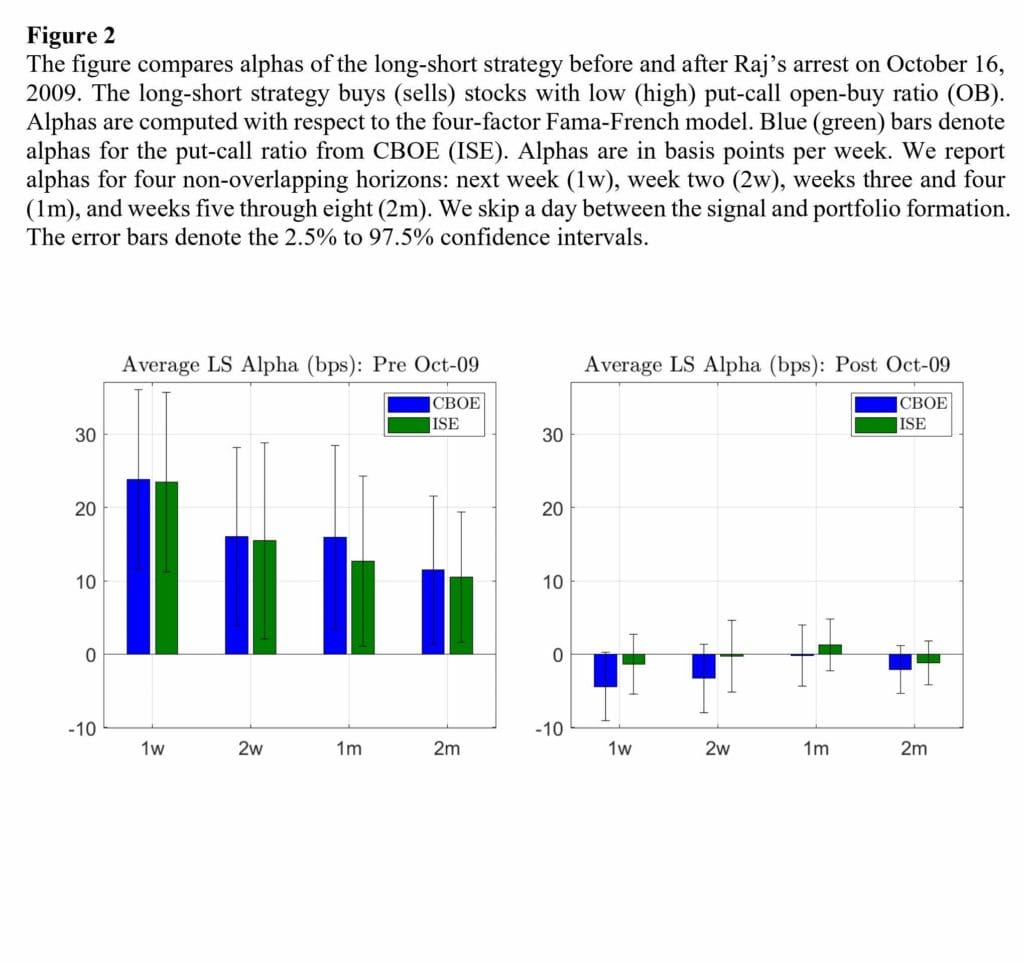

Strikingly, the return predictability by the put-call ratio abruptly disappeared shortly after Raj’s arrest and remained so for the rest of the sample period. The alphas of the long-short strategy for CBOE and ISE ratios dropped from 0.24% and 0.23% per week pre-arrest to -0.04% and -0.01% post-arrest. The corresponding t-statistics drop from 3.8 and 3.8 to -1.8 and -0.6. Option volume from both exchanges suddenly stopped predicting stock returns. Fama-MacBeth regressions confirm the portfolio sort results.

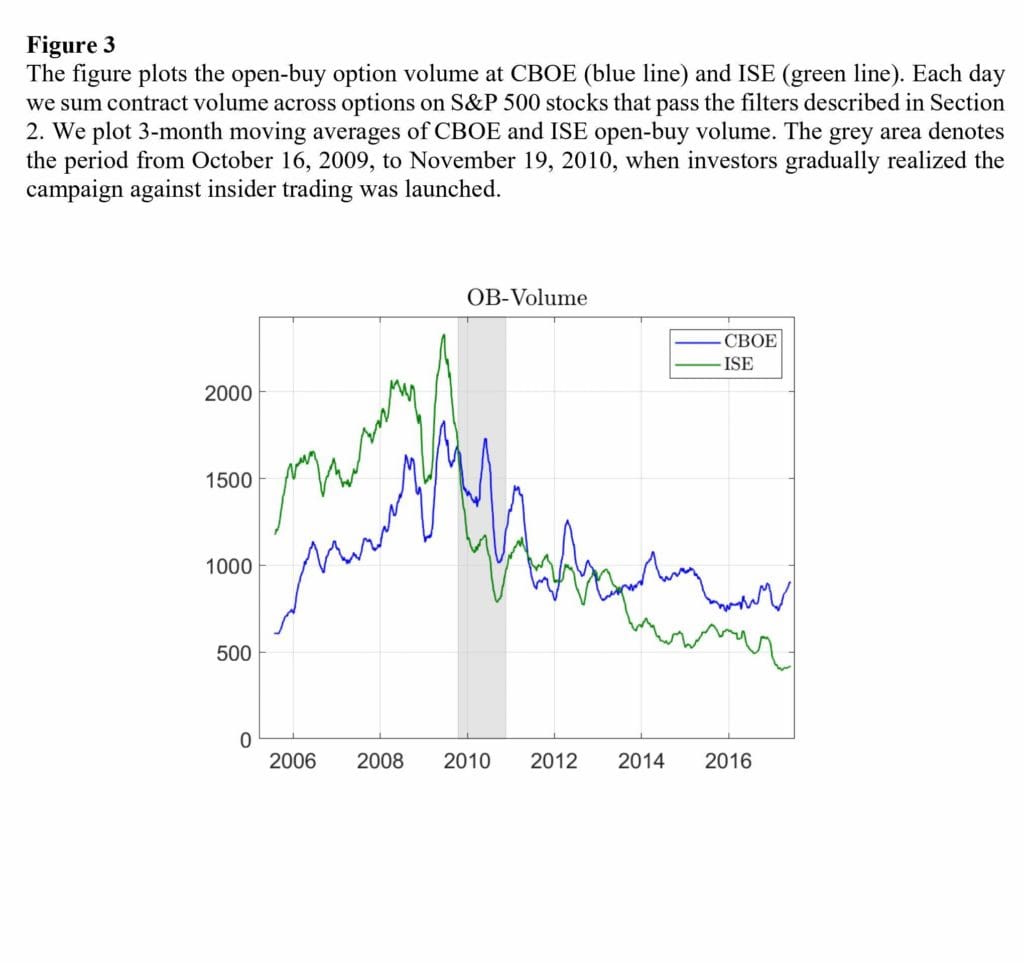

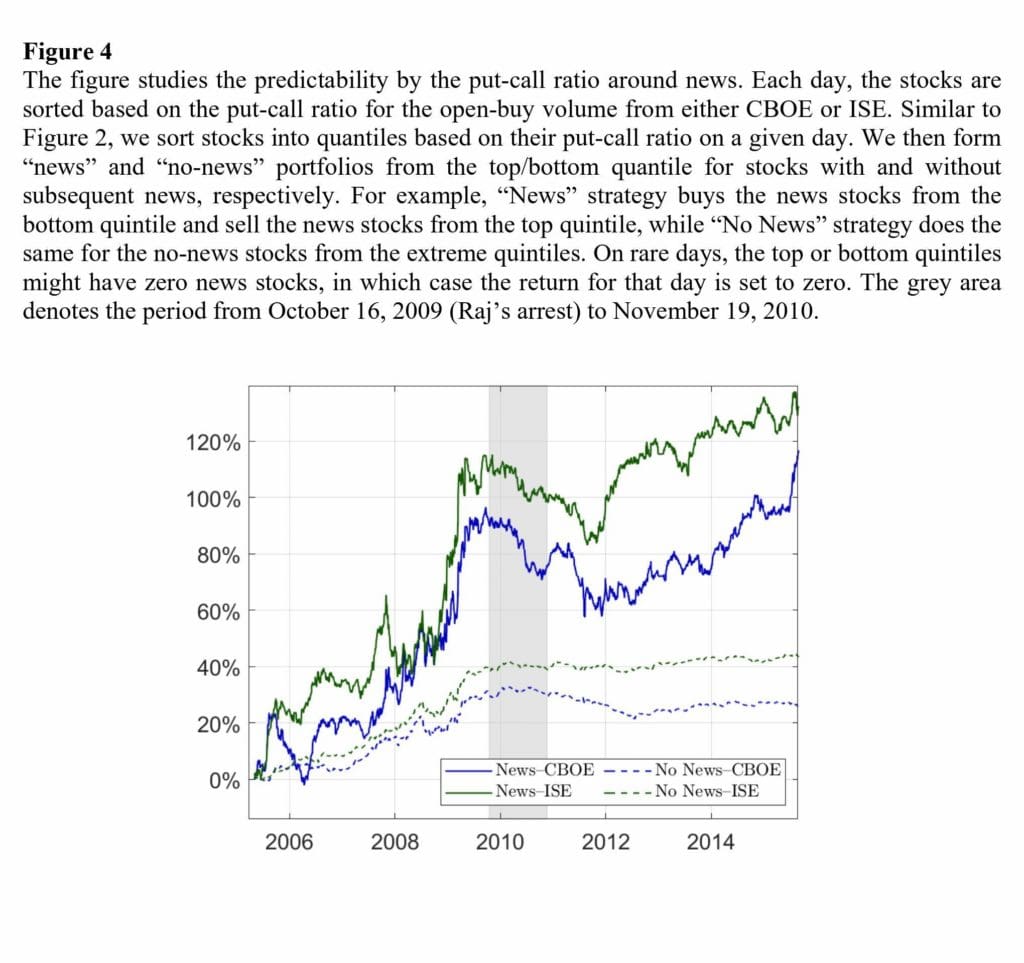

We further test the insider trading hypothesis. First, if insiders constitute a large enough share of option volume and then stop trading, then option volume will decline post-arrest. Indeed, open-buy volume from CBOE and ISE reaches the all-time high around Raj’s arrest and subsequently declines, which we further confirm with panel regressions. Stock volume declined slightly post-arrest suggesting that at most few option insiders switched from options to stocks. Second, the return predictability is fully driven by option contracts with high embedded leverage, which are particularly attractive to informed investors. Finally, prosecuted insider cases are concentrated before important stock-specific news such as earnings and merger (M&A) announcements. We find that the put-call ratio predicts returns stronger for weeks that contain unscheduled news than for no-news weeks. But this stronger predictability prior to news disappeared post-arrest.

The put-call ratios from CBOE and ISE predict returns for S&P 500 stocks extremely well in the pre-arrest period (between May 2005 and October 2009). Table 2 shows the performance for the long-short strategy for the put-call ratios from CBOE and ISE in Panels A and B. This strategy earns alphas of 23.8 basis points (pbs) and 23.5 pbs per week for CBOE and ISE signals, respectively, or 12.0% per year.6 The alphas are highly statistically significant with t-statistics of 3.81 and 3.77, respectively. The Sharpe ratios are 1.76 and 1.67, much higher than a 0.04 Sharpe for the strategy that buys and holds S&P 500 index during this period. Figure 2 shows cumulative returns for the long-short strategy and indicate that the predictability remains remarkably stable even during the 2008 financial crisis. In fact, the returns are positive in every calendar year.

What can explain this remarkable return predictability? The risk-based explanations struggle to explain it. The long-short strategy returns are unaffected by risk-adjustment; and it is hard to justify why some S&P 500 stocks earn 12% per year more than other broadly similar stocks. In fact, the put-call ratio is the biggest stock anomaly for the sample of S&P 500 stocks. Trading and shorting costs also cannot explain the predictability. S&P 500 stocks are always easy to short because of the ample supply from S&P 500 index funds. Furthermore, in untabulated results, we show that alpha comes primarily from the long side that requires buying a stock. Similarly, trading costs are low for S&P 500 stocks; institutional investors, who rely on execution algorithms, estimate the costs of trading S&P 500 stocks at about 6 bps. (Frazzini, Israel, and Moskowitz (2018)). Pan and Poteshman (2006) interpret their results as “strong and unambiguous evidence that there is informed trading in the option market,” and “the predictability appears to be driven by valuable nonpublic information which traders bring to the option market.” Building on their work, we identify the source of “valuable nonpublic information.” Investors can either extract nonpublic signals from public data or obtain nonpublic information directly from corporate insiders. While the former is legal, the latter is typically illegal. Distinguishing between these two channels is hard because investors hide the source of their information edge to preserve alpha. Luckily, a major shock to insider trading enforcement occurred during our sample period. Investors who trade on public information will not respond to the insider enforcement campaign, while investors who trade on nonpublic information will cut their trading.

We repeat the analysis of the last section for the post-arrest period and compare the results to the pre-arrest period. The put-call ratio was the strongest return predictor for S&P 500 stocks pre-arrest. But this predictability suddenly disappeared after Raj Rajaratnam’s arrest on October 16, 2009. Table 2 show that the long-short alpha for put-call ratio from ISE drops from 23.5 pbs per week pre-arrest (t-statistics of 3.8) to -1.3 bps post-arrest (t-statistics of -0.6). Similarly, alphas for CBOE ratio and for other return horizons also drop to near zero. Figure 2 highlights the discontinuity in weekly alphas pre- and post-arrest. Pre-arrest alphas are statistically significant up to two months while none of post-arrest alphas are significant and range from -4.4 bps to 1.3 bps. Similarly, for Fama-MacBeth regressions in Table 4, the coefficient for the put-call ratio from ISE (CBOE) drops from -0.20 to 0.01 (from -0.13 to 0.03) post-arrest and is insignificant. Suddenly, option trades are no longer informative about future stock returns.

Our results are most consistent with the hypothesis that the return predictability induced by the put-call ratio was driven primarily by option trading on potentially illegal insider information. After Raj’s arrest, option investors who traded on inside information realized the increased risks and quit trading options. While investors could still trade on legal private information, the lack of return predictability post-arrest indicates that trading on such information was not widespread in options. Remarkably, all the informed trading in options, a major financial market, appears to be fueled by insider information. Thus, insider trading is much more prevalent than previously thought or is implied by the number of the prosecuted cases. This paper’s results improve our understanding of informed trading and insider trading in general.

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend