Investor Sentiment and the Eurovision Song Contest

The summer is slowly approaching; therefore, our new article will be on a little lighter tone. We will examine a research paper on a periodic event with sentiment implications:

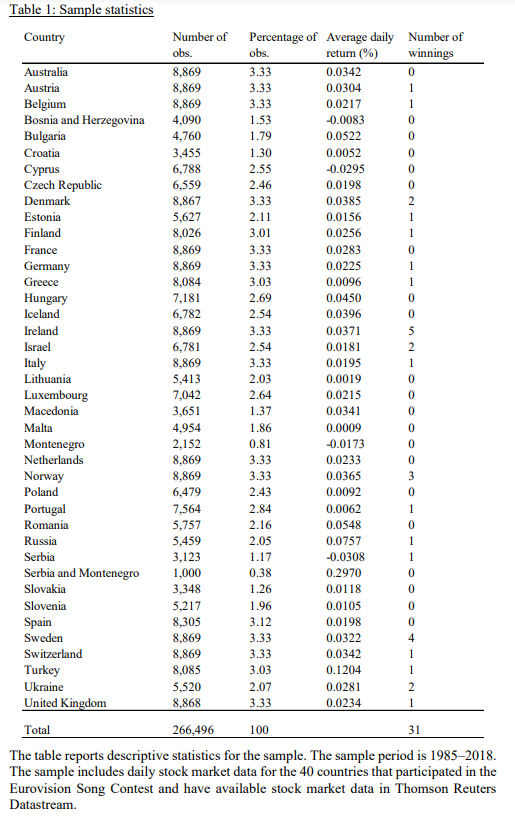

International events, such as sports tournaments and talent competitions, can affect stock market prices by changing investor mood. Many studies have examined the influence of investor sentiment on future cash flows and investment risks. The authors focused on a specific song competition – the Eurovision Song Contest, an international song competition organized annually. Every year approximately 40 delegations represent their country in the contest. The participants compete for one evening, followed by the winner announcement. No surprise, the grand finale is viewed by tens of millions of people worldwide, and the victory in the competition creates common feelings of national pride.

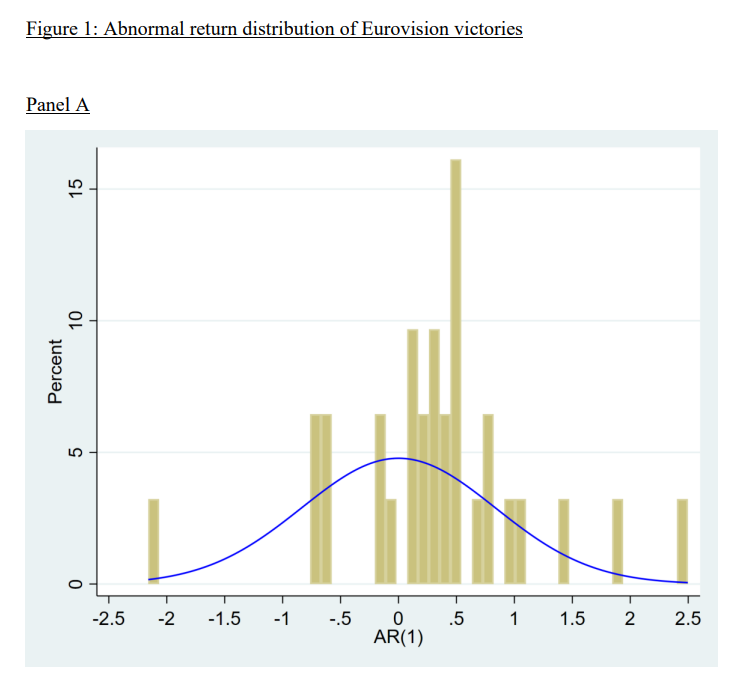

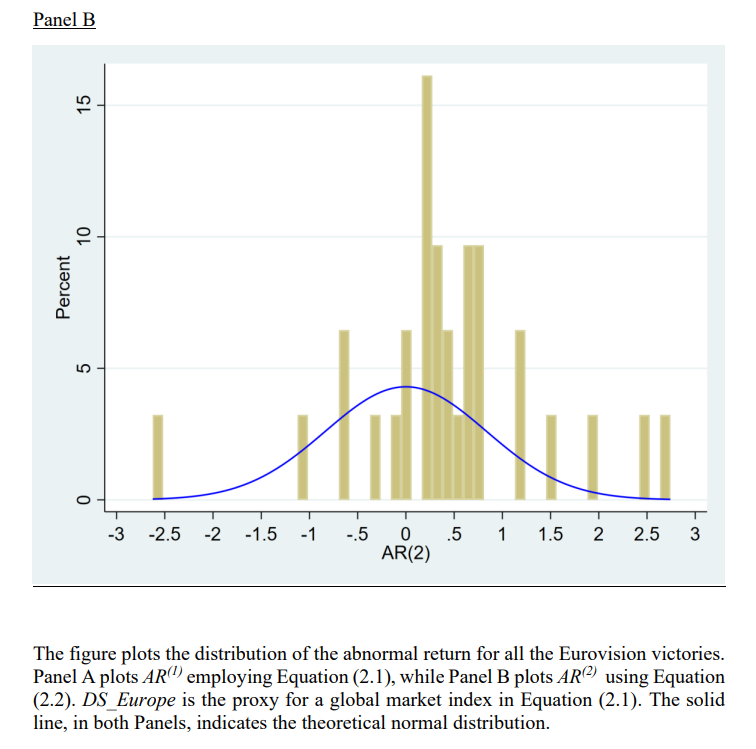

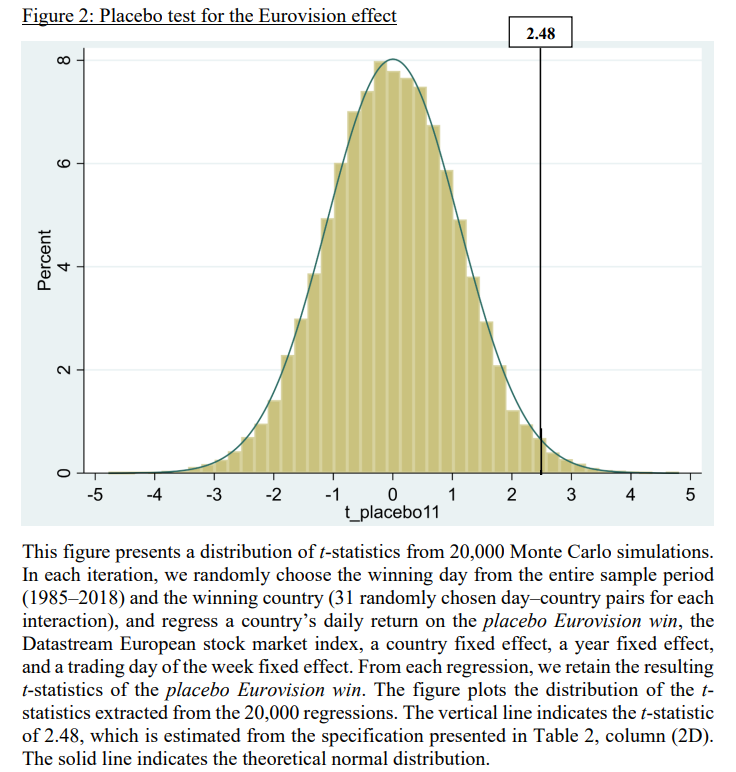

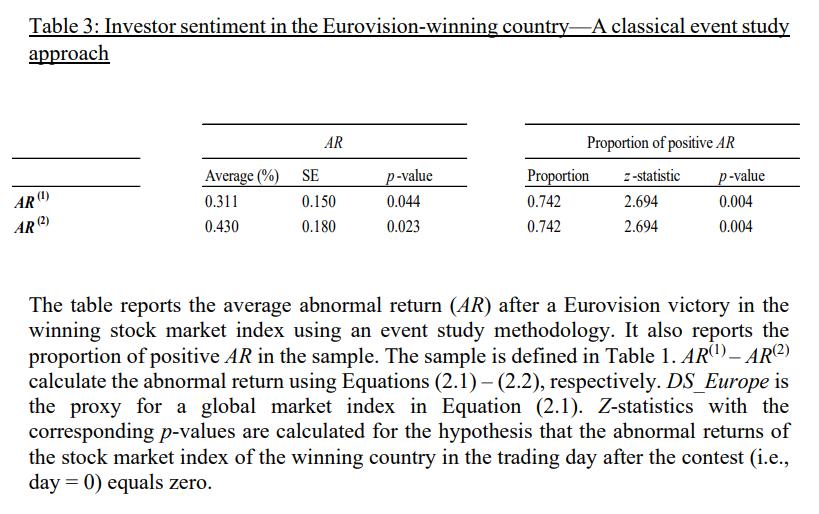

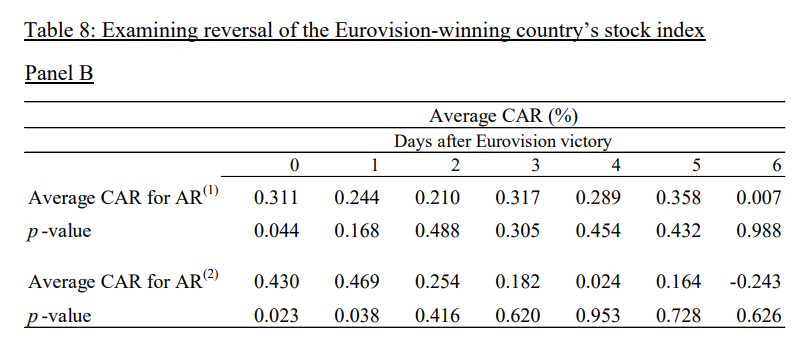

The authors of the recent academic paper (Abudy, Mugerman, Shust) examined a positive swing in investor mood in the winning country the day after the Eurovision Song Contest and documented an average abnormal return of 0.381%. On the contrary, they did not find any negative sentiment in other participating countries. To check the robustness, they applied a placebo test. The results confirmed that obtaining such an abnormal return accidentally is negligible. Additionally, the authors concluded that the positive sentiment is unique to the winning country and is not affected by other events that occur at the same time. Finally, they examined if the positive effect comes from expected economic benefits rather than investor sentiment. The test disproved this assumption and stated that the positive change acquired from an unexpected positive boost in investor mood. Last but not least, according to the authors, the positive effect is reversed within days.

Authors: Menachem (Meni) Abudy, Yevgeny Mugerman and Efrat Shust

Title: The Winner Takes It All: Investor Sentiment and the Eurovision Song Contest

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3602738

Abstract:

This paper investigates the stock market reaction to a change in investor mood following the Eurovision Song Contest—an annual international song competition and one of the most watched non-sporting events globally. Contrary to existing literature on international competitions, we find a positive swing in investor sentiment in the winning country. The elevated atmosphere is reflected in a positive abnormal return of approximately 0.35% on the first trading day after the victory. This finding is robust to various event-study methods and to various benchmarks. This positive return is reversed several days later. Further, we do not find any indication of negative sentiment in other participating countries; specifically, in countries perceived as the losers of the contest. Finally, we do not find any indication that the positive market reaction reflects economic benefits stemming from a victory. Overall, we conjecture that a competition structure is an important determinant of investor sentiment in stock markets.

As always, we present several interesting figures:

Notable quotations from the academic research paper:

„The Eurovision Song Contest is an annual international song competition organized by the European Broadcasting Union (EBU). To study the change in investor mood following the Eurovision final, we analyze daily stock returns of 40 capital markets of the participating countries for the period 1985–2018.

First, we employ an event study methodology that is suitable for the estimation of events that occur at the same calendar time. Using this approach, we document an average abnormal return of 0.381% on the first trading day following a victory.

As an additional robustness check, we also employ a placebo test in which we randomly choose the winning country and the winning day. The results confirm that the probability of obtaining such an abnormal return by coincidence is negligible.

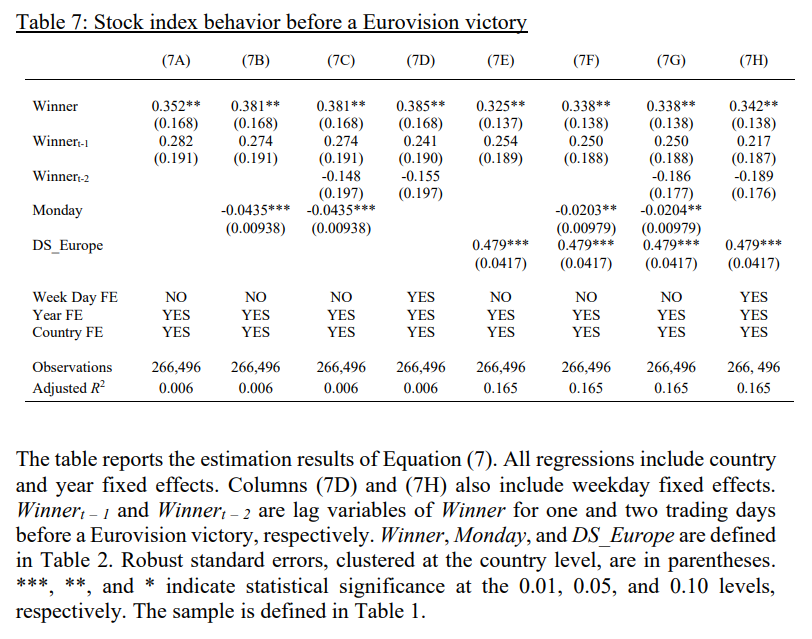

Next, we verify that the positive stock market reaction is unique to the winner and not shared by other countries that participate in the contest. First, we find that countries that come second place do not record any significant positive return on the first trading day after Eurovision. The same is true for countries that come from third to seventh place. Second, the market returns of all countries participating in Eurovision’s final on the first trading day after the contest are also insignificant. Third, to exclude the possibility that the abnormal return in the winning country results from an event that began before the contest, we examine the abnormal return one and two days before the Eurovision victory and find that the returns during these days are statistically insignificant. Taken together, these results lead us to conclude it is winning the Eurovision contest and not the date of the contest or the participation in the contest that generates the winning country’s positive abnormal stock market return.

After confirming the positive effect of Eurovision victories, we test whether there is a negative effect for countries that are perceived as the losers of Eurovision. Specifically, we focus on countries that receive very few points. In all cases, we find that the abnormal stock market return for countries in the loser category is statistically insignificant, on average. These findings indicate that when the competition is constructed so one participant wins over many others simultaneously, the reaction of investors is to a victory, and a loss does not have a significant effect on investor mood.

Next, we examine whether the positive returns recorded after Eurovision victories are followed by a reversal effect. We investigate the winning countries’ returns over the week subsequent to the event date (i.e., the week following the first trading day after the contest) using the various methodologies we employ to document the initial abnormal return. The findings suggest that, regardless of the methodology employed, the returns during this week are, on average, negative. The cumulative abnormal return becomes insignificant after two trading days, and by the end of the seventh trading day after the contest, the cumulative abnormal return completely reverses.

Finally, we examine an alternative explanation for the positive returns we document following a Eurovision victory. One may argue these returns reflect expected economic benefits rather than a change in investor mood. Our analysis shows that investors do not consider the future hosting of the Eurovision as economically meaningful, since the effect of a victory on the leisureindustry index is statistically insignificant. This result reinforces our conclusion that the positive effect we document is due to a sudden positive boost in investor mood arising from winning the Eurovision rather than expected economic benefits.

Collectively, our results are consistent with the notion that, on average, a victory in the Eurovision leads to strong feelings of national pride, which are reflected in positive market sentiment.“

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Would you like free access to our services? Then, open an account with Lightspeed and enjoy one year of Quantpedia Premium at no cost.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend