The Art of Financial Illusion: How to Use Martingale Betting Systems to Fool People

The Internet (and especially the part related to finance, trading, and cryptocurrencies) can be dangerous and full of offers of guaranteed returns, pictures of forever-growing bank accounts, and guys with golden rings swimming in the bathtub filled with cash. The truth is usually less rosy. Lucrative frauds, so-called white color crimes, have always been there, but with new technologies, they can spread faster and hide under a colorful disguise. One of the oldest concepts, from the beginnings of conceptualizing probability and statistics branches of mathematics, is Martingale betting, and this method is very often exploited to lure inexperienced new traders, who are then eaten alive by marketing sharks, selling them seemingly non-losing signals. How? An interesting paper by Carlo Zarattini and Andrew Aziz sheds some some light on these schemes.

Their empirical analysis has shown the ease with which even a random signal-based bot can appear convincingly profitable, thus misleading less experienced retail investors into significant economic risks. Especially Chapter 5, The Scammer’s Business Plan of the following paper, is an excellent probe into thinking of questionable services promising unreal trading returns. Beware, if something is too good to be true, then it almost certainly is not (especially in finances).

Through statistical analysis and simulations, particularly involving the Nasdaq 100 index (QQQ ETF), research paper illustrates the deceptive efficacy of these strategies. They project an illusion of profitability and safety, while in reality, they harbor hidden dangers and potential for significant capital losses. The Martingale system, promising to offset losses with a single win, lures investors into a false sense of security, drastically increasing their exposure to extreme risks. The efficacy of financial scams is based not only on deceptive quantitative models but also on exploiting psychological vulnerabilities as a lot of retail investors/traders are mainly interested in a high probability of small wins and underestimate the probability of large losses.

Yes, this paper will not make you a better trader (read other Carlo’s paper for that). But it will give you some arguments when you try to explain to your family members or acquaintances how they will NOT become wealthy by buying some “outstanding” product, which is usually just a form of the martingale betting scheme.

Authors: Carlo Zarattini and Andrew Aziz

Title: The Art of Financial Illusion: How to Use Martingale Betting Systems to Fool People

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4678427

Abstract:

In this paper, we undertake a comprehensive exploration of the financial scam landscape, focusing particularly on the use of Martingale betting systems and their role in artificially inflating the perceived short-term profitability of trading strategies. We trace the evolution of financial deception from the primitive practices of coin clipping to the sophisticated schemes of modern Ponzi operations, shedding light on the enduring patterns of exploitation and deceit that characterize financial fraud. Central to our analysis is the Martingale system, a method of progressively increasing investments after losses, devised in 18th-century in France. We critically examine its application in contemporary trading and how it creates an illusion of early success to mislead investors. A significant contribution of this paper is the demonstration, through statistical analysis and historical simulations, of how a trading system can seemingly generate a 20% annual return with nearly 80% probability, despite its reliance on randomly generated trading signals. Our research provides an in-depth analysis of the anatomy of financial scams, delving into their psychological and sociological foundations. We aim to equip readers with a comprehensive understanding of these deceptive practices, offering valuable insights for their detection and prevention. This paper is not just an academic exercise but a practical guide aimed at enabling investors, regulators, and the wider public to navigate the complex and often treacherous terrain of the financial world with greater awareness and discernment.

As always, we present several interesting figures and tables:

Notable quotations from the academic research paper:

“[…] aim to unravel the underlying patterns and tactics used by fraudsters and mathematically show how they work. This paper aims to systematically dissect the statistical underpinnings of these scams, with a particular focus on how they ensnare a select group of winners to create an illusion of profitability and legitimacy, thereby attracting additional investors. We explore the psychological and sociological factors that make individuals vulnerable to such scams and how scammers exploit these vulnerabilities. Using a Martingale betting systems on the Nasdaq 100 Index, we aim to provide a simple yet comprehensive understanding of the anatomy of financial scams, offering insights into their detection and prevention. A significant part of this analysis will delve into how the Martingale betting system, a strategy of doubling down on bets after each loss, is used in modern financial scams. This system, when applied in investment schemes, can be misleadingly attractive while exposing investors and traders to substantial risks. In financial scams, the Martingale betting system is often exploited to fabricate an illusion of high profitability. This technique can misleadingly transform insignificant trading signals into seemingly lucrative financial products, projecting an impressive 20% annual return with an almost 80% probability. Such manipulation effectively constructs a false appearance of efficacy and success.

In a trading context, [the Martingale system] strategy implies progressively escalating the capital risked in a position following consecutive losses. The expectation is that an eventual winning trade will offset all prior losses. For instance, if a trader loses $100 on the first trade, then doubles the stake to $200 on the second trade and loses again, the total loss is $300. If the trader then bets $400 on the third trade and wins, the total profit is $100, recouping all previous losses. However, this betting method is fraught with significant risks, mainly the rapid depletion of trading capital before a winning trade occurs. It presumes an infinite amount of capital and unrestricted trade sizes, which are not practical in real-world trading.

In the realm of financial scamming, the Martingale system is often misrepresented as a foolproof method for achieving consistent profits. Scammers may use this system to en- tice individuals into fraudulent investment schemes, promising high returns with minimal risk. They might not disclose the system’s inherent risks, such as the potential for significant losses and the requirement for substantial capital to sustain a long string of losses.

Table 2 provides an overview of the accounts’ performance. Approximately 47% of the accounts realized a positive return, whereas 53% concluded the year with a balance below their initial $1,000. This higher frequency of unprofitable accounts is largely attributed to trading commissions. Notably, no account achieved an annual return of 20% or more. The average loss among the losing accounts exceeded the average gain of the profitable ones, primarily due to commission costs.

As exhibits in Table 3 the proportion of profitable accounts increased to 84%, but the higher number of profitable accounts came with an increased average loss for the losing accounts. Despite this, the proportion of accounts achieving a 20% annual return remained low at around 1%.

In essence, while the adoption of the Martingale strategy led to a higher number of profitable accounts over a one-year period, it proved insufficient in consistently reaching the ambitious target of a 20% annual return.

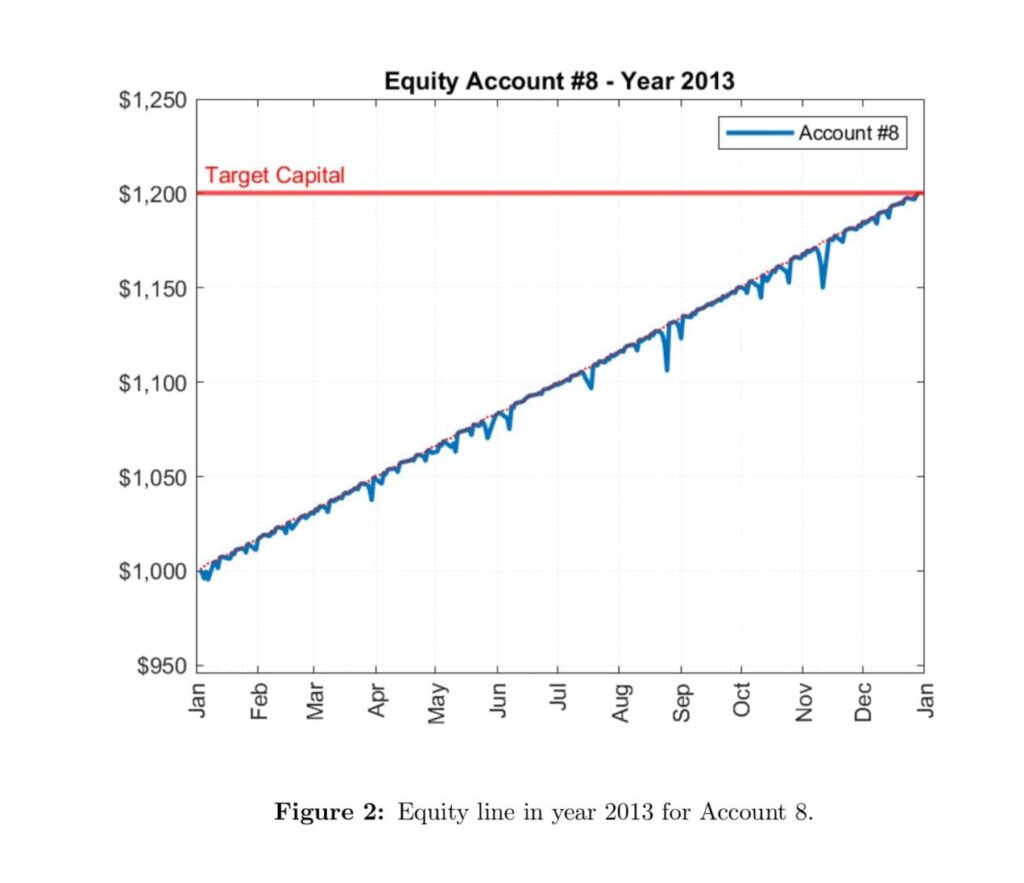

The objective of our strategy is to achieve a 20% annual return across as many accounts as possible. Starting with an initial capital of $1,000, our goal is to attain a final wealth of $1,200, which translates to an annual profit of $200. The most efficient approach to reach this year-end target is by accruing an average of $200/252 (i.e. $0.79) profit per day. The ideal Asset Under Management (IdealAUM) trajectory, which we aim to follow, is illustrated in Figure 1.

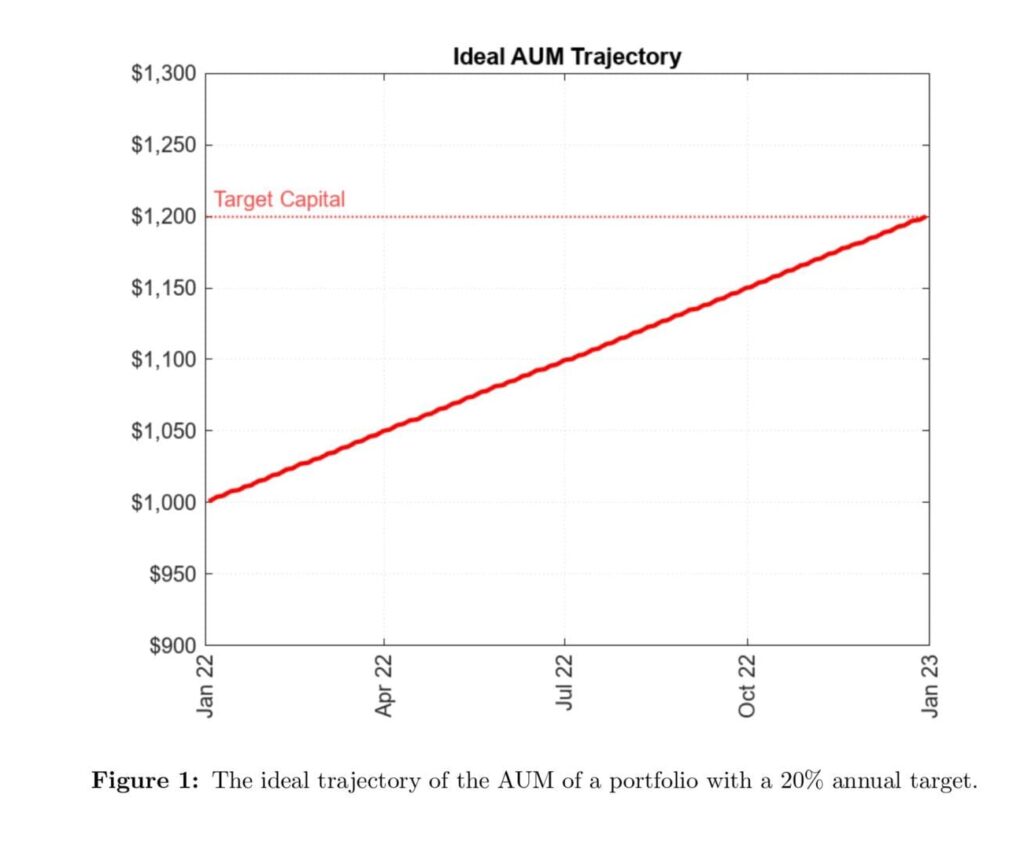

The performance of account 8 is displayed in Figure 2, which, along with a certified report of all transactions, will be used to showcase the strategy to prospective investors. The equity curve of this account is particularly noteworthy for its linearity and resilience. Every decline is quickly absorbed, leading to a trajectory that closely aligns with the ideal equity curve, as indicated by the dotted red line.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Would you like free access to our services? Then, open an account with Lightspeed and enjoy one year of Quantpedia Premium at no cost.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend