The improvement in collective human knowledge and technological progress brings many changes in our society. Numerous new businesses are emerging related to autonomous traffic, clean energy, biotechnology, etc. Without any doubt, these new companies look promising and at least the technology behind them seems to be the future. Perhaps the futuristic vision makes these companies so popular among investors.

Moreover, this novel trend is also supported by the most prominent index creators S&P and MSCI. Both providers have created numerous thematic indexes connected to these hot industries. The popularity has caused that ETFs are nowhere behind, and as a result, these thematic indexes could be easily tracked. However, popularity itself does not guarantee the best investment, and we should be interested in these indexes in greater detail. A vital insight provides the novel research paper of Blitz (2021). The findings are interesting – the thematic investors bet against quantitative investors or, more precisely, against the most common factors that are well-known from the asset pricing models. The indexes have large market betas, large negative exposure to both value and profitability factors, and are more volatile than the market. To sum it up, thematic indexes bet against stocks that are currently cheap and profitable or, in other words, against “quants”.

Authors: David Blitz

Title: Betting Against Quant: Examining the Factor Exposures of Thematic Indices

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3899750

Abstract:

We examine the performance characteristics of recently introduced thematic indices using standard asset pricing theory. We find that thematic indices generally have strong negative exposures towards the profitability and value factors, indicating that they hold growth stocks that invest now for future profitability. As such, investors in thematic indices are effectively trading against quant investors, who prefer stocks that are currently cheap and profitable. From an asset pricing perspective, the negative factor exposures of thematic indices imply low expected returns. As there is clearly a clientele for thematic indices, we discuss how investing in these strategies may be rationalized despite their unfavorable factor exposures.

As always we present several interesting figures:

Notable quotations from the academic research paper:

“Leading index providers such as MSCI and S&P have recently introduced a range of thematic stock indices. Their thematic indices are designed around “emerging macroeconomic, geopolitical and technological trends that are believed to be structural and transformative in nature and hence expected to influence society’s behavior and needs over the long term.” Similarly, S&P (2021) argues that their thematic indices provide investors access to “a series of technologically enabled, often disruptive industries, generally referred to in aggregate as the Fourth Industrial Revolution.” Examples of these themes are cyber security, robotics, autonomous vehicles, and clean power.

This paper examines the performance characteristics of thematic indices by applying the widely accepted asset pricing model of Fama and French (2015). We find that thematic indices generally have strong negative exposures towards the profitability and value factors, indicating that they hold growth stocks that invest now for future profitability.

Almost all of the S&P thematic indices have a market beta above 1, with the average level amounting to 1.21. In addition to the market betas the graph also shows volatility ratios, calculated as the volatility of a thematic index divided by the market volatility over the same period. The volatility ratios capture not only differences in beta, i.e. systematic risk, but also the idiosyncratic risk that is present in the thematic indices. The volatility ratios are above 1 for all of the S&P thematic indices without exception, with an average of 1.67. This implies that the S&P thematic indices exhibit both elevated systematic risk and a sizable amount of idiosyncratic risk. For the MSCI thematic indices we find directionally similar but much less pronounced results. The average market beta of these indices is only slightly above 1, at 1.07, while the average volatility ratio is 1.22.

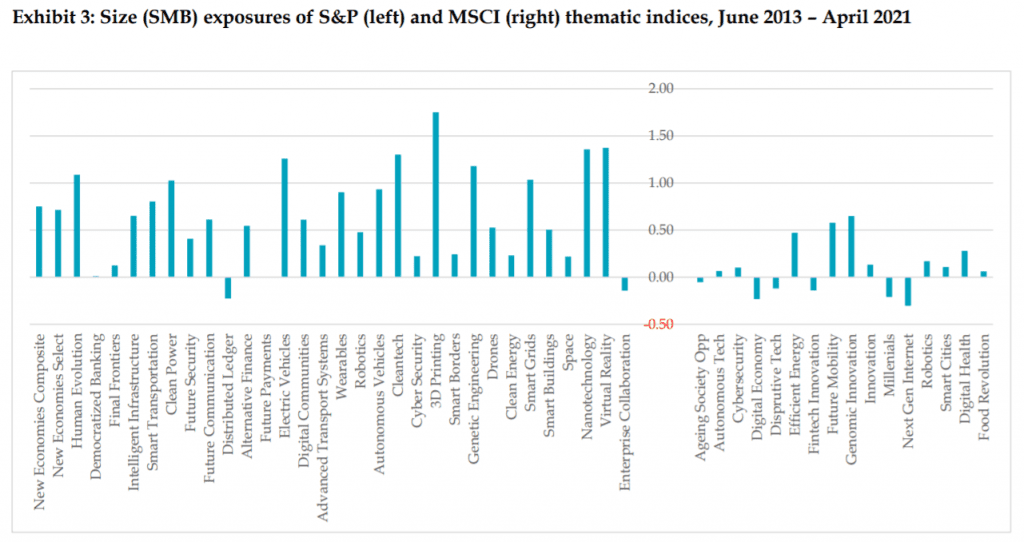

We observe that most of the S&P thematic indices have large positive exposures towards the size factor, with an average size beta of 0.65. This finding can be explained by the fact that S&P uses equal weighting as the starting point for the construction of its indices. For the MSCI thematic indices, which use capitalization weighting as the starting point, the

estimated size exposures tend to be much smaller, amounting to only 0.10 on average.

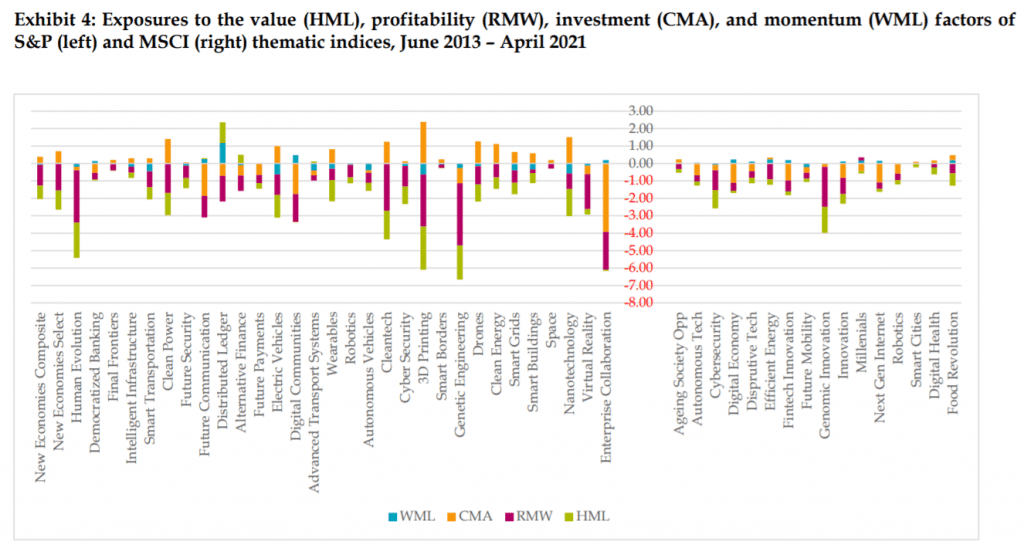

We observe that almost all of the thematic indices have large negative exposures towards the value and profitability factors. For the S&P thematic indices this is again most pronounced, with an average exposure towards the value factor of -0.64 and an average exposure towards the profitability factor of -1.18. The MSCI indices have an average value exposure of -0.41 and an average profitability exposure of -0.57. Across all 48 thematic indices, only 4 have a positive exposure towards the value factor, and only 1 has a (marginally) positive exposure towards the profitability factor. These results indicate that the thematic indices invest heavily in stocks with weak profitability and expensive valuations.

The S&P thematic indices exhibit mixed exposures towards the investment factor, with the average exposure being close to zero, at just 0.07. However, the MSCI thematic indices have mostly negative exposures towards the investment factor, equal to -0.39 on average. Since the investment factor is value-like, as shown by Fama and French (2015) and Blitz and Hanauer (2021a), this can be interpreted as additional anti-value exposure. The

exposures towards the momentum factor are much smaller and close to zero on average, at -0.10 for the S&P thematic indices and 0.07 for the MSCI thematic indices. This is not surprising because the momentum factor reflects a highly dynamic portfolio, while the thematic indices are relatively stable. Although a theme may sometimes have good momentum, there will also be times when it is out of favor, so over the long run we would not expect to find large momentum exposures.

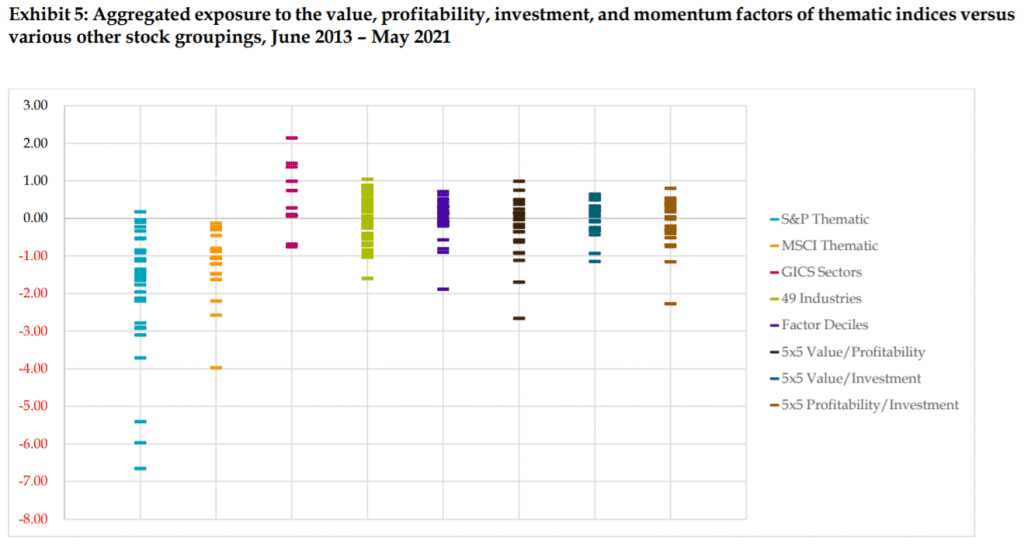

If we assume that these Fama-French factors have long-term annual premiums of 3% (which would be in line with their historical long-term realized averages) then this implies longterm expected average underperformances of 5.58% for the S&P thematic indices and 3.87% for the MSCI thematic indices.

As such, investors in thematic indices are effectively trading against quant investors, who prefer stocks that are currently cheap and profitable. From an asset pricing perspective, the negative factor exposures of thematic indices imply low expected returns. As there is clearly a clientele for thematic indices, we discussed how investing in these strategies may be rationalized despite their unfavorable factor exposures. Since our analysis is based on the thematic indices of two index providers, the conclusions

should not be generalized to thematic investing in general. Themes can be defined in numerous ways, so it should also be possible to create themes with favorable or neutral factor exposures. Moreover, if a theme has negative factor exposures, investors may consider screening out the stocks with the worst profitability and valuation characteristics. In other words, active management might be applied to improve the factor characteristics of a thematic investment strategy.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend