Macro Factor Risk Parity

Risk and diversification are critical interests of every investor, especially when things go south since the correlations across assets tend to rise during stressful times. Therefore, in the asset allocation, the risk parity allocation is one of the key topics. Factors are commonly known as underlying sources of both risk and returns, and it is assumed that they can be utilized to achieve superior risk-adjusted returns and diversification. However, there seems to be a lack of research that would be related to the macro factors. This gap is quite striking since there is a general consent that macro factors (for example, inflation) largely influence the broad set of assets. Amato and Lohre (2020) research paper fills the gap and studies the usage of macro factors as diversifiers in asset allocation.

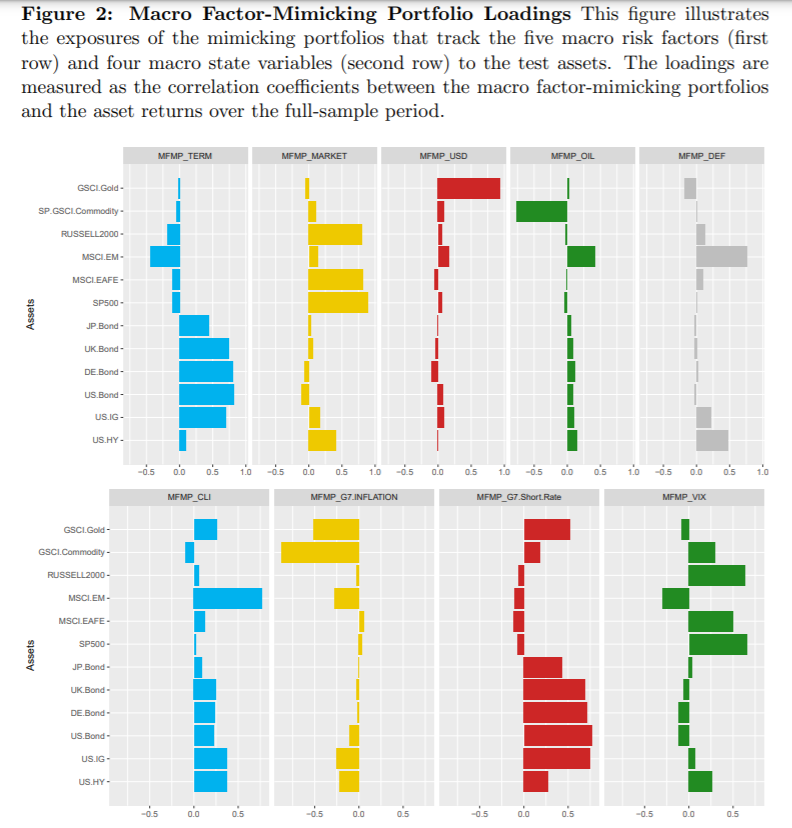

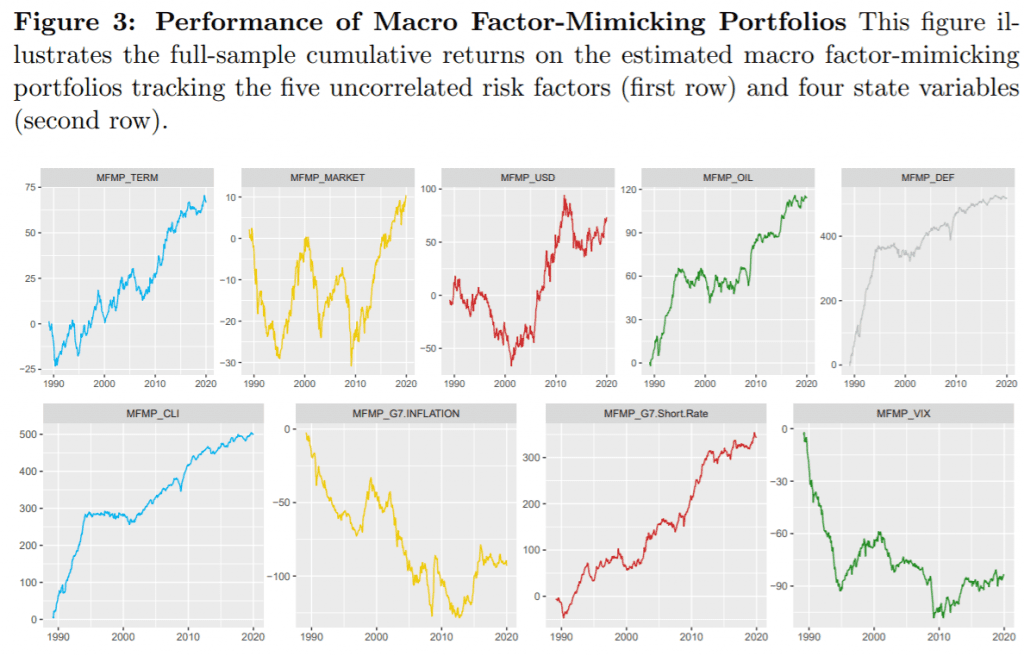

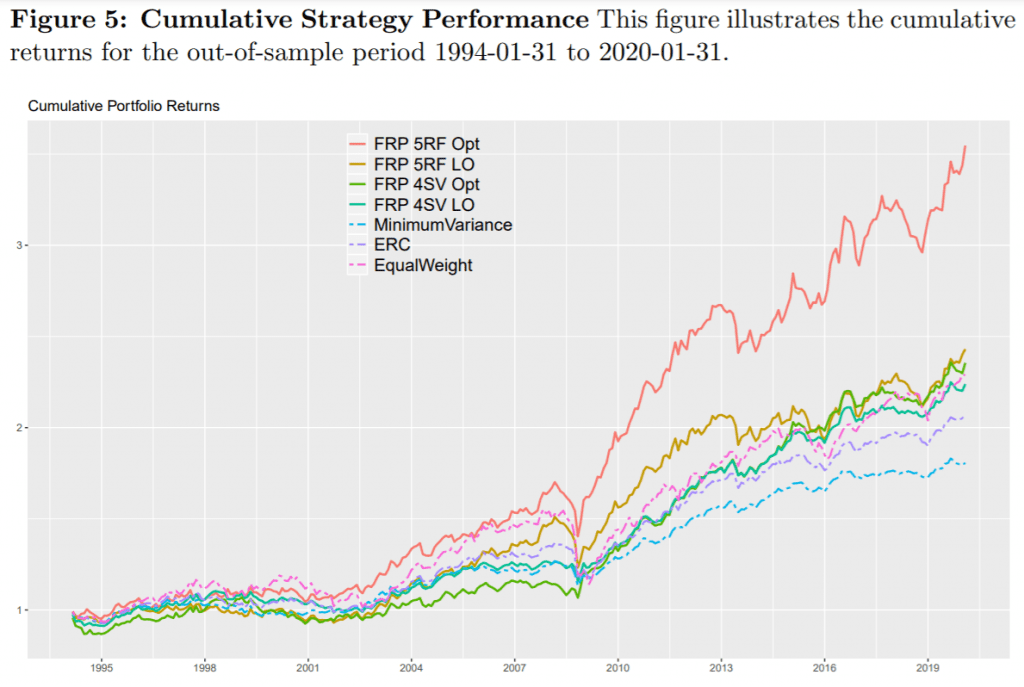

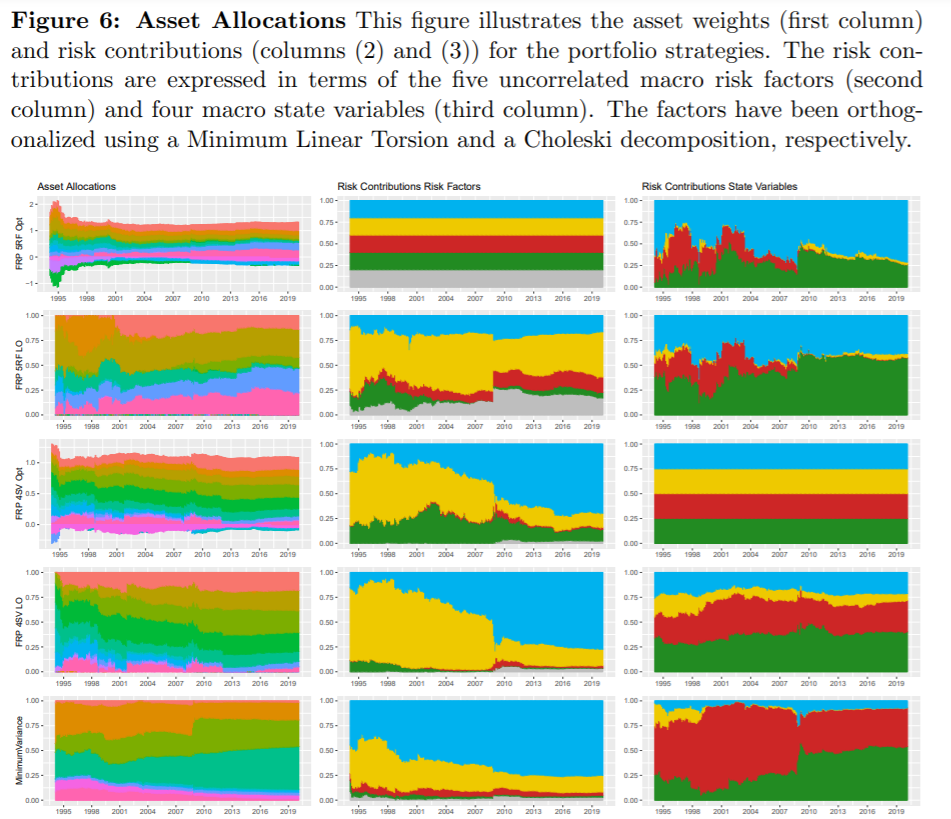

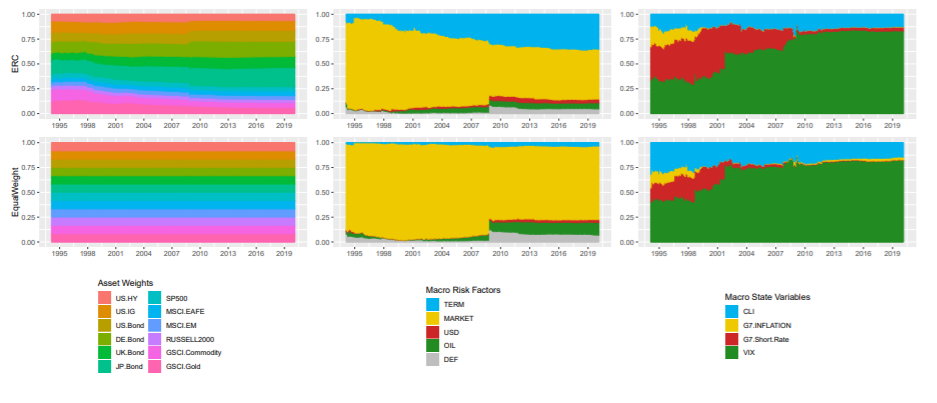

The authors divide the macro factors to two groups, where the first consists of TERM, MARKET, USD, OIL and DEF (default risk), and the second group consists of CLI (a measure of output by OECD), G7.INFLATION, G7.Short.Rate and VIX. The research shows, that when the diversification matters the most, only the second group improves both the risk and returns, acting as a successful diversification during various economic regimes and particularly, during high economic uncertainty. Overall, the paper offers exciting insights into diversification and macro factors, accompanied by more complex mathematical models definitely worth looking into.

Authors: Livia Amato and Harald Lohre

Title: Diversifying Macroeconomic Factors — For Better or for Worse

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3730154

Abstract:

It is widely acknowledged that asset returns are driven by common sources of risk, especially in challenging times when the benefits from traditional portfolio diversification fail to realize. From a top-down perspective, investors are mostly concerned about shocks in growth or inflation that ultimately govern the pricing of broad asset classes. To this extent, we propose a natural asset allocation framework to achieve a diversified exposure to orthogonal macro risk factors and to harvest the associated long-term premia. We examine the role and usefulness of different types of macroeconomic variables, as systematic sources of risk or state variables that drive time variation in the asset returns, and compare their diversification potential across different states of the world.

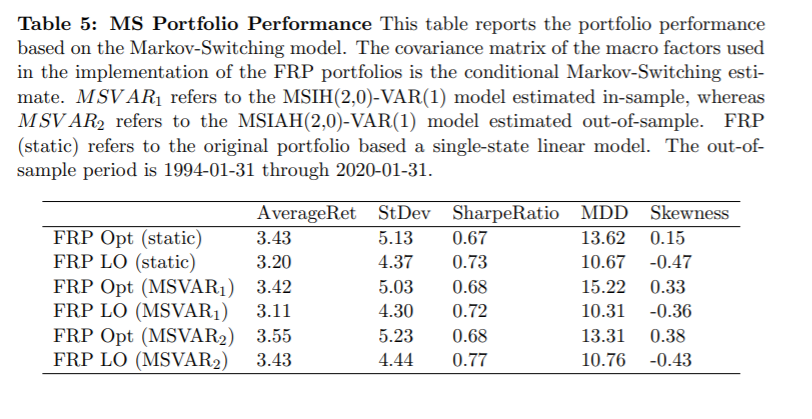

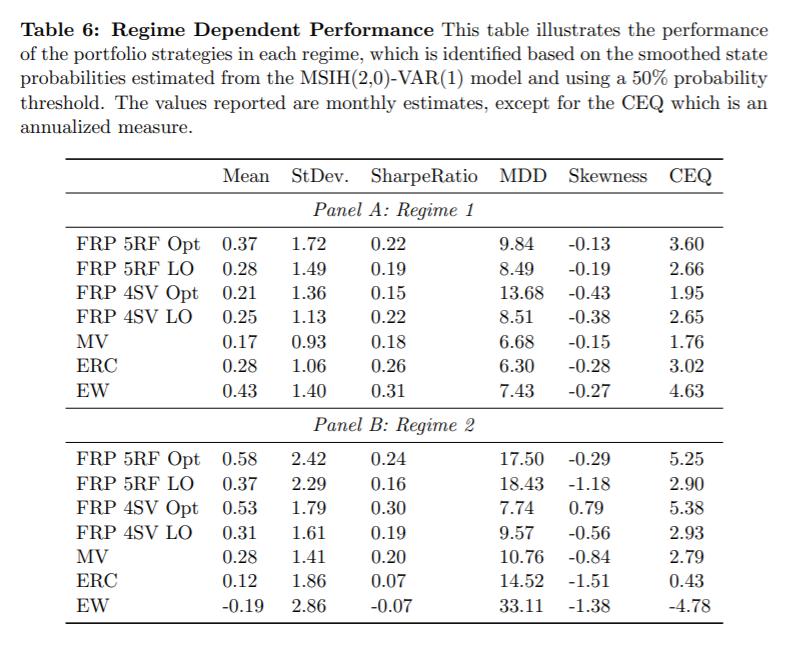

As always the results are best presented through charts and tables:

Notable quotations from the academic research paper:

“It is generally accepted that asset classes exhibit higher correlation during difficult markets, suggesting that risk and return are driven by only a few meaningful underlying forces (Longin and Solnik, 2002; Ang and Bekaert, 2002; Ang and Chen, 2001, Ang, Goetzmann and Schaefer, 2009). Accordingly, traditional risk-based strategies based on asset classes fail to provide effective diversification precisely when it is needed most, and they fail to protect investors from changes in key driving factors such as economic growth or risk aversion. Thus, a factor-based portfolio that focuses on the primary drivers of asset returns is likely to provide higher diversification benefits for portfolio performance. In this paper we study the relevance of macroeconomic factors in multi-asset allocation and present an allocation framework to achieve a diversified exposure to orthogonal macroeconomic factors based on factor risk parity portfolios. We examine the usefulness of macro factors as common drivers of assets from both a risk perspective to manage portfolio risk exposures and from a return perspective to harvest rewarded premia. Indeed, based on modern asset pricing theory, macroeconomic factors represent state variables describing different sets of bad times and exposure to these factors is then compensated by the assets’ risk premia earned during the good states.

We separately analyse the different role of macroeconomic risk factors and state variables in asset allocation and explore potential benefits from a diversified macro factor allocation versus an asset class approach. Additionally, we study a novel implementation of factor risk parity strategies where we derive orthogonal macro risk factors using a recursive identification scheme following the extensive macroeconomic literature on VAR, allowing us to give a structural interpretation to the relevant macroeconomic shocks. Ultimately, we extend the analysis to a conditional framework to assess the diversification properties of macroeconomic factors across states and we use a Markov Switching VAR model to estimate macroeconomic risks and identify economic regimes.

Our results confirm the joint importance of financial and macroeconomic risk variables in a multi-factor model of asset returns. A balanced exposure to five risk factors, deemed as the primary sources of risk across assets, enhances the risk-return profile by explicitly harvesting multiple sources of expected returns. Nevertheless, such portfolios provide only partial diversification benefits due to common variation in the risk factors at times when diversification is needed the most. On the contrary, when relyingon macroeconomic state variables which help explaining time-variation in asset returns and represent the ultimate long-term economic drivers, factor risk parity strategies offer effective diversification, especially during states of high economic uncertainty, while not forgoing higher risk-adjusted returns. On the one hand, they achieve higher upside potential by explicitly harvesting long-term macro premia; on the other hand, they reduce portfolio drawdowns through a diversified exposure to macro factors representing different states of the world, resulting in a strategy that is robust across different economic cycles.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Would you like free access to our services? Then, open an account with Lightspeed and enjoy one year of Quantpedia Premium at no cost.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend