Quantitative Easing policy in the US triggered a massive inflow of liquidity to financial markets. This liquidity, combined with the growing popularity of commodities as an asset class, is a cause for a higher inter-connectedness among equity and commodity markets. A recent academic study written by Ordu-Akkaya and Soytas shows that commodities are not such a good diversifier as they used to be in the past. Moreover, commodity markets are also affected, as periods of higher equity volatility impact commodities significantly more …

Authors: Ordu-Akkaya, Soytas

Title: Unconventional Monetary Policy and Financialization of Commodities

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3441666

Abstract:

We examine whether volatility spillover between US equity and commodity markets has significantly changed with the heavy influx of index traders in commodity derivatives markets, which is a phenomenon referred to as financialization. Previous findings show that institutional traders enter commodity markets at high liquidity episodes. Given that quantitative easing episode was highly criticized for providing excessive liquidity to the market, we investigate the impact of US quantitative easing policy on spillover between commodity and US stocks. Our results indicate that during post-financialization period, spillover from stocks to commodities have significantly increased for almost all commodities. More importantly, we show that quantitative easing is one of the underlying reasons for increasing volatility spillover between markets. Including interest rate, currency factors or default spread does not diminish the explicit role of quantitative easing on spillovers.

Notable quotations from the academic research paper:

“In this paper, we first aim to examine whether the connectedness between financial and 25 individual commodity markets have bolstered in the last decade. Connectedness can occur either in the form of co-movements or spillovers, though we focus on the latter form since it has severe advantages over the former. We also prefer to employ volatility measure over return, since volatility is the major gauge of risk.

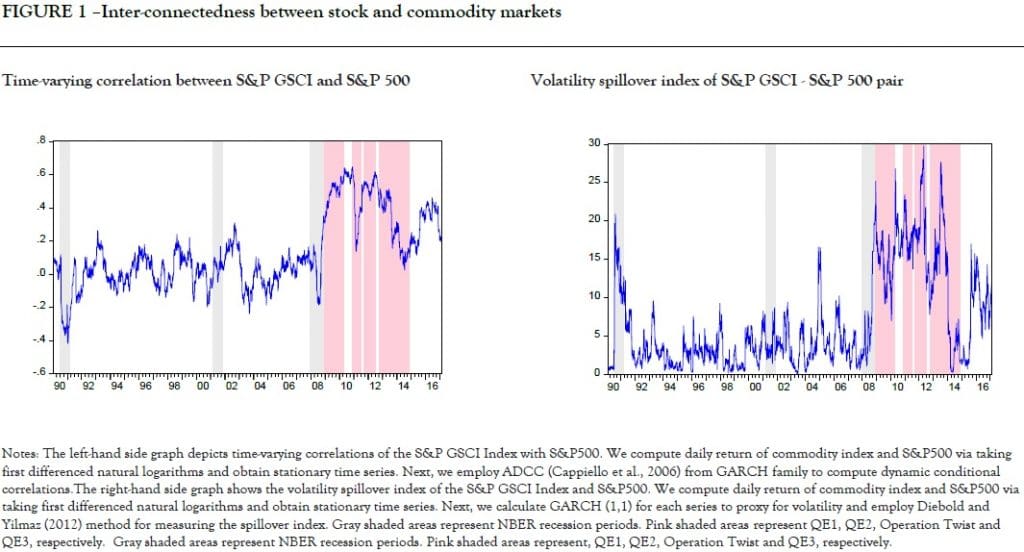

After examining the magnitude and direction of spillovers, we investigate the underlying reason for the increase in connectedness starting around 2008 at the aggregate level for S&P GSCI and S&P500. As one can see from Figure 1, different from previous crises, we see a long-lasting exceptional increase in connectedness after 2008; what drives this trend? Could the answer be QE? As Table 1 and Figure 1 represent the timeline of QE a brief glance at them reveals a matching relationship between connectedness and hot money episodes of the Fed.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend