Financial markets are full of pricing anomalies, and their existence is often explained by human behavior. Behavioral finance postulates that cognitive irrationality is manifested in biases like the disposition effect (the tendency of people to sell assets that have increased in value, but keeping assets that have dropped in value in portfolio) or overconfidence bias (the tendency of people to be more confident in their own abilities). There are some papers which directly link investment decision making caused by these biases to actual physiology of investors (for example, a known impact of testosterone on investment performance). A new research paper written by Nofsinger, Patterson, and Shank examines not only testosterone but also cortisol levels of testing subjects and then compares their performance in a mock investment contest. Both hormones are strongly related to higher portfolio turnover and inability to accept losses, with cortisol levels even more significant than testosterone.

Author: Nofsinger, Patterson, Shank

Title: On the Physiology of Investment Biases: The Role of Cortisol and Testosterone

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3546687

Abstract:

The underlying physiological mechanisms of biases are not well understood. As such, we examine the impact of testosterone and cortisol levels on several commonplace investment biases using realistic trading simulations. Cortisol, the biological marker of stress, is positively related to the disposition effect and portfolio turnover, which is consistent with the relation between judgment errors and stress in social settings. Testosterone, the male hormone, is also positively related to portfolio turnover, which is consistent with androgen-driven behaviors. Overall, the results show that the endocrine system plays a significant role during financial decision-making, that has important consequences for the financial industry.

Notable quotations from the academic research paper:

“Behavioral finance consistently shows that irrational decisions stem from cognitive errors and behavioral biases. For example, the disposition effect describes the situation in which investors hold on to underperforming assets for too long and sell overperforming assets too soon, resulting in diminished portfolio performance.

Behavioral biases appear to persist over time, even when those biases result in lower returns. One source of those cognitive errors is the individual’s underlying biological makeup. The psychobiological mechanisms underlying the disposition effect, portfolio turnover, and the vast majority of documented investment biases have rarely been studied. The related medical literature suggests that steroid hormones – notably testosterone and cortisol – play an important role in risk-reward decisions. This is particularly important in the finance industry, given that it is still very much a male-dominated, androgen-driven field, and given research showing that occupational stress is very high among finance professionals.

| What about Data? Look at Quantpedia’s Algo Trading Discounts. |

We employ a financial simulation with two multi-point portfolio rebalancing tasks involving long-term investment decision-making to examine the role of testosterone and cortisol on investment biases. Overall, the results show that there are significant individual and joint effects of steroids on investment biases. We find that testosterone is positively related to portfolio turnover. Similarly, cortisol is positively related to the disposition effect and portfolio turnover.

Testosterone and cortisol also jointly impact financial choices. Specifically, the testosterone to cortisol ratio has a positive relationship with portfolio turnover, which corroborates the dual-hormone hypothesis during financial decision-making. These results have significant implications for financial decisions and performance of all kinds of investors, from the retail investor to Wall Street professionals especially given the androgen-driven and stressful field of finance.

Testing setup:

We recruit 41 students (28 men and 13 women) from a Master of Science in Finance (MSF) program who were enrolled in the program’s Financial Software course following Institutional Review Board (IRB) approval. Participation incentives include the potential to earn bonus points towards the course final grade and a monetary reward. The exact nature of incentives is revealed just prior to data collection to maximize anticipatory arousal, stress, and the competitive nature of professional trading. Specifically, participants are informed that their overall risk-adjusted performance during the investment simulations could influence their final course grade by up to one-third of a letter grade (e.g., from A- to A). Additionally, the top three risk-adjusted performers (measured via the Sharpe ratio) receive monetary rewards of $75, $50, and $25, respectively, in the form of gift cards.

Immediately following the collection of the salivary sample, the participants engaged in RIT 2.0 investment simulations.6 During each simulation, participants are asked to create a portfolio of assets and to rebalance it at the end of years 5, 10, and 15 of a simulated 20-year period. There is an initial endowment of $500,000 with the goal of achieving a portfolio value of $1,500,000 at the end of the 20-year period (an annualized return of 5.65%). They have five ETF’s to choose from with known historical return and volatility distributions, as shown in Appendix B. Funds not invested in an ETF are kept in a “CASH” account with zero return and volatility. Additionally, participants know whether the correlation between ETF’s is high, medium, or low. Each ETF evolves as a random walk with positive drift based on its historical return and volatility. Therefore, the price path followed during a given period has no impact on future price paths, similar to the real stock market.

Based on the chosen portfolio adjustments during each 5-year period, we measure three of the best studied investment biases for each participant, as summarized in Cronqvist and Siegel (2014); namely, the disposition effect, performance chasing, and portfolio turnover.

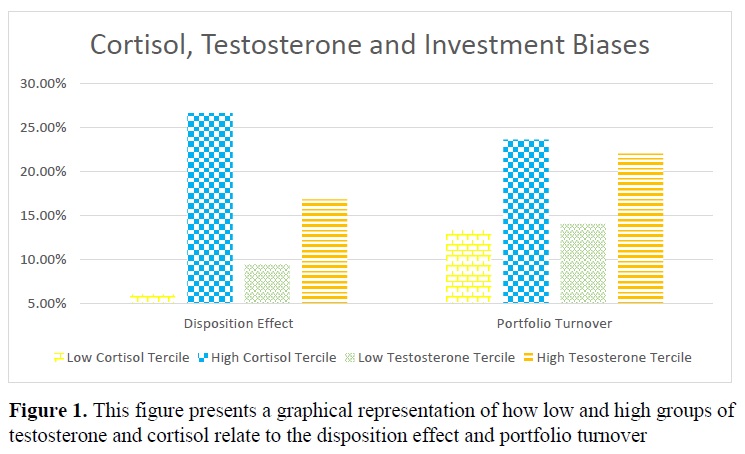

Results are presented in Table 4 with an illustration of the results displayed in Figure 1. We include a dummy variable that equals 1 if the subjects are in the top tercile for each hormone (highest amount of the hormone) to examine how individuals high in testosterone and high in cortisol trade compared to those with lower levels. The results in Table 4, Panel A confirm our previous findings that testosterone is positively related to portfolio turnover and that cortisol is positively related to the disposition effect. We also find that those who are the most stressed are more likely to have a higher portfolio turnover compared to individuals with lower levels of cortisol.”

Are you looking for strategies applicable in bear markets? Check Quantpedia’s Bear Market Strategies

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend