Transaction Costs Optimization for Currency Factor Strategies

A lot of backtests of systematic trading strategies omit transaction costs (in the form of spreads and fees). Simulation is then simpler, but resultant model portfolio and its performance can be misleading. In the case of currency factor investing, backtest without the costs simulation can pick currencies with wider spreads and higher volatilities. And in real trading, with real-world transaction costs, even using a low-cost currency brokers, a strategy can, therefore, perform significantly worse than expected. A research paper written by Melvin, Pan, and Wikstrom offers an elegant optimization methodology to incorporate currency markets transaction costs into the backtesting process which allows strategies to retain their alpha …

Authors: Michael Melvin, Wenqiang Pan, Petra Wikstrom

Title: Retaining Alpha: The Effect of Trade Size and Rebalancing Frequency on FX Strategy Returns

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3552383

Abstract:

The literature on currency investing that incorporates transaction costs uses costs relevant for small trade sizes. Using the entire order book of the major electronic brokerages for FX, we compute sweep-to-fill costs for trades of different sizes and illustrate the reduction in post-cost returns as trade size increases. Researchers should consider trade size and frequency to create realistic forecasts of post-tcost returns to gauge the capacity of a strategy. We show how incorporating tcosts (transaction costs) in the construction of a portfolio improves performance for both high and low frequency strategies and retains a larger portion of the alpha.

Notable quotations from the academic research paper:

“A popular portfolio construction technique used in many studies is to rank currencies according to some return forecast and then equal weight them in a portfolio. One problem with this approach is that it ignores the transaction costs associated with different currencies and may overweight high-cost currencies and lower post-cost returns. We show how a portfolio optimization that uses the same return forecast but incorporates a transaction costs penalty can enhance returns relative to the equal-weight portfolio. It is interesting to note that such gains are even relevant for quite small portfolios. Investors can preserve alpha by incorporating transaction costs into pre-trade optimizations in order to better size currency positions and related trade size as a function of trade costs. In addition to trade size, we also show how sensitive returns are to portfolio rebalance frequency.

We select 18 currencies: 9 developed market currencies (EUR, JPY, GBP, CAD, AUD, NZD, SEK, NOK, and CHF) and 9 emerging market currencies (CNH, SGD, MXN, CZK, TRY, PLN, HUF, ILS, and ZAR).

For our analysis, we compute transaction costs for trades of $1 million, $10 million, and $25 million, created as the top of the order book for $1 million, and sweep-to-fill costs for $10 million and 25 million.

In order to illustrate the impact of different trade sizes on the realized post-cost returns, we employ a generic investment strategies popular in currency markets, momentum and value.

In the initial benchmark approach, a simple equal weighting is used for the top three and bottom three momentum currencies in the portfolio. Next, we use portfolio optimization methods, incorporating transaction costs in the utility function to find the utility maximizing optimal weights for the currencies.

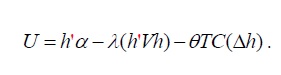

In the above utility function, h denotes optimal holdings of assets and α is the expected return of the currencies. We use historical returns as calculated in equation (1) for our estimate of expected return. V is the covariance matrix of currency returns. TC denotes transaction costs, which are a function of trade size delta-h, and calculated from the sweep to fill costs from the order book. λ is a coefficient of risk aversion.

Theta is the coefficient on transaction costs and is sometimes called the transaction cost amortization factor; the higher the θ, the greater the cost intimidation of trade size. We specify our baseline model with a theta of 1. However, we also use different values of θ to see the sensitivity of our results to optimization settings. Particularly, setting θ to 0 means that we do not consider transaction costs when optimizing, so we can compare results between optimizations with and without transaction costs.

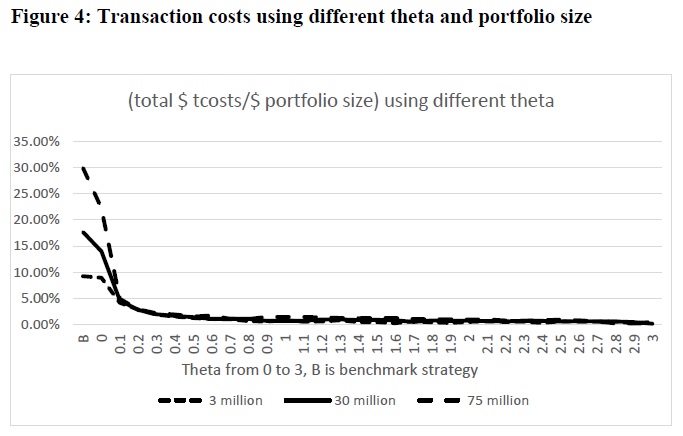

Figure 4 shows the total dollar costs relative to portfolio size over alternative thetas. Note that at the far left is the cost of trading the equal-weighted generic benchmark momentum portfolio, labeled B. An optimized portfolio without a transaction cost penalty (theta of 0) has lower costs compared to the benchmark as the optimization tends to pick currencies with lower volatility, which tend to have lower costs. Both the benchmark portfolio construction and the zero-cost portfolio optimization do not penalize for costs, but the net return always accounts for the realized costs from trading. As theta increases from zero to impose a cost penalty ex ante, costs initially drop sharply for theta of 0.1. Beyond 0.1, increasing theta results in small reductions in costs for smaller trade sizes, out to around a theta of 1, after which costs are almost constant as theta increases.

The results reported so far are for a daily portfolio rebalance of the momentum strategy. It is useful to examine the importance of accurate transaction costs if, instead of daily, an investor rebalances monthly.

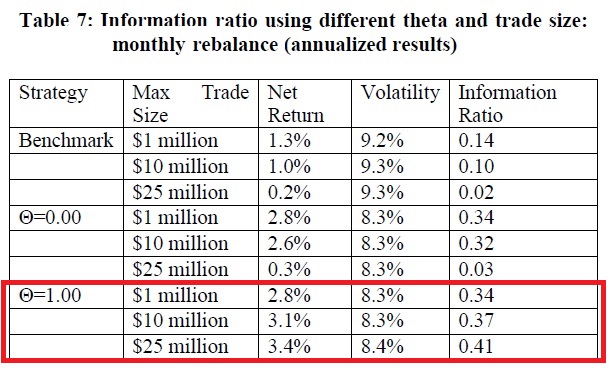

Portfolio diagnostics from our monthly simulations are reported in Table 7. Interestingly, the optimized portfolios outperform the benchmark portfolios, even for the smallest trade size. Since the optimization will downweight more volatile currencies, turnover and tcosts fall considerably relative to the benchmark. The question of particular interest here is whether tcosts still matter if rebalancing only once a month. For the smallest portfolio, optimized results are the same with and without the tcost penalty. For the middle portfolio, imposing a tcost penalty enhances performance a little. However, the largest portfolio experiences a substantial gain in performance when tcosts are accounted for in portfolio construction.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Would you like free access to our services? Then, open an account with Lightspeed and enjoy one year of Quantpedia Premium at no cost.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend