Recent corona-crisis turbulence brought us many unexpected things, and one observation is connected with the fixed-income market. The conventional wisdom says that there is a flight to liquidity during troubled times and crises. Traditionally, liquid assets are US Treasuries or high-quality corporate bonds. Therefore, in theory, the pandemic should have been connected with buying pressure of high-quality liquid assets. However, as shown by a novel, insightful research from Ha, Xiao and Zeng, the exact opposite held. There was a very unusual sellout of liquid assets such as high quality fixed income as mutual funds tried to meet their redemption requests.

Authors: Yiming Ma, Kairong Xiao and Yao Zeng

Title: Mutual Fund Liquidity Transformation and Reverse Flight to Liquidity

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3640861

Abstract:

We document that traditionally liquid asset markets, such as those for Treasuries and high-quality corporate bonds, experienced significant strains from unusually high selling pressures during the COVID-19 pandemic, which contrasts with the conventional wisdom of flight to liquidity during crises. We identify the increased reliance on fixed-income mutual funds for liquidity provision as an important contributing factor to this phenomenon. Theoretically and empirically, we show that fixed-income mutual funds transform liquidity by issuing redeemable fund shares backed by a portfolio of liquid and illiquid assets while meeting redemption requests by first selling more liquid assets in their portfolios. Therefore, when investors redeem their fund shares en masse, funds’ pecking order of liquidation generates pronounced selling pressure for liquid assets, effectively turning investors’ flight to liquidity into the observed reverse flight to liquidity in financial markets. Such volatility in asset markets can be alleviated when financial intermediation is provided by commercial banks.

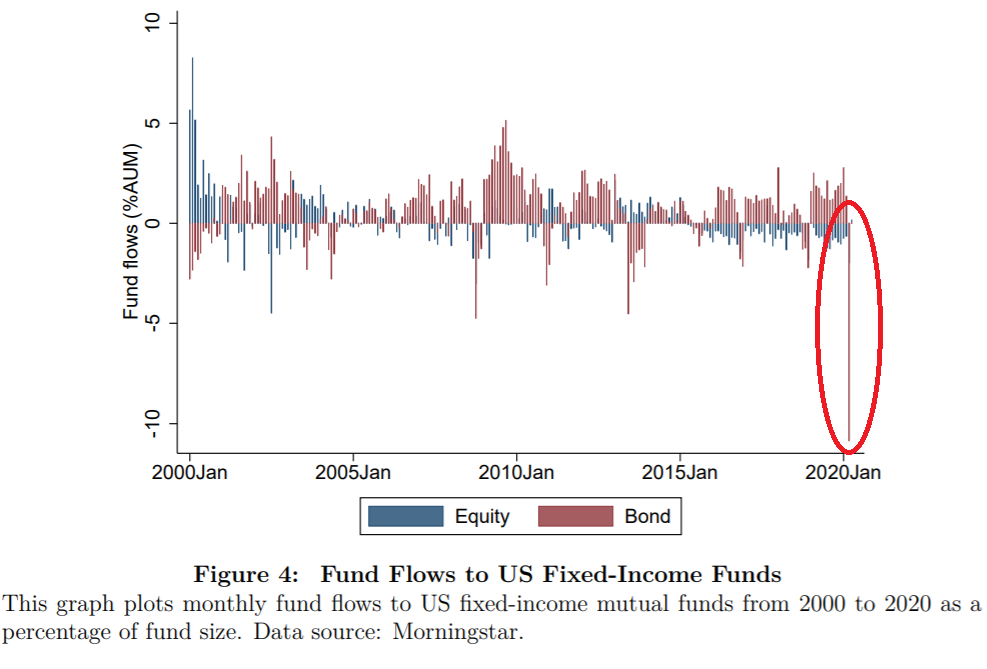

The selling pressure can be easily observed by one of the many figures in the paper. The effect is perfectly described by a plot of fund flows into US Fixed-Income Funds.

Notable quotations from the academic research paper:

“We find that the increased reliance on mutual funds as financial intermediaries has turned the flight to liquidity by individual investors into an aggregate reverse flight to liquidity in financial markets. Fixed-income mutual funds have continuously grown in size over the past decades. By

the end of 2019, they issue around $4.5 trillion of mutual fund shares, which are mostly backed by illiquid assets but can be redeemed at short notice. Mutual funds are able to transform liquidity and provide demandable claims by pooling idiosyncratic liquidity risk across investors

similar to Diamond and Dybvig (1983) style banks (Ma, Xiao and Zeng, 2019). In March 2020, however, investors seeking liquidity flocked to redeem their mutual funds for cash en masse, causing an unprecedented 12% aggregate outflow from fixed-income mutual funds within one

month. We find that in meeting redemption requests, funds optimally followed a pecking order of liquidation by first selling their most liquid assets before moving on to more-illiquid ones in order to minimize the discounts from asset sales. Pronounced outflows coupled with the pecking

order of liquidation lead to the most concentrated sales in the most liquid debt securities by the fixed-income fund sector, contributing to the reverse flight to liquidity phenomenon observed in financial markets.”

“Our findings bear important implications for how central bank interventions can alleviate strains in asset markets. Examining the effect of various policies by the Federal Reserve during the Covid-19 crisis, we find that the extended purchase of corporate bonds, including recently

downgraded junk bonds, had the largest impact on alleviating outflows from mutual funds compared to other interventions, which confirms the findings by Falato, Goldstein and Hortacsu (2020). We provide a novel explanation through our model—the commitment to purchase more

exposed assets like corporate bonds brings about a larger improvement in the benefit from staying with fund compared to the purchase of less exposed securities such as Treasuries. Since less pronounced outflows reduce the sell-off of liquid assets from fund balance sheets, central bank

interventions in traditionally less-liquid and more risky asset classes may become an effective tool for alleviating strains in traditionally more liquid asset markets in a world with increased reliance on mutual fund intermediation.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend